Investment in quantum computing exploded in the first quarter of 2025, with venture rounds topping $1.25 billion—more than double the haul from Q1 2024. The Quantum Insider reveals that spike included $854 million in commercial orders last year, a 70 percent leap from 2023 that underscores growing confidence in moving beyond lab experiments into real-world use.

Quantum Market Set for Its Biggest Leap Yet

A Markets and Markets study shows the quantum sector climbing from $1.3 billion in 2024 to about $1.8 billion by mid-2025, and it predicts the market could exceed $5.3 billion by 2029. Their analysis notes that today’s biggest funding rounds are aimed at commercial rollout rather than pure research, signalling the industry’s shift toward practical applications.

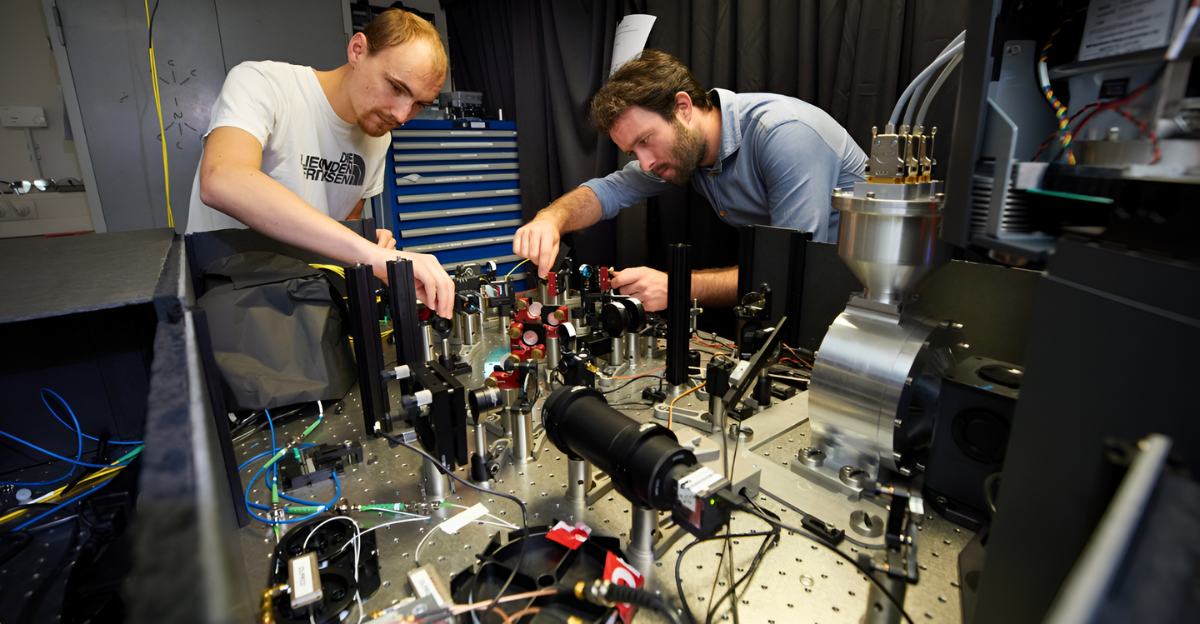

From Chalkboards to Server Rooms

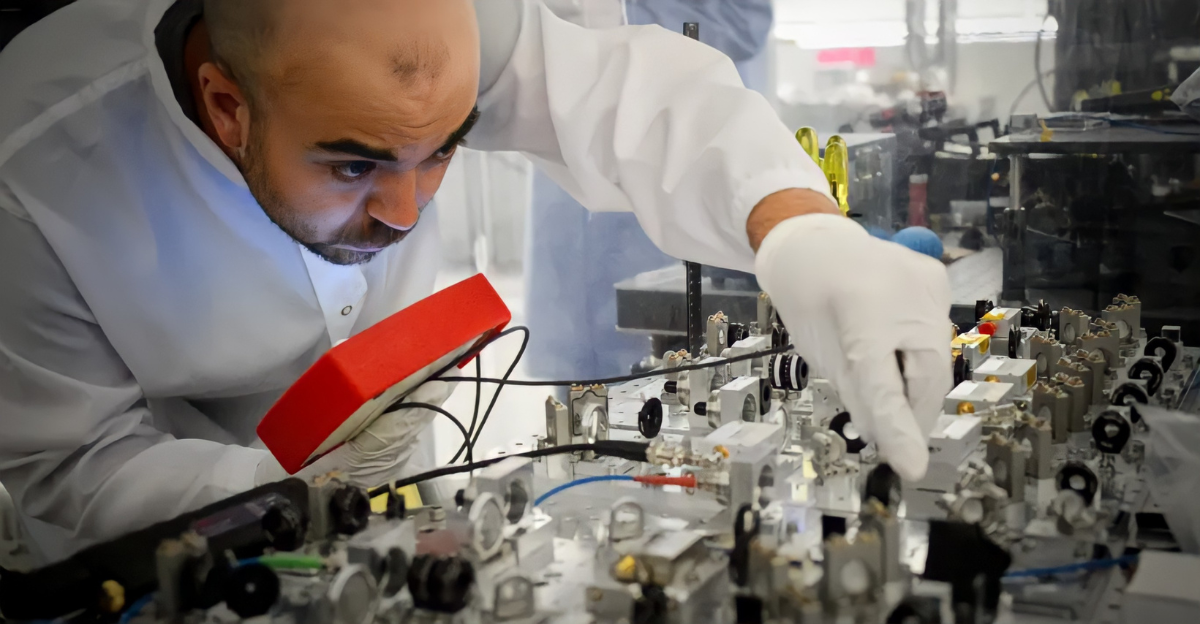

What began as niche experiments in university labs and government sites is now poised for commercialization. JLL’s recent report highlights how players draft plans for dedicated quantum facilities, marking a clear transition from proof-of-concept to operational deployments.

