Novo Nordisk, once Europe’s most valuable pharmaceutical company, has seen its market value decline by approximately $93 billion over the past year, particularly due to a significant stock drop on July 29, 2025. This downturn has shaken investor confidence and raised concerns about the future of the obesity drug market.

The company’s rapid rise and sudden fall have created uncertainty within the pharmaceutical industry, prompting a closer look at the factors behind this decline.

Billions at Stake

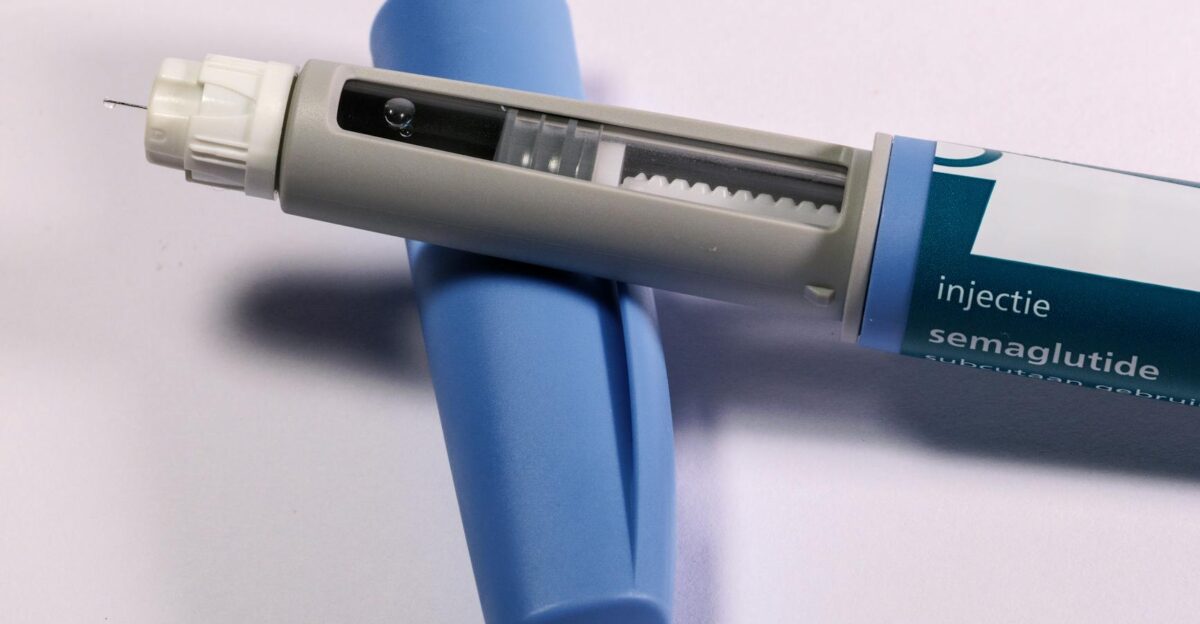

Novo Nordisk’s leading drugs, Ozempic and Wegovy, have significantly boosted its profits and reputation. However, rising competition and falling prices are threatening its market dominance.

The company’s response to these challenges could reshape the global obesity treatment market, impacting millions of patients and billions in revenue.

Meteoric Rise

By September 2023, Novo Nordisk had risen to become Europe’s most valuable company, driven by high demand for its transformative GLP-1 medications for diabetes and obesity.

This rapid growth, while solidifying its status as an industry leader, has also led to new challenges and increased competition.

Competitive Pressures

The obesity drug market is now highly competitive, with companies like Eli Lilly introducing similar GLP-1 therapies and an influx of generic and compounded options.

This has led to decreased prices and reduced profit margins for Novo Nordisk, which must adapt to maintain its competitive edge.

Layoffs Announced

On September 10, 2025, Novo Nordisk announced plans to cut around 9,000 jobs worldwide, representing 11% of its workforce.

The layoffs, effective immediately, aim to save $1.3 billion annually by 2026, marking the company’s largest workforce reduction in decades.

