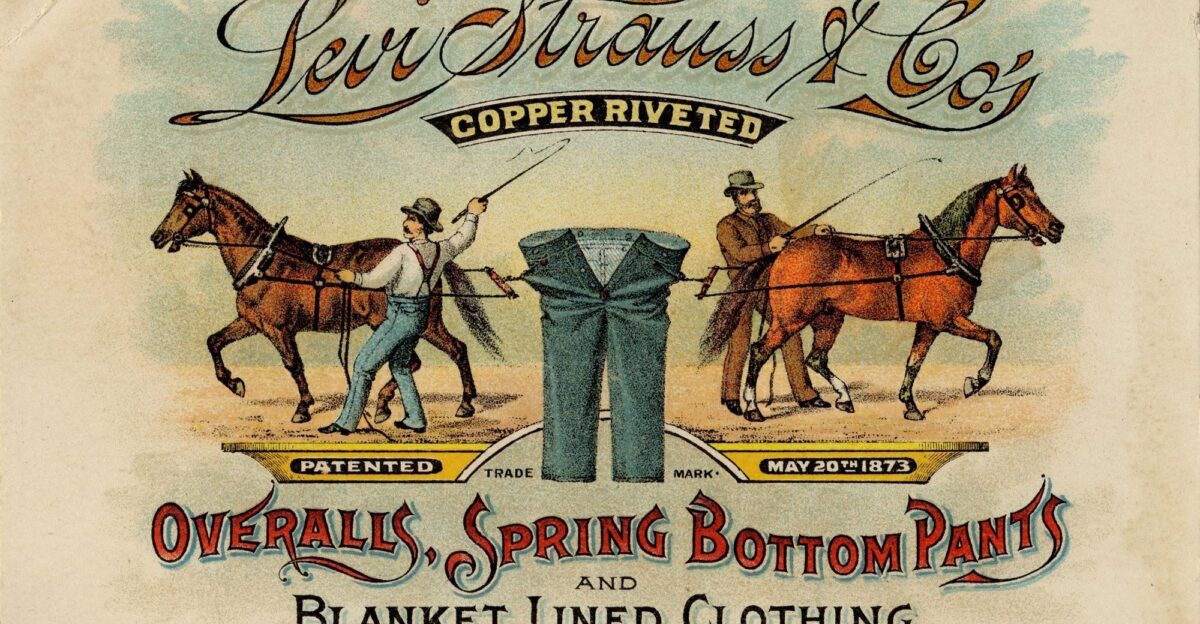

Levi’s, one of America’s most recognizable fashion exports, reported a $30 million revenue decline in its September earnings compared with the prior year. Executives said rising “anti-Americanism” was one of several factors behind the loss, alongside tariffs, inflation, and market competition.

Newsweek reported that leaders warned the downturn reflects more than economics; it signals a noticeable turn among shoppers increasingly skeptical of U.S. brands. Once a symbol of denim culture, Levi’s now finds itself navigating a world where political sentiment carries as much weight as fabric or fit.

A Global Shift Away From U.S. Brands

Levi’s slowdown is part of a wider retreat from American goods abroad. Retail analysts in London observed that European shoppers are increasingly favoring regional and Asian alternatives. Levi’s executives told distributors they sense a “noticeable hesitation” in conversations about U.S. apparel.

Where an American label once stood for authenticity and style, it is now more often viewed as out of step with local values. Company filings warn that this erosion stems less from changing fashion trends and more from identity, politics, and shifting global sentiment.

Defining ‘Anti-Americanism’ in 2025

In retail terms, “anti-Americanism” no longer just describes a political mood but translates into everyday buying choices. Industry forums in France and Germany point to boycotts, online campaigns, and casual snubs of U.S. logos. A French fashion blogger noted on social media that “a U.S. logo on the sleeve doesn’t have the cool factor it used to.”

Levi’s echoed this in its international briefings, warning that political controversies now spill into shopping behavior. In this environment, a pair of jeans is no longer judged on durability alone but also on what the label represents.