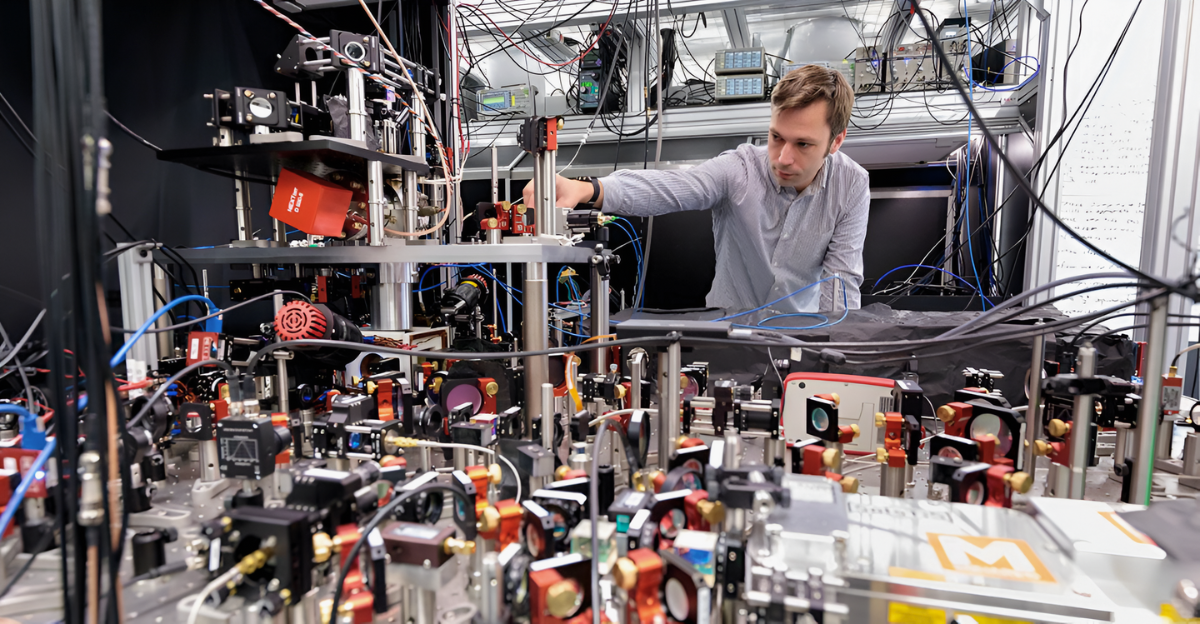

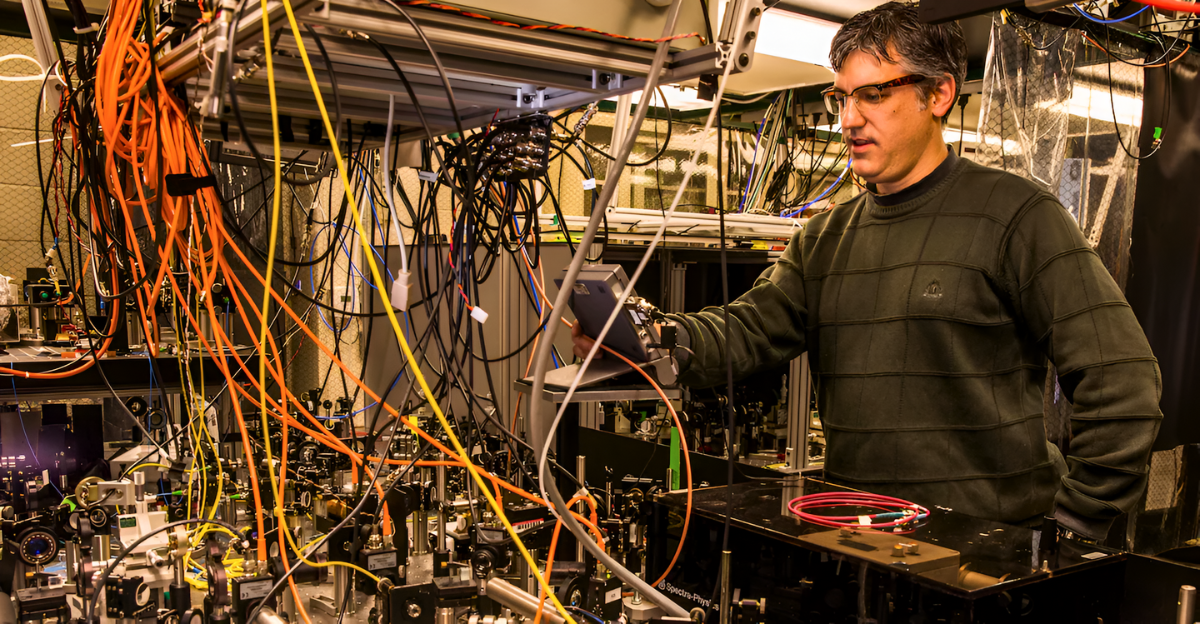

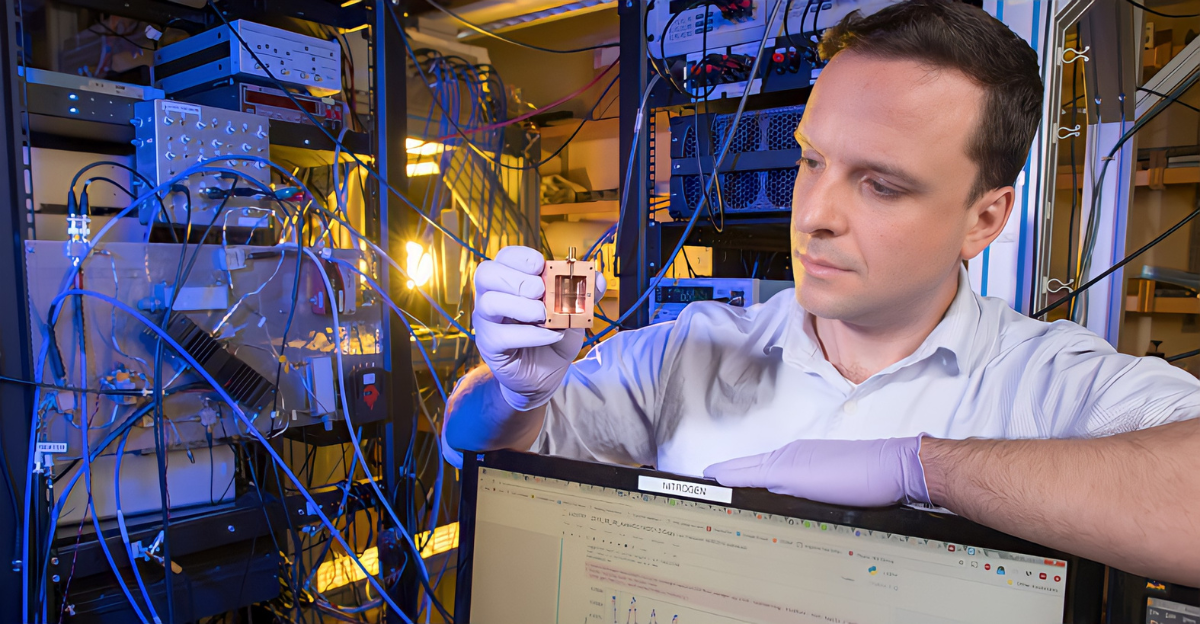

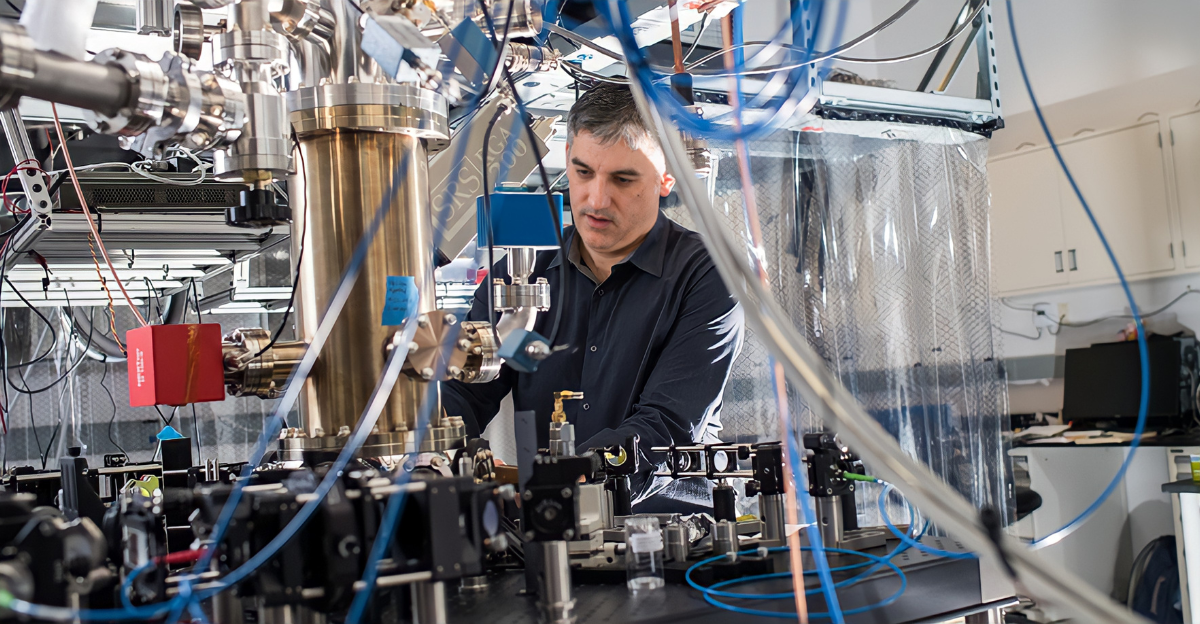

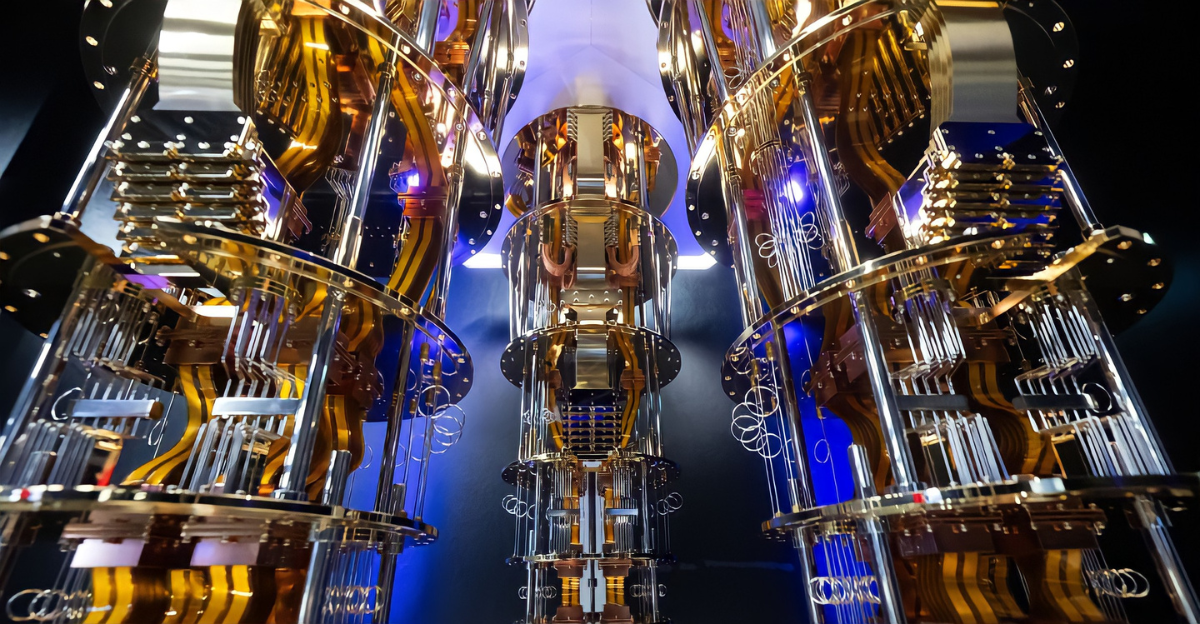

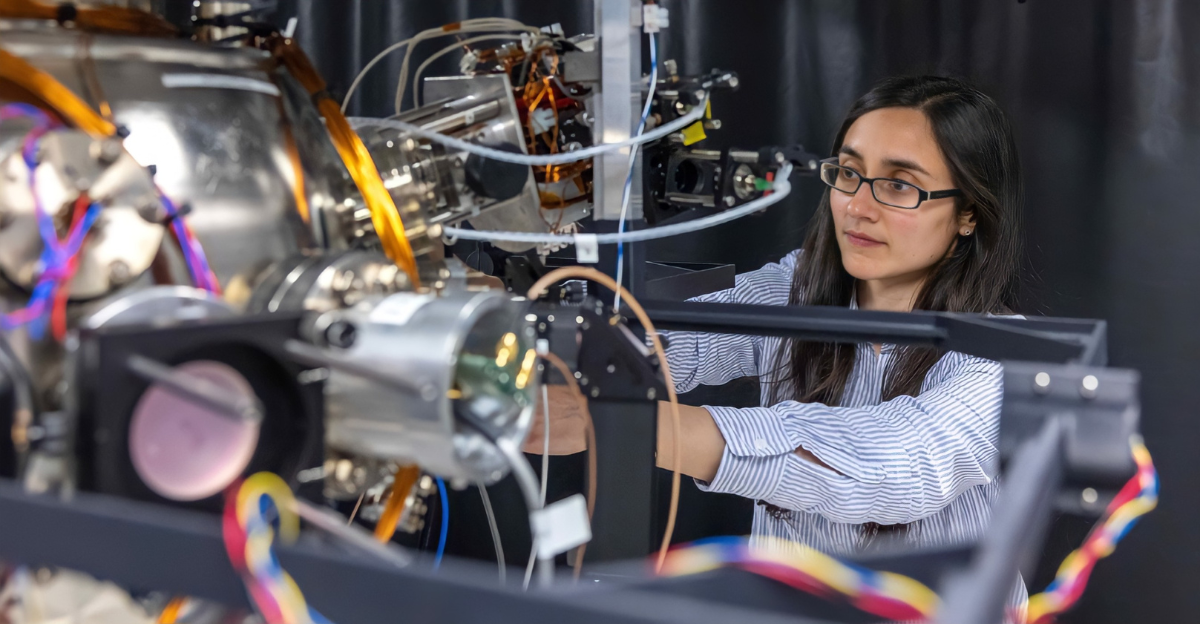

