Tesla faces a defining moment as shareholders prepare to vote on CEO Elon Musk’s proposed $1 trillion pay package. Voting closes November 5, 2025, at 11:59 PM ET, with results announced the next day. The world is watching, and Tesla’s future—and Musk’s leadership—hangs in the balance.

However, the board has sent a stark message that could sway the vote.

Board Issues Stark Ultimatum

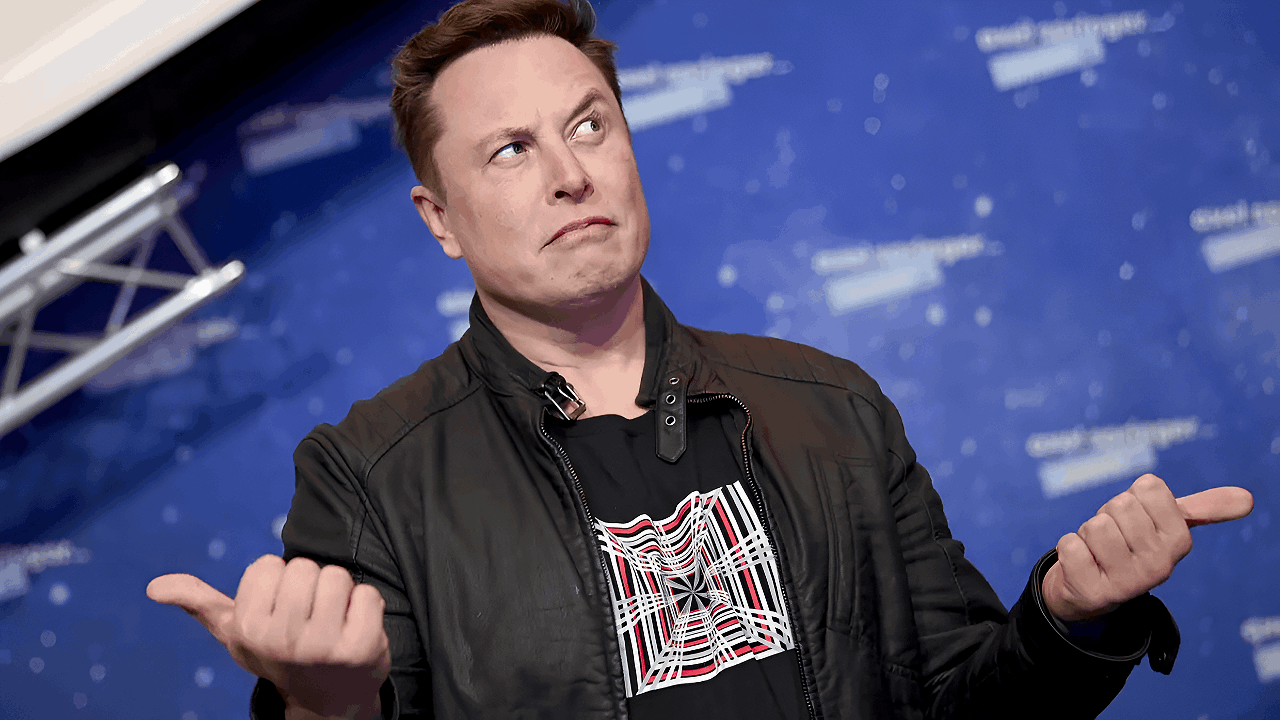

Tesla’s board chair, Robyn Denholm, warned that Musk may leave if the pay package is rejected. This ultimatum has intensified shareholder debate and raised questions about Tesla’s long-term vision. Denholm’s message is clear: approve the package or risk losing Musk, whose leadership has been pivotal to the company’s growth.

But how did Musk’s influence reach such historic heights?

Musk’s Leadership Legacy

Elon Musk has led Tesla since 2008, transforming it from a niche electric car maker into a global EV leader. Tesla’s market value reached roughly $1.5 trillion under his guidance, with innovations setting industry standards. Musk’s vision continues to shape both strategy and identity across the company.

Shareholders now face growing pressure that could determine his fate.

Mounting Shareholder Pressure

Advisory firms like ISS and Glass Lewis urge a “no” vote, citing the package’s unprecedented scale and dilution risks. Tesla’s board argues Musk’s leadership is vital for growth, framing the vote as existential. The tension highlights the stakes for investors weighing immediate concerns against long-term gains.

The clock is ticking toward a decisive moment for the company.

The $1 Trillion Decision

Voting closes November 5, with results on November 6, 2025. The plan could grant Musk up to $1 trillion over 7.5 years if performance targets are met. This would be the largest CEO package ever, nearly 18 times any previous record. The vote could determine Tesla’s leadership and trajectory.

Where this vote happens could also affect its dynamics.

Texas Hosts the Showdown

The pivotal vote will take place at Tesla’s Gigafactory Texas headquarters in Austin. Shareholders can participate in person or online through virtualshareholdermeeting.com/TSLA2025, with eligibility based on holdings as of September 15, 2025. The move to Texas has also sparked debates on governance and shareholder rights.

With location set, human stakes are also high.

