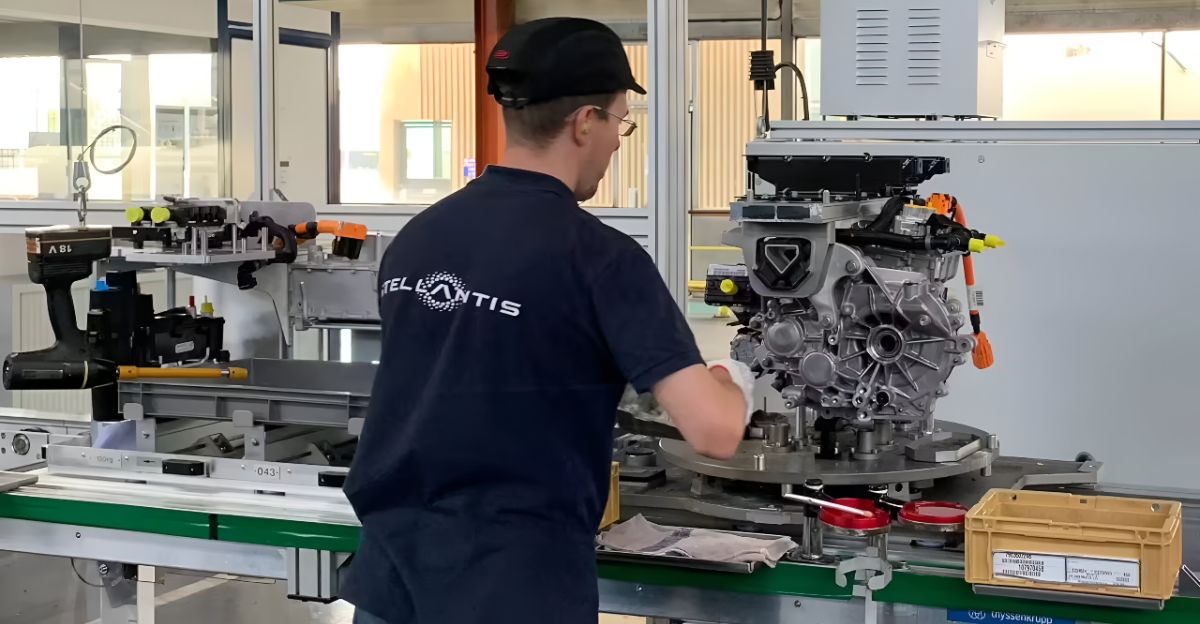

Stellantis announced on Oct. 14, 2025, a $13 billion investment in U.S. manufacturing – the largest in its 100-year U.S. history.

The plan spans Illinois, Ohio, Michigan, and Indiana, includes five new vehicle models, and will add over 5,000 jobs. Executives noted this move will “drive our growth” and expand the company’s footprint in America.

Why Now for Stellantis

CEO Antonio Filosa says reshoring was a “top priority” to regain market share. Stellantis will boost U.S. vehicle output by ~50%, partly to offset roughly $1.7 billion in U.S. tariffs this year. Filosa adds that success here “makes us stronger everywhere”.

The investment funds five new models (from trucks to EVs) and 19 product upgrades, all aimed at meeting evolving U.S. demand and tariff challenges.

More Models and Jobs

Americans will see a broader lineup. New plug-in hybrid and EV models are in the works alongside Jeeps and trucks. With 5,000+ factory jobs, local economies will surge. For example, Stellantis plans to reopen Illinois’ Belvidere plant (adding 3,300 jobs) and launch a midsize truck in Toledo (about 900 jobs).

Filosa stresses the goal of “expanding our vehicle offerings” and giving customers “the freedom to choose the products they want and love”, meaning more options for buyers.

Competitors and Suppliers

Rival automakers and parts suppliers watched closely. Analysts call Stellantis’ move “relevant” under Trump’s tariff regime and say it’s “paying off”. Massimo Baggiani of Niche Asset Mgmt. calls it an “irreversible trend” to make cars where they’re sold – hinting Ford, GM, and others may also ramp U.S. production.

At the same time, parts makers (from steel to semiconductors) anticipate large new orders. U.S.

Battery Boom and Tech Uptick

The surge in EV production is catalyzing the energy and tech sectors. U.S. investment in EV and battery manufacturing has topped $208.8 billion (with 240,000 jobs announced). Stellantis’ plans will boost demand for advanced batteries (dozens of gigafactories are already planned in states like Michigan and Indiana).

