Elon Musk’s latest Tesla pay package is potentially worth up to $1 trillion, contingent on the company producing 20 million electric vehicles (EVs) annually and deploying 1 million humanoid robots over the next decade. This historic incentive plan, approved by shareholders, sets new standards for performance-linked compensation at the executive level.

Musk’s compensation is awarded in tranches, with share grants triggered only upon achieving these ambitious operational milestones, aligning the CEO’s rewards directly to Tesla’s scaled growth and innovation. While the plan is built around direct results rather than guaranteed salary, it reflects Tesla’s belief that transformational leadership merits transformative incentives. This package represents not only a defining moment for Tesla and its leadership but also a bold bet on the possibility of industry-changing progress.

Shareholder Approval

Recently, Tesla’s shareholders voted with emphatic support, with more than 75% in favor of Musk’s unprecedented pay package. The vote took place during the annual meeting, where board members presented the plan as a means to promote extraordinary growth rather than a guaranteed reward. Under the agreement, Musk receives no standard salary or cash bonuses and instead, all compensation is bound to specific performance measures, notably the mass production of EVs and robots.

This structure was designed to motivate Musk and align his interests with the company’s long-term ambitions. Tesla’s board maintains that the package is in the best interest of both Tesla’s future and its investors, setting a new standard for how executive compensation can inspire sweeping transformation and commitment to the company’s expansive goals.

Historic Scale of the Compensation

Musk’s pay package, with an upper limit near $1 trillion, could make him the most highly compensated CEO in history, and potentially the first individual to surpass the four comma club, implying a net worth above $1 trillion. This compensation model emphasizes achievement over entitlement, as Musk must hit significant growth milestones before receiving shares.

Analysts have described this as unprecedented, noting that no CEO has ever had pay so closely tied to company-wide performance metrics at this level. The scale of the compensation underscores the high stakes for both Musk and Tesla, as each milestone contributes directly to increased company valuation and technological advancement.

The Bold Target

A key requirement of Musk’s compensation package is leading Tesla to produce 20 million electric vehicles per year, a goal more than twice the size of the world’s biggest automakers currently achieve. For context, Tesla delivered roughly 1.8 million vehicles in 2023, indicating that massive expansion and innovation is required to reach such numbers.

Achieving this target involves increasing manufacturing capacity, developing advanced battery technology, and scaling up global supply chains. While the target is acknowledged as challenging, the board and analysts suggest it is possible with sustained investment and strategic breakthroughs.

One Million Humanoid Robots

Another milestone within Musk’s compensation package is the goal of deploying at least 1 million humanoid robots, known as Optimus, over the same decade. These robots are expected to transition from the prototype stage to commercial deployment, contributing to the automation of factory floors, logistics, and potentially consumer services.

Independent verification of the likelihood of delivering 1 million units within the planned timeframe is limited, and analyst opinions on feasibility vary, however, the ambition remains unmatched in the industry. Musk and his team view Optimus as a major technological leap, with the potential to change global labor markets and introduce robotics into everyday work environments.

Market Capitalization Milestones

Musk’s compensation is also tied to Tesla’s market capitalization, with targets that aim to raise the company’s value from $1.5 trillion to as much as $8.5 trillion, according to the compensation plan. Share tranches are unlocked for each $500 billion increment in Tesla’s market capitalization, directly connecting Musk’s payout to increased shareholder value.

While the final target and precise increments lack full independent verification, the structure demonstrates a strong alignment between company success and personal compensation. Achieving such valuation growth would put Tesla among the world’s most valuable companies and indicate market-wide confidence in its ongoing innovation.

No Salary, Only Results

Under the terms of the compensation plan, Musk receives no guaranteed salary, bonus, or standard executive pay. All potential compensation comes solely from new shares, granted as major milestones are met. This means Musk earns nothing if Tesla fails to achieve the required output, valuation, and profitability targets.

The plan eliminates any entitlement to pay for effort alone, placing risk and reward entirely in the outcome. By basing Musk’s earnings on results, Tesla aims to incentivize the highest possible level of commitment and strategic execution.

