For much of the 20th century, Kodak was more than just a company; it was a name you would most likely find in every home in the U.S. Kodak dominated the market and, at its peak, had a staggering $31 billion valuation. Yet, despite its vast resources and industry clout, a single critical misstep would set the stage for its dramatic downfall.

What was once an empire built on film and innovation crumbled into bankruptcy, ruining its name for good. What could have led to the fall of such a major company?

The Start of Kodak’s Empire

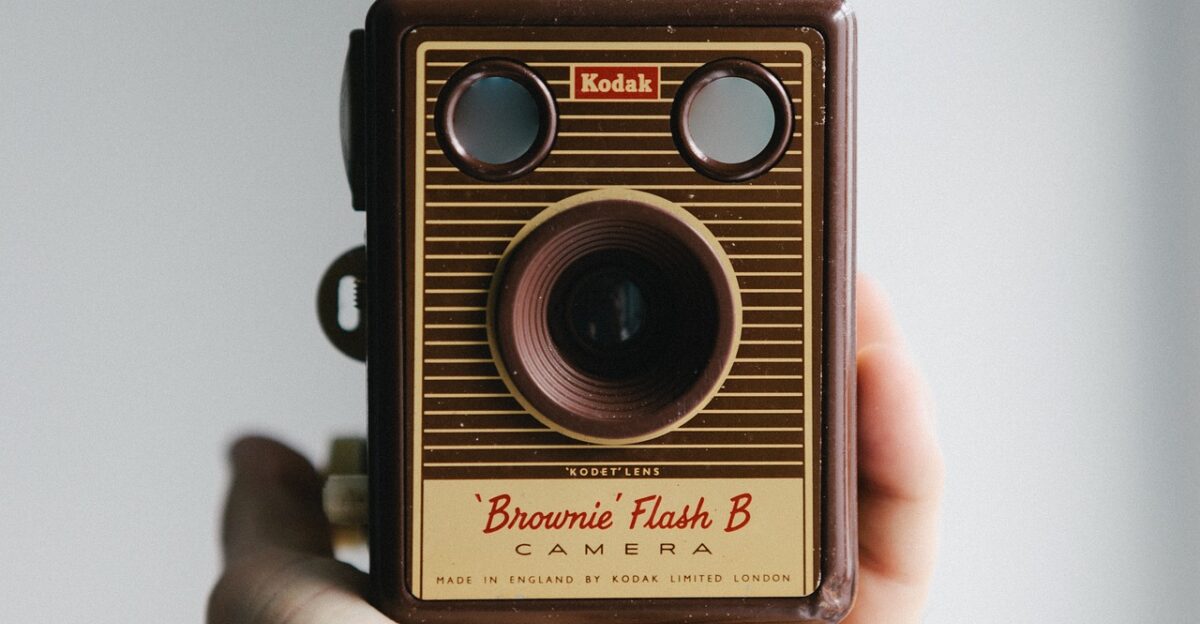

Kodak’s story began in 1888 when George Eastman and Henry A. Strong introduced the very first Kodak camera. Unlike the bulky and complex photographic equipment of the time, this camera was simple and portable and came preloaded with a roll of film that could capture 100 pictures.

Once finished, customers would mail the camera back to Kodak, where the film was developed, prints were made, and the camera was reloaded for reuse.