Denmark Hit Hard

The layoffs have a major impact in Denmark, Novo Nordisk’s home country, with 5,000 of the 9,000 jobs being cut there.

This will affect not only the employees but also local communities, suppliers, and regional economies that depend on the company.

Faces Behind the Numbers

The news was devastating for many Novo Nordisk employees. Workers in Denmark and abroad now face uncertain futures.

“Our markets are evolving, particularly in obesity,” said executive Mike Doustdar, acknowledging the personal toll of the layoffs. The human cost is real and immediate.

Rivals Surge Forward

Eli Lilly’s GLP-1 drugs have gained market share, with Zepbound surpassing Wegovy in new US prescriptions by March 2024. Meanwhile, generic manufacturers and compounding pharmacies are providing cheaper alternatives.

Regulatory agencies are struggling to keep up, and Novo Nordisk has seen mixed results in its legal battles against knockoff products.

Industry-Wide Shift

Novo Nordisk’s restructuring reflects a broader trend in the pharmaceutical industry. Major companies like Bayer, Merck, and Pfizer announced layoffs in 2025 to streamline operations.

This shift highlights the pressure on the sector to adapt to changing market dynamics and rising competition.

Return-to-Office Mandate

Novo Nordisk requires all remaining employees to return to the office full-time starting January 1, 2026.

This decision follows recent layoffs and aims to strengthen accountability and foster cultural change within the company.

Internal Tensions

The restructuring has sparked frustration among staff. Some employees question the company’s strategy, while others worry about morale and productivity.

Leadership insists the changes are necessary for long-term survival, but internal divisions remain.

New Leadership Steps In

Novo Nordisk’s new CEO, Mike Doustdar, took the helm in August 2025, just weeks before the layoffs.

He has pledged to “instill an increased performance-based culture” and prioritize investment in core therapy areas. The leadership transition adds another layer of uncertainty—and hope for renewal.

Strategic Reset

Novo Nordisk is enhancing its focus on diabetes and obesity therapies, aiming to expand approved uses of its drugs.

The company is also considering acquisitions to drive growth, to regain market position and restore investor confidence.

Skeptics Weigh In

Analysts remain cautious. While cost savings are significant, some experts doubt whether restructuring alone can offset lost market share.

The proliferation of generics and ongoing legal battles pose risks to Novo Nordisk’s recovery.

What’s Next for Novo?

Novo Nordisk is at a crucial juncture as it seeks to reclaim its leadership position in the obesity drug market. The company’s future actions, including potential new product launches, strategic partnerships, and possible restructuring efforts, will significantly shape its trajectory.

Industry observers are closely monitoring the situation for indications of a potential turnaround.

Policy and Political Ripples

The layoffs have drawn attention from Danish policymakers, who worry about the broader economic impact.

Some call for government support or intervention to protect jobs and maintain Denmark’s status as a pharmaceutical hub.

Global Workforce Impact

Novo Nordisk’s recent workforce reductions are impacting employees not only in Denmark but also across the US, Europe, and Asia.

This situation underscores the global nature of the pharmaceutical industry and the interconnectedness of various regional economies.

Legal Battles Continue

Novo Nordisk is fighting against generic and compounded versions of its drugs, filing over 130 lawsuits as of August 2025.

So far, these efforts have had mixed success, with some wins but legal costs continuing to mount. The outcome could reshape the market for GLP-1 therapies.

Shifting Public Perception

The recent layoffs and restructuring at Novo Nordisk have significantly impacted the company’s public image. Previously renowned for its innovation, Novo Nordisk is now under increased scrutiny regarding its business practices and commitment to its workforce.

This shift reflects a broader cultural conversation about the pharmaceutical industry, often called “big pharma,” as perceptions and expectations evolve.

Industry at a Crossroads

Novo Nordisk’s upheaval signals a turning point for the pharmaceutical sector.

Companies must adapt or risk obsolescence as competition intensifies and market dynamics shift. The story of Novo Nordisk is a cautionary tale—and a glimpse of what’s to come.