Levi’s Warns of Eroding Trust

Levi’s leaders did not shy away from blunt language in September. “Rising anti-American sentiment is damaging trust in our brand worldwide,” executives said on the earnings call. Retail Dive reported that analysts saw the statement as a broader caution for other U.S. companies with global reach.

Yahoo Finance added that Levi’s struggles reflect the fragility of brand trust when tied to a country’s image. For decades, Levi’s jeans carried cultural weight, but trust built over generations can erode quickly when consumers associate a label with politics rather than lifestyle.

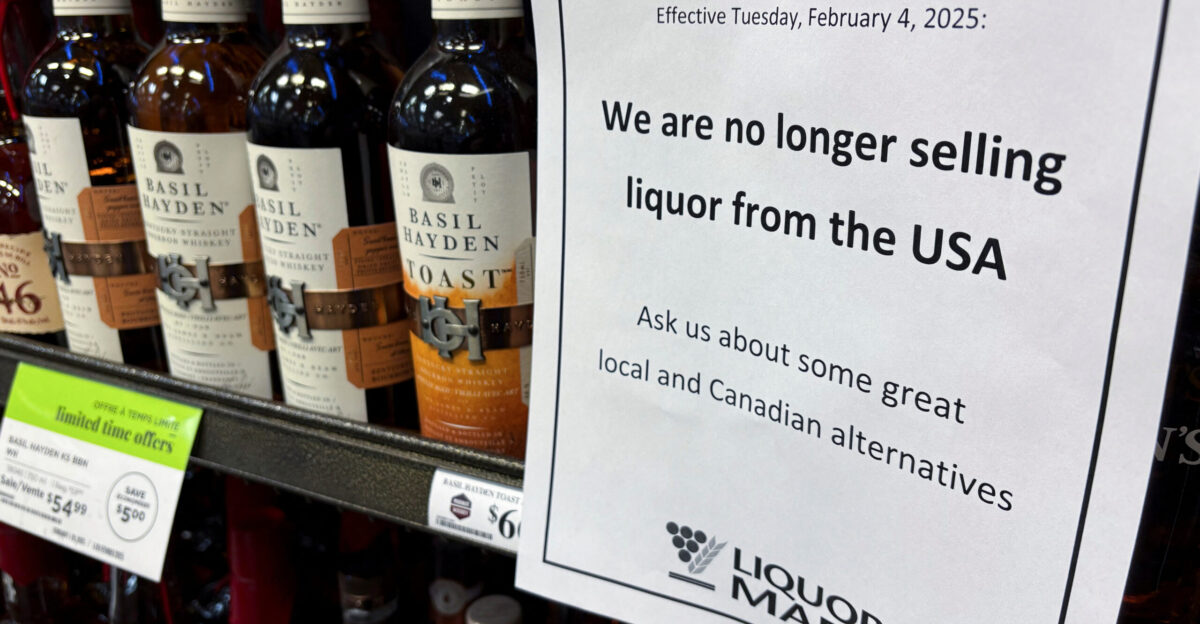

The Role of Trump-Era Tariffs

Analysts widely agree that the current backlash gained momentum during Donald Trump’s second round of tariffs in 2024 and 2025. A European market researcher told Reuters that tariffs are “not just a trade tool—they’re a statement,” often interpreted by consumers as symbolic of larger divides.

Levi’s annual report described tariffs as a “catalyst” for consumer resistance, particularly in Europe and Asia. These measures coincided with early calls for boycotts, suggesting that trade disputes created fertile ground for anti-American sentiment, spilling over into shoppers’ interactions with U.S. fashion brands.

The $30 Million Loss Explained

Levi’s $30 million revenue decline has become headline news due to the company’s symbolic status as an American brand. Modaes reported that distribution managers in the U.K., France, and Germany cited weakening demand, with buyers showing less willingness to carry U.S. apparel.

