U.S. retail electricity prices reached a historic record of 18.07 cents per kilowatt-hour in September 2025, marking a 7.4% surge from the previous year.

For the 67 million Americans served by PJM Interconnection across the mid-Atlantic region, this translates to substantially higher monthly energy bills. Carnegie Mellon research projects average electricity costs could increase 8% nationwide by 2030, with Northern Virginia potentially facing 25% hikes.

The price spike has become the defining economic issue for households and a political flashpoint for 2026 candidates. What’s driving this unprecedented surge? The answer lies in an explosive new demand for power.

Data Centers Demand Explodes

Data centers now consume 4.4% of total U.S. electricity—more than entire states, including Ohio. The International Energy Agency projects this demand will triple by 2035, growing from 200 to 640 terawatt-hours annually.

By 2028, data center electricity consumption could reach 6.7% to 12% of the U.S. total electricity supply. This surge is three times faster than residential consumption growth, creating unprecedented strain on grid infrastructure built decades ago.

The culprit: artificial intelligence systems requiring massive computational power for training and deployment at scale.

Grid Infrastructure Cracking Under Pressure

Peak electricity supply will fall short of demand by 2028 for the first time in a decade, according to grid operators. By 2033, the capacity shortfall could reach 175 gigawatts—equivalent to powering 130 million homes.

Most U.S. transmission infrastructure is more than 40 years old, well beyond design specifications. Transformer and equipment supply chain constraints have created 2-3 year backlogs on critical components.

The aging grid cannot simultaneously handle the electrification of transportation, heating systems, and manufacturing, and the explosive data center expansion, without major new generation and transmission investment.

PJM’s Capacity Auctions Hit Records

PJM’s last three capacity auctions reached record-high prices for new electricity generation, driven by urgent demand from data centers. In December 2025, the auction fell 6.6 gigawatts short of meeting reliability requirements—a failure blamed directly on “the frenzy to build massive data centers.”

Existing and planned data centers now account for nearly half of recent auction costs: $23.1 billion of $47.2 billion total.

This means regular residential ratepayers are effectively subsidizing infrastructure for tech company operations. The financial burden has sparked unprecedented political backlash.

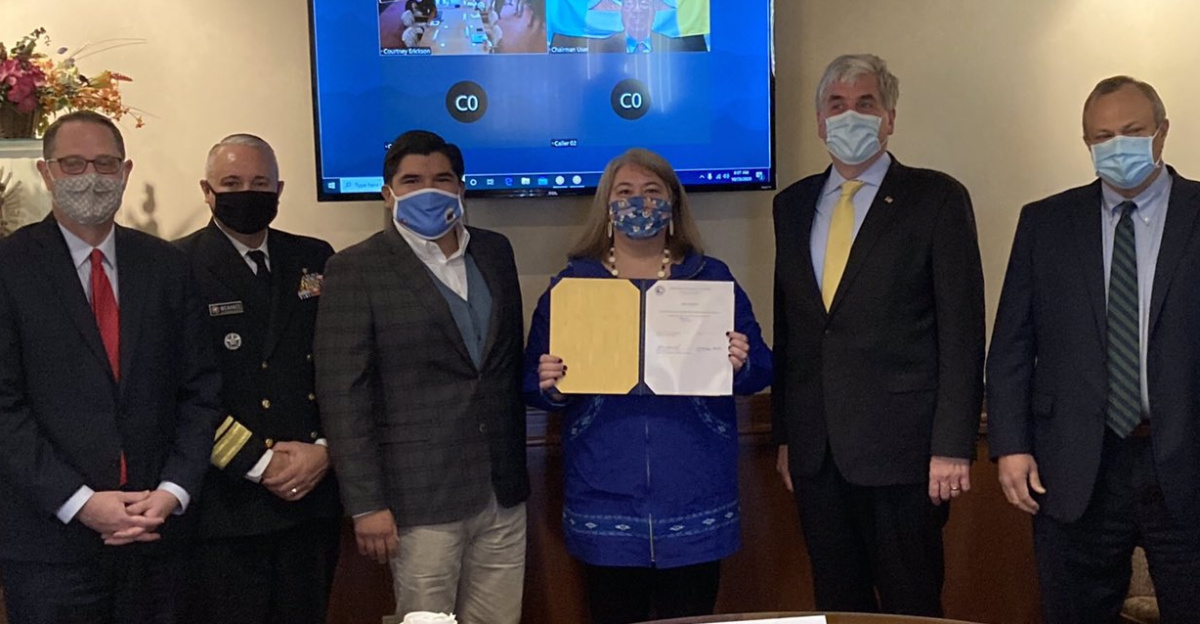

Trump Administration Proposes Emergency Auction

In January 2026, the Trump administration and bipartisan governors signed a “Statement of Principles” urging PJM Interconnection to hold an emergency auction by September 2026.

The proposal would allow tech companies to bid on 15-year power purchase agreements supporting approximately $15 billion in new power plant construction. Under this model, data centers would directly fund new generation capacity—shifting costs from residential ratepayers to tech giants.

Energy Secretary Chris Wright framed the intervention as essential to winning “the artificial intelligence race against China” while protecting American families from soaring electricity bills. This represents an unprecedented federal push to restructure electricity markets.

Northern Virginia Bears the Brunt

Northern Virginia hosts the world’s largest data center concentration with 561 facilities, making it ground zero for power grid stress. This region, which forms the technological epicenter for cloud computing and AI, faces potential electricity bill increases exceeding 25%—nearly three times the national average.

If Northern Virginia’s grid experiences supply shortages, millions of Americans lose access to critical cloud services and AI capabilities.

