Tesla announced the recall of 10,500 Powerwall 2 units due to a fire risk, marking its largest residential energy storage recall. Units sold between November 2020 and December 2022 in the US are affected. Homeowners face temporary loss of backup power while replacements are scheduled.

This recall highlights supply chain gaps and safety concerns, raising questions for consumers, installers, and investors alike.

What’s Going On?

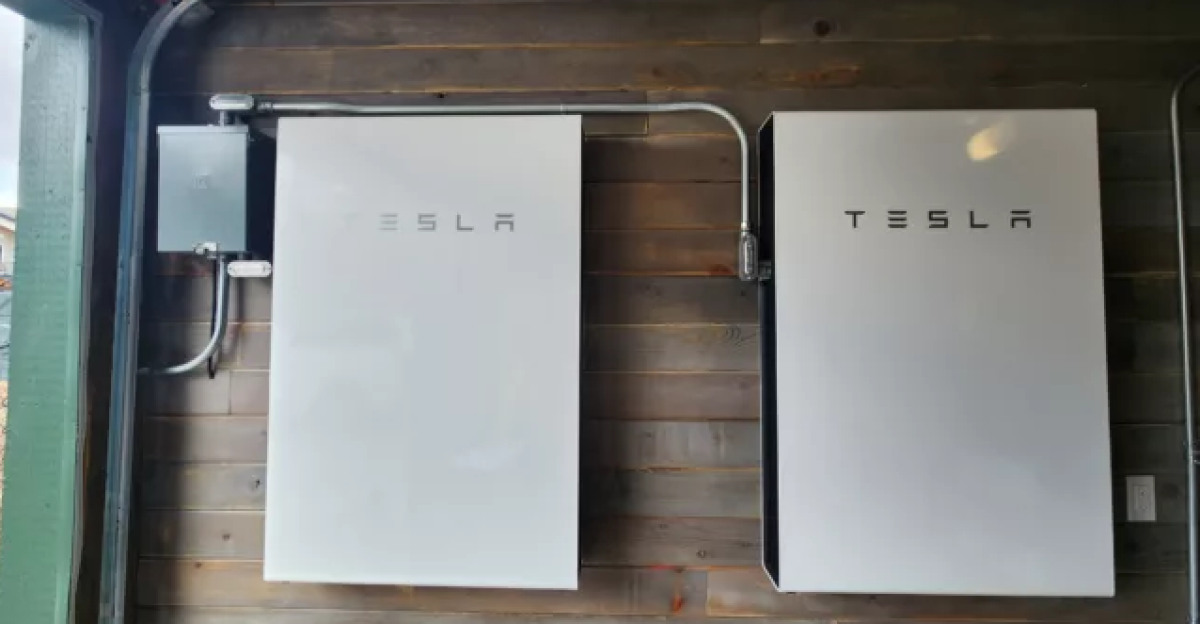

The recall affects approximately 10,500 American households, notified through the Tesla app. Each unit originally sold for around $8,000. Similar batches in Australia were recalled months earlier, showing the defect spanned multiple markets. Tesla aims to replace all units at no cost, though homeowners face weeks without backup power.

Installers and small businesses are also disrupted. Scheduling replacements stretches resources and creates reputational risk. But how did a defect in a third-party battery cell escalate to a nationwide recall?

Who Is Affected?

Homeowners paid $8,000 per Powerwall 2, often as part of solar-plus-storage systems costing $12,750–$15,400. Tesla app notifications urge users to check eligibility. Families in Virtual Power Plant programs lost income during remote discharge, though Tesla may compensate case by case. Temporary reliance on the grid increases vulnerability to outages.

Certified Tesla installers face heavier workloads, disrupted schedules, and customer dissatisfaction. With Tesla capturing 63% of the US home battery market in 2024, the recall impacts dozens of small businesses nationwide. Some installers report that workload spikes could delay other projects and increase customer complaints.

What Caused the Problem?

Tesla cites “a third-party battery cell defect” in units sold between November 2020 and December 2022. Cells are 2170-type lithium-ion with nickel-cobalt-manganese chemistry. Defective cells can overheat, smoke, or ignite, causing minor property damage. Thermal runaway is more likely in frequent charging cycles, such as grid-balancing programs.

Powerwall 3 units, using safer lithium iron phosphate batteries, avoid this risk. The defect illustrates challenges in quality control when using outsourced components. But why didn’t Tesla catch the problem earlier in production or deployment?

When Did Tesla Act?

Australia issued the first recall on 16 September 2025, followed by New Zealand on 2 October. The US recall was announced 12–13 November, leaving American homeowners exposed for 44 days after Tesla identified the defect in Q3. Winter season increased the risk during grid stress and power outages.

Tesla notified affected homeowners through the app immediately after the US announcement. The timing raises questions: why did the US recall lag behind international markets, and could earlier action have prevented potential fires?

Where Are the Units?

The 10,500 recalled units are distributed across all 50 US states, with concentrations in California, Texas, Arizona, Florida, and New York. Australia and New Zealand issued separate recalls for similar batches. Globally, more than a million Powerwall units exist, but Tesla has not indicated if other regions are affected.

