Intel has announced its intention to reduce its workforce by 24,000 employees, which accounts for approximately 25% of its global staff, as part of a restructuring program costing $1.9 billion.

This significant cost-cutting initiative, spearheaded by CEO Lip-Bu Tan, marks the largest layoff in the tech industry for 2025. The reductions will primarily affect middle management and manufacturing positions across various countries.

Financial Crisis Drives Drastic Measures

Intel reported a $2.9 billion loss in Q2 2025, following a $19 billion loss in 2024. The company faces strong competition from Nvidia in AI chips, AMD in processors, and TSMC in manufacturing.

Revenue declined 1% year-over-year to $12.8 billion, prompting a restructuring effort to restore profitability.

Planned Factory Projects Canceled Across Three Continents

Intel has canceled its planned semiconductor facilities in Germany and Poland, which involved billions of dollars in investments but had not yet begun construction.

The Ohio facility’s construction has also been delayed to 2030-2031. Moreover, Intel is consolidating its Costa Rica operations and relocating them to Vietnam and Malaysia, which will affect thousands of jobs.

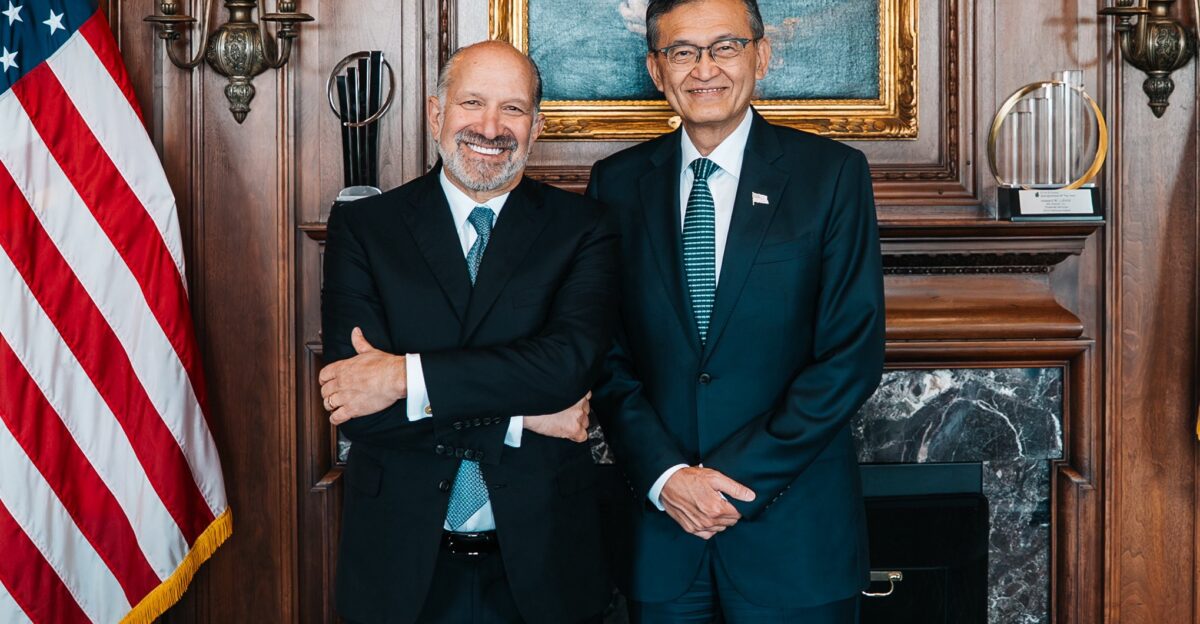

US Government Takes 10% Stake for $8.9 Billion

The Trump administration invested $8.9 billion in Intel, securing a 10% equity stake through federal grants and loans.

This move aims to protect domestic semiconductor production and minimize foreign control over the company, marking a significant government intervention in the tech sector.

Competitors’ Position to Capture Market Share

Nvidia’s stock climbed 3.2% after Intel’s announcement, indicating investor optimism about market share gains.

Meanwhile, AMD and TSMC are recruiting Intel’s displaced engineers, and Microsoft and Dell are diversifying their processor suppliers to reduce supply chain risks.

Supply Chain Disruption Hits Global Markets

Intel’s manufacturing cutbacks may lead to chip supply shortages for PC manufacturers, server companies, and the automotive sector in late 2025 and early 2026.

In anticipation, major OEMs are stockpiling Intel processors while seeking alternatives from Asian manufacturers.

Oregon Communities Face Economic Impact

Intel’s Oregon facilities, which employ over 22,000 people, are expected to experience significant layoffs, resulting in an anticipated annual tax revenue decline of $45 million.

In response, Washington County officials are developing retraining programs for displaced workers, with a focus on the clean energy and healthcare sectors.

European Semiconductor Ambitions Stalled

Germany planned to provide €10 billion in subsidies for Intel’s Magdeburg facility, which has now been canceled. Meanwhile, Poland’s government offered €7.4 billion for an assembly plant that will not proceed.

These setbacks have prompted European officials to reassess their strategies for semiconductor independence amid declining US corporate investment.

Tech Sector Layoffs Reach 180,000 in 2025

Intel’s layoffs have contributed to a record number of job cuts in the tech sector, surpassing the previous high of 2022.

Major companies, including Meta, Amazon, and Microsoft, have also announced significant workforce reductions, which could impact consumer spending in key tech hubs such as Seattle, San Francisco, and Austin.

Stock Market Reacts with Caution

Intel shares fell 4.5% to $19.73 after the company announced a restructuring, but closed down 2.1%. In Q3 2025, institutional investors cut their positions by 12%.

Analysts have also reduced Intel’s 12-month price target from $28 to $22 per share.

Asia-Pacific Operations Consolidate

Intel is relocating 2,100 assembly jobs from Costa Rica to its facilities in Vietnam and Malaysia, while retaining 2,000 engineering and corporate roles in Costa Rica.

This change reduces Intel’s global manufacturing footprint from 12 to 9 countries.

AI Strategy Pivot Amid Restructuring

Intel allocated $3.2 billion from restructuring savings toward the development of AI accelerators and the expansion of foundry services. The company aims to compete with Nvidia’s H100 chips by 2026.

New partnerships with cloud providers Amazon Web Services and Google Cloud were announced to support this transition.

Workforce Retraining Programs Launch

Intel partnered with Arizona State University and the University of Oregon to retrain 5,000 displaced workers in AI, cloud computing, and renewable energy.

The $120 million program offers 18-month certification courses with guaranteed job placement assistance. Early enrollment shows 73% of participants are middle management employees.

Industry Consolidation Accelerates

TSMC reported a 23% increase in new customer inquiries since Intel’s announcement. Samsung’s foundry division is hiring 400 engineers, many of whom are from Intel’s departing workforce.

Qualcomm and Broadcom are expanding their custom chip design teams to serve former Intel enterprise customers.

Timeline for Recovery Uncertain

Intel projects returning to profitability by the third quarter of 2026, following the completion of its restructuring. CEO Lip-Bu Tan must rebuild market confidence while competing in the rapidly evolving AI chip market.

The success of Intel’s turnaround will determine whether the company can regain its position as the world’s leading semiconductor manufacturer.