A 10-mile pipeline beneath Caribbean waters could unlock $500 million in annual revenue for Shell over three decades.

The Dragon gas field project—stalled for years under sanctions—is suddenly viable as political upheaval in Venezuela opens the door for international energy giants to claim billions in untapped reserves. But the path forward requires navigating a geopolitical minefield controlled by Washington.

Massive Reserves Await Development

The prize is staggering: 120 billion cubic meters of natural gas sitting in Venezuelan waters near Trinidad and Tobago, equivalent to three times the United Kingdom’s entire annual consumption.

Shell secured U.S. Treasury approval in October 2025 to develop the Dragon field, with proven reserves of approximately 4.2 trillion cubic feet making it one of Venezuela’s largest gas deposits.

January 2026 Changes Everything

U.S. forces ousted Venezuelan President Nicolás Maduro in early January 2026, and President Donald Trump immediately announced plans to control the country’s oil sales “indefinitely.”

The move transformed Venezuela from a sanctioned pariah state into what industry insiders call “permissioned petroleum”—where geopolitics matters more than geology, and licensing trumps drilling capabilities.

Washington Seizes Control of Oil Revenues

Trump didn’t just remove Maduro—he seized control of Venezuela’s entire energy apparatus. U.S. Energy Secretary Chris Wright confirmed the strategy bluntly: controlling “the flow of oil, the sales of oil, and the flow of the cash” provides leverage to dictate Venezuela’s future.

The administration now requires Venezuela to purchase “ONLY American Made Products” with oil revenues.

American Companies Must Lead Investment

Foreign companies like Shell must partner with U.S. firms or wait for secondary opportunities after American giants claim prime assets.

Trump told industry leaders that “the big oil companies are going to go in and they’re going to fix the infrastructure”—but he made clear he expects American companies to lead Venezuelan energy revival.

Pipeline Offers Clear Export Pathway

The Dragon field represents Shell’s best opportunity to enter this new landscape. Unlike oil projects requiring massive infrastructure rehabilitation, the gas-to-Trinidad strategy offers a defined scope with clear export pathways.

The 10-mile pipeline would transport gas directly to Shell’s existing operations at Trinidad’s Atlantic LNG terminal and petrochemical facilities.

Chevron Dominates Venezuela’s Energy Sector

Chevron holds the commanding position, producing between 100,000 and 150,000 barrels per day—accounting for roughly 20-30% of Venezuela’s total output.

The American oil giant is the only U.S. major currently operating in Venezuela and is positioned to expand operations rapidly under Washington’s patronage. Energy Secretary Wright confirmed Chevron’s operations will grow “quickly”.

European Firms Face Secondary Role

Ashley Kelty from investment bank Panmure Liberum stated that “the primary beneficiaries will be the U.S. oil giants, especially Chevron,” while European companies like Shell and BP will be “invited to collaborate later, as American firms seek joint ventures to diversify risk.”

This uncomfortable reality forces European majors to accept junior partnership roles.

Shell Maintains Strategic Silence

Shell has declined all public comment on its Venezuelan strategy, adopting the cautious silence shared across the international energy industry.

This reticence reflects uncertainty about Venezuela’s political future and the complex regulatory environment, where licenses can be revoked by executive action and success depends on diplomacy as much as engineering.

