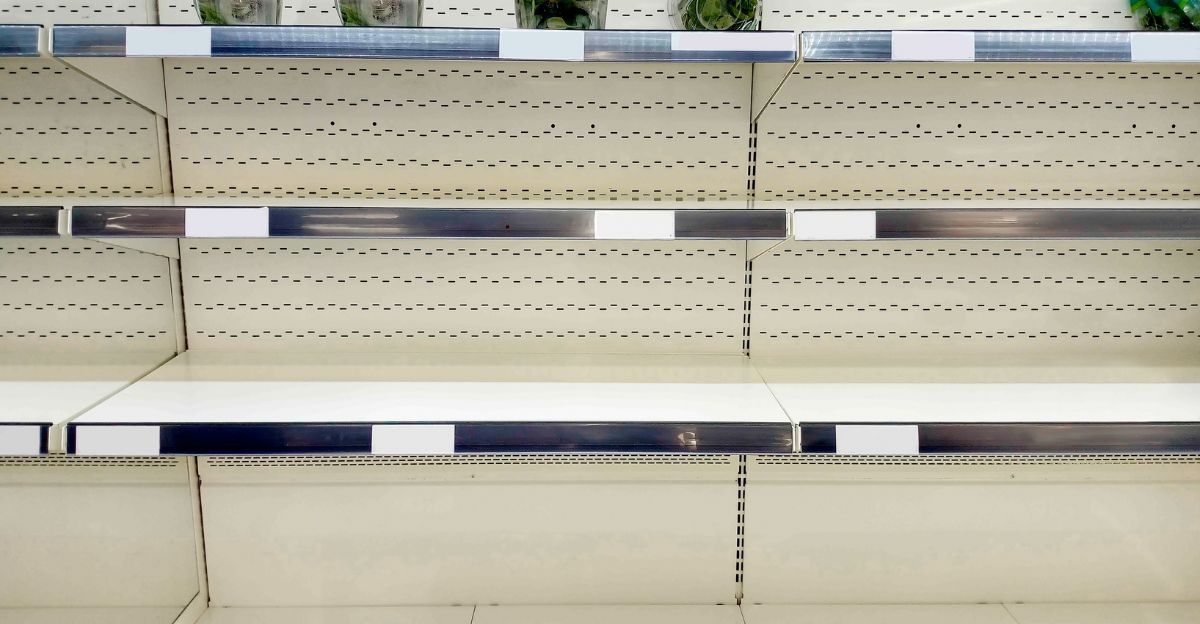

San Francisco’s downtown retail sector is facing a deepening crisis as major flagship stores, including Nordstrom and Old Navy, close their doors for good. Once a bustling hub for shoppers and tourists, Union Square now tells a different story, with its retail vacancy rate soaring to more than 20%, a record high that signals a widespread exodus of retailers.

The city’s largest mall, San Francisco Centre, has been hit especially hard, with an astonishing 93% of its retail space now sitting empty.

Economic Stakes Rise

Things are getting worse for San Francisco’s downtown shopping scene. The San Francisco Centre has lost a staggering 25% of its value in just a year, dropping to about $195 million; that’s more than a billion dollars less than what it was worth back in 2016.

High-profile closures and declining foot traffic are now threatening local jobs and city tax revenue, raising urgent questions about the city’s economic future.

Retail’s Tumultuous History

San Francisco’s retail sector has dealt with many issues over the years, but the COVID-19 pandemic accelerated longstanding challenges.

Once a magnet for global brands, Union Square and Market Street have seen a steady decline in in-person shopping since 2020, with online retail and remote work steadily changing consumer habits.

Mounting Pressures

Many retailers say they’re pulling out of San Francisco because of rising crime rates, higher rents, and the ongoing challenges of homelessness.

On top of that, the city’s formula retail restrictions and slow permitting processes have further complicated recovery efforts, making it even more difficult for new tenants to fill vacant storefronts.

Major Closures Unveiled

This major crisis peaked in 2023 when Nordstrom closed its flagship at Westfield San Francisco Centre, followed by Old Navy’s exit from 801 Market St.

Whole Foods temporarily closed its doors because of safety concerns, and Westfield surrendered the mall to lenders. These moves marked a turning point for downtown retail.