A Money-Making Machine

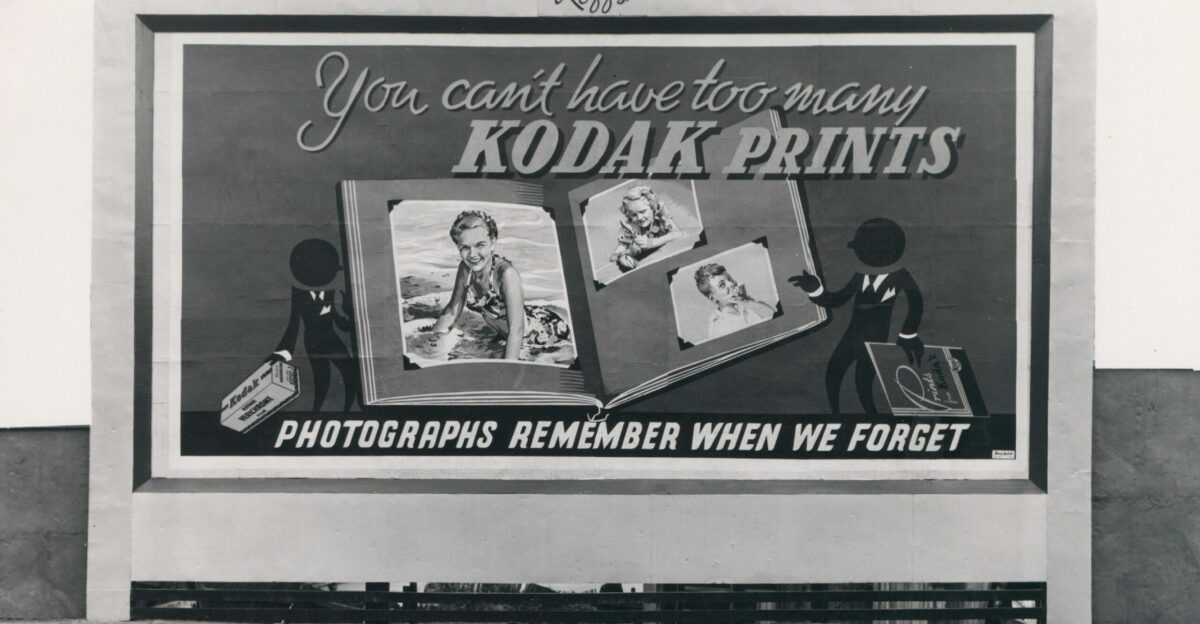

Kodak’s film business was once the company’s crowning jewel—a revenue-generating machine that defined the brand and shaped an industry. In its prime years, Kodak sold over 2.5 billion rolls of film annually, capturing nearly every aspect of amateur and professional photography worldwide.

Estimates indicate that the gross profit margins for film approached 60%, meaning that every roll generated significant returns for the company. The process was simple, but lucrative.

The Invention That Could Have Changed Everything

In 1975, Steven Sasson, a young engineer at Kodak, built the first working prototype of a digital camera. A clunky device by today’s standards, it was revolutionary for its time. This was the very technology that would one day lead to its downfall.

“As selling film separately to cameras was where Kodak made a chunk of its money, digital would lead to the brand moving in a bold direction that would abandon decades of hard work,” published Unilad Tech.

The Decision to Bury Digital

Despite holding valuable patents and early prototypes, executives feared that pursuing digital too aggressively would undermine their film empire, which generated the majority of their profits at the time. Rather than disrupting themselves, they buried their innovation, treating digital as a side project instead of the future of photography.

This short-sighted decision not only cost Kodak its chance to lead the digital era but also allowed nimbler rivals like Sony and Canon to dominate a market Kodak could have owned.

The Rise of Competitors

As Kodak hesitated, competitors wasted no time seizing the digital frontier. Companies like Sony, Canon, and Nikon quickly invested in refining digital camera technology, making devices more advanced and increasingly affordable for everyone. These competitors didn’t care about an investment in film and were set on building their digital footprint in the future of photography.

As a result, Kodak’s once-unshakable market share rapidly eroded, and the company that once defined photography began fading into the background.

Missing the Digital Wave

Kodak’s most devastating mistake was its failure to ride the digital wave at the right time. While the company had the technology, talent, and brand power to dominate the digital market, its leadership was paralyzed by fear of losing short-term profits from film.

This lack of decisive action allowed competitors to capture consumer loyalty and redefine photography, leaving Kodak scrambling to play catch-up.

Market Capitalization Peaks

In 1997, Kodak’s market capitalization soared to $31 billion, which was pretty impressive but didn’t last very long. Investors saw it as a rock-solid giant with an unshakeable monopoly on film and photography, and its stock was a staple in countless portfolios. The company’s sheer size and market power guaranteed stability and future growth, reinforcing the illusion that Kodak was too big to fail.

Leadership Turmoil

A revolving door of CEOs and executives brought shifting strategies, conflicting visions, and inconsistent execution. Some leaders pushed for diversification into printers and digital services, while others attempted to double down on film, clinging to the legacy business that was rapidly fading.

This lack of unified direction created confusion inside the company and the marketplace, eroding investor confidence.

Patent Disputes

Rather than leading through innovation, the company was entangled in lengthy patent disputes and lawsuits against rivals like Apple, Samsung, and others in hopes of generating revenue through licensing and settlements. While these patents were valuable, they fought over past inventions instead of creating the future.

