The removal of the $7,500 federal tax credit for electric vehicles (EVs) by President Donald Trump has significantly reduced EV demand and resulted in a large battery surplus in the United States. Trump’s stated objective of increasing domestic manufacturing is undermined by this growing glut, which deters new factory investment.

Battery manufacturers must deal with excess capacity, which could cancel billions of dollars’ worth of plant projects, threaten innovation, and make the United States less competitive with nations like China. The core of this developing crisis is this paradox: reducing incentives to save taxpayer money while running the risk of causing the collapse of a developing manufacturing sector.

The Background of EV Tax Credits

Battery supply chains grew quickly as a result of the federal EV tax credit, which was established to encourage the use of clean energy and reached $7,500 per vehicle.

Investments were further accelerated by the Biden-era Inflation Reduction Act, which peaked in 2022. Trump’s rollback, however, is a dramatic policy reversal that has shocked markets and indicated a move away from government-led green industrial policy. This contraction highlights the vulnerability of the pioneering industry’s reliance on incentives in comparison to previous support.

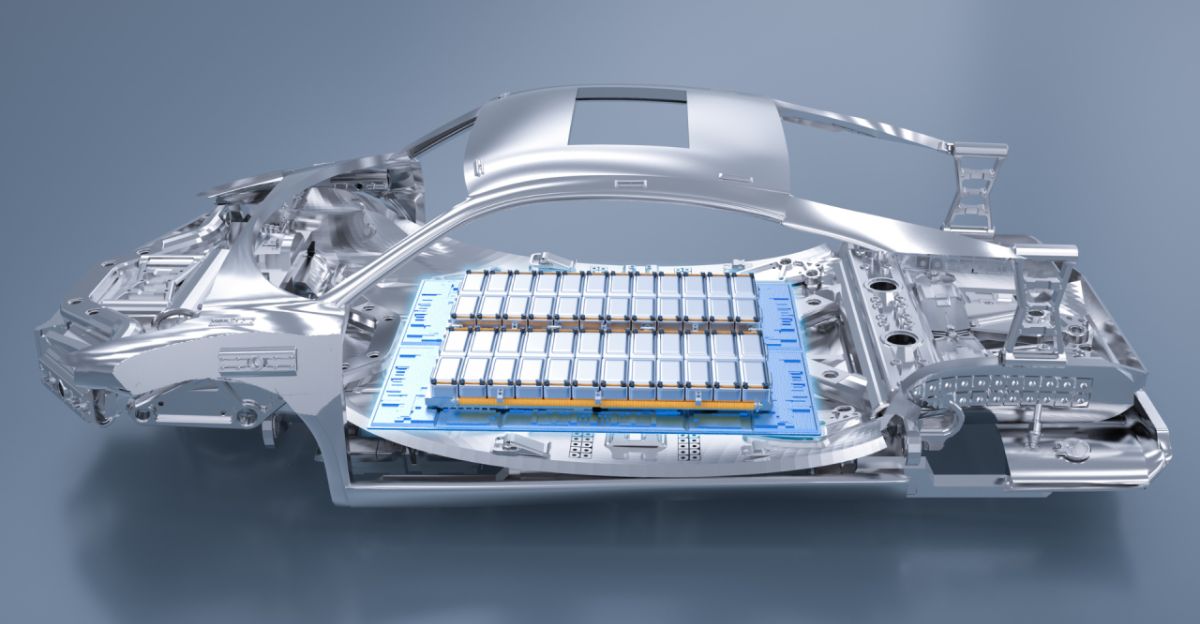

The Factory Cancellations and Battery Surplus

Only 19% of consumers are likely to purchase an EV, which is the lowest level of demand for EVs since 2019. This is due to the EV credit cut. As a result, manufacturers of batteries have faced excess inventory and production capacity.

Due to this overabundance, several factories have been shut down, including a $2.6 billion Freyr Battery facility in Georgia. In early 2025, another $6 billion worth of battery plants were put on hold. Trump’s “America First” manufacturing goals are undermined by the glut, which discourages new investment in manufacturing.

Effect on the Competitiveness of American Manufacturing

By causing a “bullwhip effect” in supply chains, lowering production incentives, and limiting innovation cycles that are essential for competitiveness, the growing battery surplus hurts American manufacturing.

Localized production costs may rise as a result of inefficiencies brought on by growing inventories, rendering batteries manufactured in the United States economically unviable. This puts long-term industrial leadership in the battery technology sector and the recovery of vital manufacturing jobs in jeopardy.

