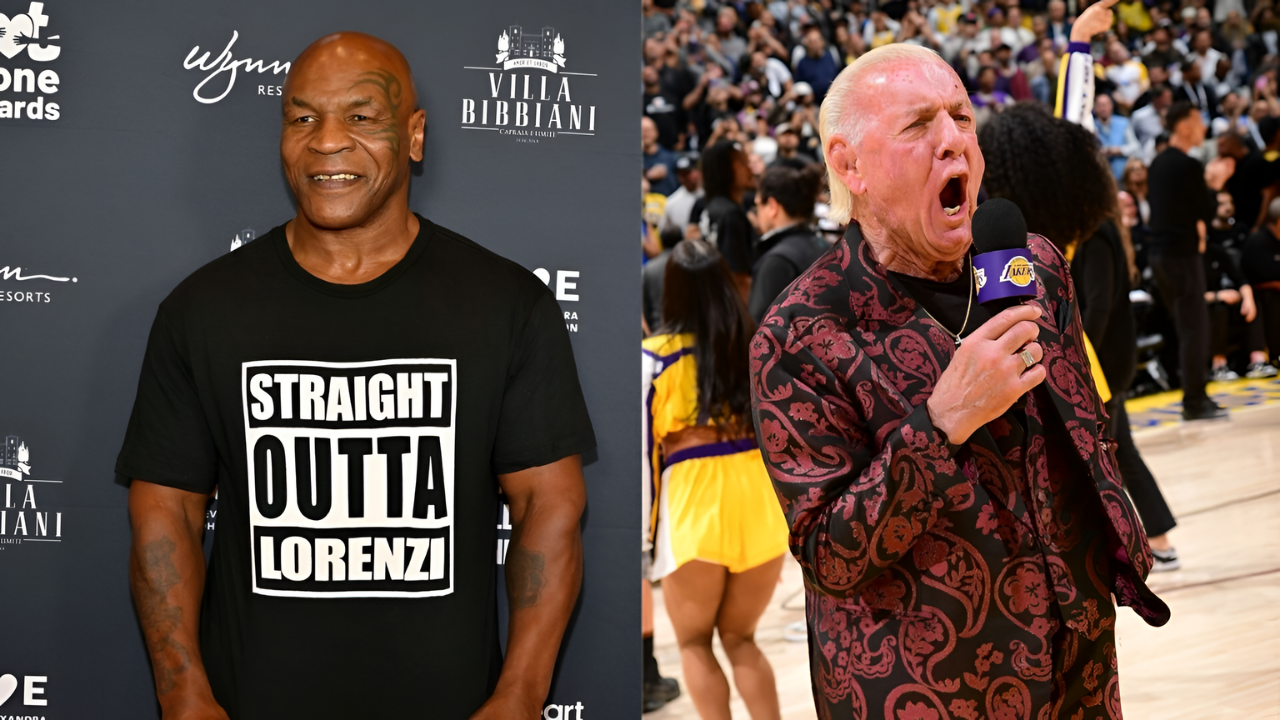

In December 2025, 2 icons filed a bombshell federal lawsuit saying their cannabis business partners looted over $1 million and secretly sold intellectual property rights. Mike Tyson and Ric Flair claim a multimillion-dollar enterprise was treated like a personal piggy bank. The 76-page complaint lists wire fraud, embezzlement, money laundering, and extortion, seeking a total of $50 million. The details quickly get darker.

A Booming Market With Weak Guardrails

The U.S. cannabis market reached $38.5 billion in 2024 and is projected to hit $76.39 billion by 2030. Celebrity-backed brands grabbed major share, with Tyson 2.0 estimated at $150 million in revenue in 2023. But rapid growth created blind spots. Carma HoldCo Inc., the parent distributor, allegedly became a hub for financial misconduct and IP exploitation. The founders say they never saw the trap forming.

Tyson’s Comeback Brand Turns Combative

Mike Tyson’s cannabis story was framed as redemption. He once earned $127 million in the 1990s purses, then faced IRS demands for $12 million and financial ruin. Tyson credits cannabis with helping manage pain, anxiety, and addiction. Tyson 2.0 expanded to 20+ U.S. states and markets, including Amsterdam, Barcelona, and Thailand. By April 2025, Tyson became CEO to gain control, and then he noticed unsettling discrepancies.

