In August 2025, U.S. stock markets climbed to new record highs amid exuberance over AI. The S&P 500 hit fresh peaks as investors cheered signs that spending on AI infrastructure was surging.

Even a minor shortfall in Nvidia’s guidance failed to derail the rally: as one strategist noted, the primary structural driver – AI – “is not going anywhere or cooling down”.

Tech giants led the advance, with their soaring valuations reflecting a broad wave of enthusiasm. The rally was powered by confidence that AI-related investments will continue driving growth across the sector.

Mixed Earnings Signals

By late summer, second-quarter earnings painted a mixed picture on AI. Cloud leaders announced massive new infrastructure budgets even as revenue gains lagged.

Amazon AWS said it will spend roughly $31 billion per quarter on data centers this year, and Microsoft CFO Amy Hood confirmed ~$30 billion of capex next quarter, citing “strong demand signals”.

Yet investors were cautious. Amazon’s stock fell after it warned of tighter margins despite record revenue, and analysts like Bob Doll warned that companies “usually lag for a while” after such huge capex leaps. In other words, even as Big Tech doubled down on AI.

Industry Evolution

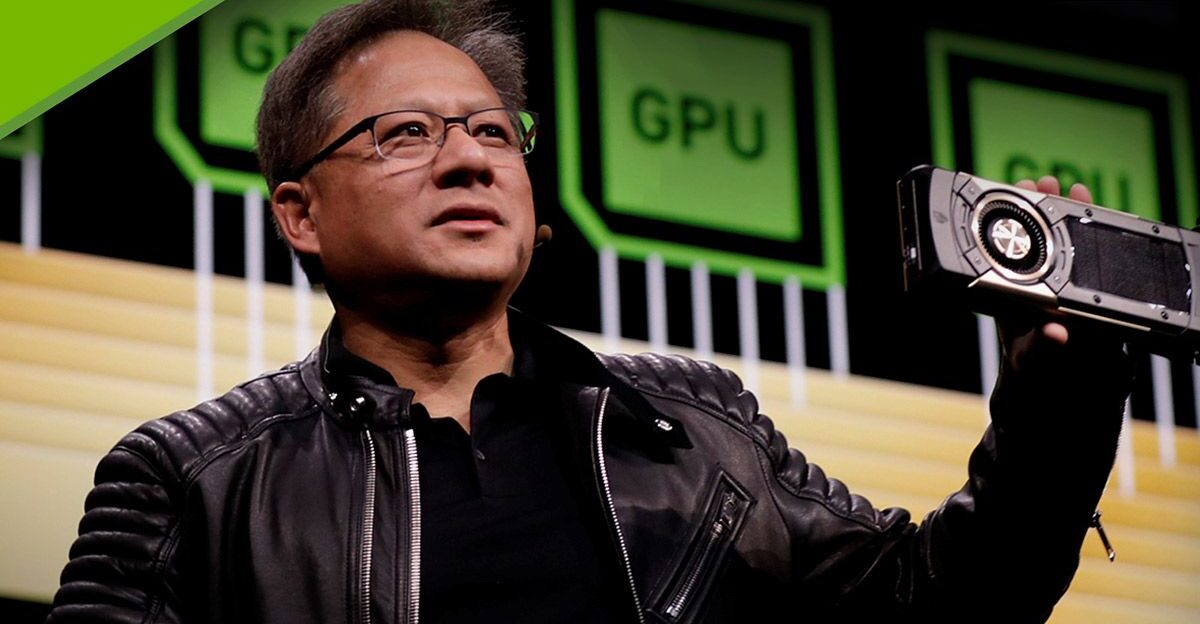

The semiconductor world has been upended by AI. Graphics processing units are now the backbone of machine learning, driving explosive demand. In a recent survey, a vast majority of chip executives predicted robust growth – 92% expect higher revenues in 2025, with over a third forecasting >10% gains – largely due to “strong demand for GPUs and advanced storage” for AI workloads.

High-performance GPUs and new AI accelerators are seen as “essential components of [the] industry’s future”.

Supply chains have shifted accordingly: fabs that once focused on smartphones are now retooling for AI chips, and chip firms are coordinating closely with cloud providers to allocate manufacturing capacity. Major silicon companies have effectively reprioritized production for AI, forging new fabrication partnerships to meet global cloud demand.

Growing Tensions

Amid the tech boom, geopolitics added fresh uncertainty. In 2025, U.S. export controls on advanced chips to China became much tighter, forcing industry shifts. For example, regulators moved to revoke TSMC’s general license for exporting chipmaking tools to China, meaning every tool shipment (even for existing factories) would need individual approval.

Chip companies had to adapt quickly: some reportedly began designing “dumbed down” chip variants for the Chinese market to comply with U.S. rules.

Chinese officials loudly protested these curbs as “unilateral intimidation,” even summoning tech executives over their China chip purchases.

Earnings Reveal

Nvidia’s July-quarter results underscored this tightrope. The company reported revenue of about $46.7 billion, topping estimates, and non-GAAP EPS of ~$1.05 (versus ~$1.01 expected). Yet its stock fell a few per cent after hours, as data-center sales growth slowed slightly.