Shareholder and Board Endorsement

Tesla’s board and shareholders crafted and approved the package, placing a strong emphasis on performance and transparency. Both groups argue that linking Musk’s rewards to nearly unimaginable growth is vital for Tesla’s competitive advantage and future trajectory. The proposal moved through extensive discussion, regulatory review, and was ratified by a decisive vote at the company’s annual meeting.

Supporters assert that Musk’s record of delivering major advancements in EVs and AI justifies high-stakes, ambitious compensation. Skeptics caution about the concentration of power, but the board maintains that Musk’s vision and execution are essential to achieving Tesla’s transformative goals.

Incentivizing Growth over Stability

Unlike traditional executive pay that emphasizes stability with regular salaries and modest bonuses, Musk’s package is entirely weighted toward growth and transformation. Actual compensation is back-loaded, released only if and when Tesla reaches historic milestones.

This ensures Musk’s incentives are aligned exclusively with creation, expansion, and breakthrough achievement. Financial analysts view the package as a high-risk, high-reward strategy, intended to drive relentless innovation at a scale rarely seen before in corporate management.

The Role of Robotaxis

Beyond mass EV and robot production, the plan includes an operational milestone for deploying 1 million robotaxis—fully autonomous vehicles functioning as part of a commercial fleet. These robotaxis represent another arm of Tesla’s disruptive strategy, offering the potential for new revenue streams and the transformation of global transportation networks.

The milestone underscores Tesla’s leadership in autonomous driving and AI integration. Skeptics raise questions about regulatory approval, technology readiness, and market demand, but the plan’s inclusion of robotaxis signifies a commitment to redefining mobility on a global scale.

Full Self-Driving and Software Targets

Tesla’s compensation plan also highlights the importance of software, particularly in boosting Full Self-Driving (FSD) subscription numbers. Software-driven recurring revenue streams are vital to Tesla’s business model, making FSD not only a technological milestone but also a financial one.

Success in scaling FSD subscriptions would position Tesla as not just a manufacturing powerhouse but a leader in integrated software and AI services. By tying compensation to subscriber milestones, the package accounts for the evolving role of technology in driving consistent, long-term revenue and company valuation.

Industry Skepticism and Hurdles

Leading analysts and industry observers highlight significant risks to achieving the scale of 20 million EVs and 1 million robots. Reaching these numbers requires enormous increases in factory construction, battery production, supply chain management, and global sales, all while maintaining quality and regulatory compliance.

Potential hurdles include delayed launches, cost overruns, and the need for constant technological breakthroughs. Despite the risks, Tesla’s history of overcoming challenges is frequently cited by proponents as evidence of the company’s potential to succeed again.

Regulatory and Legal Foundations

Tesla’s compensation plan and its disclosures are detailed in filings with the U.S. Securities and Exchange Commission (SEC). These filings outline every milestone, the principles behind tranching, and specific criteria for acceleration or exceptions.

The process ensures regulatory transparency and legal compliance, providing a public record of Tesla’s commitments. Such clarity is meant to uphold trust among shareholders and potential investors, reaffirm the legitimacy of the compensation structure, and avoid potential disputes about terms or alignment.

Investor Sentiment

Investor response has been mixed, with broad enthusiasm tempered by some concerns regarding feasibility and precedent. While the majority of shareholders approved the deal, notable institutions like Norway’s sovereign wealth fund voiced opposition due to the scale and risk.

Supporters are drawn to Musk’s track record and willingness to push boundaries, while critics warn that tying so much value to a single executive carries risks if targets are not met or market conditions change drastically.

Competitive Landscape

If targets are met, Tesla’s scale would exceed that of every major automaker, reshaping the competitive landscape across both automotive and robotics industries. The compensation plan places Tesla in direct competition not just with traditional car manufacturers, but with tech giants and robotics startups.

Musk’s leadership would make Tesla the indisputable global leader in EV production and commercial robotics deployment. Such dominance could spur further innovation and competition, challenging rivals like BYD, Volkswagen, and GM to match Tesla’s tempo and versatility.

