The global advertising business is undergoing its biggest shake-up in decades as Omnicom Group and Interpublic Group complete a merger that creates a traditional ad powerhouse with more than $25 billion in annual revenue. Finalized on November 26, 2025, the all-stock deal closed at about $9 billion, well below the original $13.25 billion valuation after both companies’ shares declined in the months leading up to completion. The combined group now faces the dual challenge of integrating sprawling global operations while defending its position against technology platforms and AI-driven marketing tools.

Strategic Motives and Market Pressure

Behind the deal is mounting pressure from technology giants, rapid advances in artificial intelligence, and advertisers’ demand for data-rich, globally scaled partners. Together, Omnicom and IPG command roughly $73.4 billion in media billings, giving the new group more leverage in negotiations with major platforms such as Google, Meta, and Amazon. Both companies had also seen their stock prices fall amid investor concerns that AI tools from tech firms could bypass agencies, pushing them toward consolidation as both a defensive move and a bid for long-term dominance.

A central pillar of the strategy is data and technology integration. IPG’s Acxiom database is being folded into Omnicom’s OmniPlus platform, which will formally launch at CES 2026 as a combined engine for first-party data, e-commerce capabilities, and agentic AI. Executives argue this scale and data depth are essential to remain relevant as automated ad buying and AI-generated messaging take a larger share of marketing activity.

Leadership, Structure, and Cost Savings

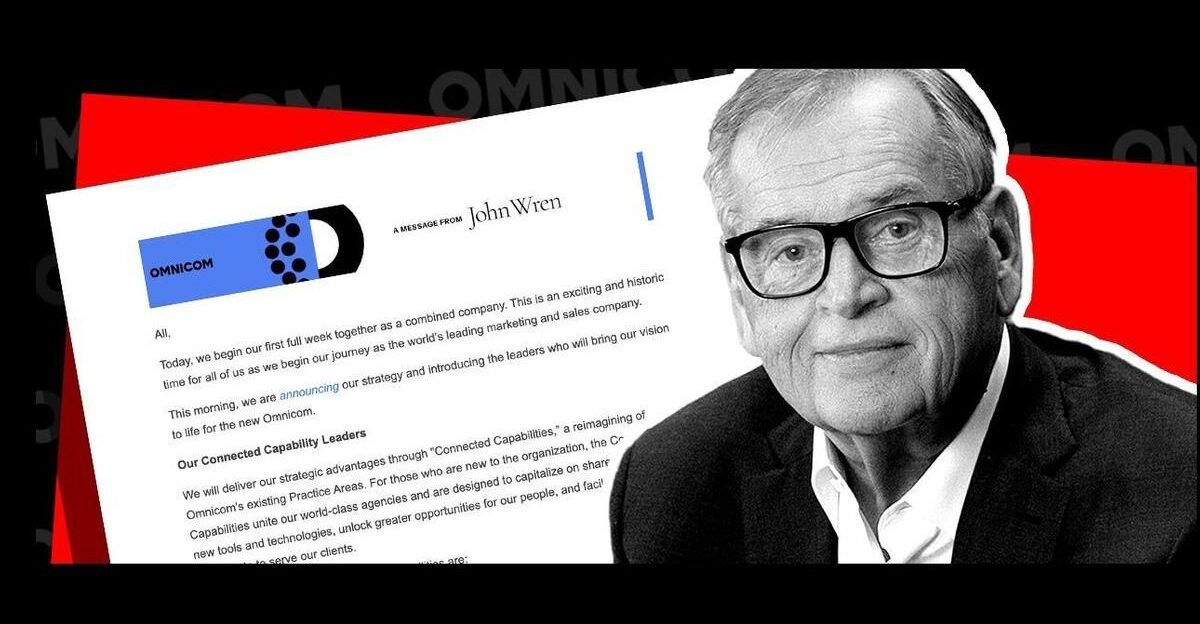

The merged company is led by longtime Omnicom chief executive John Wren, with Philippe Krakowsky and Daryl Simm serving as co-presidents. Troy Ruhanen oversees the advertising networks, while Florian Adamski runs Omnicom Media, now billed as the world’s largest media organization by billings. Leadership has framed the merger as a way to “build a company for the future,” while acknowledging the significant organizational changes required.

