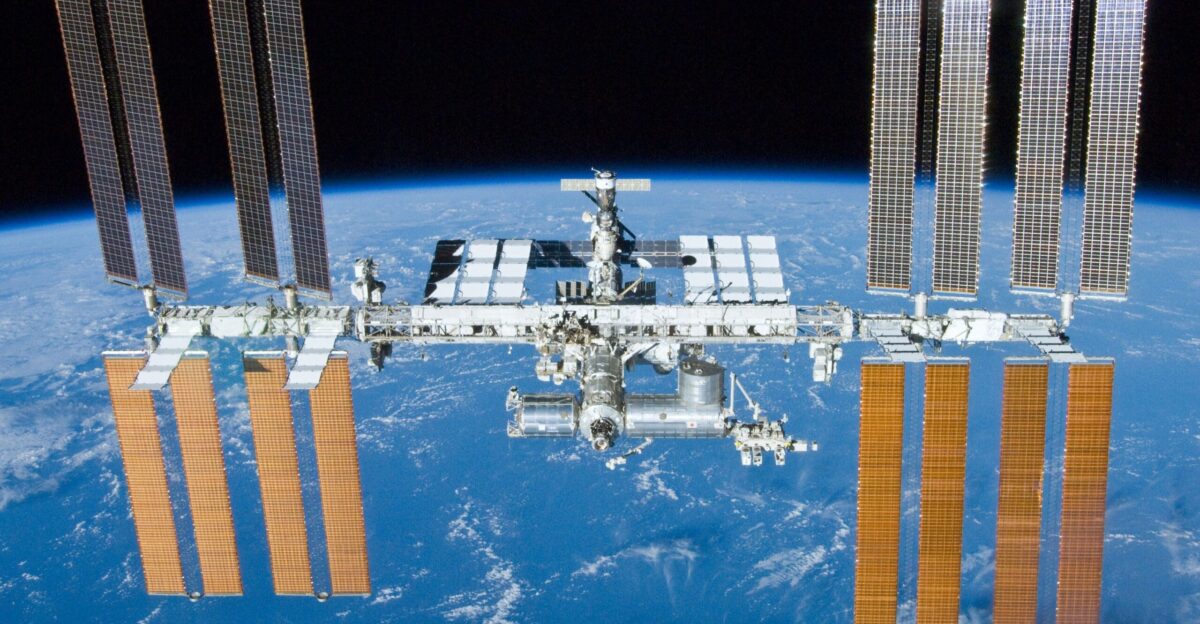

NASA’s plan to retire the International Space Station in 2030 closes the chapter on humanity’s most expensive and ambitious orbital laboratory—an investment of roughly $150 billion. The station’s shutdown doesn’t just mark an ending; it triggers the largest private space race in history. As the ISS winds down, commercial companies prepare to redefine humanity’s presence in low-Earth orbit, creating a competitive landscape unlike anything seen since the dawn of the Space Age.

Why the ISS Is Being Retired

The ISS is reaching the limits of safe operation. Aging components, recurring air leaks, and hardware failures have raised concerns about keeping the station running past 2030. Maintenance costs continue to rise sharply, and NASA’s own oversight has questioned the station’s long-term viability. With safety risks increasing, NASA is shifting toward newer, more sustainable commercial platforms that can continue vital research without the escalating hazards of an aging, two-decade-old orbital laboratory.

Direct Impact on Consumers

The ISS has quietly shaped everyday life—contributing breakthroughs to medicine, materials science, disaster monitoring, and consumer products. Its retirement means that future innovations will increasingly depend on private stations and their research priorities. Consumers may see faster development cycles for space-derived technologies, but also shifts in the types of experiments conducted. The transition could influence everything from medical treatments to the availability of space-manufactured materials entering global markets.

Corporate Response: The Rise of Private Stations

As the ISS approaches retirement, private companies are racing to fill the vacuum. Firms such as Vast, Axiom Space, Nanoracks/Voyager/Airbus, and Blue Origin are constructing their own orbital stations to capture government contracts and commercial demand. These companies aim to serve as the next-generation hubs for tourism, scientific research, advanced manufacturing, and national space partnerships. Their rapid development signals a historic transition from government-run laboratories to a commercially dominated orbital economy.

