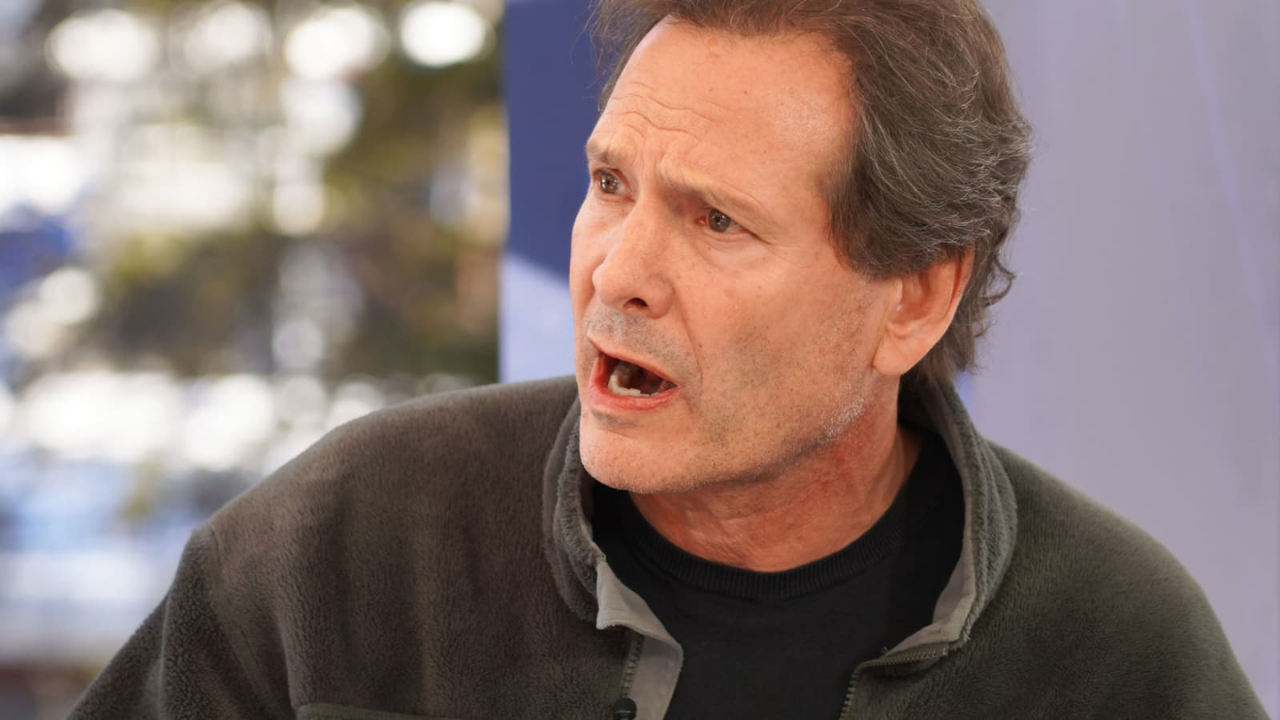

During a December 5 internal all-hands meeting, Verizon CEO Dan Schulman made a stunning confession that would reverberate through Wall Street: the company had deliberately priced itself into losing 500 to 700 basis points of market share over five years. “A lot of it is self-inflicted wounds.

A lot of it,” he told stunned employees, marking an unprecedented moment of corporate candor in the telecommunications industry where executives typically deflect blame toward competitors or market conditions.

Immediate Context—The New CEO’s Perspective

Dan Schulman, who replaced Hans Vestberg as Verizon CEO in October 2025, inherited a company hemorrhaging customers and market dominance. Within weeks of assuming control, Schulman conducted his first board meeting and prepared aggressive transformation plans that would reshape the $99.6 billion revenue corporation.

His candid December admission reflected frustration with a business model that prioritized short-term revenue extraction over long-term customer relationships—a strategy that ultimately backfired with devastating consequences.

The Price Increase Trap That Backfired

Schulman revealed the destructive cycle with brutal clarity: “When we start raising rates and when we start raising rates, you start irritating customers big time. They start churning”. The company’s churn rate increased by 20 to 25 basis points following price increases, creating a vicious downward spiral.

First-quarter 2025 experienced particularly severe damage, with consumer postpaid phone churn rising 7 basis points year-over-year due to multiple pricing actions implemented in late 2024.

Quantifying the Customer Exodus Crisis

The damage manifested in catastrophic Q3 2025 results: Verizon lost 7,000 postpaid phone customers during the quarter—a stunning reversal from the 18,000 customer additions recorded in Q3 2024. First-quarter 2025 proved even worse, with the company hemorrhaging hundreds of thousands of customers as pricing backlash intensified.

The postpaid phone churn rate reached 0.91% in Q3 2025, climbing to 0.95% per month in Q1—a decade-high level that alarmed shareholders and board members.

Competitors Capitalize on Verizon’s Strategic Misstep

While Verizon lost customers, T-Mobile added 1 million new subscribers in Q3 2025, and AT&T captured 405,000 net additions. T-Mobile’s market capitalization surpassed Verizon’s by mid-2025, reaching approximately $274 billion, compared to Verizon’s $182 billion—a remarkable reversal from historical competitive dynamics.

The wireless industry leader’s success stemmed partly from maintaining lower price points while Verizon implemented aggressive price increases, demonstrating that premium pricing without commensurate value delivery can destroy competitive positioning.

