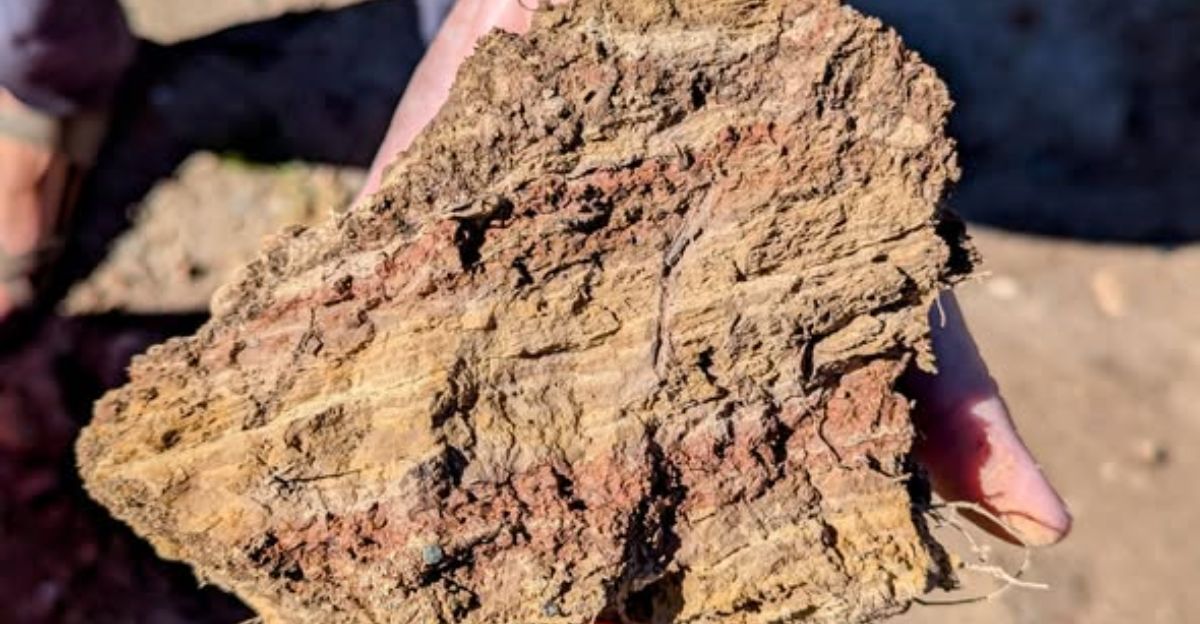

Drill rigs were already parked on the clay flats west of Utah Lake when confirmation arrived. Beneath roughly 4,000 acres of permitted land sat a full spectrum of rare earths and critical minerals tied to AI chips, EV motors, and defense systems.

What had been routine exploration at Silicon Ridge abruptly crossed into national significance. Company officials described the results as immediate, measurable, and far larger than early targets—marking a shift from local geology to strategic infrastructure.

From Quiet Lease to National Signal

Silicon Ridge had been leased and explored quietly for years, with no public fanfare. That changed once independent third-party assays confirmed a broad, high-grade mineral system beneath the site. The transition was not gradual.

Within weeks of the December 2025 announcement, the project moved from a regional clay operation to a potential anchor for domestic critical-minerals supply. For federal planners and manufacturers, the signal was clear: a rare domestic opportunity had surfaced faster than expected.

Understanding the $120 Billion Figure

The headline number reflects estimated gross in-situ value—the theoretical worth of all minerals underground if fully extracted and sold at current market prices.

This figure is based on company estimates awaiting independent verification in the upcoming Preliminary Economic Assessment. It does not represent revenue, profit, or confirmed economic output; it represents the maximum theoretical value based on current commodity prices.

Based on an average deposit grade of approximately 2,700 parts per million across 16 identified critical minerals, extrapolated across the lease area, total mineral content could approach $120 billion in gross in-situ value. This figure frames potential scale, not economic certainty.