China’s Dominance Is Increased

China maintains its global dominance by controlling over half of the world’s EV production and battery supply chains, while the United States’ battery capacity stagnates.

Due to economies of scale and lower production costs, China unintentionally gains a competitive advantage when EV tax credits are eliminated. This undermines the national security and economic goals of the United States by increasing China’s geopolitical influence in vital raw material and energy technology sectors.

The Perspective of Political Economy

Deregulation, tax cuts, and limiting subsidies to control government spending are the main economic objectives of Trump’s declared platform. However, removing EV credits would result in short-term financial savings at the expense of long-term industrial expansion.

By contrasting strategic industrial policy with fiscal conservatism, this policy highlights conflicts between ideological coherence and practical economic vision in supporting developing industries that are essential to future expansion.

Impacts on Consumer Behavior and Psychology

In addition to saving money, eliminating incentives sends a psychological message that the government is reversing its support for EVs, which makes consumers hesitant and uncertain.

According to behavioral economics, policy signals have a significant impact on adoption rates; in the absence of subsidies, EVs are no longer seen as being as affordable or valuable, which exacerbates demand declines even in the face of rising environmental consciousness. This slows the dynamic of market transformation by undermining consumer confidence.

Climate and Environmental Factors

Reducing EV incentives delays emission reductions that are essential to achieving climate goals by slowing the transition from fossil fuels to electrification.

Ironically, the battery glut undermines domestic green industrialization while increasing waste risks and resource inefficiencies. This policy trend highlights the need to align economic and environmental priorities, which runs counter to the global movement toward decarbonization.

Possible Remedies to Equilibrate Trade-Offs

Recalibrated policies are needed to address the glut, including targeted subsidies for battery innovation, a gradual tapering of credits rather than their abrupt removal to maintain demand, and strategic trade cooperation to lessen reliance on China.

Enhancing R&D spending and workforce development could maintain industrial momentum and lessen the adverse effects of inventory oversupply. To prevent endangering the fledgling American EV ecosystem, more intelligent policy design is essential.

Second-Order Effects on Supply Chains Extrapolated

The supply chains for lithium, cobalt, and nickel are disrupted by the battery glut because manufacturers cut back on orders, which causes price volatility.

Miners, refiners, and component manufacturers are all impacted by this global shock, which increases volatility and uncertainty. Instability in supply chains makes it difficult to scale production after demand stabilizes, which further erodes the strength of the American manufacturing sector.

Pain in the short term, gain in the long run?

The credit cuts and glut force the American industry to become self-sufficient by eliminating inefficiencies and weak players. Instead of subsidies, this “creative destruction” could result in leaner, more robust manufacturing that is in line with market dynamics. However, if protective policies are not correctly calibrated to support innovation, such a strategy runs the risk of permanently marginalizing the United States, given China’s size and head start.

Given that battery technology affects not only the automotive industry but also the energy storage and defense sectors, this strategy overlooks how urgent it is to preserve domestic technological leadership in the face of international competition. The risk here is that short-term sacrifices will result in robust innovation ecosystems, but if demand collapses too soon, the timing and scale may work in favor of competitors.

Comparing This Industrial Shift to Others

Oil crises and semiconductor cycles are examples of abrupt policy-induced demand shocks that have historically destroyed industries before they recover. However, because of their infancy and scale mismatches, green technologies are more susceptible. In order to prevent disastrous manufacturing downturns, lessons learned from these cycles point to the significance of unified national strategies and stable policies.

In contrast to more established sectors, battery production needs consistent demand in order to attain economies of scale and iterative innovation. Boom-bust cycles brought on by previous sudden policy reversals in the energy sector, such as solar subsidization, have resulted in a cascade of plant closures and talent flight. This emphasizes the necessity of steady incentives and careful timing in developing industries that are vital to both economic and climate security.

The Geopolitical Strategic Battle

The foundation of the energy and defense industries of the future is battery technology. The US foothold in this strategic arena could be weakened by the glut. China uses its dominance in batteries to form alliances and manage supply chains, so maintaining strong manufacturing capabilities is crucial from an economic and geopolitical standpoint.

National security may be jeopardized if market share is lost because it could result in less control over essential minerals and battery technology standards. In a world power balance that is changing quickly, the United States runs the risk of losing control of a whole value chain that is essential to grid storage and transportation electrification, which would reduce its diplomatic and strategic clout.