Substitutes and Adjacent Markets

A wave of new orbital platforms is emerging to replace the ISS’s capabilities. Projects like Vast’s Haven-1—a compact, crew-capable commercial module—are designed to host microgravity experiments, tech demonstrations, and short research missions. These stations open space access to startup labs and commercial R&D teams that once relied solely on NASA. Adjacent markets, from pharmaceutical testing to materials development, stand to benefit as private companies offer flexible, specialized facilities that didn’t exist during the ISS era.

International Trade Effects

The shift to commercial space stations will rewrite global trade dynamics in the space industry. Nations and private firms will compete to supply modules, robotics, propulsion systems, software, and space-qualified hardware. Countries previously reliant on the ISS may align with private operators for crew access and research opportunities. This redistribution of partnerships, contracts, and supply chains could reshape long-standing alliances and introduce new players into the international space economy.

Human Perspective: Astronauts and Workers

The transition from the ISS to private orbital platforms is a major turning point for astronauts and space-industry workers. Many are shifting from government careers to private-sector missions and training programs. Figures like former NASA astronaut Andrew Feustel, now working in leadership roles with commercial station developers, embody the shift. As companies build their own fleets and laboratories, they’re reshaping astronaut career paths and expanding opportunities for non-government space professionals.

Political and Policy Response

Governments are rapidly adjusting policy frameworks to support the commercial station landscape. NASA has committed hundreds of millions of dollars to accelerate private station development, ensuring that U.S. access to low-Earth orbit continues uninterrupted after the ISS retires. Regulatory agencies are crafting new guidelines for commercial operations, safety standards, and international cooperation. This coordinated approach aims to prevent gaps in research capability and maintain strategic leadership in the global space sector.

Economic Ripple: Inflation and Investment

The shift from government-funded stations to commercial ones will influence investment flows and pricing across the space industry. Building, launching, and operating new platforms requires massive upfront capital, which may temporarily raise costs for research, crew missions, and manufacturing. Over time, however, increased competition among private station operators could lower prices, stimulate innovation, and attract new investors—potentially creating a more efficient, scalable economy in low-Earth orbit.

Retailer Strategies and Adaptations

Tech companies and major retailers are positioning themselves early in the commercial space economy. Partnerships with private stations could enable the development of novel materials, microgravity-enhanced manufacturing methods, or space-grown biological products. These innovations may eventually flow into consumer markets, shaping product lines in pharmaceuticals, electronics, and luxury goods. Businesses that adapt quickly will be well-placed to take advantage of the new opportunities emerging in orbit.

Hospitality and Tourism Shifts

The commercial space race is opening the door to orbital tourism. Companies developing private stations envision hosting private astronauts, research crews, and short-duration visitors seeking the ultimate travel experience. Concepts include multi-day missions, curated space itineraries, and luxury accommodations for high-net-worth travelers. As the cost of access gradually declines, space tourism may evolve from an elite novelty into a structured hospitality market with repeat customers and specialized service providers.

Knock-On Industries

A wide network of industries will feel the effects of this transition. Aerospace manufacturing will see increased demand for spacecraft components, life-support systems, and station modules. Telecommunications companies will benefit from expanded satellite networks supporting orbital operations. Manufacturers developing advanced materials and precision components will see new business opportunities tied to microgravity research. Even Earth-based companies—such as those producing rocket-grade fuels and orbital logistics services—stand to gain.

Global Consumer Impact

As research shifts to commercial platforms, consumers around the world may see faster, more targeted innovation. Private stations could enable more frequent microgravity experiments focused on consumer needs—from drug development to next-generation alloys and electronics. The increased pace of experimentation may bring new products to market sooner, benefiting healthcare, energy, infrastructure, and technology sectors. This global ripple effect positions space-based R&D as a driver of everyday improvements.

Health and Lifestyle Changes

The next wave of microgravity research may transform health, medicine, and wellness. Private stations will host experiments on tissue growth, drug stability, protein crystallization, and regenerative therapies that require conditions only space can offer. These breakthroughs could lead to new treatments for chronic diseases, improved pharmaceuticals, and advanced biomaterials. As commercial operators expand capacity, health-focused research may accelerate, directly influencing products available to consumers.

Cultural and Environmental Debate

Retiring the ISS sparks debate about the cultural legacy and environmental future of space exploration. Many view the ISS as a symbol of international cooperation unlikely to be repeated soon. Others argue that moving to commercial platforms is essential for sustainability and innovation. The eventual deorbiting of the station also raises environmental concerns, prompting questions about space debris, responsible disposal, and the long-term stewardship of low-Earth orbit.