What Prices Drive the Estimate

Rare earth pricing underpins the valuation. Neodymium-praseodymium oxide traded near $79,000 per tonne in January 2026, following significant volatility throughout 2025.

Dysprosium oxide has been reported in ranges varying widely by source and specification, with Western-sourced material often commanding higher premiums than Chinese domestic prices.

These volatile markets amplify uncertainty but also explain why even moderate domestic deposits attract intense attention from policymakers and industry alike.

Why In-Situ Value Isn’t Revenue

In-situ estimates ignore real-world constraints. Extraction costs, processing losses, infrastructure investment, permitting timelines, and recovery rates sharply reduce realizable value.

Large mining projects typically see significant reductions from in-situ value to economic output due to these factors. Silicon Ridge’s upcoming Preliminary Economic Assessment, expected in the first half of 2026, will determine Net Present Value and whether the deposit translates into a viable long-term operation.

Why This Discovery Emerged Now

Ionic MT began leasing Silicon Ridge in 2023 with a narrow focus on halloysite clay for advanced batteries. More than 100 boreholes later, the geology told a different story. Timing proved decisive.

Growing concern over China’s dominance in rare earths—and export restrictions announced in late 2024—accelerated domestic exploration. What began as targeted drilling evolved into a strategic mineral discovery.

A Supply Chain Under Pressure

China controls approximately 60–70% of global rare earth production and up to 90% of processing capacity. Export bans and licensing requirements on gallium, germanium, and select rare earths—including December 2024 restrictions—exposed how vulnerable Western supply chains had become.

While China subsequently paused these export controls in November 2025, the restrictions demonstrated Beijing’s willingness to use critical minerals as geopolitical leverage.

Silicon Ridge entered the picture as U.S. manufacturers and defense planners searched for alternatives that could operate under domestic regulatory and geopolitical frameworks.

What This Means for Everyday Technology

Rare earths and critical minerals are embedded in daily life. Smartphones, laptops, EV motors, wind turbines, fiber-optic networks, and AI data centers depend on them.

A domestic supply source does not guarantee cheaper products overnight. But it could reduce exposure to sudden shortages, dampen long-term price swings, and give manufacturers greater certainty when planning multi-year production cycles.

A Magnet for Industry Attention

Independent third-party assays identified at least 16 critical minerals at Silicon Ridge, including gallium, germanium, lithium, tungsten, niobium, and vanadium. Ionic MT points to existing permits, nearby infrastructure, and a 74,000-square-foot processing facility in Provo as advantages.

That readiness could shorten timelines and explains why federal agencies and potential strategic partners are monitoring the project’s next phase.

How It Compares Globally

Geologically, Silicon Ridge resembles ion-adsorption clay deposits that underpin production in China, Brazil, and parts of Australia. Analysts caution it will not replace global supply or end substitution research.

Still, it could compete meaningfully with foreign producers and prompt renewed exploration across the American West. The discovery suggests similar resources may exist closer to home than previously assumed.

Shifting the Trade Equation

For decades, China’s dominance in rare earths has shaped trade negotiations and industrial policy. Export controls demonstrated how quickly leverage can be applied. A sizable U.S. deposit changes the calculus, even if only partially.

Silicon Ridge offers Washington and allied manufacturers a bargaining chip—one that could influence future trade talks, procurement strategies, and long-term industrial planning.

Jobs and Local Stakes

Located west of Utah Lake near the Lake Mountains, Silicon Ridge sits within an hour of the state’s “Silicon Slopes” corridor.

Ionic MT estimates that mining and processing could generate hundreds of jobs, though formal employment studies are pending and dependent on project feasibility.

Lease payments and royalties flow to Utah’s School and Institutional Trust Lands Administration, directly linking mineral development to public education funding.

Political Momentum Builds

State leaders quickly embraced the announcement. Utah officials framed the discovery as both an economic opportunity and a national-security asset, aligning it with broader energy-expansion goals.