Levi’s filings and its September earnings call flagged rising anti-American sentiment as a contributing risk. Still, executives emphasized that the financial performance reflects a combination of pressures, including tariffs, inflation, and local competition. The case illustrates how cultural and political factors can amplify ordinary market challenges for iconic brands.

Shifting Preferences, Shifting Power

Across Paris, Berlin, and Seoul, local brands are thriving, often at the expense of American competitors. In interviews with the trade press, Levi’s executives admitted that regional fashion houses are gaining traction where U.S. labels once dominated. Shoppers told journalists that American brands “feel out of step with local values right now,” creating openings for European and Asian companies to expand.

The shift concerns price and resonance as consumers increasingly want products that align with cultural identity, sustainability practices, or national pride, where homegrown labels often have an edge.

Levi’s Leadership Voices Concern

Company leaders, including CEO Michelle Gass, have repeatedly warned of long-term consequences. As Newsweek reported, executives fear losing a generation of global shoppers if current trends continue, a point Gass herself has echoed in recent interviews. Morning Consult added that these warnings reflect more than pop culture concerns; they stem from ongoing boycott calls and negative sentiment that began intensifying in mid-2024.

Levi’s management, led by Gass, has framed the problem as both economic and cultural, signaling that restoring trust abroad will require more than a marketing campaign. For the first time in decades, Levi’s executives see international brand loyalty as fragile and risky

Is This Only About Politics?

While trade tensions and foreign policy contribute, experts say the forces at play are broader. BBC business roundtables quoted a U.K. retail consultant noting, “Politics is just the backdrop.” Levi’s executives point to cultural debates—spanning climate action, corporate responsibility, and global leadership—as increasingly influencing everyday shopping decisions.

In practical terms, jeans, sodas, and sneakers are no longer detached from current events. Consumers are signaling that the political and cultural climate of the United States can shape how they perceive and choose American brands, even in stores thousands of miles away.

A Shopper’s Perspective

Behind the statistics are personal choices. Yahoo News interviewed a Paris resident who explained, “My friends avoid U.S. brands for political reasons and out of solidarity.” In Tokyo, a boutique manager told reporters that customers increasingly ask about product origin before buying and often choose local options instead.

These voices illustrate what Levi’s has reported in its filings: a grassroots shift where consumers link their values with their purchases. For Levi’s, these small everyday decisions add up, gradually undermining sales in markets that were once considered dependable strongholds.

What Surveys Reveal

Retail Dive highlighted surveys in the U.K. and France showing that more than half of respondents supported boycotts of American brands. Levi’s executives referenced these surveys in their earnings call as evidence of waning support, particularly among younger consumers.

While the company acknowledged that full methodology details were not always available, analysts said the results align with declining purchase intent seen in Levi’s filings.

American branding once implied innovation, but it is now viewed with greater caution. The figures reflect a broader cultural and political sentiment pattern shaping consumer behavior.

A Legacy Under Pressure

For generations, Levi’s symbolized American independence and style, worn by rock stars, workers, and everyday shoppers alike. That cultural cachet is no longer guaranteed. FashionUnited quoted a brand historian who said, “Levi’s has gone from global icon to political lightning rod—in some circles, their logo now raises controversy, not status.”

This marks a dramatic change for a company that built its reputation on authenticity and heritage. The brand’s challenge today lies in selling denim and navigating how its history as a U.S. icon is now interpreted worldwide.

Echoes Across Other Brands

Levi’s troubles mirror challenges faced by other U.S. names. Jack Daniel’s has encountered boycotts in Europe, McDonald’s has adapted menus in the U.K. to address cultural sentiment, and technology firms have seen mixed responses depending on their manufacturing base. McDonald’s U.K. said in a company statement that it is “adjusting menus and branding to respond to local sentiment.”

Analysts warn that Levi’s may be the most visible casualty, but a domino effect could spread across other American brands. The difficulties underline how political and cultural climates increasingly shape corporate performance abroad.