Execution Risks

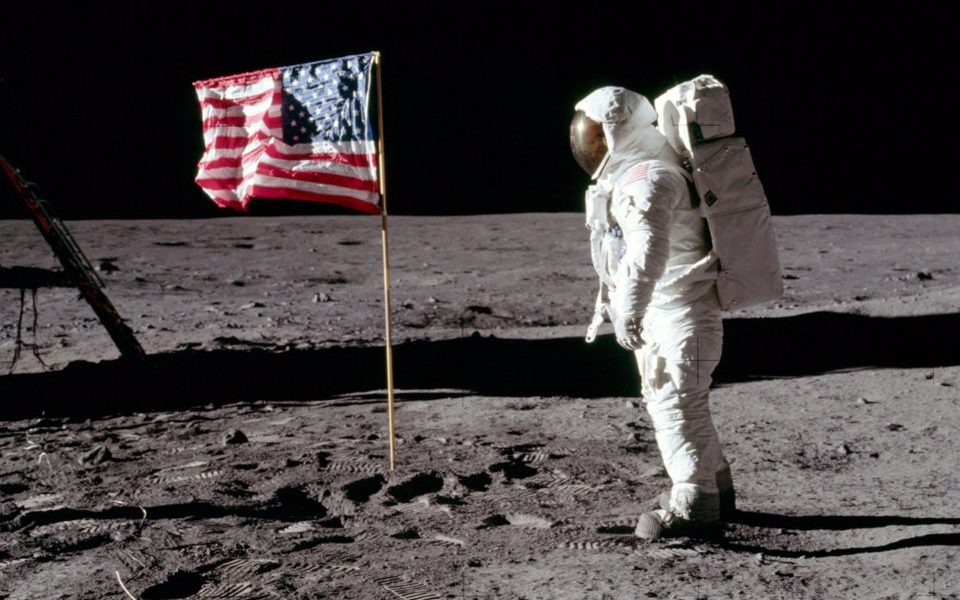

Experts compare the engineering and operational challenge of Musk’s compensation plan to historic projects such as the Manhattan Project or the Apollo Moon mission. Achieving 20 million EVs and 1 million robots means building massive new factories, securing critical minerals, and managing complex global logistics.

The plan is subject to risks at every stage, from sourcing raw materials to market acceptance. Commentators note that such expansive ambitions require simultaneous advances across technology, infrastructure, and organizational leadership.

Robotics Innovation

Deploying one million Optimus robots could have wide-reaching impacts on labor markets and the use of robotics worldwide. The robots are intended to perform tasks ranging from industrial applications to consumer services, potentially reducing human exposure to dangerous or repetitive work.

Economists and industry commentators suggest that the rapid adoption of humanoid robots would shift employment patterns and productivity, introducing new questions about regulatory oversight and social impacts.

Musk’s Public Statements and Promises

Elon Musk frequently speaks about the scale and ambition of Tesla’s new chapter, promising “record quarters” and major advances in AI and robotics in public communications. He describes the plan as larger and more transformative than any before, with the potential to challenge and redefine entire industries.

Though some critics remain skeptical, Musk’s history of delivering bold innovations lends credibility to his promises. His direct involvement and leadership are consistently cited as central assets in making Tesla’s aggressive targets realistic.

Contingency Clauses and Force Majeure

Recognizing potential challenges from global uncertainties, Tesla’s compensation plan allows for covered events” like wars, pandemics, and regulatory changes that could delay or alter milestones. Such clauses provide flexibility and adaptability, allowing for adjustments if circumstances outside the company’s control disrupt progress.

The provisions demonstrate awareness of how unpredictable global conditions might affect Tesla’s ability to execute and ensure that compensation remains fair and well-managed in extreme situations.

Legacy and Precedent

No prior executive pay plan matches the scale or structure of Musk’s compensation agreement. Whether Musk meets all, part, or none of the targets, the plan sets a new benchmark for incentivizing world-changing leadership and risk.

Industry insiders and observers regard it as a study in audacity, demonstrating how deeply compensation can be tied to transformation rather than incremental progress.

Conclusion: A Defining Corporate Bet

Tesla’s $1 trillion bet on Elon Musk places faith in exponential growth and visionary leadership. If achieved, the package will change how the auto and robotics industries work, establish Musk’s legacy, and become a symbol for the most lucrative, and conditional, executive pay deal ever devised.

The outcome depends entirely on deliveries: both of vehicles and radical, new technology.