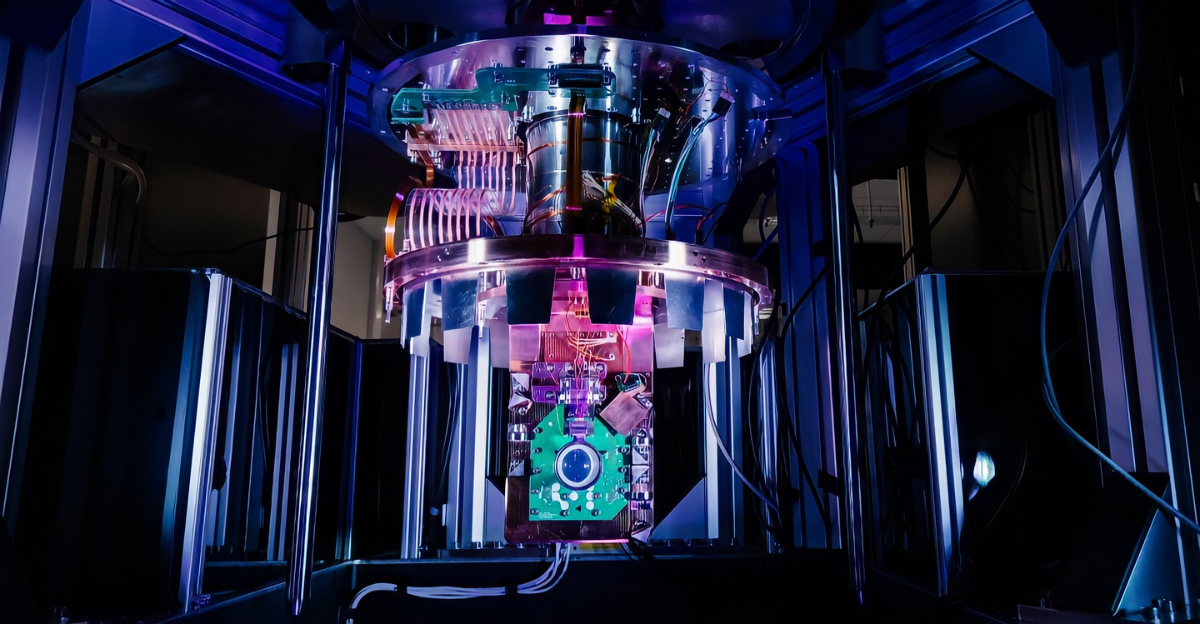

Why Qubits Demand Their Own Real Estate

Quantum bits—or qubits—demand far more protection than conventional servers. As JLL experts explain, cryogenic cooling, electromagnetic shielding, and ultra-precise control systems are all mandatory, making