A.M. Scott Distillery in Troy, Ohio filed for Chapter 11 bankruptcy on December 22, 2025, marking another casualty in a devastating year for American spirits producers.

The three-year-old craft distillery listed assets of approximately $500,000 against liabilities ranging from $1 million to $10 million, with up to 199 creditors. Court documents reveal the company’s performance collapsed 75% year-over-year.

Founder Faces Legal Troubles

Distillery founder Anthony Michael Scott, 44, faces separate legal challenges including felony charges in Mercer County for alleged fraud and theft exceeding $6,500.

He pleaded not guilty to two felony counts related to fraudulent check-passing and product theft occurring in December 2024. A jury trial is scheduled for December 1, while Scott also faces a civil lawsuit from a former business partner.

City Loans at Risk

Troy extended approximately $400,000 in loans to Scott for multiple ventures, including the distillery operation in the historic Mayflower building. City officials are now assessing recovery options as both the Moeller Brew Barn locations and Mayflower distillery have closed.

Troy City Director Patrick Titterington confirmed the city hasn’t filed criminal or civil actions while exploring all available remedies.

Wave of 2025 Bankruptcies

A.M. Scott Distillery joins at least a dozen spirits producers seeking bankruptcy protection throughout 2025.

Notable casualties include House Spirits Distillery’s Westward Whiskey, which filed in April and sold assets for $2.7 million; Boston Harbor Distillery in Massachusetts; Devils River Distillery in Texas; and Luca Mariano Distillery in Kentucky. The failures span geographic regions and market segments.

Craft Sector Contracts Dramatically

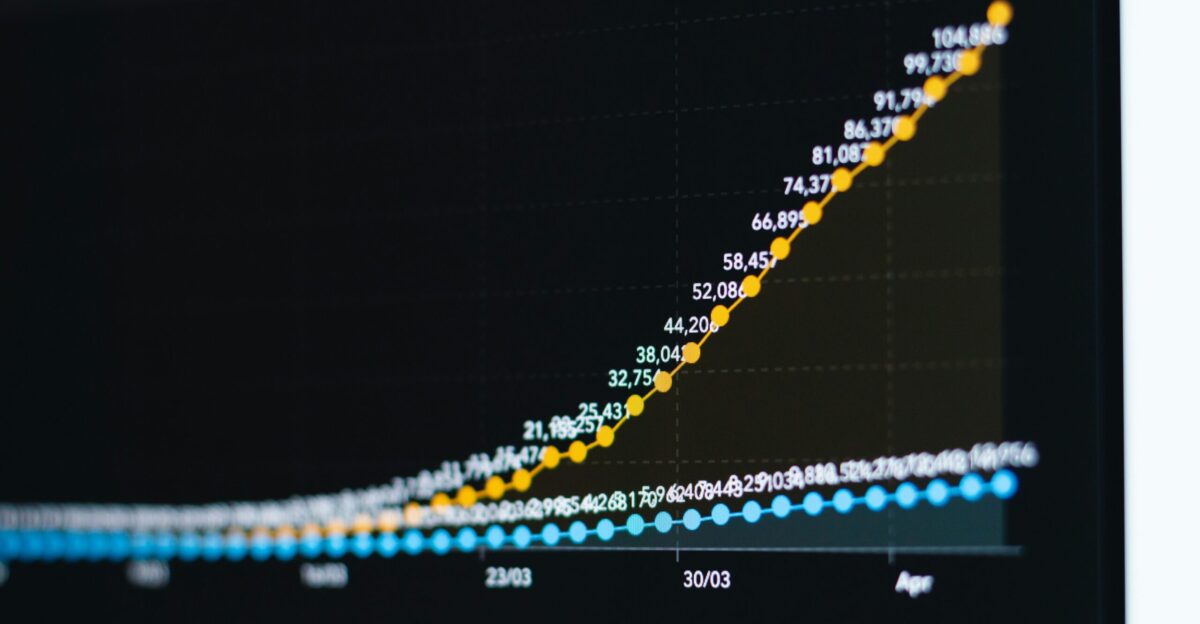

The American craft spirits sector experienced a catastrophic 25.6% decline in active distilleries between August 2024 and August 2025—a loss of 787 distilleries in just twelve months.

This represents the steepest decline in the industry’s modern history, completely reversing the prior year’s 11.5% growth rate. California alone lost 45% of its craft distilleries during this period.

Sales Volume Plummets

Craft spirits sales volume dropped 6.1% to 12.7 million cases in 2024, nearly doubling the 3.6% decline from 2023. Value declined 3.3% to $7.58 billion, accelerating from the prior year’s 1.1% drop.

The gap between volume and value declines suggests producers raised prices attempting to protect revenue, but couldn’t offset lost volume—squeezing profitability from both directions.

Historic Drop in Alcohol Consumption

A Gallup poll from July 2025 revealed only 54% of U.S. adults now consume alcohol—the lowest rate in the poll’s nearly 90-year history.

This marks a precipitous decline from 62% in 2023 and 58% in 2024. Among current drinkers, average weekly consumption fell to 2.8 drinks, down from 3.8 drinks just one year earlier.

Health Concerns Drive Decline

For the first time in Gallup’s tracking, a majority of Americans—53%—stated that moderate drinking (one or two drinks daily) is bad for health, compared to just 28% holding this view in 2015.

Only 6% believe moderate drinking benefits health. This fundamental shift in public perception appears to be reshaping drinking behavior across all demographics.