Financially, legacy Omnicom shareholders hold 60.6 percent of the new entity, with IPG investors owning 39.4 percent. IPG’s $2.95 billion in senior notes have largely been exchanged for new Omnicom-issued debt, reshaping the balance sheet. Management is targeting at least $750 million in annual cost savings through headcount reductions, consolidation of office space, elimination of overlapping IT and software systems, and greater buying power in media. Wren has indicated that the eventual benefits could exceed this initial savings estimate.

Jobs, Legacy Agencies, and Global Impact

The human cost of the merger is significant. The integration will result in about 4,000 new job cuts, mostly in administrative, support, and duplicate management layers, representing roughly 3 percent of the combined workforce. When added to earlier moves, more than 10,000 roles are expected to be affected. Since December 2024, IPG had already cut around 3,200 positions and Omnicom approximately 3,000, largely to streamline overlapping divisions ahead of the deal.

Some of the deepest changes are felt in the creative networks. Longstanding agencies DDB, FCB, and MullenLowe are being retired as standalone brands, despite their historic work on campaigns such as Volkswagen’s “Think Small,” Budweiser’s “Wassup?,” Stella Artois’ “Reassuringly Expensive,” and FCB’s award-winning efforts at Cannes Lions in 2025. Their absorption into larger networks disrupts decades of agency culture and affects senior creative and account leadership. Media operations are also being reshaped as Omnicom Media pulls more than a dozen agencies into a single structure, cutting overlapping planner and buyer positions while aiming to keep about 85 percent of remaining roles focused directly on client work.

The footprint of the new group spans more than 100 countries, with major hubs in New York, London, Tokyo, and Sydney. In the United States alone, between 1,600 and 2,000 jobs may be lost, particularly in creative and media centers, with Europe and Asia-Pacific also facing sizable reductions. Back-office functions in finance, HR, procurement, compliance, payroll, and other shared services are being consolidated onto unified financial, CRM, and cloud systems to remove duplication. While these shifts are designed to simplify operations, they are expected to cause near-term disruption across offices and teams.

Clients, Conflicts, and an AI-Driven Future

The merger creates new account conflicts, as the combined group now serves head-to-head competitors such as AT&T and T-Mobile in telecom and State Farm and GEICO in insurance. That raises the risk of client defections or reviews if advertisers become uncomfortable with data separation arrangements or perceive strategic conflicts. Industry analyst Brian Wieser has cautioned that the success of the transition—both in managing staff upheaval and reassuring clients—will be critical to whether major contracts stay in place or are reopened.

AI sits at the center of the company’s long-term vision. OmniPlus is being positioned as a way to connect first-party data, commerce activity, and AI agents capable of planning and optimizing campaigns across channels. Adamski has predicted that within five years, a growing share of activity will involve communicating with AI systems rather than exclusively with human audiences. That raises questions about how many traditional roles—particularly in planning, buying, and mid-level management—will be automated, and how human creativity will be deployed alongside algorithmic systems.

For employees, leadership has promised rapid notifications to avoid prolonged uncertainty and has put severance and outplacement support in place, though the timing of layoffs around the holiday season adds pressure for many households. Beyond full-time staff, freelancers, production partners, and media vendors are also feeling the effects as project volumes shift and large clients reconsider their rosters. Independent specialists and platforms connecting companies with freelance creatives have reported increased activity as displaced workers seek new income sources.

Across the industry, rivals are already adjusting. Publicis has reported solid growth and is moving to attract talent and accounts unsettled by the merger, while WPP continues to grapple with challenges in North America. Smaller independent shops may benefit if large marketers decide to diversify away from mega-groups perceived as complex or slow-moving. At the same time, the broader sector is still absorbing more than 20,000 lost jobs over 2024–2025, driven by automation, outsourcing, and consolidation.

Omnicom’s takeover of IPG marks what John Wren has called a defining moment for the sector, concentrating power in a single group at a time when more than half of the global ad market is already controlled by technology platforms. The success or failure of this integration will influence how fast agencies adopt AI, how much room remains for independent creative brands, and how future employment in marketing evolves. As the new entity pursues scale and efficiency, the industry will be watching whether it can balance cost-cutting with innovation and maintain client trust in an increasingly automated advertising landscape.

Source:

Business Insider 1 December 2025

Adweek 1 December 2025

PRNewswire 28 November 2025

Campaign ME 26 November 2025

Omnicom Group Official Newsroom 9 December 2024

eMarketer June 2025

Branding in Asia 1 December 2025

Axios 9 December 2024