retrofits costly and prompting the rise of purpose-built campuses.

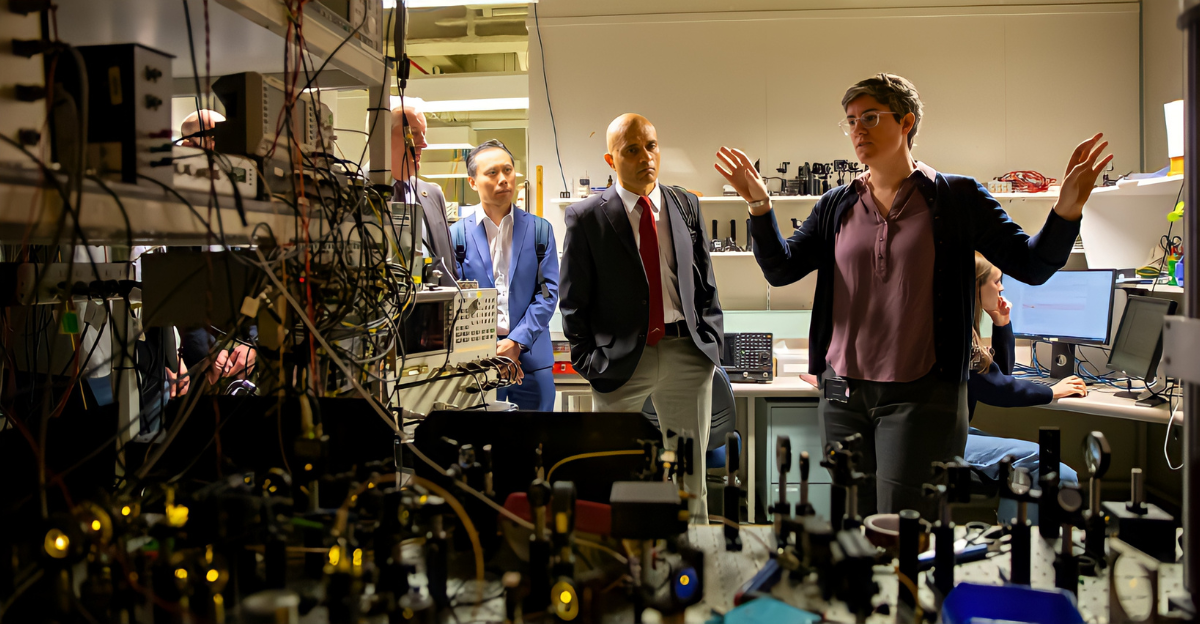

Inside Europe’s First Public Quantum Center

IBM broke new ground last October by opening Europe’s first commercial-scale quantum facility in Ehningen, Germany. The Quantum Insider describes it as a watershed moment—proof that quantum is stepping out of research labs and into accessible, cloud-connected infrastructure.

How Former Steel Mills Became Quantum Campuses

In the U.S., Chicago transformed a 420-acre former steel mill into a quantum hub backed by state and federal support, while Colorado’s Elevate Quantum consortium broke ground on a 70-acre research campus. CoStar also reports IBM’s $20 billion expansion in Poughkeepsie, confirming strong regional bets on quantum real estate.

