Target CEO Brian Cornell is warning Americans to prepare for higher prices. A 2.8% drop in sales has shaken the company, which blames both political backlash and weak consumer confidence. As tariffs on Chinese and Mexican imports drive up costs, the company faces a tough choice—absorb the hit or raise prices.

Cornell says the retailer has held the line for as long as possible, but inflation and external pressures are mounting. If trends continue, Target may pass some of the burden onto customers, joining a growing list of retailers forced to adjust to a dramatically shifting economic landscape.

Retailers Grapple With Tariffs Hitting 30%

Retailers across the U.S. are under intense pressure from steep new tariffs, some hitting 30% on Chinese imports and 25% on goods from Mexico and Canada. These costs are squeezing supply chains, increasing the price of raw materials, and threatening product affordability across categories like electronics, produce, and furniture.

Target, Walmart, and others are exploring how long they can absorb these costs before raising prices. The National Retail Federation has warned that consumers should expect price hikes soon. This surge in tariffs is more than a trade dispute, it’s becoming a crisis with real consequences for every household’s bottom line.

DEI Backlash Sparks Boycotts, Hurts Sales

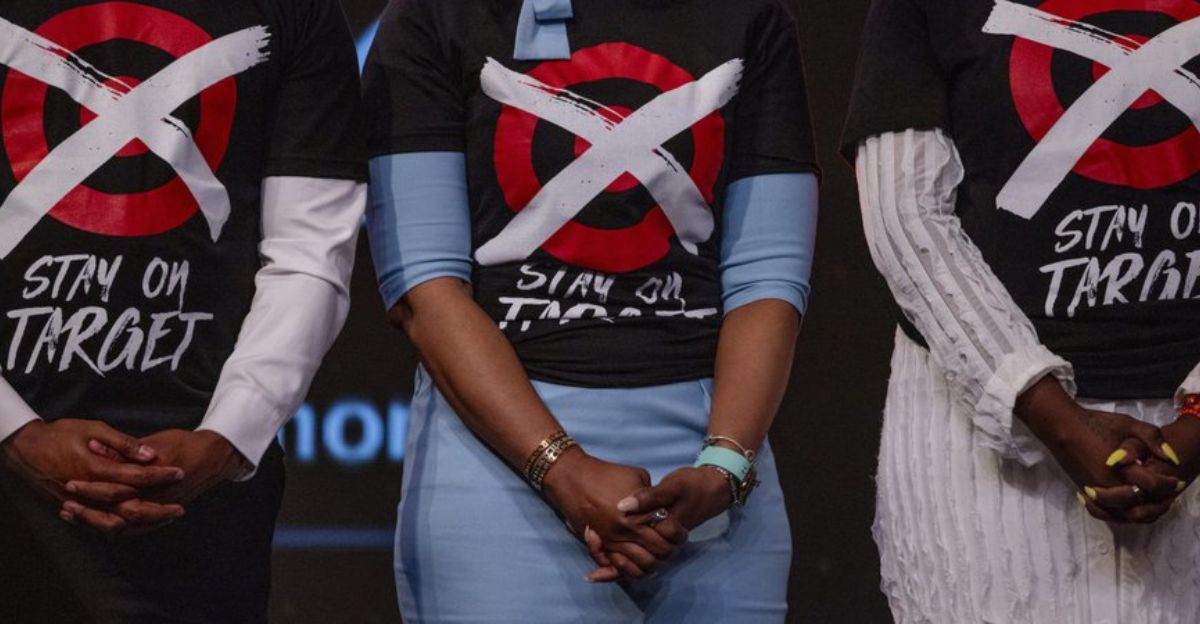

Target is facing public blowback after pulling back on diversity, equity, and inclusion (DEI) programs, prompting coordinated boycotts. Many customers view the move as a step backward and have responded by walking away from the brand. The result? A drop in sales and growing investor unease.

The boycott has quickly expanded from a niche protest to a broader reflection of consumer frustration. Americans are signaling that they expect more from corporations, not just low prices, but strong values. Target’s stumble is becoming a case study in the high stakes of cultural decisions.

Consumer Confidence Takes a Nosedive

Economic anxiety is on the rise, and the numbers show it. In May 2025, the University of Michigan’s Consumer Sentiment Index recorded its second-lowest reading in recent history. Inflation, political instability, and recession fears have Americans pulling back on spending. Many households are skipping nonessentials and prioritizing value-driven shopping.