Generational Shift Away from Alcohol

Gen Z drinks approximately 20% less than millennials, with only 50% of adults aged 18-34 reporting alcohol consumption in 2025. Among those under 35, just 62% drank during 2021-2023, down 10 percentage points from 72% in 2001-2003.

Cannabis legalization, changing socialization patterns, and health consciousness drive younger Americans away from traditional alcohol.

Canadian Boycott Devastates Exports

U.S. spirits exports to Canada plummeted 85% in the second quarter of 2025, falling below $10 million after provincial liquor boards removed American products in retaliation for Trump administration tariffs.

Canada previously represented 11% of U.S. spirits exports with annual imports exceeding $250 million. Most provinces continue banning American spirits despite removing retaliatory tariffs in September.

Global Export Collapse

Beyond Canada, U.S. spirits exports fell across all major markets in the second quarter of 2025. The European Union, representing half of all American spirits exports, declined 12% to $290.3 million.

The United Kingdom dropped 29% to $26.9 million, while Japan decreased 23% to $21.4 million. Overall U.S. spirits exports fell 9% year-over-year.

Massive Inventory Oversupply

American whiskey inventories have tripled since 2012, reaching nearly 1.5 billion proof gallons by end of 2024. In contrast, total domestic sales and exports combined represent only 103 million proof gallons annually—meaning total consumption equals less than 7% of stored inventory.

Kentucky’s bourbon barrel inventory surged 44% from 9.86 million barrels in 2019 to 14.2 million in 2024.

Jim Beam Halts Production

Jim Beam announced it will halt distillation at its main Clermont, Kentucky campus for all of 2026, effective January 1. The bourbon company attributed the decision to planned “site enhancements,” but industry observers cite bourbon oversupply and declining demand.

Production will shift to other facilities while bottling, warehousing, and tourism operations continue. Diageo similarly pulled back Kentucky production in March.

Rising Costs Squeeze Margins

Inflation has driven production costs sharply higher across labor, materials, and energy. Energy bills increased 50-70% for many distilleries, while glass prices rose 40%, freight increased 55%, cereals climbed 50%, and oak barrels jumped 16%.

Spirit prices at retail increased 4.9% in the twelve months to June 2025, exceeding overall inflation but insufficient to offset volume losses.

Distribution System Challenges

The three-tier distribution system—requiring sales through wholesalers before reaching retailers—creates acute challenges for craft distilleries.

Small producers struggle to secure distributor partnerships, while direct-to-consumer sales remain heavily restricted in most states. This structure adds substantial markups at each tier, disadvantaging local producers competing against large manufacturers with established distribution networks.

Overall Industry Performance Weakens

The entire U.S. spirits sector suffered volume declines of 6.3% in the first quarter of 2025, with revenue down 5.1%. On a rolling twelve-month basis, volume declined 3.8% with revenue at 3.9%.

Whiskey sales for the twelve months ending July 2025 fell 4.9% by volume and 5.1% by revenue, indicating pricing power has essentially evaporated.

Non-Alcoholic Alternatives Surge

The non-alcoholic spirits category rose 13% globally in 2024 and is forecast to increase 10% in 2025 and 9% in 2026. The U.S. market is predicted to grow 18% by volume through 2028 as health-conscious consumers seek alternatives.

The global non-alcoholic spirits market was valued at $336.46 million in 2024 and projected to reach $624.56 million by 2032.

Ready-to-Drink Market Expands

Ready-to-drink alcoholic beverages represent significant growth potential, valued at $40.1 billion in 2024 and predicted to reach $117.9 billion by 2034.

Spirit-based RTDs rose from 55% of launches in 2021 to 67% in 2024, while hard seltzers fade. Canned cocktails specifically are projected to grow from $2.9 billion in 2025 to $11.9 billion by 2035.

Continued Decline Forecast

The Wine & Spirits Wholesalers of America predicts continued modest declines through 2026, with core spirits categories expected to drop 4.39% in the fourth quarter of 2025, gradually lessening to 4.12% by the third quarter of 2026. Cannabis-based and hemp-based beverages add competitive pressure.

Tequila shows relative resilience with reposado growing 12.4%, while bourbon gains overall category share.

Industry Faces Structural Reset

The convergence of declining consumption, trade disruptions, inventory oversupply, cost inflation, and distribution challenges signals a structural crisis rather than temporary downturn. Industry consolidation appears inevitable as larger producers acquire distressed assets.

The distilleries that survive will be leaner operations better aligned with reduced demand and younger consumers’ preferences for alternatives to traditional alcohol.

Sources:

“Another U.S. liquor brand files Chapter 11 bankruptcy.” Yahoo Finance, 23 Dec 2025.

“Alcohol Consumption Reaches 90-Year Low.” Gallup Poll via Convenience.org, Aug 2025.

“Craft Spirits Sales See Second Year of Decline.” American Craft Spirits Association, 20 Oct 2025.

“US spirits exports tumble as drinkers shun American brands.” Reuters, 6 Oct 2025.

“American Spirits Exports 2025 Mid-Year Report.” Distilled Spirits Council of the United States (DISCUS), 16 Oct 2025.

“Jim Beam Will Halt Operation at Main Kentucky Distillery in 2026.” VinePair, 21 Dec 2025.

“Non-alcoholic Spirits Market Size, Share, Trends Report 2024-2032.” Fortune Business Insights, 31 Oct 2024.