The Trump administration’s $8.9 billion investment for a nearly 10% stake in Intel isn’t just a one-off headline—it represents a bold shift in how the U.S. backs critical industries. Instead of writing traditional checks, Washington is now claiming long-term equity in companies at the heart of national security and tech independence. The Intel deal is the first test of that evolving strategy.

Funded by repurposing unused dollars from the CHIPS Act and Secure Enclave program, this move is designed to boost American tech dominance, reduce reliance on foreign production, and create more direct value for taxpayers.

This deeper partnership between Washington and big tech marks a new chapter in U.S. economic policy—one that intertwines public money with private industry in the name of both innovation and security.

Transformation of Government Grants Into 10% Equity Stake

Instead of paying out previously approved grants to Intel, the government flipped $5.7 billion from the CHIPS Act and $3.2 billion from Secure Enclave funding into common stock. That totaled about 433 million shares at roughly $20.47 each—adding up to an $8.9 billion stake.

This change gives taxpayers a direct financial stake in Intel’s success. It also aligns federal support with the company’s market performance instead of simply disbursing funds and walking away.

Now that taxpayers have skin in the game, how exactly is this being framed at the top?

Trump Claims Zero Cost and Values Intel at $11 Billion

President Trump declared that the U.S. “paid zero” to acquire shares now worth nearly $11 billion, highlighting that the funds were already allocated and no new spending was required to close the deal.

Commerce Secretary Howard Lutnick echoed that sentiment, calling it a smarter use of money that would have otherwise gone out the door as a grant with no financial return.

And while the government now owns a big piece of Intel, what kind of influence does it really have?

Implications: U.S. as One of Intel’s Largest Shareholders

The U.S. government is now among Intel’s top shareholders—but it isn’t taking over the boardroom. The arrangement comes with no board seats or voting rights, keeping Intel’s management separate from political influence.

Industry insiders say this setup adds credibility and stability without compromising the company’s independence, a high-wire balance that could shape future investment models.

And speaking of future plans, this deal may just be the start of something bigger.

Trump Hails Deal as Economic Victory for America

According to Trump and his team, this move signals a pivot from one-time grants to purposeful investments that give taxpayers a stake in future gains. And Wall Street seems to agree, Intel’s stock jumped more than 4% after the announcement.

The market’s bounce reflects optimism about this investor-style government support, and also hints at the potential scale of what might come next.

So, where does the administration want to take this strategy from here?

Promise of More Government-Private Sector Deals

Senior officials, including Trump himself, have said that more government-for-equity transactions are on the horizon. Kevin Hassett, Director of the National Economic Council, called the Intel stake a “down payment” on what could become a broader investment playbook.

The idea is to expand this model beyond chips, to any sector critical to America’s future competitiveness and security.

And at the top of that list? Companies built around defense and national resilience.

Beyond Semiconductors: Expansion Into Other Industries

Commerce Secretary Howard Lutnick pointed to firms like Lockheed Martin as examples of where the government might next take a stake. He argues these defense contractors already operate hand-in-hand with U.S. national security goals.

By investing directly, the government hopes to further align public dollars with private capabilities in industries that go far beyond tech.

But Intel’s role in this isn’t just symbolic; it’s foundational to reshoring America’s chip dominance.

Strengthening U.S. Chip Production Amidst Global Tensions

Intel is currently the only major U.S. company doing cutting-edge logic chip research and manufacturing on American soil. That makes it a strategic anchor as the U.S. tries to secure domestic control of this vital supply chain.

The equity stake helps fund Intel’s infrastructure ramp-up while backing its push to take on foreign giants like TSMC.

This becomes even more important when you consider just how global Intel’s revenue really is.

Strategies Against Overseas Manufacturing Dependence

With around 29% of Intel’s revenue coming from China, the company is deeply exposed to global supply chain risk. The administration hopes partial government ownership gives it a lever to bring more of that production back home.

Onshoring chip production is also about preparing for future shocks, a lesson learned painfully through recent supply disruptions.

Now, beyond shoring up the domestic side, the U.S. is also keeping a close eye on how China is playing the game.

Focus on Technology Leadership in Competition With China

China’s aggressive state-sponsored support for its tech industry has long been seen as a threat to American firms. The Intel deal is aimed at giving U.S. companies equivalent strategic backing to compete on a more level playing field.

This updated economic strategy borrows from foreign playbooks, but injects American-style transparency and accountability into the mix.

And this strategy isn’t limited to equity alone. It’s part of a broader, multi-pronged approach.

Tariffs and Restrictions: Tools of the Administration

The Trump administration is stacking its deck with more than just investments. Tariffs, export controls, and now equity positions all work together to give the U.S. stronger influence over critical sectors.

The idea is to combine old tools and new tactics in a way that protects national interests while offering real financial upside to the public.

And that approach isn’t just theoretical, it’s already hitting major players like Nvidia and AMD.

Nvidia and AMD in the Government’s Sight

As part of its China strategy, the administration has required Nvidia and AMD to pay a 15% cut on chip sales to Chinese buyers in exchange for export licenses.

This creates a steady revenue stream for the government and shows how export approvals can be used as negotiation tools, not just permissions to be issued.

It also shows the administration’s comfort with taking things straight to the C-suite.