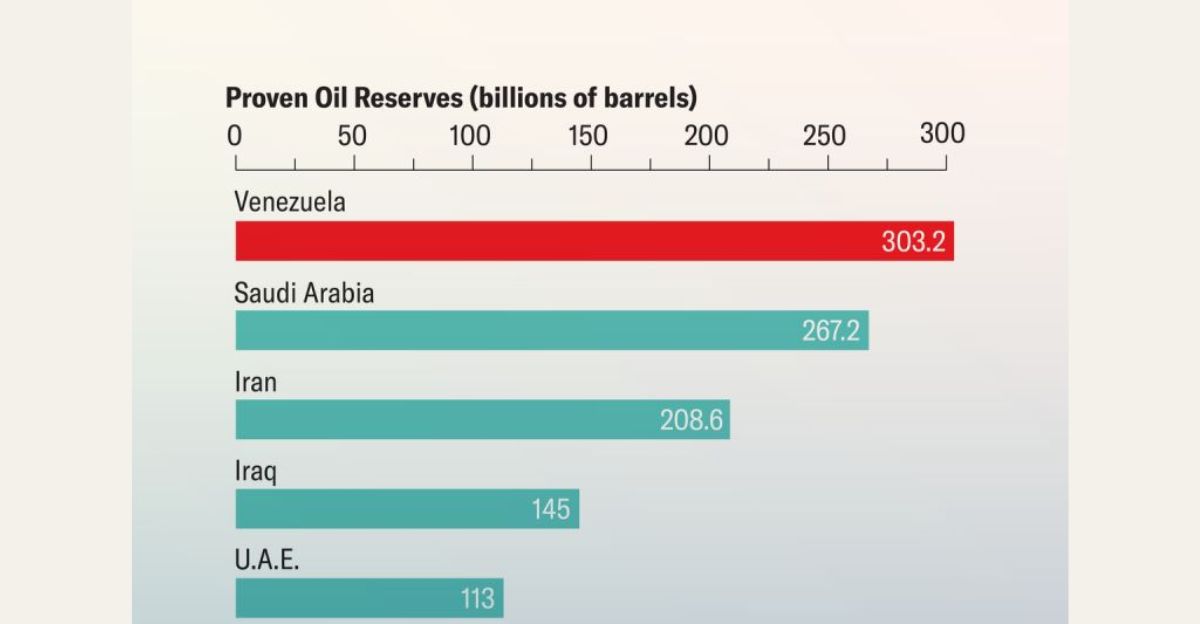

World’s Largest Oil Reserves Sit Underdeveloped

Venezuela possesses the world’s largest proven oil reserves at 303 billion barrels, yet ranks only 20th in global production.

Current output stands around 800,000 to 950,000 barrels per day—a fraction of capacity due to decades of mismanagement, corruption, and sanctions that left the energy sector in catastrophic disrepair.

$183 Billion Needed for Full Recovery

Independent research firm Rystad Energy estimates that restoring oil production to 1990s levels requires $183 billion in investment over more than a decade.

Another analysis suggests $110 billion is needed just to lift production from 1 million to 2 million barrels per day by 2030. These staggering figures explain widespread industry hesitation despite political changes.

Expropriation History Haunts Foreign Investors

Venezuela’s track record of asset seizures remains a significant deterrent to foreign investment. ExxonMobil and ConocoPhillips withdrew in 2007 following government expropriations, creating lasting concerns about property rights and contract sanctity.

Even with Maduro gone, institutional memory of nationalization campaigns makes major capital commitments extraordinarily risky.

OPEC Faces Market Control Nightmare

Greg Newman, CEO of oil trading firm Onyx Capital, warned that “OPEC’s grip on global oil supply and demand is already tenuous. An increase in Venezuelan production from the U.S. may flood the market.” Additional Venezuelan barrels could add one to two million barrels per day to already oversupplied global markets.

Oil Prices Fell 18% in 2025

Oil prices declined 18% in 2025—the steepest drop since the 2020 pandemic—reflecting OPEC’s diminishing market influence. OPEC+ recently agreed to halt supply increases during first quarter 2026 to stabilize prices, but Venezuelan output threatens to overwhelm these efforts and push markets into deeper surplus, further weakening the cartel’s pricing power.

Three-Phase Licensing Creates Uncertainty

U.S. Treasury Department structured the Dragon field authorization in three phases with escalating requirements. The initial phase allows Trinidad and Shell to negotiate with Venezuela and state-owned PDVSA through April 2026, but subsequent phases require additional approvals.

This creates significant uncertainty about project timelines and ultimate feasibility.

License Revocations Demonstrate Policy Volatility

In April 2025, the Trump administration revoked licenses for the Dragon project and a similar BP initiative, demonstrating the precarious nature of regulatory approvals.

New authorizations were later granted, but the reversal highlighted how quickly Washington can change the rules governing Venezuelan energy investments, keeping companies perpetually off-balance.

BP Lobbies for Project Reinstatement

BP holds interests through an exploration license for the Manakin-Cocuina field granted in 2024, though U.S. approvals were revoked in April 2025.

The British company has been actively lobbying for reinstatement of those critical authorizations, underscoring the competitive scramble among European majors to secure positions in Venezuela’s reopening energy sector.

Short-Term Production Gains Expected

Analysts at Kpler estimate that with sanctions relief, Venezuela could increase output by 100,000 to 150,000 barrels per day within three months, bringing total production closer to 1 million barrels per day. By year-end 2026, production capacity could reach between 1.1 and 1.2 million barrels per day—modest but meaningful gains.

Major Increases Require PDVSA Reform

Reaching production levels above 2 million barrels per day requires “sweeping reform at PDVSA, as well as new upstream contracts signed with foreign operators,” according to Kpler.

State oil company restructuring remains essential for attracting the massive capital needed to revive Venezuela’s energy sector comprehensively and restore international investor confidence.

Geopolitics Now Trump Geology

Industry analysts describe Venezuela as representing a return to “permissioned petroleum”—where “geology is optional; licensing is everything—and geopolitics is the real project operator.”

Shell’s ultimate success depends on navigating U.S. policy shifts, Venezuelan political stability, competitive positioning against American firms, and market conditions that currently favor caution over bold commitments.

Sources:

Reuters energy sector reporting; US Treasury Department Dragon field licensing documentation (October 2025)

Rystad Energy Venezuela infrastructure analysis; Kpler oil production forecasts

US Department of Energy official statements; White House Venezuela policy briefings (January 2026)

Yahoo Finance Shell Venezuela coverage; Bloomberg Venezuela energy market analysis

Panmure Liberum investment analysis; Onyx Capital market commentary

Major newswire reporting: AP, Reuters, BBC, New York Times Venezuela political developments (January 2026)