When Governors Turn Tech Evangelists

“Real estate groups can seize a first-mover edge by jumping in now,” JLL’s Andrew Batson and Daniel Thorpe advise. In Illinois, Governor J.B. Pritzker, who admits to being “a quantum geek”, has personally championed multi-million-dollar incentives, showing how political backing can drive development.

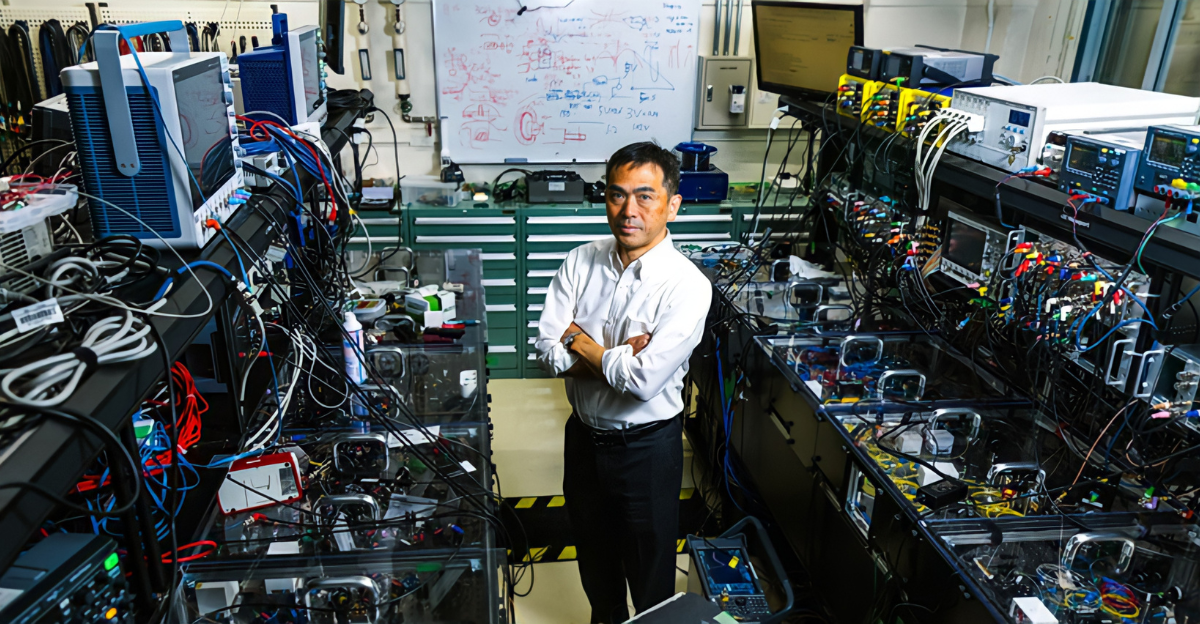

Big Tech’s Quantum Land Grab

IonQ has unveiled plans for a $1 billion, 105,000-square-foot quantum lab in Seattle, and Google is converting an 8-acre California site for its operations. Microsoft, meanwhile, has urged Congress to lock in long-term funding to keep U.S. leadership on track.

Who’s Winning the Global Funding Race

Public budgets for quantum topped $1.8 billion worldwide in 2024. McKinsey’s latest briefing indicates that China’s roughly $15 billion commitment far outpaces U.S. levels. In comparison, Japan and Spain have earmarked $7.4 billion and $900 million, respectively—fueling a new breed of technology rivalry.