Investor reactions were mixed. One tech investor observed that “Nvidia’s dominance remains clear in a white-hot AI market”, reflecting the company’s strong positioning. Others cautioned that the results were “solid… not a massive beat” given sky-high expectations.

CEO Jensen Huang took a long view: he emphasized that this is just the beginning of AI’s rise and that demand remains strong (noting that Nvidia’s systems are “in every cloud” and scaling rapidly).

Market Impact

Nvidia’s data-center caution rippled through chip markets. In after-hours trading, fellow chipmakers like AMD and Intel slid on the news. For example, AMD dropped about 1.6% and Intel ~0.3%, as investors rechecked valuations. The weakness extended overseas. Taiwan’s TSMC (Nvidia’s key fab partner) fell around 0.8%, and other Asian chip stocks dipped by roughly 1%.

One analyst noted that Nvidia’s report underscored “rising challenges facing AI chipmakers,” not just at Nvidia but industry-wide.

Meanwhile, some market-watchers suggested that the fallout might slightly favor Chinese and other domestic chip firms, since tensions and shortages have refocused attention on homegrown suppliers.

Customer Investment

Hyperscale customers continue to spend aggressively. Nvidia executives pointed out that the AI hardware pipeline is booked far in advance. CFO Colette Kress estimated that cloud and enterprise customers will spend roughly $600 billion on AI-related infrastructure in 2025 – roughly double the annual figure from just a year prior. By way of context, analysts had pegged total Big Tech AI capex in 2025 at roughly $330 billion.

Nvidia also disclosed that one large customer (outside China) bought about $650 million of its latest H20 GPUs in a single quarter.

Data centers are locking in supply far into the future. Industry observers say this reflects intense demand: major cloud providers view Nvidia chips as mission-critical, and are effectively acting as “mega-customers” reserving capacity for years. As one crypto investor said after the quarter, those commitments – not immediate profit – explain why the outlook is still compelling.

Competitive Landscape

Beyond Nvidia, the chip competition is shifting fast. AMD’s recent earnings highlighted steady AI demand: its data-center business grew roughly 14% year-on-year. (AMD noted some weakness in AI chip sales to China due to restrictions, but its overall AI efforts remained solid.) Intel, by contrast, continues to struggle with a sluggish PC market, though it is seeking a rebound in servers.

One wildcard is Broadcom: it reported another strong quarter and guided for 55–60% growth in AI-related revenue next year.

Broadcom’s analyst briefings also flagged that its specialized AI networking and ASIC products are approaching a $20 billion annual run-rate. Meanwhile, major cloud companies are pursuing their own chips.

Regulatory Moves

U.S. trade policy is changing the game. A recent breakthrough was an unprecedented revenue-sharing deal: the administration got Nvidia and AMD to agree to pay 15% of sales of certain AI chips in China back to the U.S. government in exchange for export permission.

This is effectively a user fee on exports. The plan raised immediate legal questions: experts noted that making trade contingent on government payments “resembles an export tax,” which the U.S. Constitution generally prohibits.

Legislators on Capitol Hill voiced concerns. One congressman said, “There are questions about the legal basis” for the agreement and warned it might set a dangerous precedent of using trade policy as a bargaining chip.

Production Reality

Nvidia’s back orders are filling the world’s chip fabs. Reports indicate the company has effectively sold out its Blackwell GPU capacity through 2026. Analysts noted that every new batch of Blackwell chips is already reserved: Morgan Stanley wrote that customers have booked “essentially the entire production” for the next year.

New orders today would likely ship in late 2026. Nvidia has responded by locking up fab capacity: for example, it has secured a Wistron server plant in Taiwan entirely for its AI servers through 2026, and it is ramping dedicated facilities with TSMC and Foxconn for domestic production.

Even with these moves, supply remains constrained. As one industry analyst observed, given the backlog, “Nvidia is likely to actually gain share of AI processors in 2025… everything we heard this week reinforced that”.

Internal Pressures

The breakneck pace has internal and supplier consequences. Nvidia has had to pause work on some China-bound projects (for example, instructing partners to halt a Chinese-market GPU), and insiders say these abrupt shifts strained its supply chain.

Executives and engineers reportedly told colleagues that juggling rapid growth targets with new export rules is a major challenge. At partner foundries, production teams scrambled to meet Nvidia’s rigorous quality standards on accelerated timelines.

Some customers reacted to the trade uncertainty by postponing orders: companies with Chinese operations wanted guarantees on future regulations before placing multi-year commitments.

Strategic Shifts

To mitigate these risks, Nvidia announced a bold strategy: build AI chips in the U.S. for the first time. In April 2025, it revealed plans to spend up to $500 billion over four years on U.S. AI infrastructure.

The company is collaborating with major foundries and contractors – TSMC, Foxconn, Amkor, Wistron and others – to construct over a million square feet of new fabs and assembly plants across Arizona and Texas. TSMC’s Arizona factory has already begun churning out the new Blackwell chips.

