Most streaming platforms are either gaining subscribers or at least holding steady. But in 2025, one major player quietly lost 1.3 million in a single quarter. Not due to bad content.

Not due to a global boycott. So what exactly happened? And what does it say about the state of the streaming wars overall? Let’s dig in and follow the numbers.

A Crowded Market

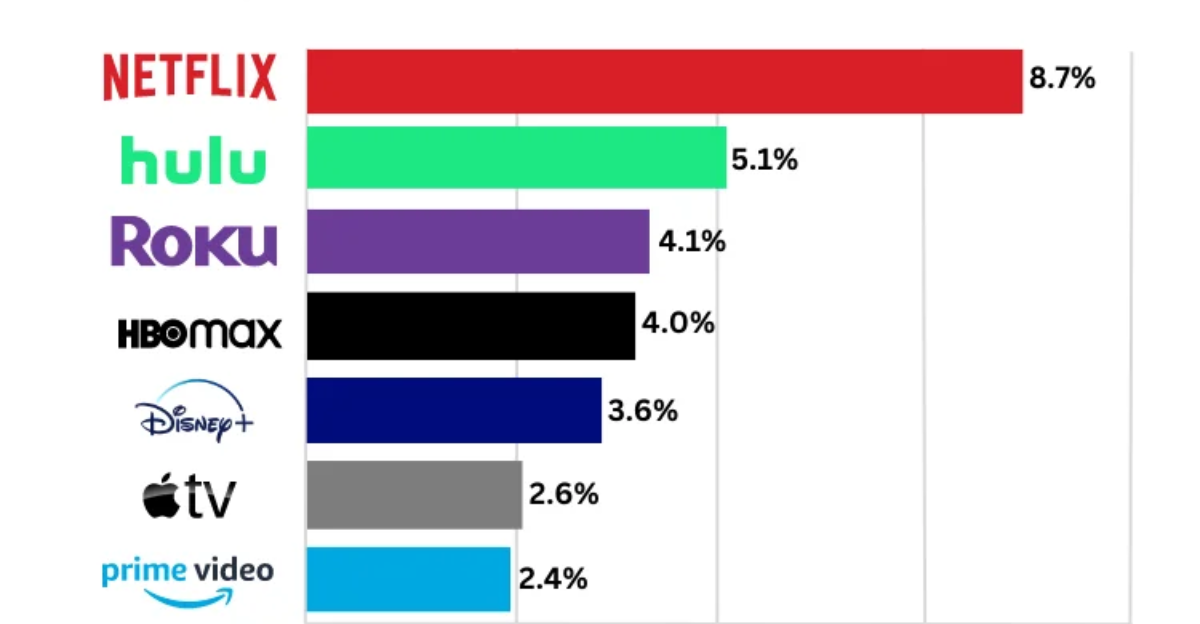

The streaming landscape is more competitive than ever. Between Netflix, Disney+, Max, Prime Video, Apple TV+, and newer services, audiences have options.

That means loyalty is fragile, and even small missteps or strategic changes can lead to noticeable shifts in subscriber numbers.