Cells came from unnamed suppliers, likely including CATL and Panasonic. This obscured accountability exposes the vulnerability of Tesla’s supply chain and challenges the notion of complete vertical integration. Could global sourcing pressures have contributed to accepting defective components?

Why Did This Happen?

A manufacturing defect in third-party battery cells led to thermal runaway, overheating, and potential fire. Factors include slow degradation, batch-specific issues, and gaps in remote monitoring. Units in virtual power plant programs experienced faster cycling, accelerating failures. Tesla did not name the supplier, leaving questions about accountability unresolved.

Analysts argue Tesla bears responsibility for oversight despite blaming suppliers. Multiple suppliers supplied these high-priced units, yet quality assurance gaps allowed dangerous cells into homes. This underscores systemic supply chain risks, even for premium energy products.

How Severe Is the Risk?

CPSC reported 22 overheating incidents, 6 smoking events, and 5 minor fires, with zero injuries. The 0.21% failure rate suggests rarity, but once overheating begins, 22.7% escalate to fire. Tesla remotely discharged most units, leaving homeowners temporarily without backup power during winter grid stress.

Property damage remains partially unreported, raising credibility concerns. The “minor damage” label masks potential hazards to roofs, electrical systems, or interiors. Could Tesla’s cautious language underestimate the true risk to homeowners?

Tesla’s Response

Tesla confirmed: “The affected subset of Powerwall 2 units may stop functioning normally, resulting in overheating, smoking and in some cases smoke or flame causing minor property damage.” — Tesla, 13 November 2025. All units will be replaced free of charge, including hardware, installation, and transport.

Homeowners can track progress via Tesla App, phone, or email. Tesla also remotely discharged batteries for safety. However, lost backup energy and delayed replacement could leave consumers vulnerable for weeks, especially those relying on stored solar energy during winter.

Financial and Market Impact

Tesla Energy generated $3.42 billion in Q3 2025, representing 21.2% of gross profit. The recall caused a 6.64% single-day stock drop, erasing $8.65 billion in market value. Investors, including Soros Fund Management, reduced Tesla positions rapidly, signaling concern over quality control and corporate oversight.

Analysts note Tesla’s fastest-growing division faces reputational damage. Questions about CEO Elon Musk’s communication strategy and reliance on third-party suppliers may affect both consumer confidence and Tesla’s long-term competitive advantage in home energy markets.

Impact on Installers

Certified Tesla Powerwall installers, roughly 85–90 nationwide, face scheduling challenges, doubled workloads, and potential disputes over warranties. Small contractors reliant on Tesla partnerships could experience revenue loss. One installer explained: “We manage these permits as soon as possible throughout the process to avoid any regulatory issues holding up your installation.”

The recall underscores how a product defect ripples through the industry, affecting labor, operations, and trust. Installer delays could stretch 4–6 weeks or longer in winter conditions, impacting homeowners’ backup energy plans and small business cash flow.

Supply Chain Lessons

The recall exposed lithium-ion battery supply vulnerabilities. North America faces a 50 GWh undersupply, relying on imported cells from China, Japan, and South Korea. Tesla prioritized production volume over quality verification, highlighting the challenge of balancing growth with safety in high-demand markets.

Even premium products at $8,000+ retail can fail when supply chains are stressed. Other companies like LG Energy have faced similar recalls, showing systemic risk across the stationary energy storage industry. What happens if demand spikes while quality checks lag?

Replacement Process

Tesla’s replacement plan includes app notifications, remote discharge, scheduling, installation, and verification. Replacement typically takes 4–6 weeks, but winter demand and logistical delays could extend timelines. Free replacement covers hardware, installation, and transport, though lost energy savings may not be reimbursed unless case by case.

Tesla has not clarified whether Powerwall 2 units will be replaced with Powerwall 3. This uncertainty leaves homeowners weighing safety, compatibility, and timing, while installers juggle resource constraints. Will the new units fully restore energy independence?

Historical Context

Tesla’s recall is its first major energy storage recall with CPSC involvement. Comparable recalls by LG affected similar unit numbers, but Tesla’s 10,500-unit recall is notable for its timing and scale. Tesla Energy was the company’s fastest-growing division, representing high-margin revenue and three consecutive years of record deployments.

The recall challenges Tesla’s vertical integration narrative, exposing reliance on third-party suppliers. Musk’s claims of full control over production contrast with reality, raising questions about oversight and accountability during rapid expansion.

Looking Ahead

The Powerwall 2 recall tests Tesla Energy’s ability to scale safely while maintaining consumer trust. Homeowners face temporary energy loss, installers face operational strain, and supply chains face scrutiny. Regulatory involvement may accelerate oversight of battery safety standards, including mandatory monitoring and supplier transparency.

Competitors may gain market share as risk-averse consumers seek alternatives, yet the recall highlights energy storage’s critical role in grid resilience. Tesla must rebuild trust to protect its reputation and growth trajectory in the renewable energy market.