Economic Pressures Emerge

Declining film sales gutted its once-reliable cash flow, while the company struggled to invest enough in digital initiatives to catch up with rivals. Costs of restructuring, layoffs, and maintaining outdated operations only deepened the financial strain.

Declining Revenues and Workforce

As film sales plummeted and digital competitors dominated the market, annual revenues that once reached tens of billions steadily collapsed. To cut costs, the company was forced into multiple rounds of layoffs, reducing a proud global workforce to just a fraction of what it used to be.

According to Financier Worldwide, “In 2003 the company posted revenue of around $13.3bn while employing a work force of around 64,000. By 2011, the number of employees had shrunk to around 17,000 and revenue to $6bn.”

Shrinking Factory Footprint

In Rochester, New York, massive factories that had once been bustling stood abandoned or were demolished. The company ended up having to close down 13 factories and 130 photo laboratories, a clear indication of the financial pressures it was facing.

What had once been a proud industrial powerhouse was reduced to scattered remnants of its former glory.

Mounting Debt and Bankruptcy

By the early 2010s, the company had borrowed heavily in desperate attempts to restructure, invest in printers, and sustain operations while its revenues continued to collapse. Unable to generate enough profit from its shifting business model, Kodak had no choice but to file for Chapter 11 bankruptcy protection in 2012.

According to Financier Worldwide, “Kodak filed for Chapter 11 bankruptcy protection in January 2012, listing assets of $5.1bn and liabilities of $6.75bn. During the bankruptcy process, 121 year old Kodak auctioned its digital imaging patent portfolio for $527m and sold off its personalised imagining and document imaging unit to the UK Kodak Pension Plan for around $650m.”

Environmental Liabilities

Decades of operating massive film and chemical production facilities had left behind toxic waste, polluted groundwater, and extensive cleanup responsibilities. The company was held accountable for costly remediation efforts in Rochester and other factory towns, compounding its already dire financial position.

According to the EPA, “Under the agreements, Kodak commits to fund a trust with $49 million for cleanup at the EBP site and the Genesee River; the New York State Department of Environmental Conservation (DEC) agrees to fund any additional costs of cleanup between $49 million and $99 million; and Kodak and DEC each agree to pay half of any costs above $99 million.”

The Human Toll

Thousands of employees, retirees, shareholders, and local economies were thrust into financial and emotional hardship. Retirees who relied on Kodak for healthcare and steady retirement checks found themselves with drastically reduced support. Shareholders, many of whom were company employees or Rochester residents, were left with nothing.

“This comes on a day when many are losing retirement benefits, and many are finding that their recovery as a creditor is just a minute fraction of what their debt is,” Judge Gropper said. “But I cannot decree a larger payment for creditors or any payment for shareholders if the value is not there.”

Exiting Bankruptcy

Stripped of its consumer business and iconic place in everyday life, Kodak reinvented itself with a new focus on commercial printing, digital imaging technology, and business-to-business services. No longer a household name associated with family memories, it pivoted toward niche markets that relied on its technical expertise rather than mass consumer appeal.

“In June 2013, Kodak agreed an $895m financing package with JPMorgan Chase & Co, Bank of America, and Barclays Plc. The newly reorganised company will have an estimated enterprise value of around $785m to $1.38bn,” wrote the Financier Worldwide.

Their Plans for the Future

The company has shifted toward commercial printing, advanced materials, and digital imaging for businesses, seeking to carve out a sustainable niche rather than chasing mass-market dominance.

Kodak has also explored opportunities in areas like packaging and functional printing and even ventured into pharmaceuticals, reflecting its attempts to diversify beyond its traditional scope.

Lessons for Business

While their legacy might have crumbled under the financial pressures of the industry, they serve as a reminder to all businesses. Never cling too tightly to what you know and embrace the change that’s happening all around you. Kodak had the foresight, the technology, and the resources to lead in digital photography, but fear of cannibalizing its film empire blinded leadership to the bigger picture.

Hope for Renewal

Kodak has worked to rebuild itself, smaller but more focused, proving that renewal is possible even after a fall of historic proportions. While it no longer dominates the consumer world, the company has leaned on its innovation heritage to find relevance in commercial printing, specialty chemicals, and imaging technologies.

Though the glory days of film are gone, Kodak’s survival shows that reinvention can still lead to success, even if the path is different.