Molson Coors Beverage Company confirmed in October 2025 it will cut about 400 salaried jobs—roughly 9% of its Americas workforce—by year-end. Newly appointed CEO Rahul Goyal said the decision “wasn’t made lightly” but reflects “the need to move faster” in a challenging market.

According to Reuters, the restructuring is among the company’s largest in more than a decade, highlighting how sharply the industry has shifted.

A storied brewer facing new realities

From Coors Light to Blue Moon, Molson Coors has long been part of North American life. But even icons must adapt. “The company’s performance deteriorated sharply in the first half of 2025. In the first quarter, brand volumes declined 8.0% year-over-year, primarily due to weaker demand in the U.S. and unfavorable market conditions.

With about 16,800 employees worldwide, the brewer now finds itself rebalancing decades of legacy against the stark economics of a shifting beverage landscape.

Tariffs turn up the pressure

The company’s troubles deepened when the Trump administration doubled aluminum tariffs in June 2025—from 25% to 50%—a decision that hit nearly every major supplier. Since beer cans depend on that metal, costs surged overnight.

According to Reuters, Molson Coors warned that tariffs alone would add $20 to $35 million in expenses in the second half of 2025, with total aluminum costs expected to reach up to $55 million for the year.

Former CEO sounded the alarm

Before stepping down, outgoing CEO Gavin Hattersley cautioned that rising tariffs and weaker spending were “weighing more heavily than anticipated.” In August, he told analysts the company was “feeling the full effect of the macroeconomic climate and consumer slowdown.”

His remarks, reported by Bloomberg, foreshadowed the leadership change ahead—and the scale of restructuring that would soon follow under Goyal’s watch.

Outlook dims as margins tighten

By August 2025, Molson Coors had revised its full-year guidance downward for the third straight quarter. Net sales were now projected to fall 3% to 4%, with adjusted earnings per share expected to drop 7% to 10%.

According to MarketWatch, management attributed the decline to inflation, tariffs, and shifting drinking habits. The adjustments reflected a sobering reality: the company’s cost base was rising faster than its ability to offset it through pricing.

Global beer fatigue sets in

Across both the U.S. and Europe, beer demand has cooled. Molson Coors reported a 4.5% decline in brand volume in Q3, including 4.4% in the Americas and 5% in EMEA and Asia-Pacific. Executives stated that the combination of higher shelf prices and health-conscious consumers continues to erode sales.

Competitors such as Constellation Brands face similar declines, suggesting this is less a Molson Coors problem—and more an industry recalibration.

A multibillion-dollar reality check

The company took a $3.65 billion goodwill impairment in its Americas division during Q3, acknowledging that earnings from underperforming brands may never fully recover. According to Inside Beer, the writedown signals more than an accounting adjustment—it’s an admission that the beer market itself is evolving.

For a brewer that helped shape the industry, it’s a reminder that even household names must evolve or fade.

New leadership, new tone

When Rahul Goyal officially assumed the role of CEO on October 1, 2025, he inherited both the challenge and the opportunity. A 24-year veteran of the company, Goyal told The Wall Street Journal he believes the business “has made progress, but must transform even faster.”

His message was clear: the layoffs weren’t about short-term savings—they were about buying time to reinvent how Molson Coors competes.

Goyal’s first decisive move

The restructuring marks Goyal’s first major act as chief executive. According to Reuters, hundreds of the 400 eliminated roles were already vacant from earlier “role-prioritization” efforts. The remainder will come from active positions, with voluntary severance offered to some.

Goyal’s quick action signaled urgency and reflected his view that slow, incremental change simply wouldn’t keep pace with today’s market.

Streamlining for speed and focus

The company described the overhaul as a way to create a “leaner, more agile Americas organization.” In an internal memo obtained by Food Dive, Goyal said resources will be shifted “closer to consumers and key growth categories.”

The message carried a mix of candor and optimism: Molson Coors isn’t retreating—it’s retooling, hoping to emerge more focused, faster, and better aligned with how people now drink.

Betting on beverages beyond beer

The brewer plans to invest savings from the restructuring into faster-growing drink categories—premium mixers, non-alcoholic beverages, and energy drinks. Earlier this year, Molson Coors acquired an 8.5% stake in Fever-Tree for $88 million, gaining U.S. rights to the British company’s cocktail mixers.

According to Food Dive, the deal underscores a shift in strategy: diversifying beyond beer toward beverages that cater to modern tastes.