Too Many Services, Not Enough Time

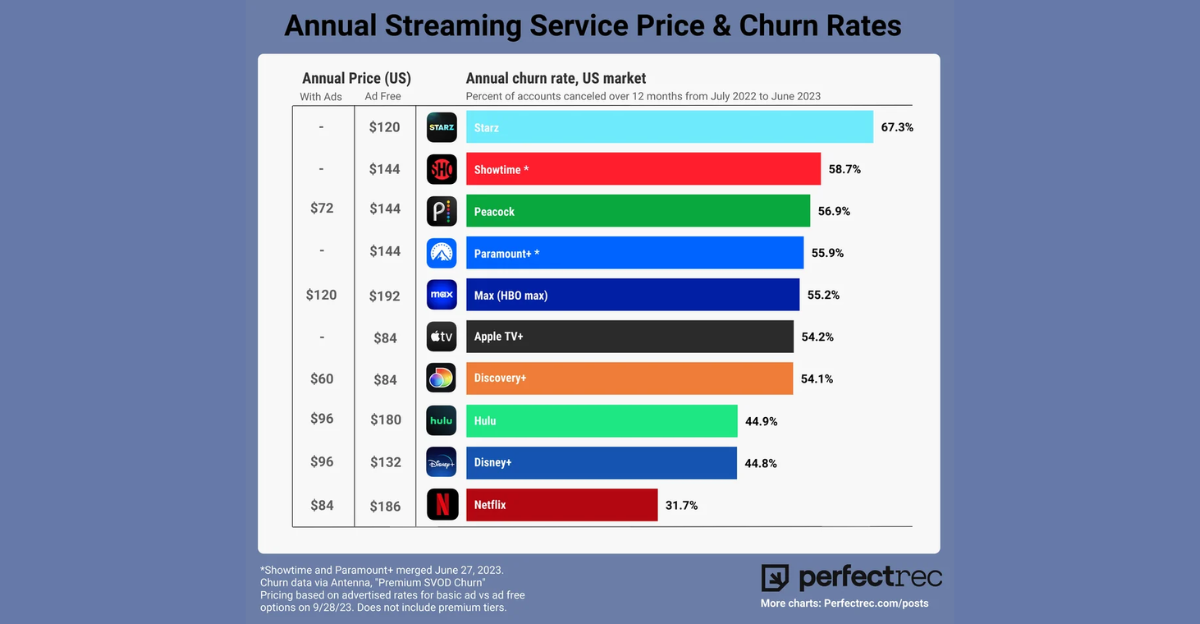

Many users have started cutting down on their subscriptions. Bundling fatigue, rising prices, and overlapping content libraries are making people pick and choose. The race for attention is intense, and it’s no longer enough just to offer good shows.

The Company in Question

In Q2 2025, Paramount+ reported a net loss of 1.3 million subscribers. The drop took its total from 79 million to 77.7 million by the end of July. That makes it one of the few platforms to post a subscriber decline during general streaming growth.

What Caused the Drop?

The primary reason wasn’t a content problem. It was the end of an international bundled promotion. When the bundle expired, many users didn’t renew.

This highlights how fragile subscriber counts can be when driven by short-term deals rather than long-term loyalty.

Not All Bad News

Despite the decline in user numbers, Paramount+ saw a 22% increase in subscription revenue. That came from both price hikes and a more valuable core subscriber base. This suggests a shift from quantity to quality in their revenue strategy.

Viewership Actually Grew

Interestingly, total global viewing hours across Paramount+ and Pluto TV rose 29% year-over-year. So fewer users didn’t mean less engagement. In fact, the platform may be attracting more committed viewers who use it frequently.

Churn Hits a Low

According to company statements, churn, the rate at which customers cancel, reached a record low. That means while many users left due to the bundle ending, those who stayed are sticking around. That’s a sign of healthy retention.

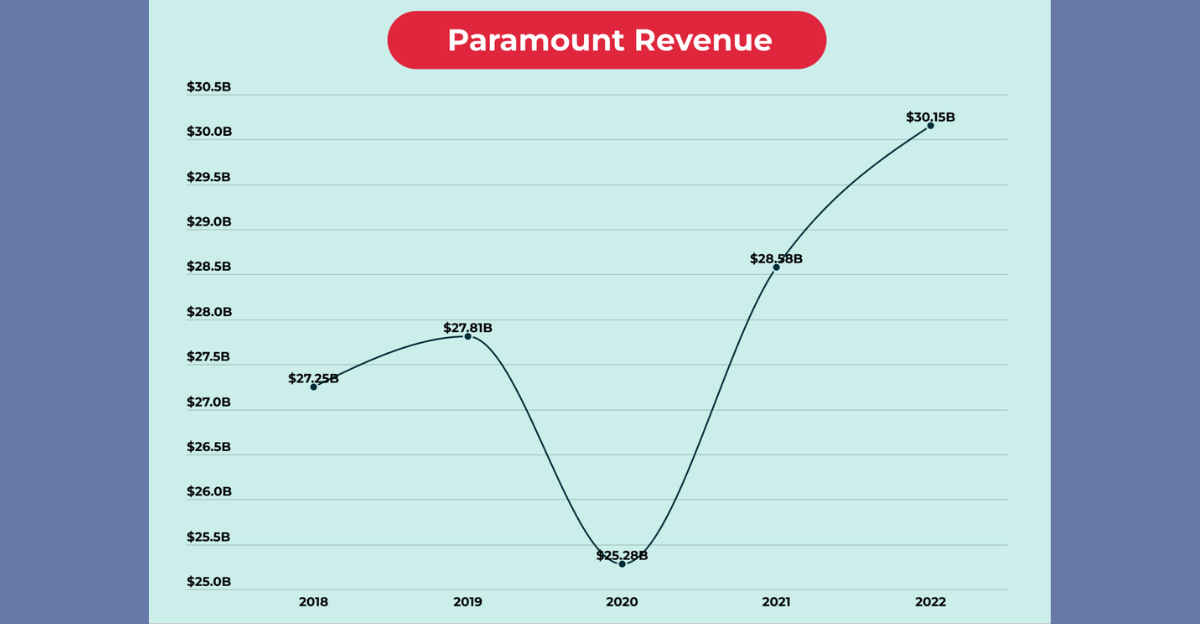

Revenue Tells a Different Story

Total revenue climbed 15% to $2.1 billion. This was attributed to stronger monetization per user and growing advertising revenues from free platforms like Pluto TV. Again, it suggests the subscriber drop didn’t hurt the business model as much as it may seem.

