The bankruptcy filing hits with a jarring reality: after 77 years of growth, a once-dominant furniture chain is now facing a wave of closures that will leave empty storefronts across 14 states. The company’s 33 locations, once familiar hubs for everyday American furniture shopping, are set to shutter in the coming months, leaving employees and customers scrambling for answers.

As liquidation sales begin, the stakes are high, and the future of this household name hangs in the balance. Will the company be able to rebound, or is this the final chapter of its storied history?

Financial Struggles Prompt Bankruptcy Filing

As American consumers pull back on spending, the furniture retailer’s financial troubles worsen. After years of success, the company filed for Chapter 11 bankruptcy on November 22, 2025.

Once thriving in suburban shopping centers, the chain is now forced to close stores and restructure in hopes of stabilizing its operations amid a challenging market.

Storied History

Founded in 1948, the retailer grew to become a major player in the U.S. furniture market. With 120 stores across 17 states, it was a trusted name in affordable home furnishings.

The company catered to middle-income families, offering sofas, bedroom sets, and dining furniture in accessible locations nationwide.

Pressure Intensifies Post-Pandemic

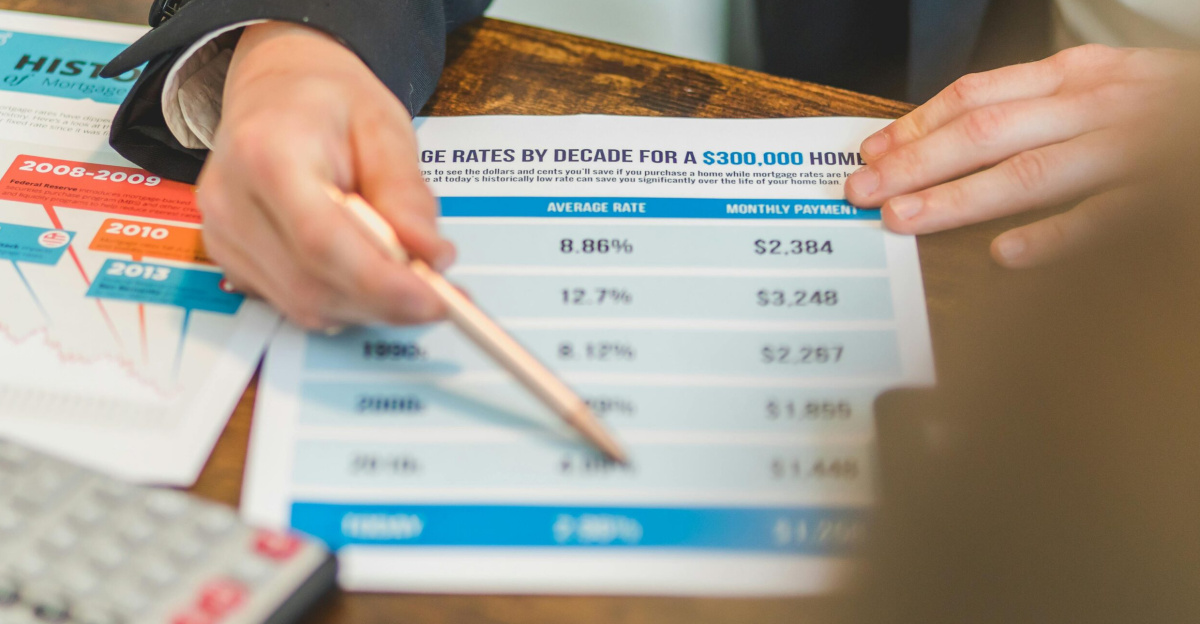

Following the pandemic, the company faced mounting pressure from various factors. The housing market slump, increased tariffs, rising freight costs, and higher interest rates all took a toll on the company’s profitability.

The once-booming furniture industry saw a sharp decline, leaving the company struggling to maintain its foothold in a rapidly shifting market.

The Bankruptcy Trigger: A Stark Reality

In late November 2025, American Signature filed for Chapter 11 bankruptcy protection. The company’s liabilities far outweighed its assets, and it faced over 1,000 creditors.

The filing marks a dramatic shift for a company that once had a strong presence in the U.S. furniture market, now seeking to sell its assets to a potential buyer.

Store Closures Across 14 States

As part of the bankruptcy plan, American Signature is closing 33 stores in 14 states, including locations in Illinois, Indiana, Michigan, New York, and Georgia.

These closures reflect the company’s need to exit underperforming markets and reduce its footprint. The liquidation process is expected to conclude by January 2026, marking the end of an era for many regional showrooms.

The Human Cost of Bankruptcy

For the employees and customers of American Signature, the bankruptcy process has been particularly difficult. With over 1,300 jobs at risk at Value City Furniture alone, workers are left uncertain about their future.

