In a major operational shift, U.S. special operations forces boarded a cargo vessel hundreds of miles off Sri Lanka last month, seizing military-grade components bound for Iran. This marked the first known interception of Chinese-origin weapons destined for Tehran in recent years.

While the cargo was destroyed, experts warn much still got through, highlighting a critical challenge in halting global weapons pipelines. Here’s what’s going on.

The Critical Moment That Changed Everything

Last summer, a 12-day Iran-Israel conflict devastated Tehran’s military infrastructure. Pentagon assessments noted destruction of 120 missile launchers, 70 missile batteries, and key enrichment facilities at Fordow, Natanz, and Isfahan. Iran’s planetary mixer infrastructure, vital for solid-fuel missiles, was eliminated. Tehran now raced to restore deterrence rapidly. This urgency explains why the weapons pipeline became both critical and urgent in the months that followed.

Beijing’s Calculated Decision To Arm Tehran

China’s 2021 $400 billion, 25-year partnership with Iran became a weapons pipeline after the summer conflict. Analysts noted Iran serves as a “forward partner” providing battlefield feedback relevant to PLA modernization. Chinese planners now see Tehran as capable of challenging U.S. maritime dominance at key chokepoints, including the Strait of Hormuz. This strategic alignment transformed transactional sales into a long-term counter-U.S. posture.

How The Weapons Pipeline Actually Works

The network spans eight countries through shell companies and intermediaries. Treasury designations identified six Iranian entities, five Chinese firms, and one Iranian company that manage sodium perchlorate and dioctyl sebacate shipments. Shenzhen Amor Logistics and E-Sail Shipping coordinated transport, while Yanling Chuanxing and Dongying Weiaien supplied materials. Despite sanctions, the pipeline operated systematically. The precision and reach of this network explain why interdictions face limits.

“Beijing’s Aid Enables Tehran’s Post-War Rearmament”

Representatives Raja Krishnamoorthi and Joe Courtney warned: “Beijing’s aid enables Tehran’s post-war rearmament efforts despite U.S. efforts to deter such transfers.” Since late September, 2,000 tons of sodium perchlorate reached Bandar Abbas via 10–12 vessels, enough for 500 mid-range missiles. UN sanctions explicitly prohibited these transfers. Beijing’s decision reflected a strategic defiance. The question became whether any measures could truly halt Tehran’s arsenal buildup.

The April Sanctions That Changed Nothing

Treasury Secretary Scott Bessent announced April sanctions targeting the procurement network, which block property and assets within U.S. jurisdiction. He stated, “Treasury will persist in employing all possible strategies to limit Iran’s access to resources essential for advancing its missile initiatives.” Yet Krishnamoorthi and Courtney reported shipments continued, with 1,000 tons delivered in June. By summer, the sanctions had little effect, leaving the pipeline largely intact.

A Devastating Accident Reveals The Supply Scale

On April 26, Bandar Abbas’s Port of Shahid Rajaee experienced a catastrophic explosion. Official reports cited 57 deaths; independent analysis suggests over 110. The blast involved sodium perchlorate, a precursor to Chinese-made missiles. More than 1,000 workers were injured. The accident revealed Iran’s overwhelming import pace, storing dangerous chemicals in civilian facilities. The incident underscored both the urgency and scale of the weapons pipeline, beyond what sanctions could contain.

November: Washington Escalates Its Response

On November 11, the Treasury designated 32 entities across 8 countries tied to propellant ingredient transfers. This ecosystem-wide approach disrupted the “MVM partnership” network spanning the UAE, Türkiye, China, Hong Kong, India, Germany, and Ukraine. Treasury instructed U.S. institutions to block and report all property of designated persons. Insurance and banking partners complied, isolating the network. Yet, even this escalation occurred just weeks before a critical operational move in the Indian Ocean.

The Ocean’s Secret: A Seizure In Darkness

U.S. special operations forces intercepted a vessel off Sri Lanka carrying military-related and dual-use components for Iranian missile networks. The Wall Street Journal reported that the cargo was seized and destroyed quietly. The ship proceeded after removal. Analysts called it a “denial mission executed with intent and restraint,” demonstrating strategic capability over headlines. The operation revealed intelligence maturity, but it also suggested the vast volume of shipments still in transit.