Utilities and charging networks will also benefit: more EVs on the road mean the grid must expand charging stations.

Reviving U.S. Manufacturing Lead

Stellantis’ decision is shifting global auto supply chains. In 2024, about 40% of Stellantis’ U.S. sales came from imports, mainly from Mexico and Canada. Moving those models stateside reduces import exposure.

Canada reacted sharply: Industry Minister Melanie Joly warned Stellantis that failing to honor past commitments would be a contract “default”, while Ontario Premier Doug Ford said he was “disappointed” by moving the Jeep Compass from Ontario to Illinois.

Midwest Communities Rejoice at Jobs

Local regions hit by layoffs now get relief. Illinois, Michigan, Indiana and Ohio communities will feel the impact. Belvidere, IL (population ~21,000) alone will add about 3,300 jobs, reviving a plant idle since 2023.

Illinois Gov. JB Pritzker praises the plan, saying it will “anchor long-term economic growth” and support families “left behind”. In Michigan, the Warren plant will gain 900 jobs building a new EV SUV.

Governments Rally Behind the Investment

State and federal leaders are touting this as a policy win. Michigan Gov. Gretchen Whitmer lauded Stellantis for “betting on Michigan once again” and said the funding helps “make cars and trucks that people rely on every day”. Illinois committed support packages around Belvidere’s 3,300 jobs.

In Congress, both parties highlight the move as evidence that U.S. incentives and tariffs are bringing jobs home.

Higher Wages and Spending

Adding thousands of manufacturing jobs tightens the Midwest labor market. Economists note that new demand for skilled auto workers will likely push up regional wages and household incomes. That wage growth will boost consumer spending in nearby towns.

For context, U.S. EV and auto firms have announced nearly 195,000 manufacturing jobs since 2015, and Stellantis alone adds 5,000 more.

Dealers Gear Up for New Models

Dealerships in the Midwest are preparing for a flood of new inventory. Stellantis sells through about 2,600 U.S. dealers. Many Chevrolet, Ford, and Toyota showrooms now share dealer space with Jeep/Ram outlets; all are planning training and infrastructure upgrades.

Jeep’s North American chief Bob Broderdorf notes “dealers overwhelmingly asked us for training” to handle the new EV models.

Local Commerce Set for a Boom

Nearby service businesses see a boost. Hospitality and retail will get new customers as plant staff fill hotels, shops, and restaurants. For example, Belvidere’s full reopening (3,300 workers) represents a ~15% population increase, meaning millions in annual consumer spending flowing into Boone County.

Restaurant owners and retailers across the four states anticipate higher sales from suppliers and employees alike.

Supply Chain Surge Across Sectors

The auto investment ripples into many industries. Stellantis operates with ~2,300 U.S. suppliers. Steel mills (e.g., Nucor) will ship more sheets for bodies; electronics firms will supply sensors and chips; software companies will code new infotainment and driver-assist systems.

Even non-automotive industries feel it: paper and plastic companies supplying auto plants, and logistics firms moving parts, will win extra business.

American-Made Cars Eye Global Markets

As U.S. factories ramp up, American-built vehicles will play a larger role overseas. Stellantis could export more Jeep SUVs and Ram trucks to Europe and Asia, where “Made in USA” can be a selling point.

Analysts expect Stellantis to balance serving U.S. consumers with continuing exports: the new Jeep models made in Michigan will likely ship to left-hand-drive markets, expanding the global footprint of U.S. plants.

Cleaner Air via Electrification

Transportation is the largest source of U.S. greenhouse gases (about 28% of all emissions). By expanding EV and hybrid production, Stellantis supports cleaner air goals. Its new large SUV in Michigan will be offered as a battery-electric model, reducing tailpipe pollution.

Research shows that transitioning to EVs can avoid tens of thousands of premature deaths from air pollution.