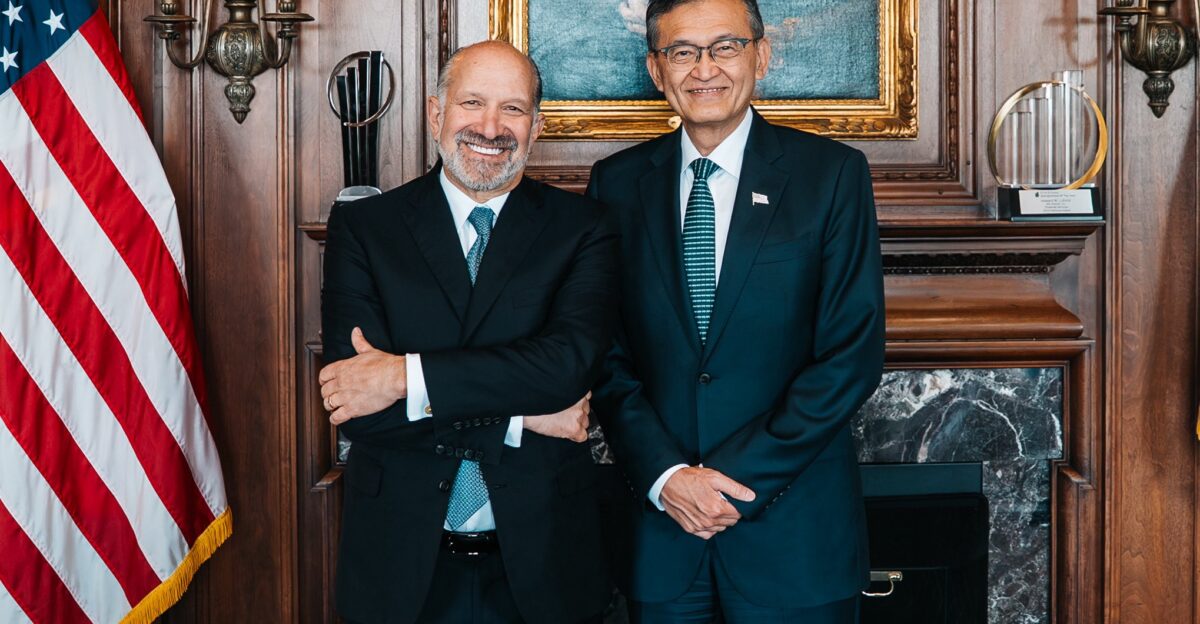

Presidential Conflict With Intel CEO Lip-Bu Tan

Tensions peaked when Trump openly called for Intel CEO Lip-Bu Tan to step down over past ties to Chinese firms. But after direct conversations and reassurances from Tan, the President backed off.

This moment of friction highlights the administration’s willingness to push corporate leaders, then patch things up as long as national priorities are met.

But even with direct diplomacy, some investors are getting nervous.

Potential Investor Concerns Over Government Ownership

Intel’s own SEC filings caution that some investors are uneasy about what government ownership might mean, especially when nearly a third of the company’s sales come from China.

To address that, the government is keeping its role passive with no voting or governance rights, aiming to offer stability without stepping on boardroom toes.

Still, Wall Street seems to be taking a wait-and-see approach.

Stock Rebounds but Faces Continued Challenges

Investors gave a modest thumbs-up to the move, Intel’s stock popped more than 4%, despite the company’s known struggles around growth and competitive pressures.

That quick bounce suggests the market sees federal backing as a plus, at least in the short term, for an industry grappling with rapid change and tension.

But under the surface, big changes are underway at Intel itself.

Layoffs and Industry Hurdles Ahead for Intel

In response to sector-wide headwinds, Intel announced plans to cut up to 15,000 jobs, about 15% of its global workforce. That’s a major shakeup as it pivots toward AI and high-performance computing.

The government’s investment is being pitched as a cushion through that transition, a way to support Intel while it rebuilds for the next generation of tech.

But as federal money gets closer to industry, the rules of engagement are shifting too.

Regulatory Implications of Government Ownership

Intel’s equity deal highlights the fine balance between government support and corporate independence. It also introduces new regulatory challenges and expectations.

Public documents show the company is preparing for increased oversight, but also signaling the benefits of stronger alignment between federal dollars and innovation results.

So, what does all of this mean for broader U.S. economic thinking?

Trump’s Economic and Technological Policy Interventions

This type of direct investment represents a conscious break from decades of economic orthodoxy. The U.S. is now deliberately backing private companies, not just as overseers, but as stakeholders.

While inspired in part by foreign models, the American version leans heavily on transparency, market discipline, and shared national goals.

And central to that is a new kind of relationship between public money and company growth.

Strategic Equity: Aligning Public and Corporate Goals

Equity stakes offer more than oversight, they give taxpayers a shot at sharing in future company profits. This helps align government objectives with corporate performance in a lasting, measurable way.

Supporters say this public-private hybrid is essential to preserving America’s tech edge and keeping high-cost industries like semiconductors within U.S. borders.

Now, all eyes are on what the Intel stake signals for the road ahead.

Major Stake Signals New Path for U.S. Innovation Strategy

With the Intel investment, the U.S. government is moving from funder to co-owner—testing a new model where public dollars generate both innovation and returns. It’s a bold strategy designed to safeguard technology leadership while giving taxpayers more than just symbolic involvement.

By converting unused grants into scalable equity, this deal could shift the foundation of U.S. industrial policy—pushing federal support into new territory as a long-term economic lever.

As global competition tightens, the Intel playbook may become the new norm for how Washington bets on America’s tech future. The precedent is set. Now comes the real test of scale.