Shifting Tactics at Levi’s

In response, Levi’s is exploring more regionalized marketing campaigns, adjusting symbolic branding, and even considering non-U.S. manufacturing sites. Bloomberg’s retail podcast reported that analysts view these steps as attempts to appear more locally connected. Levi’s told industry press that it is “listening closely to international voices” as it develops new strategies.

Experts say such adaptations are crucial as authenticity, flexibility, and local relevance matter more than global dominance. For Levi’s, the shift may represent a reimagining of how a once-universally American product presents itself in a fragmented marketplace.

Not All Sectors Are Hit Equally

Morning Consult’s April 2025 report showed that anti-American backlash varies by sector. Food, beverage, and apparel companies appear hardest hit, while technology firms and luxury brands often fare better due to local manufacturing or neutral branding.

Levi’s struggles, therefore, stand as a cautionary example of how iconic labels, deeply tied to national identity, are more exposed to sentiment swings. Analysts argue that companies with hybrid supply chains or flexible branding have been more resilient, insulating themselves from political turbulence that Levi’s has been unable to avoid.

Inflation and E-Commerce

Levi’s is also battling pressures unrelated to sentiment. Inflation continues to squeeze consumer spending across Europe and Asia, and the rise of e-commerce has intensified competition with local brands. Reuters quoted a German retailer saying, “In hard times, shoppers pick necessity over nostalgia.”

This dynamic makes it even harder for Levi’s to rely on its past reputation. The dual challenges of political boycotts and economic tightening mean the company faces layered obstacles. Analysts note that cultural backlash alone is damaging, but combined with inflation, the risks to global sales multiply.

What Experts Expect Next

Industry observers warn that anti-American sentiment will not fade quickly if trade conflicts and cultural divides persist. The Independent quoted a branding consultant saying, “Brand America is bruised, and rebuilding trust won’t be quick.” Levi’s annual report included forward-looking risk language, noting “ongoing challenges” tied to consumer sentiment.

Analysts emphasized that such phrasing reflects caution rather than confirmed sales data, but they agree the risk is real. For Levi’s, the next few years may require patience, adaptation, and reinvention as it works to steady its position in global markets.

Resilience, Not Retreat

Despite the challenges, Levi’s is not retreating. FashionUnited reported that in its fall 2025 strategy update, the company committed to product innovation, sustainability initiatives, and new partnerships abroad. Levi’s executives said they were “listening to local voices and evolving” to stay connected globally.

Industry analysts believe resilience will require steady engagement with shifting consumer expectations rather than withdrawal. Levi’s message is clear: The brand intends to weather the storm, leaning on its legacy while reshaping how it presents itself in international markets where sentiment has grown cold.

Rebuilding Consumer Trust

At the heart of Levi’s challenge is consumer trust. Bloomberg News interviewed a retail psychologist who explained, “A brand isn’t just its label, but what people believe about it.” Levi’s executives admitted that their $30 million loss reflects more than declining denim sales; it represents strained relationships with shoppers worldwide.

Trust built over decades can be lost quickly, but experts say it can also be rebuilt through consistent listening, local adaptation, and transparency. Trust may now be the single most valuable fabric for Levi’s global business strategy.

What Comes Next for Levi’s

Looking forward, Levi’s executives say they see this moment as a turning point. The Business Press quoted a senior manager saying, “We view this as a chance to rebuild bridges and redefine our role.” The company hopes that time, dialogue, and investment will help reconnect with international consumers.

For Levi’s, survival means proving its value beyond being an American symbol and becoming a brand that resonates across cultures. The outcome could set a precedent for denim and how all U.S. companies navigate an era of heightened global sentiment.

A New Era for Global Brands

Levi’s $30 million loss is more than a quarterly statistic; it signals how cultural sentiment now shapes international business. Once celebrated as a global icon, the brand has become a case study in how politics and perception influence what people buy.

Surveys, boycotts, and personal stories reveal the depth of change. For Levi’s, the message is clear: adapting to global voices is no longer optional. As 2025 unfolds, its experience offers a warning and a wake-up call for every American brand competing in a marketplace where identity matters as much as quality.