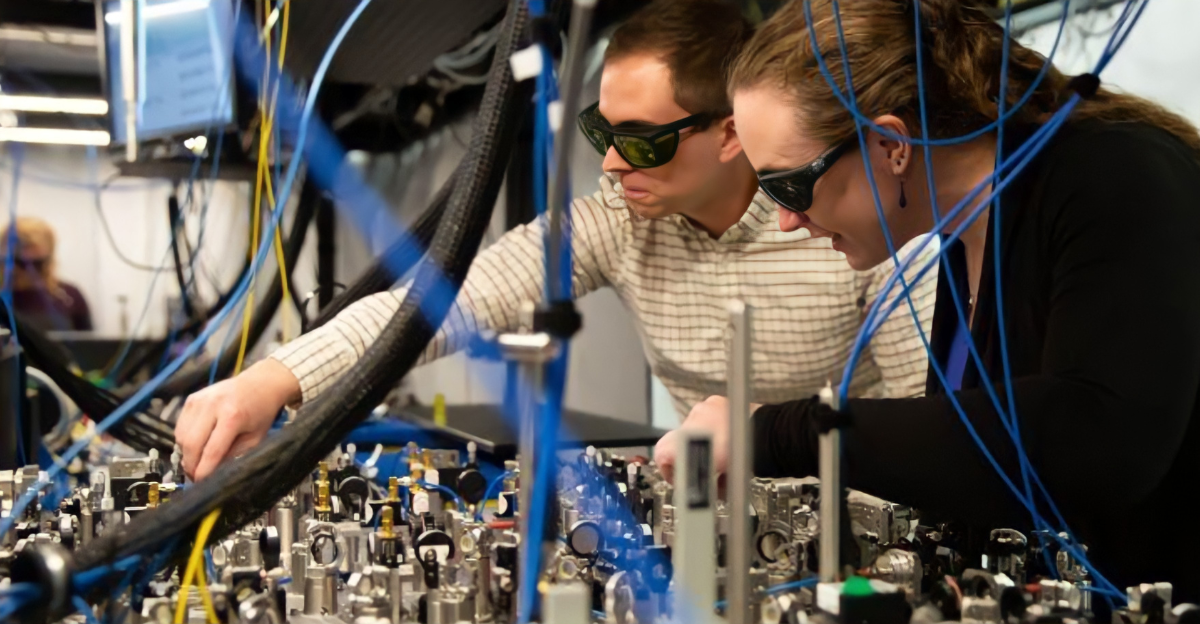

Hybrid Facilities Emerge

JLL’s research uncovers a hybrid model that colocates quantum processors next to classical data center gear in adjacent, heavily shielded spaces. This arrangement keeps qubits safe while maintaining seamless integration with existing cloud services.

Specialized Hubs or Widespread Rollout?

Industry insiders remain divided over Quantum’s location strategy. Some argue that its exacting specs confine it to specialized hubs, while others believe pairing with AI-optimized data centers will unlock economies of scale and broader adoption.

When Industrial Wastelands Become Innovation Zones

CoStar coverage shows PsiQuantum selecting Chicago’s steel mill over other contenders and Related Midwest planning 59 million square feet of quantum-focused development—proof that aging industrial plots are rapidly converting into cutting-edge tech campuses.

U.K.’s Long-Term Bet

The U.K. government has pledged £670 million to quantum research over the next decade, securing stable funding for its National Quantum Computing Centre and giving local developers the runway they need through at least 2037.

Can Early Adopters Capture the Crown?

“We expect six or seven U.S. regions to capture early investment before the trend broadens,” says JLL’s Rob Kolar. However, he concedes that independent data confirming a nationwide real estate shake-up remains scarce, calling for measured optimism.

Quantum-as-a-Service Hits the Mainstream

Quantum-as-a-Service platforms are gaining steam, letting companies tap quantum processors through the cloud rather than buying hardware outright. JLL’s analysis suggests the growth of QaaS will shape whether facilities cluster in hubs or diffuse across established data centers.

Could Budgets Make or Break the Future?

Microsoft warns that federal quantum R&D funding slipped from $1.041 billion in 2022 to about $1 billion in the current budget request, setting up a pivotal debate in Congress over extending the National Quantum Initiative and sustaining U.S. competitiveness.

Asia’s Quiet Quantum Charge

IBM’s Ehningen hub now serves over 80 European organizations and 850 certified developers. Meanwhile, Singapore has sunk $222 million into quantum startups, and McKinsey notes that Asia’s ecosystem is emerging as a real challenger to U.S. and European incumbents.

Red Tape vs. Radical Tech

A Dell Technologies white paper warns that current building codes lack clauses for electromagnetic shielding and cryogenic safety. This gap could bog down approvals for new quantum-classical hybrid facilities.

Universities and Workers Are Pivoting

Time magazine reports that universities are rolling out quantum engineering programs and that professionals are retraining for qubit-focused roles—signs that the industry is evolving from academic curiosity to commercial reality.

Why the “Quantum Boom” May Be Overstated

Despite headline-grabbing investments and flagship facilities, no independent analysis confirms a global “quantum boom” set to supercharge all real estate markets. The technology’s specialized nature means its impact will likely target select regions and property types rather than spark a widespread property frenzy.