Why The U.S. Let The Ship Go Free

The vessel’s release reflected sophisticated maritime doctrine. SOFREP noted that avoiding detention minimized diplomatic friction while sending a strategic message. Interrogating crews or seizing the ship could trigger international incidents and Chinese protests. Removing the cargo proved sufficient to signal U.S. capability. Analysts highlighted, “The ocean is not a safe back road anymore.” Intelligence suggests that many more shipments exist, indicating that the November seizure was only one action in a wider operational campaign.

The Dual-Use Deception: What Actually Got Seized

Seized components were described as “military-related articles and dual-use goods.” Defense reporting indicates items included precision-guidance systems, gyroscopes, accelerometers, and specialized electronics for solid-fuel missiles. Experts emphasized the danger of dual-use technology: it converts crude designs into operational weapons. Analysts noted, “Dual-use goods are only invisible until someone decides they are not.” The seizure prevented operational missile development, yet represented only a fraction of the overall shipments, leaving broader capabilities largely intact.

2,000 Tons: The Chemical Precursor Still Getting Through

Despite November’s interception, 2,000 tons of sodium perchlorate have reached Iran from China since late September. This quantity could fuel roughly 500 mid-range missiles, valued at $20–40 million in raw materials. Once weaponized, the downstream impact multiplies exponentially. The shipment illustrates the challenges faced by sanctions and enforcement in halting the supply of critical military-grade chemicals. The November seizure mattered, but the scale of deliveries reveals a persistent strategic challenge for U.S. policymakers.

“April Treasury Sanctions Failed To Halt The Flow”

Krishnamoorthi and Courtney stated, “April Treasury sanctions on Iranian and Chinese entities failed to halt the flow, as shipments continued unabated with another 1,000 tons delivered in June.” Targets adapted, networks displayed resilience, and Chinese backing provided confidence against escalation. The Treasury’s stated goal was behavioral change, yet sanctions proved ineffective. Even after spring interventions, deliveries continued, showing both the network’s sophistication and the limits of conventional punitive measures.

China’s Defiance: Strategic Calculation, Not Accident

U.S.-China Economic and Security Commission warned on November 13 that Chinese facilitation is deliberate. With 366 Chinese and Hong Kong-based entities on SDN lists, U.S. measures highlighted offenders but left Beijing’s facilitation intact. Analysts noted Iran provides valuable feedback for PLA modernization. The partnership is strategic, not commercial. Chinese planners openly view Iran as a testing ground, ensuring weapons development continues despite international sanctions, emphasizing deliberate long-term planning over incidental compliance failures.