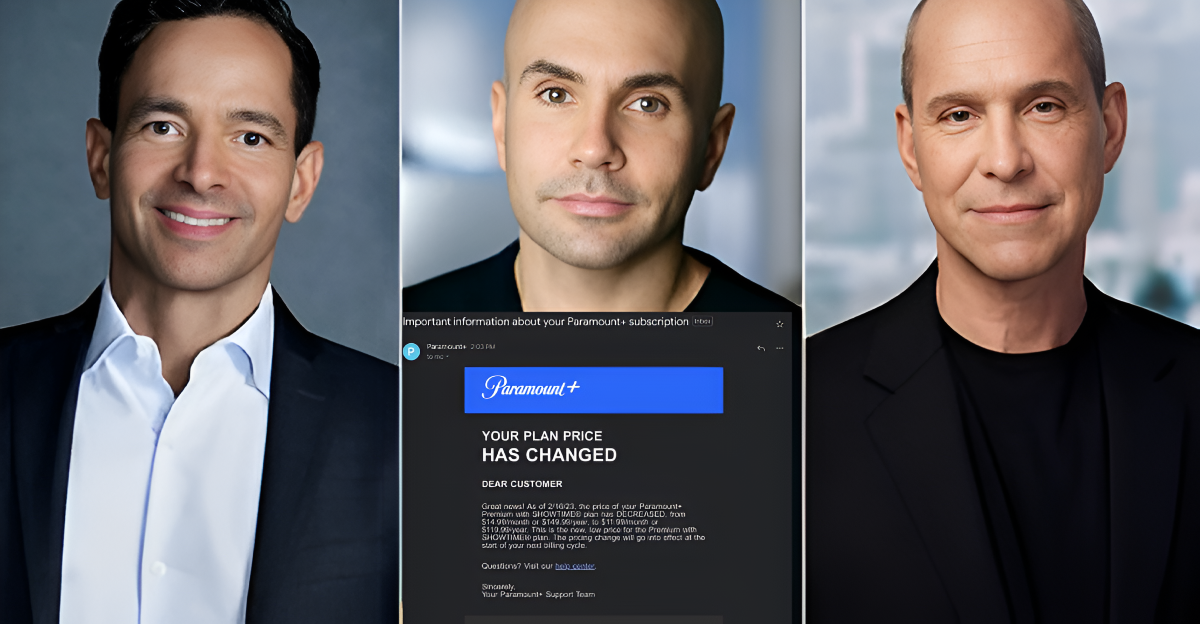

A Bigger Transition Is Underway

These shifts come during a much larger transformation. Paramount Global is being sold to Skydance Media in an $8 billion deal, expected to close on August 7. The subscriber loss may be one part of a broader strategic reset.

The Skydance Deal

Skydance is acquiring Paramount at a time when traditional media companies are trying to reinvent themselves for digital-first futures.

The deal may impact everything from what content gets greenlit to how global streaming is handled moving forward.

Why This Loss Matters

Even though revenue went up, a subscriber loss of this size during a competitive period sends a signal. Streaming isn’t just about quantity anymore. It’s about sustainable growth, smart pricing, and strategic content.

Promotions vs. Loyalty

The situation shows how promotional deals, while good for initial growth, don’t always build lasting audiences.

As those offers expire, companies face the real challenge: keeping people engaged long-term without constant discounts.

The FAST Factor

Paramount’s focus on free ad-supported streaming (FAST) like Pluto TV may be a smart pivot. This model is gaining traction among cost-conscious viewers and helping the company reach broader audiences without relying solely on paid subscriptions.

Originals Still Pull Weight

Paramount+ continues to have strong content. It claimed the most top 10 SVOD originals after Netflix. This helps explain why viewing hours increased and why its core audience may be growing more engaged.

The Netflix Shadow

No matter how well others perform, Netflix still sets the bar. Most platforms are measured against its user base, global reach, and cultural dominance. That makes even moderate losses stand out more sharply.

What Happens Next?

Post-merger, Paramount is likely to revisit its bundling strategy, international expansion plans, and content spending.

Expect more focus on profitability and possibly tighter offerings to reduce user confusion and boost loyalty.

Lessons for the Industry

This isn’t just about Paramount. It’s a wake-up call for the whole streaming sector. Flashy growth metrics won’t cut it anymore. Platforms need retention, smart monetization, and clear brand identity to survive the next wave.

The Consumer Advantage

For users, this streaming shift may mean better choices. As companies refine their offerings and compete on content and value, it’s a good time to be selective. Bundles may come back smarter and ad-supported tiers may improve.

The Bottom Line

Paramount+ lost 1.3 million subscribers but gained something else: clarity. With revenue up, viewership rising, and churn down, it might be better positioned for the next phase than it seems. In the streaming wars, the first hit doesn’t always mean defeat.