A $23 billion mining project in Guinea is poised to reshape the global iron ore market, challenging Australia’s long-standing dominance and giving China unprecedented control over both supply and demand. The Simandou mine, home to the world’s largest untapped deposit of high-grade iron ore, is set to export its first shipment by the end of 2025, marking a pivotal moment for the industry and for Guinea’s future.

Simandou’s Long Road to Production

Simandou’s iron ore reserves were first identified in the 1950s during French colonial rule, but decades of political instability, corruption, and logistical hurdles kept the project dormant. Rio Tinto began serious exploration in 1998, sending geologists through Guinea’s dense forests to confirm the scale of the deposit. Despite the promise, progress stalled amid coups and legal battles. Ownership of the mine shifted repeatedly, with Rio Tinto losing half its stake in 2008 after Guinea’s president revoked its licenses and awarded them to diamond magnate Beny Steinmetz. Steinmetz’s subsequent conviction for bribery and Vale’s costly missteps underscored the risks of operating in Guinea. By 2019, Chinese and Singaporean companies had secured rights to key blocks, setting the stage for China’s growing influence.

Market Shake-Up and Price Pressures

Iron ore prices have already fallen sharply from their 2021 peak of $200 per ton to just over $100 in late 2025. Industry leaders like BHP, Rio Tinto, and Vale anticipate further declines, with forecasts suggesting prices could drop to $85 per ton by 2028 as Simandou’s output ramps up. The downturn is driven by weakening demand from China’s steel sector and the anticipated flood of new supply from Guinea. Simandou’s reserves, estimated at over 3 billion tons, are controlled primarily by Chinese state-owned enterprises, which now own about 75% of the project. The first shipment—9,850 tons—departed Guinea’s newly built port in November 2025, with more expected before year’s end. This influx could fundamentally alter global supply chains, especially as China consolidates its position as both the largest buyer and, increasingly, the supplier of iron ore.

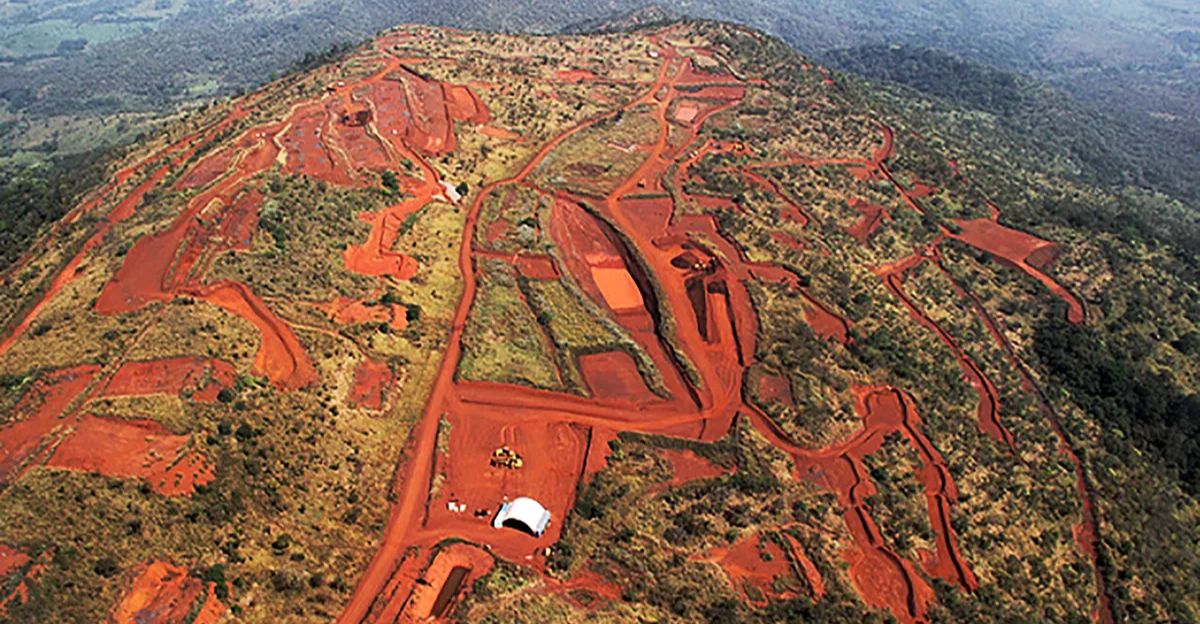

Local Impact and Environmental Concerns

Simandou promises to transform Guinea’s economy, with projections that it could boost GDP by more than 25% by the early 2030s. The project’s scale is immense, involving a 600-kilometer railway with over 200 bridges and more than 140 locomotives ordered to transport ore to the coast. Many local workers, previously reliant on subsistence farming, now operate advanced machinery in one of Africa’s largest mining ventures. However, the rapid industrialization has come at a cost: over 450 communities face disruption, and construction accidents have claimed lives. Environmentalists warn that the mine threatens the habitat of the critically endangered West African chimpanzee, and iron ore extraction risks contaminating local watersheds. In response, Guinea’s government has required feasibility studies for a domestic steel plant to capture more value from the resource and mitigate some environmental impacts.

Australia’s Challenge and China’s Leverage

Australia’s Pilbara region has long been the backbone of global iron ore supply, but Simandou’s high-grade ore—averaging above 65% iron content—offers a quality advantage over Pilbara’s typical 55-62% grades. While Simandou’s reserves are smaller, the strategic ownership by Chinese firms means its impact on pricing and market power could be outsized. China’s steel sector, which consumes more than half the world’s iron ore, is now facing slowing demand due to a cooling property market and government crackdowns on overcapacity. This shift is troubling for traditional suppliers, as China’s control over both supply and demand gives it new leverage in setting global prices. The China Mineral Resources Group (CMRG), representing over half of China’s steelmakers, has quickly become the world’s largest iron ore buyer, further consolidating market power.

Geopolitical Stakes and Guinea’s Future

Simandou’s development is closely tied to China’s Belt and Road Initiative, with infrastructure built using standardized designs and rapid construction methods. The U.S. embassy in Guinea has advocated for continued Western involvement, highlighting the strategic importance of balancing Chinese dominance. Guinea’s military-led government has sought to secure the country’s first sovereign credit rating and attract investment, hoping to avoid the “resource curse” that has plagued other mineral-rich nations. The government’s “Simandou 2040” roadmap aims to use mining wealth to diversify the economy, but critics warn that without broader development, Guinea risks repeating the mistakes of other resource-dependent countries.

As Simandou begins production, the global iron ore market faces a new era of uncertainty and opportunity. China’s dual role as the largest consumer and a major supplier could reshape pricing and trade dynamics for years to come. For Guinea, the stakes are equally high: the nation stands on the brink of transformation, with the potential to become a mineral powerhouse or fall victim to the pitfalls of rapid, uneven development. The world is watching as this mega-project unfolds, its full impact yet to be determined.