Customer Satisfaction Scores Plummet Below Competitors

J.D. Power customer satisfaction surveys revealed the extent of Verizon’s reputation damage: the company scored just 583 points, trailing T-Mobile’s 636 and narrowly exceeding AT&T’s 573. Schulman acknowledged the devastating gap during internal meetings: “Our satisfaction scores are worse than our competitors”.

This marked a significant deterioration from Verizon’s historical position as the customer satisfaction leader, with pricing-driven dissatisfaction permeating all customer segments.

The Structural Barriers to Customer Retention

Schulman identified systemic obstacles preventing frontline employees from retaining customers. “We don’t have enough financial flexibility” to empower customer service representatives to resolve issues, he explained.

The company’s labyrinthine promotional structure created friction: “We have so many different promotions out there,” Schulman lamented, describing the complexity that confused customers and prevented employees from offering competitive retention packages.

Market Share Losses Cascade Across Divisions

Beyond wireless phone subscribers, Verizon’s retreat accelerated across product lines. The company lost 70,000 Fios video pay-TV subscribers in Q3 2025, representing a 5.4% year-over-year decline.

While the broadband division performed better, adding 306,000 fixed wireless and fiber customers in Q3, overall market dynamics favored competitors who maintained more balanced pricing strategies. The cumulative market share erosion compelled Schulman to conclude that a fundamental business model transformation was necessary to prevent total competitive displacement.

The Inevitable Layoff Announcement—November 20, 2025

Facing unsustainable financial pressures, Schulman announced on November 20 that Verizon would eliminate more than 13,000 positions—approximately 13% of the company’s workforce of 99,600 people.

This marked the most severe workforce reduction in company history and the telecommunications industry’s worst monthly layoff total since April 2020. In his employee memo, Schulman framed the cuts as necessary medicine: “The actions we’re taking are designed to make us faster and more focused, positioning our company to deliver for our customers while continuing to capture new growth opportunities”.

Schulman’s Justification: No Halfway Measures Possible

During his December 5 all-hands meeting, Schulman explained why gradual, smaller cuts were insufficient. “The massive layoffs were inevitable because if we don’t have enough money to put back into our value proposition to customers, we are going to continue to shrink”.

He argued that partial reductions would eventually necessitate larger future layoffs, making the immediate comprehensive restructuring preferable to prolonged organizational atrophy.

Strategic Transformation Priorities for 2026

Schulman’s transformation agenda centers on three key pillars: customer-centric operations, operational simplification, and the integration of artificial intelligence. The CEO disclosed that he presented detailed plans to Verizon’s board during his first meeting and would share additional specifics with Wall Street analysts during upcoming earnings calls.

The strategy explicitly rejects the “price without growth” approach that damages customer relationships, signaling commitment to rebuilding value perception and market competitiveness.

The $20 Million Career Transition Fund—Softening the Blow

Despite the massive layoffs, Schulman established a $20 million Reskilling and Career Transition Fund to assist affected employees in developing skills for an AI-driven economy.

The initiative provides professional development, digital training, and job placement services—recognition that technology transformation requires proactive workforce development investment. This measure, while not mitigating the human cost of restructuring, positions Verizon as acknowledging its responsibility to support displaced workers through technological transition.

Industry Implications—A Cautionary Tale for Telecom Giants

Verizon’s crisis carries profound implications for the broader telecommunications industry, where all major carriers face pressure to balance profitability with customer retention. The company’s experience demonstrates that premium pricing strategies fail without corresponding value enhancement, and that market share losses create financial constraints that ultimately force more drastic measures.

Schulman’s candid admission that Verizon created its own problems represents a rare moment of executive accountability that may influence how other telecom leaders approach pricing and customer strategy decisions.

Financial Impact and Cost Savings Projections

Industry analysts estimate the 13,000 layoffs will generate approximately $1 billion in annual cost savings beginning in 2026. These savings provide capital for Schulman to reinvest in customer value propositions, network improvements, and competitive service enhancements.

However, cost reduction alone cannot reverse market share losses without accompanying strategic improvements in customer experience, promotional clarity, and value perception—the core challenges Schulman has identified as central to Verizon’s transformation agenda.

The Road Ahead—Redemption or Continued Decline

Verizon stands at an inflection point, where leadership transition, unprecedented workforce restructuring, and strategic repositioning will determine whether the company can reclaim market leadership or continue to lose ground to T-Mobile and AT&T.

Schulman’s willingness to acknowledge previous management mistakes and implement transformative rather than incremental changes suggests a serious commitment to recovery. The coming months will reveal whether massive layoffs, a reinvigorated customer focus, and AI-driven operational improvements can restore Verizon’s competitive vitality or merely slow an inevitable decline in an industry where customer-centric competitors are increasingly dominant.

Sources:

“Verizon CEO reveals mistakes that led to over 13,000 layoffs.” TheStreet/MSN, December 8, 2025.

“Verizon’s smug stance crumbles after brutal Q3, and its new CEO admits to ‘self-inflicted’ wounds.” PhoneArena, October 28, 2025.

“Verizon names former PayPal boss Dan Schulman as new CEO.” USA Today, October 6, 2025.

“Verizon CEO tells employees about massive layoffs and transformation strategy.” Yahoo Finance, December 9, 2025.

“Why Verizon’s new CEO is cutting 13,000 jobs at the wireless company.” Morningstar/MarketWatch, November 20, 2025.

“How T-Mobile Overtakes Verizon: Focus on Core Business.” LinkedIn, August 26, 2025.

“Verizon Communications Inc. Earnings Transcript First Quarter 2025.” Verizon Official SEC Filing, April 22, 2025.