Local Impact Intensifies

By the second quarter of 2025, Union Square’s vacancy rate had climbed to a staggering 23%, with direct vacancies sitting at 20.9%. The situation took another hit in May when Saks Fifth Avenue closed its doors, a major loss that sent shockwaves through the district.

This summer, six more restaurants closed their doors inside San Francisco Centre, stripping away dining options and putting additional strain on local workers and nearby businesses that rely on steady foot traffic.

Human Toll Emerges

Store employees, restaurant staff, and small business owners are all facing mounting uncertainty as closures continue to pile up.

For many displaced workers, the search for new jobs has become an uphill battle, with fewer opportunities available in the shrinking retail and hospitality sectors. Small business owners, meanwhile, are grappling with dwindling customer traffic and rising costs.

Competitors and Regulators Respond

While some corridors struggle, others are seeing new entrants. Nintendo and Pop Mart opened in Union Square, and Ross Dress for Less launched nearby.

City officials tout the “Vacant to Vibrant” program, aiming to attract new retailers and revitalize empty spaces, but results remain mixed.

Macro Trends Shape Recovery

Citywide, retail vacancy rates have stabilized at 7.6% in the first quarter of 2025, but hotspots like Van Ness Avenue exceed 50% vacancy.

The rise of e-commerce and remote work continues to suppress in-person shopping, while inflation and high rents challenge both landlords and tenants.

Mall Auction Delays

A foreclosure auction for San Francisco Centre has been postponed eight times, but it is now set for September 18, 2025.

Previous owners Westfield and Brookfield stopped paying their $558 million mortgage after Nordstrom’s exit, showing the financial turmoil gripping downtown retail.

Stakeholder Frustration Grows

Landlords, city officials, and business groups have all voiced their growing frustration over how slowly the retail district is bouncing back.

On top of that, the San Francisco Unified School District, which owns part of the mall’s land, is locked in negotiations with lenders over lease obligations, complicating efforts to stabilize the property.

Ownership Shifts and Defaults

Westfield and Brookfield’s decision to surrender the mall to lenders in 2023 marked a dramatic shift in ownership.

The property’s uncertain future has deterred investment, while ongoing lease disputes with the school district have added further complexity.

Comeback Attempts

Despite all of these setbacks, some retailers and city programs are fighting back.

The “Vacant to Vibrant” initiative has brought new stores and restaurants to Union Square, with brands like Bulgari and Polo Ralph Lauren opening new locations, signaling cautious optimism.

Expert Outlook Remains Guarded

Analysts warn that while some indicators are improving, the overall outlook is unclear for now.

Retail rents have risen 9% year-over-year, but persistent vacancies and inflation-adjusted sales growth of just 0.3% suggest recovery will be slow and uneven.

What’s Next for Downtown?

With the foreclosure auction looming and new retailers testing the market, the future of downtown San Francisco hangs in the balance.

Everyone is now wondering: Will revitalization efforts succeed, or will more flagship stores follow Nordstrom and Old Navy out the door?

Political and Policy Implications

City leaders are now facing mounting pressure to address the crime, homelessness, and regulatory hurdles that are causing all of these issues.

The debate over formula retail restrictions continues, with some arguing these policies hinder recovery by deterring national brands from entering the market.

International Effects

San Francisco’s retail struggles have garnered global attention, prompting international brands to reassess their U.S. strategies.

The city’s challenges are seen as a cautionary tale for other urban centers facing similar pressures from e-commerce and urban decline.

Legal and Environmental Angles

Legal disputes over lease obligations and foreclosures are also complicating any recovery efforts.

Meanwhile, vacant properties are also raising environmental concerns, as underused buildings contribute to urban blight and waste. City officials are exploring incentives for sustainable redevelopment.

Cultural Shifts and Perceptions

The retail exodus has altered the city’s cultural fabric. Once-bustling corridors now feel empty, changing how residents and visitors experience downtown.

Some see opportunity for reinvention, while others mourn the loss of iconic stores and local gathering places.

What It Signals Now

San Francisco’s retail crisis is a warning sign for cities nationwide. The interplay of crime, economic shifts, and policy decisions will shape the future of urban retail.

As the city seeks a path forward, its experience offers lessons and caution for the next chapter in American downtowns.