The Debate

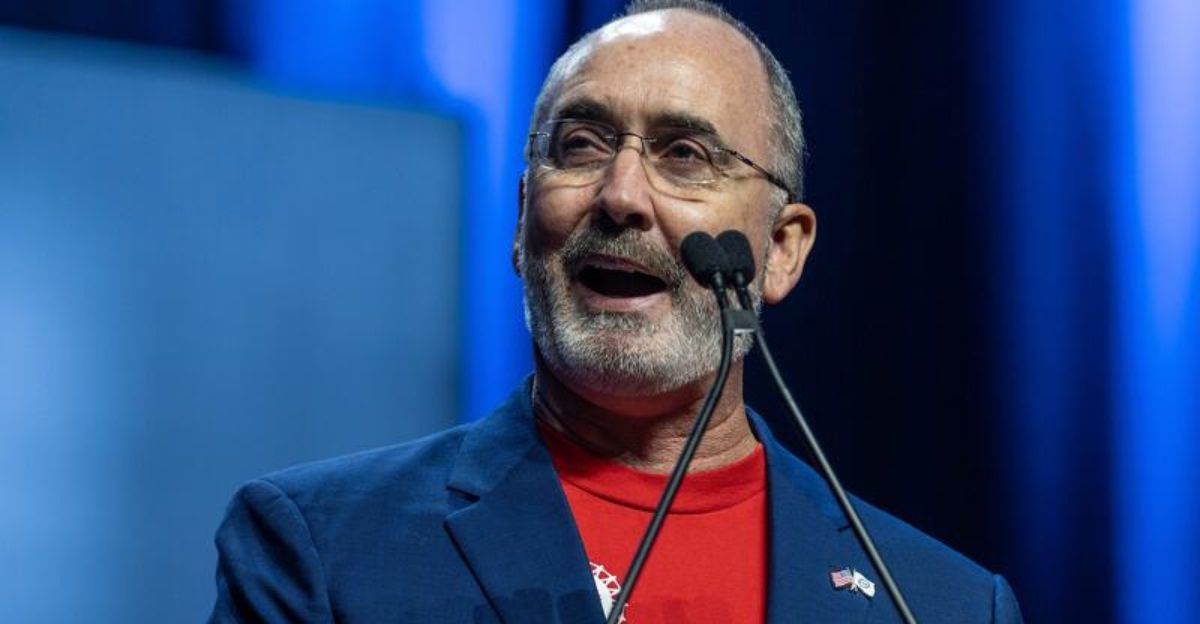

The announcement reignited a familiar debate. Labor leaders and union advocates celebrate the thousands of new factory jobs. UAW President Shawn Fain says the move proves targeted tariffs can “bring back thousands of good union jobs to the U.S.”.

Environmentalists are more cautious: while they welcome more EVs, they question new investments in large SUVs and trucks. Some climate groups note that long-term emissions goals require phasing out gasoline vehicles, so they urge Stellantis to focus on EVs and efficiency.

Winners and Losers in the Auto Boom

The shift reshuffles the industry map. Clear winners are U.S. autoworkers, Midwest suppliers, and local economies, plus investors betting on U.S. auto stocks. By contrast, Canadian auto workers may be losers: Ontario’s leadership warned of lost jobs.

Mexican and other foreign plants will lose out on projects moved stateside. Smaller automakers might face stiffer competition as Stellantis ramps up. Even within the U.S., regions with aging workers may struggle to find enough talent fast enough.

Wall Street Cheers and Cautions

Investors reacted positively: Stellantis shares jumped over 4% after the news. Analysts boosted forecasts, noting the plan aligns Stellantis with the “new business environment”.

One portfolio manager said the move is “paying off” the strategy under tariffs. Stock analysts raised price targets on European listings, expecting U.S. sales growth. However, market watchers also advised caution: the auto sector remains cyclical, and any supply chain hiccup or demand slowdown could add volatility despite the upbeat mood.

Timing and Incentives

Car buyers should watch for the new Stellantis models and financing deals. Dealers often offer attractive incentives at launch – for example, big rebates or 0% loans on new Jeeps. Buyers in EV markets should compare state and local incentives: note that the federal $7,500 EV tax credit was phased out by late 2025, but some states still offer rebates or HOV perks for EVs.

Prospective buyers will benefit from timing their purchase around the new model releases (starting in 2027) and checking for special offers on outgoing models .

Stellantis’ 2029 Plan

Stellantis has laid out a roadmap through 2029. It will launch 5 all-new U.S.-built vehicles and refresh 19 existing models as part of this push. For example, an all-new Jeep Cherokee and Compass will come from Belvidere in 2027, and the new Dodge Durango will be built in Detroit by 2029.

The company will also invest in workforce training and supply-chain logistics to meet these goals.

A New Era in the U.S. Auto

In sum, Stellantis’ $13B plan could mark a turning point. It underscores how U.S. industrial policy, tariff pressure and EV trends are reshaping the global auto industry. Investors describe a “forced de-globalisation” taking hold: automakers are now racing to build cars where they’re sold.

The project cements the Midwest’s role as an automotive hub and signals that American manufacturing still matters.