Unexpected Winners and Losers

The shift to privatized orbital stations will create surprising beneficiaries. Agile private companies and space startups stand to gain the most, securing contracts that once belonged to large government contractors. Nations without existing station access may also benefit by partnering with commercial operators. On the other hand, legacy firms dependent on ISS-related contracts may face disruptions as funding and demand shift toward new entrants in the space market.

Financial Market Speculation

Investors are closely watching companies involved in commercial station development, anticipating both volatility and long-term growth. Space-related equities and private investment vehicles may see increased activity as the market transitions from government-led missions to profit-driven operations. Speculation revolves around which companies will establish reliable orbital platforms first, secure government contracts, and dominate the emerging ecosystem. This moment represents one of the most transformative periods for space-linked financial assets.

Practical Advice for Consumers

Consumers should monitor developments in the commercial space sector, as new products, services, and investment opportunities may emerge rapidly. Space tourism options, biotech breakthroughs, and space-enhanced materials could soon reach mainstream markets. Individuals interested in investing may explore companies involved in microgravity manufacturing, orbital infrastructure, or launch systems. Staying informed will help consumers understand how the transition from the ISS to private stations could influence life on Earth.

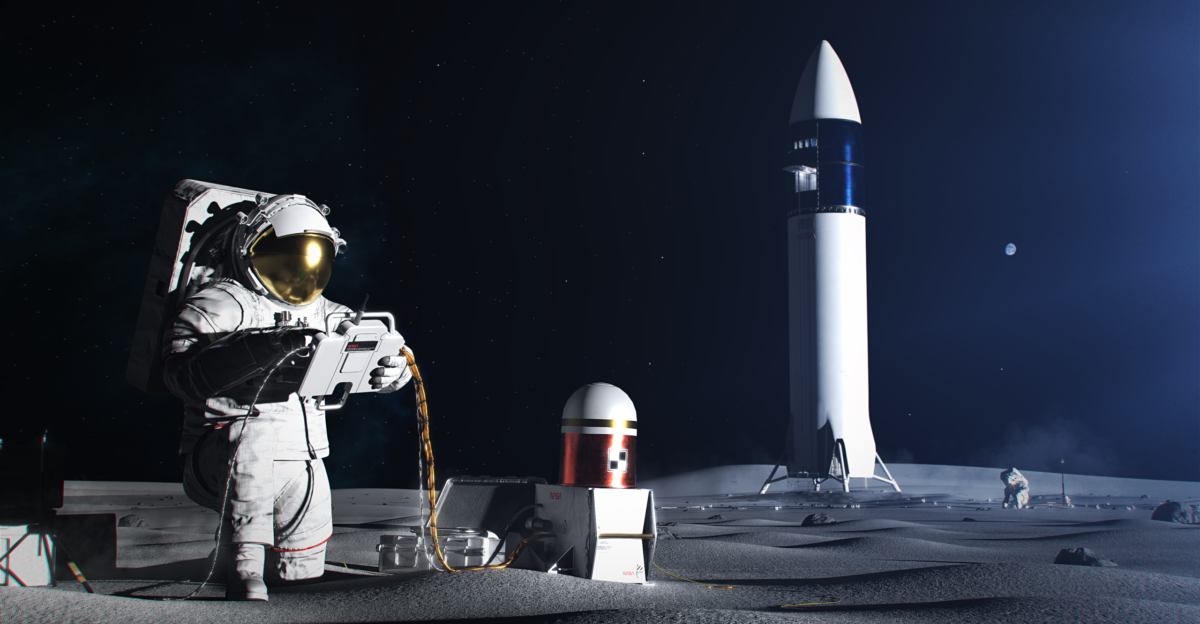

What’s Next for Space Exploration

The retirement of the ISS doesn’t signal a slowdown in exploration—quite the opposite. Commercial stations will allow NASA and other agencies to redirect resources toward deep-space missions, including lunar builds and Mars preparation. These new orbital platforms will support astronaut training, long-duration experiments, and technology testing. Together, government and private operators are laying the groundwork for a multi-destination, interconnected space ecosystem that extends far beyond low-Earth orbit.

The Ripple Effect

The ISS retirement is more than a symbolic end—it’s a catalyst reshaping space, science, business, and global innovation. As commercial stations rise to replace it, new industries, partnerships, and consumer benefits will emerge. This transition marks the beginning of a more competitive, diversified orbital economy, with consequences reaching every sector on Earth. The ripple effect will define the next chapter of human space activity, influencing how nations, companies, and individuals engage with space.