The Bottleneck Model of Innovation

The glut results in a “innovation bottleneck” whereby a stagnant production volume diminishes the R&D feedback loops necessary for battery technology’s gradual advancement and cost reduction. The United States runs the risk of becoming technologically trapped and lagging behind in terms of energy density, storage efficiency, and cost competitiveness if innovation is not accelerated.

This model explains why industrial leapfrogging requires consistent market growth with incentives. Slowdowns obstruct the rapid iteration necessary for innovations in battery chemistry and manufacturing processes under actual production conditions. Breakthrough technologies are further delayed by the bottleneck effect, which also makes supply vulnerabilities worse and increases reliance on imported technology.

Perspectives on Investment Trends from Economic Data

According to data, announced investments in battery manufacturing fell by an astounding 80% between 2022 and 2024, with cancellations totaling more than $6 billion in early 2025 alone. This sharp decline is a sign of investor skepticism brought on by erratic policy environments. These numbers demonstrate the direct correlation between policy uncertainty and capital flight, which impacts employment and regional economic growth.

The downward shift undermines regional revitalization initiatives and affects workers’ livelihoods by upsetting manufacturing clusters intended to foster synergies in logistics, skills, and innovation ecosystems. The economic effects could last for years after the current crisis if people don’t have new faith in government assistance.

Factory Cancellation of Freyr Batteries

The crisis is best summed up by Freyr Battery’s decision to cancel a $2.6 billion factory in Georgia. The company pointed to policy reversals and declining battery prices, which were fueled by a decline in EV demand. The impact of policy disincentives on corporate decision-making, investment plans, and local economies slated for industrial revitalization is highlighted by this well-publicized retreat.

In addition to stopping thousands of possible manufacturing jobs, Freyr’s withdrawal has an impact on the entire supply and value chain, from suppliers of raw materials to assembly facilities further down the line. Political fallout from the cancellation emphasizes the challenges states face in promoting green manufacturing in the face of shifting national policies.

Effects of Energy Prices on Factories

Producers are forced to reduce output due to overcapacity, which raises energy costs per unit. Green energy production becomes more expensive in the absence of economies of scale, endangering the financial sustainability of nearby factories. This dynamic undercuts attempts to maintain global competitiveness while reshaping American manufacturing toward sustainable energy.

In addition to discouraging innovation-driven processes and factory openings and expansions, high costs can make it more difficult for American companies to compete on price and quality with lower-priced imports from China and other markets. An already complicated manufacturing equation is made more difficult by energy costs associated with the battery glut.

Linking EV Regulation to More Comprehensive Supply Chain Sturdiness

Battery surpluses and EV credit reductions need to be considered in the larger framework of post-pandemic disruptions in global supply chains. Ironically, the ensuing supply glut reduces the resilience of the US supply chain by impeding the integration of domestic resources and capacity-building.

Fragile, less autonomous manufacturing that is susceptible to outside shocks is the result. Predictable demand signals are necessary for a robust supply chain in order to support investments in domestic mining, refining, component manufacturing, and recycling. Despite having an abundance of domestic resources, the combination of policy volatility, trade tensions, and raw material shortages puts the United States at risk of becoming dependent on foreign supply chains.

Consumer Perception’s Impact on Market Dynamics

Policies that are stable and encouraging are essential to consumer trust. Internal combustion engine adoption is discouraged and incumbency is prolonged when incentives are abruptly removed. Just as crucial as economic measures in propelling the EV revolution and industrial growth is reviving consumer perception through consistent policy messaging.

In order to restore momentum and consumer confidence and create sustained demand, which in turn drives cycles of innovation and production scale, new incentives will be required. Education initiatives and public-private partnerships can lessen the detrimental perceptions caused by policy reversals.

A Request for Strategic Foresight and Balanced Policy

Despite being in line with some fiscal priorities, Trump’s EV credit cuts have caused a harmful battery surplus that jeopardizes US factory growth, industrial innovation, and geopolitical standing. Policymakers must adopt well-rounded, forward-thinking incentives that stabilize demand, encourage innovation, and fortify supply chains if they are to realize the promise of a competitive American EV market.

The United States could lose a vital technology race to China and miss out on domestic economic revival powered by clean energy manufacturing if it doesn’t make such a strategic realignment. Global decarbonization requirements and the long-term financial stability inherent in battery leadership must also be taken into account in strategic foresight. The foundational infrastructure required for future prosperity is sacrificed when short-term savings are the only priority.