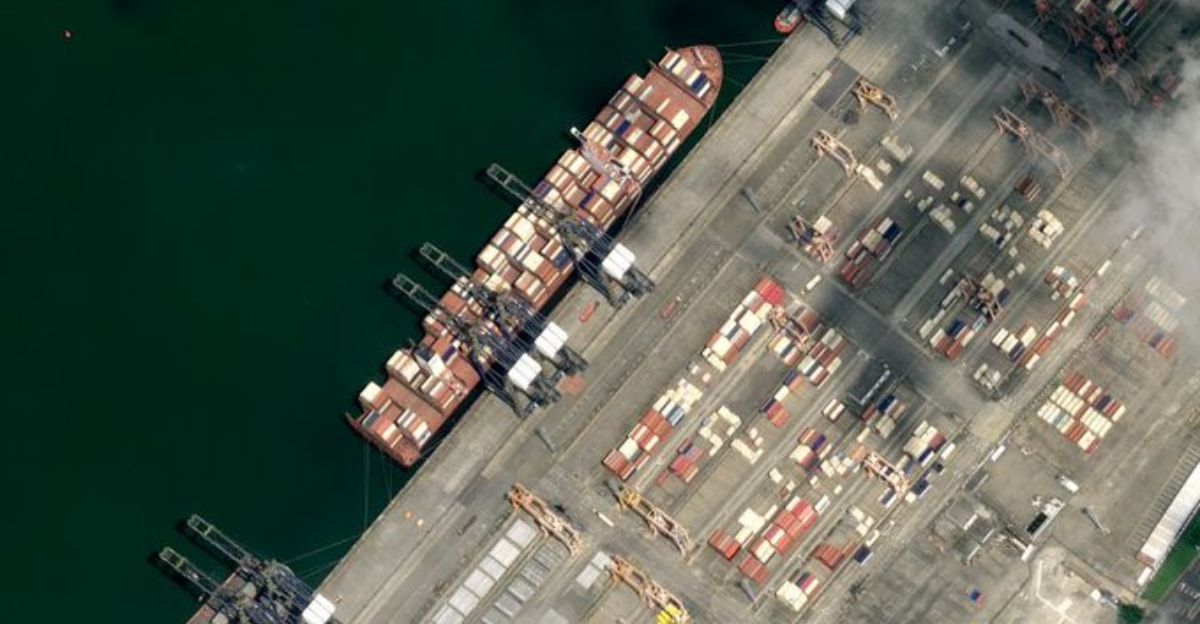

The Global Supply Chain Collapse: Hidden Consequences

Maritime disruptions from the Iran-Israel conflict affected 96% of major ports, with wait times exceeding 10 days at Rotterdam, Singapore, Cape Town, and Ningbo-Zhoushan. Maersk suspended calls at Haifa; vessels rerouted via the Cape, adding two weeks and raising costs by 15–25%. Small operators faced compliance pressures. While global trade suffered, the procurement network adapted. The real costs were borne by local workers and commercial actors far removed from weapons production.

The Houthi Factor: Proxy Weapons Enabled By Chinese Tech

Chinese components reaching Iran enabled weapons transfers to Houthis, who attacked commercial vessels. Dryad Global reported a 40% increase in successful strikes, totaling over 130 incidents since 2024 in the Red Sea and Gulf of Aden. Proxy transfers link Chinese technology to Iranian operations abroad, amplifying global shipping disruptions. The November seizure only intercepted a fraction, revealing the broader geopolitical and economic consequences of technology flows beyond the Middle East conflict zone.

The Intelligence Question: Why Now, Why This Shipment?

The November seizure reflected advanced intelligence: signals, human, and open-source tracking pinpointed the vessel. Crew social media, port records, and AIS data were leveraged, revealing that other shipments likely went unchallenged. Analysts emphasized operational discretion in execution. Understanding why this shipment was chosen shows U.S. forces’ ability to act selectively while minimizing exposure, highlighting both the network’s vulnerability and the precision of maritime monitoring in a vast, opaque arms pipeline.

UN Sanctions Snapback: Legal Cover For Military Action

The UN arms embargo snapback on September 28 restored authority to seize Iranian weapons transfers. China and Russia opposed the move but failed to block it. The embargo prohibits the transfer of conventional weapons and ballistic missile technology.

November’s operation was legally framed as UN enforcement rather than unilateral U.S. action. The diplomatic nuance allowed Washington to demonstrate restraint while acting decisively, reinforcing operational legitimacy while highlighting limits in preventing illicit flows on the open seas.

What Happens Next: Escalation or Stalemate?

The December report of the seizure coincided with expanded sanctions, congressional investigations, and intelligence warnings that networks remain active. Historical arms transfers reached $539 million in 1987 and $318 million in the 1990s. China’s 25-year partnership suggests sustained Iranian capabilities. The November seizure is one step in a decades-long competition. Questions linger about whether sanctions, interdictions, and public warnings can disrupt strategic transfers backed by a supplier nation with implicit political support.

The Uncomfortable Truth: Supply Chains Have Winners And Losers

The November interception exposed the unequal burdens of global commerce. Large corporations absorb costs, but port workers and small operators bear risk. The April Bandar Abbas explosion killed 57–110 workers, while the December port disruptions cost millions in lost productivity.

Meanwhile, Chinese facilitation and Iranian rearmament continued. One seized shipment demonstrates U.S. capability, but the 2,000 tons already delivered show that global supply chains prioritize interests differently, and strategic realities often outweigh individual enforcement efforts.

Sources:

“U.S. Boarded Ship and Seized Cargo Heading to Iran From China,” Wall Street Journal, December 12, 2025

“U.S. Special Forces seize Chinese cargo tied to Iran missile program,” Army Recognition, December 15, 2025

“Iran’s Regime Imported 2000 Tons of Missile Fuel Material From China,” Iran Focus, October 29, 2025

“US lawmakers urge probe into China’s missile fuel shipments to Iran,” Iran International, November 14, 2025

“Treasury Targets Network Procuring Missile Propellant Precursor for Iran,” U.S. Department of Treasury, April 28, 2025

“Treasury Disrupts Iran’s Transnational Missile and UAV Program,” U.S. Department of Treasury, November 11, 2025