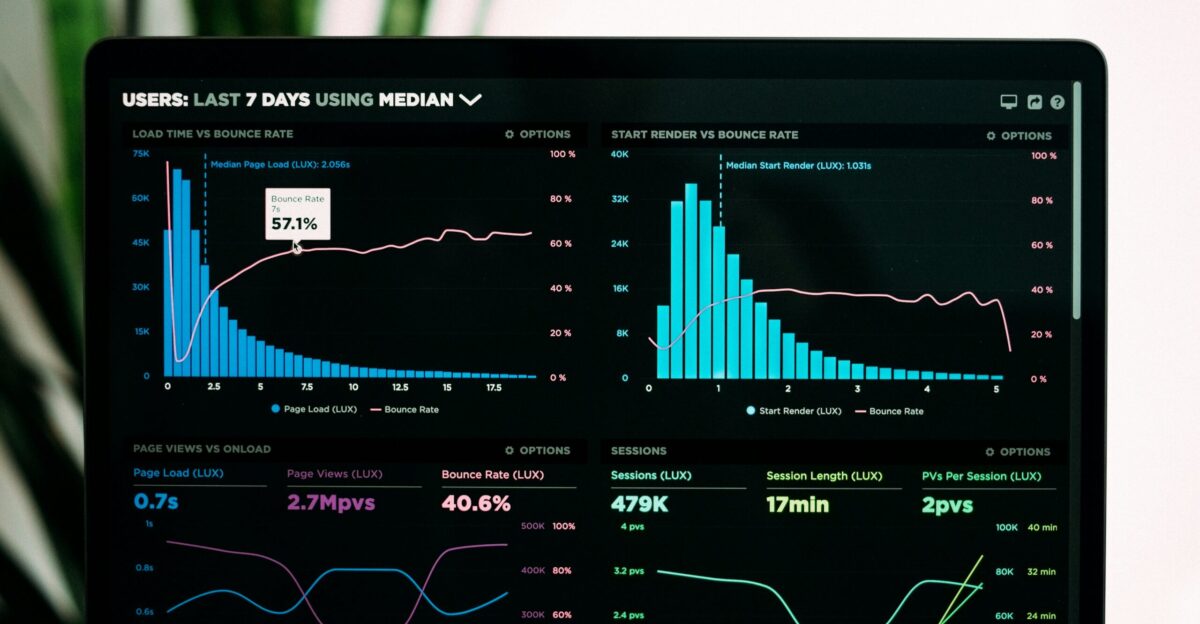

Small indicators are revealing a potential massive shift for the U.S. economy. Economists such as Moody’s Analytics’ Mark Zandi are paying close attention to clues that could suggest a looming recession.

Although no official downturn has been announced yet, changes in jobs, industry lines, and consumer spending hint at looming trouble.

Catching these trends early can benefit both companies and people, who can then prepare ahead. This series covers three of the most relevant economic trends that arise before recessions. This is what economists track and why these trends are essential to the workforce and the economy.

Employment Growth Slows

One of the first signs of an approaching recession is a deceleration in job growth. While employment may not yet decline, fewer new hires across multiple sectors can signal economic stress.

Economists are watching monthly payroll closely to assess whether the labor market is starting to weaken, often preceding broader economic contraction.

Rising Industry Job Cuts

When various industries start to report job cuts, it can mean trouble ahead. A recession often follows if many industries report declining employment.

Reviewers look beyond headline unemployment stats and concentrate on the spread and consistency of job losses across different sectors to determine possible economic downturns before they become official.

Consumer Spending Shifts

A change in consumer behavior can also precede a recession. Spending may plateau or decline as households become more careful about finances.

Economists closely monitor reduced retail sales, slow demand for nonessential goods, and differences in savings patterns, as these shifts often suggest that confidence in economic stability is waning.