Meanwhile, customers with pending orders and warranties are left wondering if their purchases will be fulfilled before stores close.

Industrywide Furniture Shakeout

American Signature is not the only furniture retailer to face struggles in 2025. Several other regional furniture chains have filed for bankruptcy or are closing stores.

The broader industry shakeout reflects the pressure on mid-market furniture retailers, which have seen declining sales and mounting debts amid a challenging retail environment.

Macroeconomic Headwinds Hurt Sales

The broader economic backdrop, including high mortgage rates and inflation, has directly impacted furniture sales.

With fewer consumers able or willing to make big-ticket purchases, the furniture industry is facing a tough reality. The shift in consumer spending habits is especially evident in the furniture market, where discretionary purchases are down.

Other Retail Casualties in the Past Year

American Freight, another major player in the discount furniture market, also filed for bankruptcy earlier in 2024, leading to the closure of all 328 of its stores.

The fall of American Signature and American Freight highlights the broader contraction in mid-tier furniture and home goods retail, signaling a tough future for similar chains.

American Signature’s Bankruptcy Plan

American Signature’s Chapter 11 strategy focuses on deep cuts and the potential sale of its assets. Some stores have already started closing sales, while others continue to operate as part of the ongoing restructuring process.

The company aims to exit unprofitable markets and focus on regions that still offer potential growth.

Financing Through Bankruptcy

To navigate its financial troubles, American Signature secured $50 million in debtor-in-possession financing. This move allows the company to continue operating while it negotiates with creditors and attempts to sell its assets.

However, the company’s future hinges on whether it can find a buyer willing to take on the business in its current state.

Customer Concerns Over Warranties

One of the major concerns raised by customers is whether their warranties will be honored as the company goes through bankruptcy.

Many customers are worried that their recent purchases, including sofas and mattresses, may not be delivered or replaced, leaving them with a product and no guarantee of customer service.

Industry Experts Express Doubts

Many experts question whether a smaller American Signature can thrive in the current market. The company’s efforts to downsize may not be enough to overcome the broader economic issues facing the industry, such as high tariffs, increased costs, and a slowing housing market.

Restructuring in the current climate may not be sufficient to ensure long-term success.

Uncertainty Surrounding Future Store Network

The fate of American Signature’s store network remains uncertain. The company has indicated that the outcome of the sale process will determine whether more store closures or relocations are necessary.

This uncertainty raises concerns for employees, customers, and landlords alike, as the brand’s future remains up in the air.

Policy Challenges Contribute to the Collapse

The broader policy environment, including high borrowing costs and trade measures, has contributed to the struggles faced by American Signature. These policies, aimed at combating inflation, have made it harder for retailers like American Signature to maintain profitability.

The company’s bankruptcy highlights the interconnectedness of economic and trade policies with retail performance.

Global Supply Chain Impact

While American Signature is a U.S.-based retailer, its bankruptcy has global repercussions. Overseas manufacturers, particularly in Asia, are among the company’s unsecured creditors.

This underscores how domestic retail struggles can ripple through global supply chains, impacting manufacturers, logistics providers, and other international businesses.

The Legal Process Unfolds

The bankruptcy proceedings in Delaware will determine how creditors and suppliers are compensated. The outcome of these proceedings will also impact the company’s real estate holdings and potential future operations.

The legal process will be closely watched by industry insiders to see how it shapes the future of furniture retail.

Changing Consumer Preferences

The bankruptcy of American Signature highlights a shift in consumer preferences. Younger shoppers increasingly turn to online-first or direct-to-consumer brands, leaving traditional furniture chains like American Signature struggling to adapt.

The rise of e-commerce and changing expectations for shopping experiences have created a challenging environment for brick-and-mortar stores.

The End of an Era in Furniture Retail

American Signature’s fall signals a larger transition in the furniture retail market. Once a staple in suburban shopping centers, large furniture chains are now facing declining demand and increasing competition from e-commerce.

The company’s bankruptcy and closures reflect the broader struggles in traditional retail, where consumer habits are rapidly shifting.

What’s Next for American Signature?

American Signature’s future remains uncertain, with potential changes on the horizon. As the company undergoes its Chapter 11 proceedings, the outcome will determine whether the brand can survive in a diminished form or if it will vanish entirely.

The fate of its remaining stores and employees depends on the court’s decisions in the coming months.

Sources:

United States Bankruptcy Court for the District of Delaware filings (In re: American Signature, Inc.); American Signature Inc. Chapter 11 Voluntary Petition (November 22, 2025)

Business Wire: American Signature Inc. Restructuring Announcement; Second Avenue Capital Partners DIP Financing Disclosure

Furniture Today Market Analysis; Retail Dive Bankruptcy Monitor

Reuters U.S. Retail Reporting; American Freight Chapter 11 Liquidation Filings (2024)