This shift is hurting big-box stores like Target, which are seeing shrinking demand and thinner margins. As the retail landscape evolves, consumers are driving a quiet revolution, one based on caution, affordability, and skepticism. For Target and its peers, rebuilding trust in uncertain times is proving harder than slashing prices.

Target Cuts Forecast—And It’s a Bad Omen

Target has slashed its full-year forecast, a move that underscores the depth of its current troubles. The announcement sent ripples through the retail industry, highlighting broader economic concerns. The first quarter of 2025 saw the U.S. economy shrink for the first time in three years. Boycotts and tariffs are not only reducing sales, they’re also disrupting supply chains and pressuring local economies.

With reduced revenue, retailers may be forced to lay off workers, shut down stores, or cut investment in communities. Target’s revised outlook isn’t just about its future, it’s a warning sign for the entire consumer-driven U.S. economy.

Retailers Rethink Supply Chains and Strategy

To stay competitive, Target is now reevaluating its sourcing strategies, considering shifting away from China and increasing domestic production. The company is also looking at ways to streamline operations and adopt more efficient, sustainable practices. Automation, AI-driven inventory management, and alternative distribution models are becoming part of the conversation.

While short-term challenges mount, some executives see this moment as an inflection point, an opportunity to modernize and reconnect with changing consumer values. However, these changes take time, money, and commitment. Whether this pivot will come quickly enough to counter the rising tide of costs and criticism remains to be seen.

CEO Says Price Hikes Are a ‘Last Resort’

Brian Cornell has emphasized that price hikes are not a decision Target takes lightly. With profit margins already tight, the company has tried to absorb rising costs for as long as possible. But the impact of tariffs, inflation, and shrinking consumer demand may leave no other choice.

Walmart has already warned of price hikes starting at the end of May , making higher costs nearly unavoidable for most consumers. Cornell called the move a “last resort,” but acknowledged that continued pressure will force action. For everyday Americans, the price of goods is becoming a reflection of global and political tensions.

Trump Tells Retailers to ‘Eat the Tariffs’

President Donald Trump has reignited political controversy by urging retailers to “eat the tariffs”, rather than passing them on to consumers. The directive has drawn sharp criticism from business leaders who say that approach is unrealistic given the scale of current tariffs.

Companies like Walmart and Target argue they simply can’t afford to bear the brunt without risking layoffs or closures. The clash between political rhetoric and business reality is becoming increasingly public. In the middle are American consumers; caught between high prices at the checkout and the political gamesmanship that continues to shape the economy.

The Toll on the Average American

These economic pressures are hitting everyday Americans the hardest. Families are making tougher decisions at checkout, often choosing between needs and wants. For lower-income households, even small increases in food, household items, and clothing can be devastating. Some shoppers are switching to discount chains or cutting back entirely.

Meanwhile, potential layoffs and slowed hiring affect job security. The price increases aren’t just about higher totals, they’re about lost stability. Target’s decisions, though corporate in nature, affect real people. And as the gap widens between wages and expenses, the question becomes: how long can American families keep absorbing the cost?

The New Consumer: Adaptation and Anxiety

Shoppers have changed. The brand loyalty that once defined American retail is slipping. Consumers are switching to generic labels, hunting for deals online, and reevaluating what’s truly “essential.” Economic stress is shaping habits, some are meal-planning weeks ahead, others are skipping impulse buys entirely. Emotional fatigue is real. So is the demand for transparency.

Consumers want to know why prices are up, who’s profiting, and what brands really stand for. This isn’t just frugality, it’s a form of quiet protest. In a world where trust feels scarce, today’s buyer is more skeptical, more strategic, and far less forgiving than ever before.

What Comes Next?

The warning from Target’s CEO may be just the beginning. As costs climb and consumer patience thins, the next few months could redefine what Americans expect from retail, and what they’re willing to accept. Will brands adapt with honesty and innovation, or fall back on short-term price hikes? Will local businesses seize new loyalty, or will global e-commerce giants consolidate even more power?

The future remains unclear, but it’s already in motion. What we’re seeing now isn’t just a market correction, it’s a cultural reckoning with how we spend, save, and survive. One thing’s clear: the rules have changed. Are we ready?