The geographic concentration creates acute vulnerability: a single regional failure cascades across the entire nation’s digital infrastructure. This concentration is precisely why PJM’s auction matters most to this region.

Public Opposition Blocks $98 Billion in Projects

From April to June 2025, communities across America blocked or delayed 20 data center projects worth $98 billion, signaling intense public backlash. Voters are angry about rising electricity costs and demand action on the impact of data centers.

Local and state leaders face unprecedented pressure from constituents to oppose expansion without mandatory cost-sharing mechanisms. Every political candidate in the 2026 cycle has been forced to adopt a position on data center policy.

Data centers have become the defining infrastructure issue of the election cycle. This political pressure created the conditions for federal intervention.

Tech Companies Agree to Pay

Microsoft pledged to cover electricity costs for its data center operations, signaling industry-wide acceptance of cost-sharing. Microsoft president Brad Smith publicly stated that “tech companies must pay their own way” for electricity costs.

Trump echoed this position, declaring “Big Technology Companies must ‘pay their own way'” for grid infrastructure. Google announced plans to spend $25 billion on AI data centers in the PJM region.

This industry acceptance reduces political opposition and creates a viable path for the emergency auction proposal. Tech companies recognize that uncompensated grid impacts threaten their expansion plans and public support.

The Regulatory Hurdle

PJM Interconnection is reviewing the emergency auction proposal with stakeholders and market participants. Critically, any auction mechanism requires formal approval from the Federal Energy Regulatory Commission (FERC), the independent federal regulator for electricity markets.

FERC Chair Laura Swett has listed data center grid connection as a top priority. Implementation estimates suggest 6-12 months minimum for approval and deployment.

PJM was notably not invited to the White House announcement—it must voluntarily adopt the proposal pending regulatory review. This multi-layer approval process creates uncertainty about final implementation.

$7.5 Gigawatts of Fossil Fuel Lock-In

The $15 billion auction could support approximately 7.5 gigawatts of new generating capacity—roughly equivalent to one large nuclear reactor. The Trump administration is prioritizing natural gas and nuclear generation to meet data center power needs.

The proposal includes guaranteed 15-year revenue contracts to accelerate plant development. Environmental advocates warn this creates a 15-year lock into fossil fuel infrastructure, potentially sidelining clean energy projects from PJM’s interconnection queue.

Data centers also require massive amounts of water for cooling: demand is projected to rise by 170% by 2030. The auction’s collateral impact on climate policy and water resources is substantial and largely unexamined.

Transmission Bottlenecks Create Years of Delay

New transmission lines take 7-10 years to build due to lengthy permitting and environmental siting delays. Supply constraints on transformers and high-voltage equipment are limiting grid upgrades across PJM and competing regions nationwide.

The Trump administration’s infrastructure policies aim to streamline the National Environmental Policy Act (NEPA) environmental review processes. The administration is fast-tracking project approvals across federal agencies to reduce review periods from years to months.

However, even accelerated timelines cannot overcome fundamental construction constraints. The transmission infrastructure gap remains the critical bottleneck to grid modernization.

States Push Data Center Cost Accountability

States like Oregon have implemented regulations requiring data center operators to offset grid impacts. These state-level mechanisms are creating precedent for other jurisdictions to implement their own compensation requirements.

Environmental advocates warn the federal emergency auction could preempt stronger state regulations. The interstate competition over data center policies is intensifying, with each state seeking to attract facilities while protecting ratepayers.

Pennsylvania Governor Josh Shapiro secured extended wholesale capacity price caps through 2028 alongside the federal proposal. State-level action is forcing federal coordination.

National Security Framing Dominates

The Trump administration is explicitly framing data center infrastructure as critical to U.S. artificial intelligence leadership versus China’s competing capabilities. Every political candidate in 2026 has adopted a position on data center expansion as a national security issue.

Tech industry dependency on reliable, abundant electricity is absolute—AI model training and deployment require an uninterrupted power supply at scale.

The administration is balancing energy security needs with competing demands on the grid from domestic manufacturing, electrification, and traditional power consumption. This national security lens is the primary justification for federal intervention in electricity markets.

Market Restructuring Underway

The intersection of AI growth, aging grid infrastructure, and public opposition is forcing fundamental restructuring of American electricity markets. The Trump administration is prioritizing rapid data center expansion as a national security imperative in the face of competition with China.

The emergency auction proposal represents a policy shift toward tech companies directly funding new generation rather than spreading costs across general ratepayers.

Implementation over the next 6-12 months will shape electricity prices, grid reliability, and energy policy for the remainder of the decade. Precedent-setting policy decisions are being made in real time.

Will the Auction Solve the Crisis?

The critical question remains unresolved: will the emergency auction actually prevent electricity price spikes for the 67 million Americans served by PJM? Tech companies have signaled willingness to pay for the new generation, but regulatory approval remains uncertain, and the timeline is compressed.

Environmental advocates question whether locking in fossil fuels for 15 years solves the deeper problem. Competitors in power generation—including traditional utilities and renewable energy developers—oppose the priority treatment for data center contracts.

The auction’s success depends on rapid regulatory approval, successful tech company bidding, plant construction timelines, and sustained political will. What happens if any of these elements fails?

Sources:

U.S. Department of Energy Fact Sheet – Emergency Auction Proposal, January 2026

U.S. Department of Energy – Statement of Principles, January 16, 2026

Federal Energy Regulatory Commission Priority Statement, January 2026

Energy Information Administration – Electricity Price Data, September 2025

International Energy Agency – Data Center Demand Projections, 2025

Pennsylvania Governor’s Office – PJM Price Cap Extension, January 2026