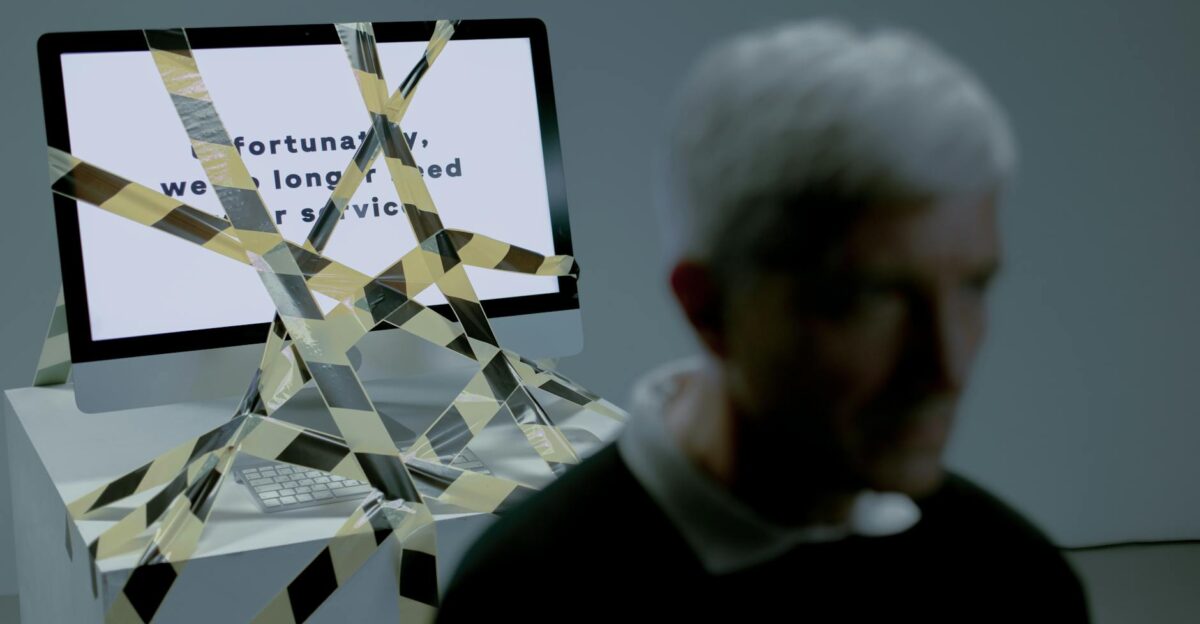

Layoffs ripple across the Americas

The workforce reduction spans salaried employees in the U.S., Canada, and Latin America. A company spokesperson told Reuters that no Canadian breweries would close, emphasizing that the cuts were “not solely tariff-driven” but accelerated by cost pressures.

For many longtime staff, the announcement landed as hard a reminder that even the most established employers are not immune to global economic tides.

A signal of a larger industry shift

Molson Coors isn’t the only household name trimming jobs. In October 2025, Nestlé announced plans to cut 16,000 positions, about 6% of its global workforce, under its new CEO, Philipp Navratil.

Food Dive reported both moves as part of a growing corporate reckoning, as inflation, trade tension, and weak consumer confidence push food and beverage companies to re-size for a leaner era.

Trade policy fuels an economic squeeze

The timing of Molson Coors’s cuts coincides with wider trade policy volatility. Aluminum tariffs doubled in June 2025, while new duties on imported goods increased production costs across the manufacturing sector.

Reuters noted that American consumers, facing higher living expenses, have tightened discretionary spending on alcohol. For Molson Coors, those trends collided—a “perfect storm” of rising costs and softening demand.

The changing face of the beer drinker

Beyond economics, tastes are evolving. MarketWatch reported that younger consumers are increasingly opting for non-alcoholic beers, hard seltzers, and functional drinks over traditional lagers.

Analysts say Molson Coors’s layoffs reflect that recognition: it’s no longer just about making beer, but about making what consumers actually want today. Goyal has framed the shift as “diversifying faster than ever.”

Who’s most affected

Molson Coors hasn’t disclosed which departments will bear the brunt of reductions. According to Reuters, salaried roles in marketing, operations, and supply-chain planning are being reviewed, with final notifications expected by year-end.

Including vacant positions within the 400 total softens the headline number, but for those affected, it still marks a significant turning point in how the brewer operates day-to-day.

Leadership ranks reshuffled

The restructuring extends beyond headcount. Food Dive confirmed that Molson Coors eliminated its Chief Commercial Officer position as part of a streamlined leadership model.

The consolidation reduces overlap between regional divisions and shortens decision paths, a symbolic but practical move that signals Goyal’s intent to flatten bureaucracy and focus leadership where it drives the most value.

Restructuring carries a financial cost

According to Reuters, the company expects total severance and post-employment charges of $35 million to $50 million, which will be recognized primarily in Q4 2025 and early 2026. That translates to an average of $87,000 to $125,000 per affected employee.

A finance executive said the costs represent “an investment in long-term efficiency,” not a retreat—evidence that even painful cuts can serve a bigger plan.

Investors cautiously optimistic

Market reaction was muted. Molson Coors shares barely moved after the announcement, as investors weighed near-term disruption against potential efficiency gains.

Analysts told MarketWatch that while layoffs often signal strain, they can also mark the start of a turnaround if followed by sustained strategic execution. Much now rests on how quickly Goyal can translate cost savings into growth.

Reinvention amid uncertainty

Looking ahead, Molson Coors faces a challenging road ahead, marked by shifting trade policies, evolving consumer tastes, and macroeconomic headwinds. Management said it will outline its next phase in early 2026.

“We’re not just cutting—we’re reinventing for what comes next,” Goyal told Reuters in October. The statement captures both the risk and promise of the moment: a heritage brand betting boldly on its own reinvention.