Ric Flair’s Late-Career Business Bet

Ric Flair’s cannabis move was newer and personal. At 74, he met Chad Bronstein at a marina in Tampa, Florida, and heard a pitch for a product line. Flair, who said he has been taking Xanax since 1989, described edibles as improving his sleep and helping him quit addictive medications. His brands included Ric Flair Drip and Wooooo! Energy. The lawsuit says he never truly controlled what he thought he owned.

“I’m making more money than ever”

“I’m making more money than ever” captured Flair’s optimism in 2025 as he promoted cannabis and energy drink success. The lawsuit now claims that optimism was built on misinformation about equity, ownership stakes, and licensing deals done without his knowledge. The quote reads like a snapshot taken seconds before a fall. So what exactly do Tyson and Flair say was happening behind the curtain?

A 76-Page Complaint With Heavy Charges

The complaint filed in the U.S. District Court for the Northern District of Illinois describes a “brazen RICO conspiracy” with 4 defendants and 21 counts. Allegations include wire fraud, embezzlement, money laundering, extortion, and securities fraud. The suit claims defendants enriched themselves by tens of millions via unauthorized licensing deals and diverted assets. It allegedly accelerated after Carma acquired Ric Flair Drip in September 2022. The spending details are especially jarring.

“Treated CARMA as Their Own Personal Piggy Bank”

“Treated CARMA as Their Own Personal Piggy Bank” is how the complaint frames alleged misuse of $1 million+ on personal expenses. Examples include private jet travel, yacht-related costs, home renovations, mortgage payments, and entertainment. It cites a $15,000 luxury watch for Los Angeles Rams Head Coach Sean McVay, nearly $3,000 in Gucci, and $6,350 for a home theater system. But the IP claims go further.

A $400,000 IP Deal Flair Says He Never Approved

After Carma acquired Ric Flair Drip, the lawsuit says Chad Bronstein sold Flair’s intellectual property rights to LGNDS for about $400,000. The deal allegedly covered hemp, mushrooms, nicotine, kava, smelling salts, beverages, and merchandise like shirts, pants, sweaters, and footwear. It also claims Flair “was unaware he was not the majority owner” from inception. How could leadership allow such sweeping licensing?

“We never saw it coming”

“We never saw it coming” reflects the alleged shock around Carma’s internal culture in December 2025. The suit says governance failed because multiple insiders enabled misconduct through negligence or participation. It names Nicole Cosby, Chief Legal Officer, as approving arrangements granting Bronstein personal ownership stakes. It also names CEO Adam Wilks, accused of concealing kickbacks tied to vape maker DomPen. The complaint suggests this was coordinated, not accidental. One deal is a key example.

The DomPen Kickback Allegation

Adam Wilks allegedly entered an undisclosed arrangement with vape manufacturer DomPen, receiving concealed payments while ignoring DomPen’s unauthorized use of Carma’s intellectual property. The lawsuit frames it as a fiduciary breach: an officer benefiting personally while harming the company. It argues DomPen benefited from brand equity built by Tyson and Flair while Wilks received smaller kickbacks. If true, it undermined licensing control and company value. The AEW situation, though, raised the financial stakes overnight.

A $1.5 Million Crisis From An Unauthorized Sponsorship

The complaint says Chad Bronstein negotiated an All Elite Wrestling sponsorship for Ric Flair’s Wooooo! Energy without authorization. It claims that he falsely presented himself as Flair’s agent, although he lacked the authority, and Flair never agreed to the terms. The arrangement allegedly stayed hidden until AEW threatened a $1.5 million lawsuit for breach. Carma and LGNDS, the suit alleges, paid the penalty despite never having approved the deal. Why would an executive risk such exposure?

Conflicts Beyond The Cannabis Company

Bronstein, described as Carma’s former President and Chairman, allegedly pursued competing ventures while inside the company. After termination in November 2023, he co-founded Real American Freestyle with the late Hulk Hogan, streaming on FOX Nation. He also developed Real American Beer, allegedly using confidential information from Carma’s beer brand project. The lawsuit paints this as a pattern of divided loyalty and self-dealing. The defendants, however, say the entire case is backward.