Human Impact: Board and Investors

Robyn Denholm stated, “Tesla may lose his time, talent and vision, which have been essential to delivering extraordinary shareholder returns.” Investors worry about Musk’s departure and potential stock declines. The vote carries consequences for the company’s direction, leadership stability, and investor confidence worldwide.

But regulatory concerns may further complicate the picture.

Regulatory Scrutiny and Pushback

ISS and Glass Lewis recommend rejecting the package, citing its unprecedented size and dilution. New York State Comptroller Thomas DiNapoli and other institutional investors have criticized executive compensation, signaling the vote could influence broader corporate governance standards. The scrutiny reflects tensions between ambitious CEO pay and shareholder protections.

The debate mirrors a larger national conversation on pay.

CEO Pay Under Fire

Tesla’s proposal comes amid intense scrutiny of executive compensation. Critics say such packages worsen inequality and undermine shareholder value, while supporters argue they retain visionary leaders. Tesla’s $1 trillion plan—33.5 times larger than prior CEO compensation—has heightened debate about fairness, corporate governance, and how much a company should reward its top executive.

Shareholder rights controversies further fuel the discussion.

Shareholder Rights Eroded

In May 2025, Tesla changed bylaws to require a 3% stake—about 97 million shares worth $34 billion—to file derivative lawsuits. This blocks nearly all shareholders from legal action. DiNapoli filed a proposal to repeal the bylaw, calling it a “bait-and-switch” shielding executives from accountability.

Internal dissent among directors is now coming to light.

Internal Dissent Emerges

Some Tesla directors face criticism for enabling “pay for power.” DiNapoli and other advocates highlight weak oversight, lack of transparency, and Musk’s divided focus across X, SpaceX, and the Trump administration’s DOGE initiative. The board’s handling of executive pay raises questions about governance and fiduciary responsibility.

Re-election battles could reshape board accountability.

Board Faces Re-Election Test

Three Class III directors—Ira Ehrenpreis, Joe Gebbia, and Kathleen Wilson-Thompson—are up for re-election November 6. Their involvement in approving Musk’s pay has drawn scrutiny, with DiNapoli urging votes against them. The contest highlights investor efforts to restore accountability and strengthen board independence amid the high-stakes CEO compensation debate.

The retention plan itself also faces skepticism.

Tesla’s Retention Strategy

The 2025 CEO Performance Award is fully performance-based, with no guaranteed salary. Musk must meet ambitious targets including $2–8.5 trillion market cap, 20 million vehicles delivered, 10 million FSD subscriptions, $50 billion adjusted EBITDA, and a million Optimus robots and Robotaxis. Payouts occur only if all objectives are achieved.

Experts remain unconvinced these goals ensure Musk’s focus.

Expert Skepticism Grows

ISS cautioned that, despite retention goals, “there are no explicit requirements to ensure that this will be the case.” Critics cite Musk’s divided attention across SpaceX, X, xAI, and DOGE initiatives. Glass Lewis and DiNapoli question whether another trillion-dollar incentive truly benefits shareholders or secures his focus.

The upcoming vote could determine Tesla’s long-term path.

What’s Next for Tesla?

If approved, Musk could remain for up to a decade, aiming for an $8.5 trillion market cap. If rejected, Denholm warns of leadership uncertainty and potential market volatility. The vote’s outcome will shape Tesla’s strategy, investor confidence, and the company’s trajectory well into the next decade.

Political attention is already intensifying around the decision.

Political and Policy Attention

The vote drew criticism from state officials like DiNapoli, who called it “excessive” and “unjustifiable.” While no new federal regulations are imminent, scrutiny of CEO pay and shareholder rights is rising. The debate highlights how Tesla’s decision could influence broader conversations about executive accountability in corporate America.

Global operations could also feel ripple effects.

Tesla’s Global Operations at Stake

Tesla operates worldwide, with China contributing 21% of revenue and 37% of 2024 vehicle sales, while Gigafactory Berlin serves Europe. European sales fell 22.5% year-over-year as of late 2025. Any leadership disruption could trigger operational uncertainty across complex supply chains, though day-to-day effects remain uncertain.

Governance controversies continue to challenge investor trust.

Governance Controversies Continue

Tesla’s May 2025 bylaw change requiring 3% ownership to file lawsuits sparked debates on shareholder rights. DiNapoli filed a proposal to repeal it, calling it a barrier to accountability. Critics warn it weakens oversight, highlighting tensions between protecting management and ensuring shareholder recourse.

The broader implications test corporate accountability norms.

A Test of Corporate Accountability

The controversy raises questions about leadership and executive power in American business. Pension funds and institutional investors increasingly demand transparency and limits on CEO pay. Tesla’s vote occurs amid a shift from founder deference toward stronger board independence and shareholder protections, offering a high-profile example of these changing corporate norms.

Ultimately, this moment will define how companies balance vision and accountability.

Why This Moment Matters

Tesla’s shareholder vote is more than a compensation decision—it tests how companies weigh founder retention, board accountability, and shareholder interests. With the largest pay package in history on the line, the November 6 outcome will be watched by boards, investors, and policymakers navigating tensions between visionary leadership and fiduciary responsibility.