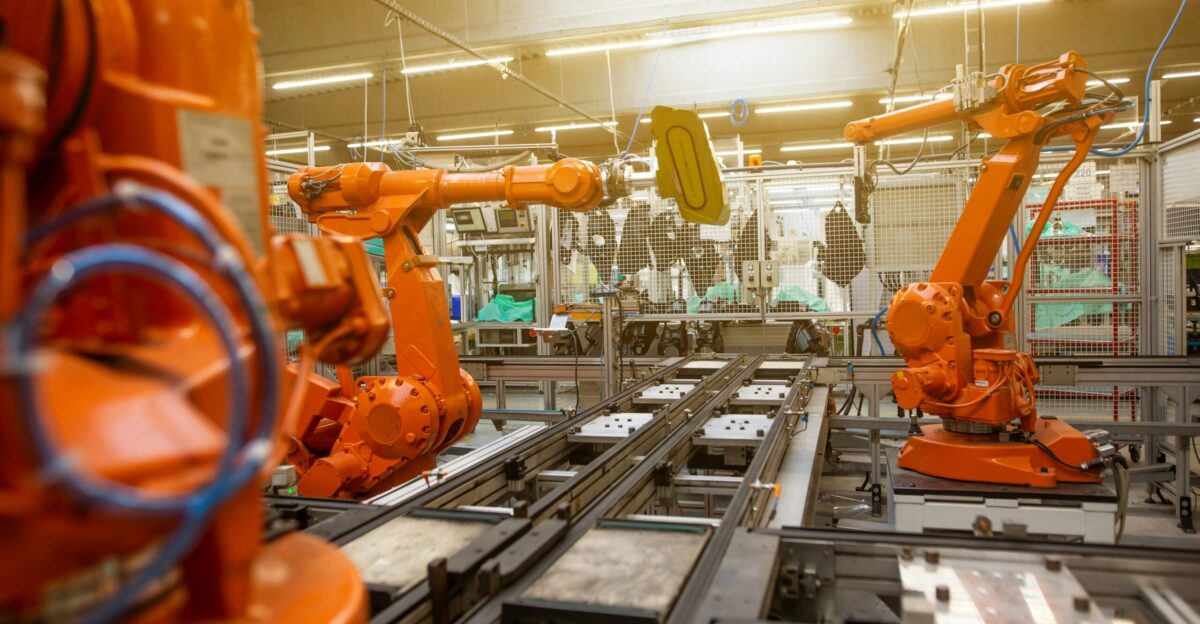

Business Investment Declines

Companies may delay or decrease investment in technology, equipment, or development during early signs of a downturn.

Slower capital spending can affect productivity development and overall economic momentum. Economists track these trends because decreased business spending often leads to lagging job creation and lower long-term growth.

Credit Conditions Tighten

Lenders and banks often become more wary as a recession approaches. Tighter lending standards, higher interest rates, and decreased borrowing can delay economic activity.

Monitoring the availability of credit and changes in interest rate spreads enables analysts to gauge the financial system’s health and possible risks to growth.

Stock Market Volatility

Financial markets can quickly react to expected economic changes. Increasing volatility or plunging stock indices may reflect investor concerns about future growth.

While many factors impact markets, persistent downward trends can cue businesses and households to be ready for a potential slowdown.

Yield Curve Inversions

An inverted yield curve happens when short-term interest rates grow above long-term rates. This occurrence has historically preceded considerable recessions, implying that investors expect weaker growth ahead. Economists watch this effort closely as a potential early warning of economic contraction, even before other indicators fall.

Rising Unemployment Claims

Initial claims for unemployment benefits can rise before the official unemployment rate increases. Tracking weekly claims enables analysts to detect early job losses.

While unemployment statistics lag behind other signals, spikes in claims across multiple regions or enterprises can foreshadow broader labor market weakness.

Corporate Earnings Drop

Slower or declining earnings reported by companies often precede a recession. Businesses may adjust forecasts downward, mirroring reduced demand or higher costs.

Analysts see earnings reports as one of several indicators to evaluate economic health and anticipate potential declines in hiring or investment.

Housing Market Slows

A slower housing market often hints at broader economic stress. Fewer home sales, falling prices, and less new construction can indicate that consumers are cautious about spending and borrowing. Economists observe housing data as it reflects financial circumstances affecting other sectors.

Manufacturing Output Falls

Manufacturing is susceptible to changes in demand. Declines in factory output or new orders can arise before a recession.

Analysts observe indexes of manufacturing activity, like the ISM, to catch early signs that production and financial momentum are slowing down.

Business Sentiment Weakens

Survey data on business confidence can exhibit caution before other economic factors decline. If executives expect lower demand or lagging growth, they may delay hiring or investment. These sentiment measures often supply early insight into potential shifts in economic activity.

Rising Inflation Concerns

Rapidly increasing prices may precede a slowdown, especially if central banks tighten monetary policy. Inflation that outpaces wage growth diminishes consumer purchasing power and may slow spending.

Economists monitor inflation trends and policy responses to understand how they could contribute to recession risk.

Government Policy Shifts

Changes in fiscal or regulatory policy can affect economic growth. Tax increases, trade restrictions, or cuts in spending can reduce demand in the short term.

Analysts evaluate policy impacts alongside other indicators to evaluate how government measures might contribute to a conceivable downturn.

Slowing Wage Growth

Even if unemployment stays low, stagnating wages can indicate weakening economic conditions. If home incomes fail to grow, consumer spending may plateau or decline.

Wage trends are a key aspect in predicting how resilient the economy might be during early signs of contraction.

Global Economic Pressures

International developments, like slower growth in major economies or geopolitical tensions, can influence domestic stability.

Economists watch trade flows, currency fluctuations, and global market trends as these external factors amplify domestic economic vulnerabilities.

Corporate Defaults Rise

An increase in bankruptcies or missed debt payments may indicate stress in the business sector. Rising defaults can disrupt credit markets and reduce investor confidence. Analysts track these events to identify early signs of broader economic deficiency.

Stockpiling and Inventory Changes

Businesses often modify inventory levels, anticipating demand shifts. Excess inventory or decreased production signals caution.

Supply chain activity changes give insight into consumer demand expectations and potential industry deceleration.

Monitoring Patterns Together

No one indicator predicts a recession perfectly. Economists, including Mark Zandi, examine multiple patterns together: spending, employment, industry trends, and financial signals to form a more precise picture.

Understanding these patterns helps policymakers, businesses, and households make educated decisions before economic conditions deteriorate.