Legislative leaders highlighted Utah’s permitting environment and resource base as competitive advantages. The political backing signals that Silicon Ridge will likely receive sustained attention as federal and state priorities increasingly converge around critical minerals.

Supply Security and Inflation Pressure

Federal assessments, including a September 2024 GAO report, have flagged significant shortfalls in critical materials needed for defense and advanced manufacturing.

The Pentagon’s Defense Logistics Agency has launched a critical minerals procurement program as part of a broader federal initiative that includes approximately $7.5 billion in funding for critical mineral programs under the One Big Beautiful Bill Act, with $2 billion allocated specifically for defense stockpiles.

A domestic source won’t fix shortages quickly, but over time it could ease inflationary pressure tied to import dependence and global disruptions.

Manufacturers Hedge Their Risk

With a preliminary economic assessment expected in 2026, manufacturers are watching closely. Favorable results would offer U.S. electronics, automotive, and energy firms a more predictable input source.

While no offtake agreements or supply contracts have been announced, the reliability such a source could provide matters for long-term contracts, production planning, and investment decisions—especially as geopolitical shocks increasingly disrupt overseas mineral flows and complicate just-in-time supply models.

Energy Links Beyond Tech

Rare earths underpin wind turbines, grid infrastructure, and EV fleets that support logistics, hospitality, and delivery services.

Data centers powering cloud and AI services rely on stable electrical systems built with these materials. A strengthened domestic supply chain rooted in Utah could support broader transitions toward cleaner, more resilient energy systems across the service economy.

A Vertically Integrated Strategy

Ionic MT’s model converts halloysite clay into three co-products: critical minerals, high-purity alumina, and nano-silicon. These feed batteries, LEDs, specialty ceramics, and solar technologies.

If scaled successfully, the approach could reshape procurement strategies for industries currently dependent on imported refined materials, offering flexibility that extends beyond a single commodity market.

Environmental and Cultural Questions

Clay-hosted deposits may require less blasting than hard-rock mining, and the company describes its process as low-emissions and near-zero-waste.

Still, mining near Utah Lake raises legitimate concerns about water use, habitat disruption, and cultural landscapes. Environmental performance will depend on operational choices, monitoring, and reclamation—factors that regulators and local communities will scrutinize closely.

Valuation Reality Check

In-situ value often overstates economic impact. Mountain Pass mine in California, the only operating U.S. rare earth mine, demonstrates the gap between theoretical resources and realized value—production facilities and actual output are typically worth far less than in-situ calculations suggest.

Even if Silicon Ridge realizes just 10–15% of its theoretical $120 billion in-situ value, it would still represent a $12–18 billion resource—large enough to matter strategically without defying industry norms.

One Discovery, National Implications

From a clay deposit west of Utah Lake, Silicon Ridge now touches technology supply chains, geopolitics, education funding, and climate goals.

Company leadership calls it a potential watershed moment for U.S. resource independence. Whether it fulfills that promise—or exposes new trade-offs—will depend on feasibility studies, execution, regulatory oversight, and how the economic and environmental benefits are ultimately shared.

With typical U.S. mine development timelines spanning 15-29 years, Silicon Ridge’s true impact will unfold over decades, not months.

Sources:

“Ionic Mineral Technologies Announces Major U.S. Discovery of Rare Earth and Critical Technology Metals.” Ionic Mineral Technologies, 11 Dec 2025

“Massive critical minerals deposit found in Utah.” Mining.com, 14 Dec 2025.

“Ministry of Commerce Notice 2024 No. 46: Notice Concerning Strengthening Controls on Exports of Relevant Dual-Use Items to the United States.” Center for Security and Emerging Technology, Georgetown University, 3 Dec 2024.

“One Big Beautiful Bill Act makes $150B investment in Defense.” Inside Government Contracts, 13 Jul 2025.