Foxconn is building an AI supercomputer plant in Houston and Wistron in Dallas, with both sites ramping up over the next 12–15 months.

Recovery Plans

Management insists the long-term growth story is intact. CFO Colette Kress reiterated Nvidia’s forecast that total AI infrastructure investment (cloud, enterprise, sovereign efforts, etc.) will reach $3–4 trillion by 2030. Jensen Huang put that figure in context of the coming “fourth industrial revolution,” arguing that current demand is just the beginning.

He told investors that 2025 would be a “record-breaking year” and that he expected similarly historic growth ahead. In line with this vision, Nvidia has begun calling itself more than a chipmaker — essentially an “AI infrastructure” company building everything from hardware to full systems.

Analysts note this positioning reflects Nvidia’s central role: by embedding its GPUs and interconnects throughout cloud and enterprise stacks, the company is tying its fate to the broader AI ecosystem.

Analyst Skepticism

Wall Street’s reaction to Nvidia’s valuation is mixed. Some banks remain bullish but cautious. For example, Goldman Sachs kept a $200 price target and a Buy rating, while explicitly noting that “high investor expectations limited upside” after the latest results. Other strategists pointed out that most corporate AI spending is still in early stages.

One research piece flagged that roughly 95% of firms investing in generative AI have reported no financial return yet. That statistic – drawn from a recent MIT study – has fueled concerns that many AI projects are not delivering value in the near term.

Analysts warn that with valuations as lofty as Nvidia’s, any sustained revenue slowdown or execution hiccup could quickly temper the stock’s gains.

Future Questions

As the dust settles, key questions loom. Can the record levels of AI investment be justified by results? Critics point to uncertainty over the technology’s limits. A recent report found that most companies pouring money into AI haven’t seen benefits yet, and OpenAI’s Sam Altman himself warned investors might be getting “over-excited” about AI.

Many ask whether today’s large language models and AI tools are truly on the cusp of enabling the productivity revolution investors expect, or whether those gains remain further off.

Observers note that we could be at a turning point: the next 6–12 months of corporate earnings and deployments will test if Nvidia’s surge reflects a genuine transformation in computing or a speculative peak.

Policy Implications

The Nvidia-China export deal has sparked policy debates. Legal experts point out that tying trade licenses to revenue-share payments resembles a tax, which the Constitution forbids. Some lawmakers are already discussing whether Congress should formally authorize or restrict such arrangements through legislation.

For now, supporters argue the deal is a wartime-like emergency measure to limit China’s AI advance, while critics view it as a slippery slope of government intervention.

Going forward, any similar U.S.-China tech agreements will likely require clearer legal authority: groups have proposed drafting new rules so that future export controls and revenue-sharing (if any) are implemented transparently and with due process.

Global Response

Outside the U.S., the Nvidia saga is reshaping strategies. China’s government has loudly denounced U.S. export curbs as “unilateral intimidation,” promising to accelerate its own chip programs and reduce dependency on American technology.

In Europe, officials have expressed concern about being caught in the middle of a U.S.–China tech feud, urging the EU to build its own “strategic autonomy” in semiconductors.

Other countries are quietly reassessing their reliance on any single supplier. For example, India and Japan have stepped up investments to boost domestic chip manufacturing and diversify import sources. Even allies in Asia and the Middle East are revisiting their tech supply chains.

Economic Ramifications

Analysts warn that the new U.S. policies could introduce significant costs into the tech sector. Forrester Research’s Charlie Dai called the 15%-of-sales scheme “unprecedented” for chip trade. By effectively adding a surcharge to advanced chip exports to China, the deal raises prices for American sellers and their customers alike.

Industry groups note this could ripple through global markets: manufacturers might pass the extra 15% onto buyers, or some Chinese firms may turn to local or alternative suppliers.

In the long run, such intervention risks adding complexity and expense for any company wanting to serve Chinese or other protected markets.

Cultural Shift

Nvidia’s leadership offers a new take on AI’s impact on work. In interviews, Jensen Huang suggested that, contrary to earlier promises of more leisure, AI will make remaining work hours far more intense.

He predicted that firms will likely move to four-day workweeks, but workers will end up “busier than ever” on those days to maintain output. In his words, “we are going to be busier in the future than now” as AI tools accelerate workflows.

This reflects a cultural shift: instead of automation yielding more free time, companies may demand higher productivity per hour. If that view proves correct, the social changes from AI could be as significant as its technological ones, requiring managers and workers to adapt to a faster pace of life.

Broader Reflection

Nvidia’s performance has become a bellwether for the broader AI story. Its success – or any future falter – will help settle a larger debate. On one hand, Nvidia’s growth embodies the promise of AI: massive investment driving next-generation productivity.

On the other hand, critics worry it may be part of a speculative bubble. As tech commentator Gary Marcus noted recently, with enormous funds flowing into AI, the sector will face a harsh reality check if companies don’t begin reaping results soon. In that sense, Nvidia’s trajectory will shape confidence in the AI economy.

If AI enables the sweeping gains in efficiency and innovation its boosters claim, it could justify today’s valuations and revolutionize industries.