When Oroville Hospital opened its doors more than six decades ago, it became a vital medical anchor for tens of thousands in the Northern California foothills. Today, that same institution is in Chapter 11 bankruptcy, burdened with $208 million in debt and an unopened patient tower.

The building, intended to secure its future, now reflects the scale of its financial crisis. “We are facing unprecedented challenges in rural healthcare financing,” hospital officials said. Here’s what’s happening…

Ambitious Expansion, Unmet Expectations

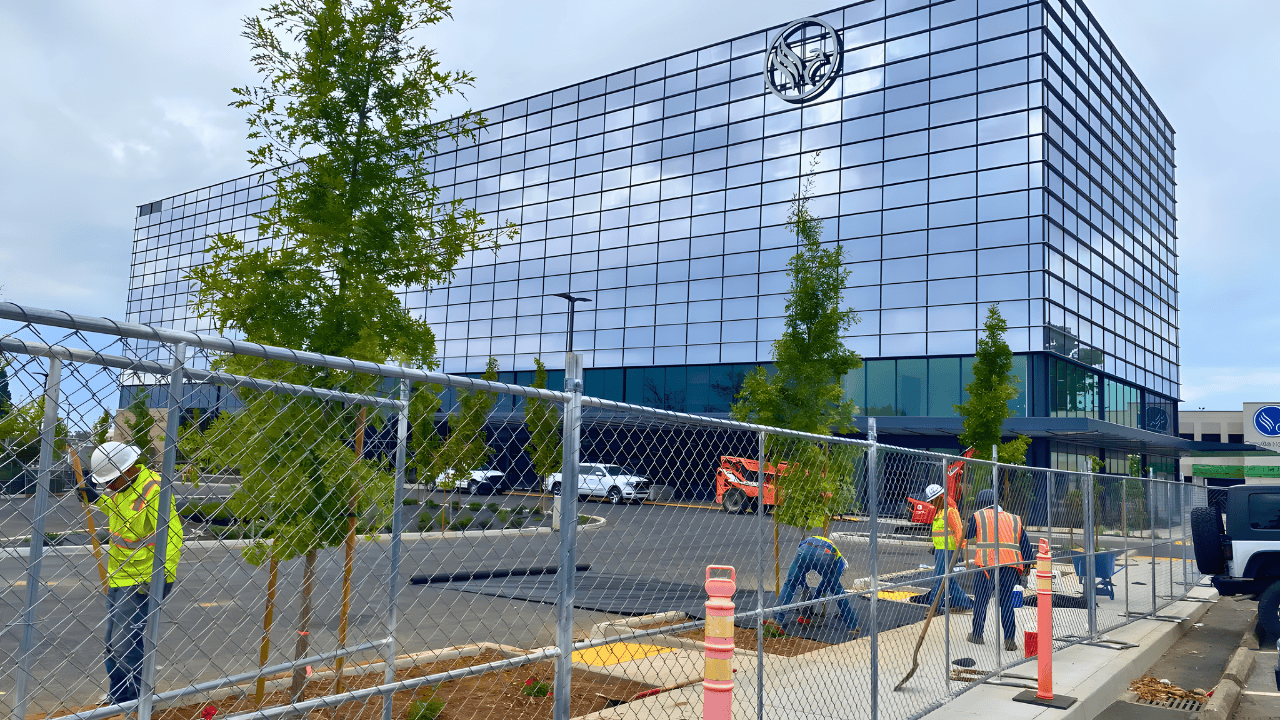

In February 2019, Oroville Hospital issued approximately $196 million in municipal bonds to fund a major expansion. The plan aimed for a 78-bed increase, a 59% jump in capacity, to attract patients from surrounding rural areas. A new five-story patient tower was constructed, physically completed by March 2025, using nearly all bond proceeds.

However, the tower remained locked and empty for months. Hospital leaders had counted on revenue from the new beds to cover multimillion-dollar bond payments, but without patients, the expansion quickly became a financial burden. Questions about how a rural hospital could sustain such debt grew increasingly urgent.

Regulatory Delays and Mounting Pressures

State regulators delayed the tower’s licensing, citing concerns over fire protection, staffing, and California’s strict seismic safety requirements. Meanwhile, disputes with contractor Modern-Sundt added another layer of complexity. In March 2024, the contractor filed a lawsuit seeking $16.8 million in unpaid construction costs. While the hospital later reduced the immediate lien, the legal battle highlighted the stalled project’s seriousness.

Each month the tower remained idle, bond debt payments continued. Additional financial pressures arrived in December 2024, when the U.S. Department of Justice announced a $10.25 million settlement over alleged improper billing and Anti-Kickback Statute violations, further straining working capital just as regulatory and construction problems drove costs higher.

Legal Battles and Chapter 11 Filing

The financial situation worsened on October 1, 2025, when Oroville Hospital missed a $5 million bond payment. The default triggered action on the entire $193 million in bond debt, with bond trustee UMB Bank seizing $27.1 million from hospital accounts.

With operating funds depleted, questions arose about payroll and service continuity. On December 8, 2025, the hospital filed for Chapter 11, stating the move was necessary to “facilitate a court-supervised transaction with a partner.” The filing reflected both urgent financial realities and a strategy to stabilize the institution during restructuring.

Community at Risk

The bankruptcy affects hundreds of employees, including nurses, physicians, technicians, and support staff. Community members voiced concerns over pensions, health benefits, and the future of hospital services. Patients in Oroville and surrounding foothills face even higher stakes. A significant reduction in services could require traveling roughly 70 miles to Sacramento for trauma care or major surgery, underscoring the hospital’s essential role in the region.

Court-Supervised Sale and Future Prospects

U.S. Bankruptcy Judge Christopher D. Jaime now oversees the search for a buyer. Oroville Hospital obtained $16 million in debtor-in-possession financing from Rosemawr Management LLC to cover wages and supplies during the restructuring. Hospital leadership acknowledged that a transaction is the only path to “securing the hospital’s long-term future.” Any successful buyer must address the $208 million debt, resolve regulatory hurdles, and maintain core community services.

A Test Case for Rural Healthcare

Oroville Hospital’s collapse represents one of the largest municipal bond failures by a rural California hospital in recent years. Ambitious expansion, regulatory delays, and a significant federal settlement created a fragile structure where missteps compounded over time.

The Chapter 11 case has sparked broader conversations about the financial sustainability of rural medical centers, highlighting challenges that could affect similar institutions nationwide. Lessons from Oroville’s crisis may guide policymakers, hospital leaders, and communities striving to protect essential healthcare in remote regions.

Sources:

Oroville Hospital Enters Chapter 11 Filing to Help Facilitate a Transaction. Business Wire, December 8, 2025.

California Hospital With $193 Million Muni Debt Files Bankruptcy. Bloomberg, December 9, 2025.

Oroville Hospital Overview Case: 25-26876. Epiq 11 (Claims Agent), December 8, 2025.

California Hospital To Pay $10.25M To Resolve False Claims Allegations. U.S. Department of Justice, December 12, 2024.

Contractors file civil lawsuit against Oroville Hospital. Action News Now (Transcript), September 27, 2025.