First Brands Group’s massive debt pile (~$6B) and hidden financing drove its loan prices to collapse. The 2027 term loan plunged to just ~32¢ on the dollar.

The auto parts giant behind brands like FRAM and TRICO is now out of cash, and lenders are refusing to extend credit outside bankruptcy, setting the stage for a dramatic collapse and debt restructuring.

Ratings Tumble as Loans Plunge

Financial markets reacted in kind: one Bloomberg report said investors ‘watched in horror’ as roughly half of First Brands’ debt value vanished.

Fitch Ratings cut the company’s score from ‘B’ to ‘CCC’, citing its ~6B debt and billions in off-balance sheet financing.

The move — quickly followed by a rating withdrawal — signals looming restructuring risks across the auto-supply chain.

Empire Built on Debt-Fueled Deals

Since its founding, First Brands has expanded through aggressive debt-funded acquisitions.

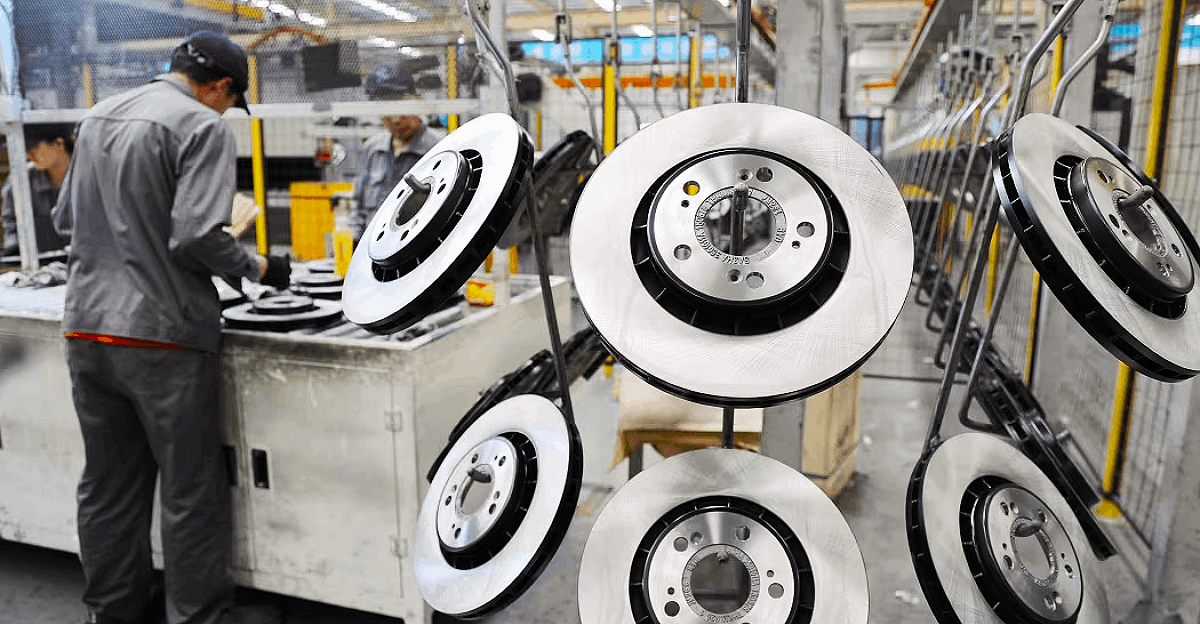

Malaysian-born Patrick James built a “roll-up” empire – acquiring FRAM filters, TRICO wipers, Raybestos brakes, and Autolite spark plugs under his Ohio-based Crowne Group – turning one wiper company into a $4–5B aftermarket powerhouse. The strategy relied on heavy leverage for growth.

Nearshoring Boosts Market Dominance

James then overhauled operations. He shifted production out of China and Italy to new plants in Mexico and Romania, driving economies of scale.

An executive noted his goal was “40% or higher” market share in each category. He combined multiple brands’ output – e.g., running Trico, Anco (Michelin,) and Michelin wipers through one facility in Matamoros, Mexico. This near-shoring cuts costs while dominating markets.

On the Brink of Bankruptcy

Sources say First Brands will file for Chapter 11 imminently, with no restructuring support agreement in hand.

Its affiliated finance arm, Carnaby Capital, listed just ~$500M in assets against >$1B of liabilities in a Sept. 24 bankruptcy petition.

Such a rushed, pre-planned filing is highly unusual for a firm of this size and underscores how desperate funding conditions have become.

Employees Face Uncertain Future

Meanwhile, First Brands is headquartered in Rochester, Michigan, and employs several hundred people at plants in Michigan, Ohio, and Mexico.

One Matamoros, Mexico, facility now produces three major wiper brands.

No official layoffs have been announced amid the Chapter 11 threat, but uncertainty looms large over the workforce as funding dries up.

Industry Faces Widespread Cuts

This strain comes as other parts suppliers have already announced deep cuts. Bosch plans to slash 13,000 jobs in Europe; its board member Stefan Grosch admitted, “This is very painful for us, but unfortunately, there is no way around it”.