“My clients won’t be bullied and are prepared to knock out this meritless lawsuit in court”

“My clients won’t be bullied and are prepared to knock out this meritless lawsuit in court” is how Wilks’s attorney Terry Campbell responded in December 2025. Other defense counsel called the complaint “fiction dressed up as a lawsuit,” arguing “settlement demands that read more like a shakedown.” They also insist “facts and law are squarely on our side.” With those denials, why does the filing still scare executives?

The Lawyer In The Room, Under Fire

Nicole Cosby served as Carma’s Chief Legal and Licensing Officer, tasked with protecting intellectual property and ensuring licensing compliance. The lawsuit alleges she participated in selling licensing rights without proper authorization and approved arrangements granting Bronstein personal ownership stakes. Plaintiffs argue that, as chief legal officer, she either failed at oversight or collaborated in wrongdoing. Either scenario suggests deep structural breakdown, not a clerical mistake. The legal strategy also signals plaintiffs want maximum leverage.

Why This Became A RICO Case

The lawsuit invokes the Racketeer Influenced and Corrupt Organizations Act, a tool once aimed at organized crime and now used in complex commercial fraud. RICO requires a “pattern of racketeering activity,” including at least 2 predicate acts such as wire fraud or securities fraud.

Plaintiffs argue that those elements fit here through repeated diversion and deceptive deals. If proven, it unlocks treble damages and attorney’s fees. That math changes everything, quickly.

The $50 Million Demand That Could Triple

If damages are proven at $50 million, RICO can multiply that to $150 million, plus attorney’s fees that could reach $10-20 million, given the complexity. The complaint argues this pressure turns a business fight into an existential threat for defendants.

Plaintiffs gain settlement leverage, while defendants face escalating legal bills and massive downside risk. Even if some claims fail, one strong finding can reshape valuation and control. That’s why Tyson’s motivation matters.

“Cannabis changed my life, and I want to share that with the world”

“Cannabis changed my life, and I want to share that with the world” captures Tyson’s stated mission in December 2025. The filing portrays him as fighting for more than profit, especially after he became CEO in April 2025.

It also notes that when President Trump signed an executive order directing federal cannabis rescheduling from Schedule I to Schedule III in late 2025, Tyson thanked the president for “listening to people across the country and taking a practical step toward modernizing outdated policies.” Still, the industry context is shifting fast.

A Governance Wake-Up Call For Cannabis

The case lands as cannabis legitimacy appears to grow, with rescheduling discussions and a market projected at $76.39 billion by 2030. Institutional investors increasingly focus on governance, audits, and IP controls. The lawsuit argues Carma’s rapid scaling outpaced oversight, letting insiders exploit celebrity brands.

If stars cannot protect their names through professional partners, future celebrity participation may shrink. On the other hand, aggressive litigation could set stricter expectations. But do the brands survive the public mess?

Sales Keep Moving While Lawyers Fight

Despite the lawsuit, Tyson 2.0 and Ric Flair Drip continue to operate and expand their distribution. Tyson 2.0 launched in Maryland and Pennsylvania through TerrAscend Corp. partnership in November 2025, and products still rank strongly in multiple states.

Wooooo! Energy expanded retail partnerships and extensions. The draft suggests that consumers separate beloved celebrity names from those of corporate executives now accused of misconduct. Yet long litigation can erode trust slowly, especially if discovery produces more surprises. What precedent will the court set?

The Verdict Could Redefine Celebrity Brand Safety

The case is now in federal court in the Northern District of Illinois, unfolding during rapid cannabis expansion and shifting federal policy. If Tyson and Flair prevail, it signals that courts will enforce fiduciary duties and protect celebrity intellectual property from insider exploitation. If defendants win, it highlights how vulnerable celebrity-backed ventures can be without deeper due diligence. Either outcome will be studied by future partners, investors, and stars entering cannabis. The most revealing evidence may come from what documents show next.

Sources

Mike Tyson, Ric Flair Sue Ex-Partners in Weed Business for $50M. Front Office Sports, December 23, 2025

Mike Tyson Takes Weed Partners to Court, Alleging Fraud and Self-Dealing. New York Sun, December 23, 2025

Mike Tyson Named CEO of Carma HoldCo, Signaling Bold New Chapter for Portfolio of Lifestyle Brands. Cannabis Business Times, April 17, 2025

Federal Marijuana Rescheduling: Process and Impact. Moritz Law Center, Ohio State University, January 2, 2026