Volkswagen, too, warned it would shut several German plants and lay off “tens of thousands” of workers, underscoring industry-wide consolidation pressures.

Retailers and OEMs on Alert

First Brands parts are sold through chains like Walmart, AutoZone, and O’Reilly, so disruptions could cascade through retail auto parts channels.

Its TRICO wiper division even won GM’s 2022 Overdrive Supplier of the Year award, reflecting a century-long OEM relationship.

Those deep links mean creditors and buyers must consider supply gaps: dealers and vehicle assemblers worry about parts shortages if production halts.

Off-Balance Financing Sparks Concern

Meanwhile, financial analysts have raised alarms about First Brands’ secretive financing. Goldman analysts reported they have “serious doubts” the company can avoid bankruptcy.

Court and broker data show roughly $2B of invoice-factoring debt kept off the balance sheet, with some facilities charging over 30% interest.

These opaque deals have obscured how much First Brands truly owes.

Debts Laid Bare in Filings

Court filings now peel back the veil on First Brands’ liabilities. Carnaby Capital (a financing affiliate) disclosed just ~$500M in assets against over $1B of debt.

These filings suggest billions more in guarantees and contingent obligations, revealing that much of the company’s borrowing was hidden from investors and rating agencies.

Creditors Scramble as Losses Mount

Consequently, creditors are in full panic mode. Bloomberg Law reports lenders “are tallying paper losses in the billions of dollars” as First Brands’ debt markets implode.

Many bondholders have formed ad hoc committees to protect their interests.

With the company silent on its plans, some investors say they have been “watching in horror” as prices plunged, intensifying anxiety over recovery prospects.

Elusive Founder Under Spotlight

At the center of this is Patrick James. The Malaysian-born CEO of Crowne Group has kept a notably low profile, even as First Brands expanded.

Over a decade ago, he and linked companies faced civil fraud allegations from lenders — claims he denied and that were later settled out of court.

Today, James owns First Brands primarily through layers of private debt, with little public disclosure.

Bankruptcy Task Force Assembled

In response, First Brands has lined up top advisers for bankruptcy. It hired Lazard, Weil Gotshal & Manges, and Alvarez & Marsal, while major creditors retained Gibson Dunn and Evercore for negotiations.

The company is seeking roughly a $1.25B debtor-in-possession loan to fund operations under Chapter 11 — far more than first estimated, underscoring how much cash is needed to keep plants open.

Analysts Warn of Fraudulent Transfers

Legal experts warn that these factoring deals could unravel any recovery plan. First Brands had about $2B of receivables factoring off its books, which may become a “significant issue” in Chapter 11.

If the court treats those transactions as asset sales, they could be clawed back as fraudulent transfers.

That scenario might force piecemeal liquidation of businesses instead of an orderly reorganization.

Can Private Credit Withstand the Test?

Overall, First Brands’ downfall has broader implications for the $1.7T private credit market. Some analysts call this a “canary in the coal mine” for leveraged lending.

Dan Rasmussen (Verdad Advisers) warns private credit is “the riskiest type of corporate lending” today — borrowers are small, overleveraged, and highly fragile.

This saga will test whether opaque debt-fueled strategies become a playbook for investors, or a stark warning about risks in shadow banking.

Tariffs Threaten to Squeeze Suppliers

Also, tariffs on vehicles and parts add to the squeeze. One analysis found U.S. automakers would face a $2,000–$12,000 tariff impact per vehicle even after adjustments.

First Brands’ Mexico factories may evade some duties under USMCA rules, but higher costs on imports will still pressure margins. Tariff uncertainty thus compounds the risk for already-weak suppliers.

Worldwide Supplier Turmoil

Elsewhere, parts suppliers are under pressure worldwide. European makers announced 54,000 job cuts in 2024, and another 22,000 in 2025, as demand shifts to EVs and ICE parts fall out of favor.

First Brands’ struggles mirror this global trend of consolidation. In an industry retooling for electric vehicles, the debt-fueled aftermarket model faces existential questions.

Court to Probe Hidden Debt

Bankruptcy courts will now scrutinize every financing move. Creditors may argue the factoring agreements were really asset sales, allowing them to void those deals as fraudulent transfers.

If successful, courts could force First Brands to unwind or repurchase those contracts, recovering potentially billions. The outcome may set a precedent on enforcing disclosure of off-balance sheet liabilities in Chapter 11 cases.

Aftermarket Customers in the Lurch

Ultimately, the fallout would reach consumers. Millions of vehicles use FRAM filters, TRICO wipers, and Raybestos brakes — now at risk of shortage or higher prices.

One supply-chain expert noted that “a broad contingent of consumers… have become anti-China” and could pay a premium for U.S.-made parts.

That patriotic edge and price premium will vanish if those brands disappear.

Bankruptcy Sparks Industry Crossroads

In conclusion, First Brands’ bankruptcy marks a crossroads for the auto parts industry. Will lenders salvage the brands via reorganization — or will financial engineering yield to asset liquidation?

Either outcome will test whether debt-fueled consolidation can survive the EV transition, new trade barriers, and supply-chain upheavals.

The case answers the “why” behind each risk, but only time will tell if traditional strategies can endure.