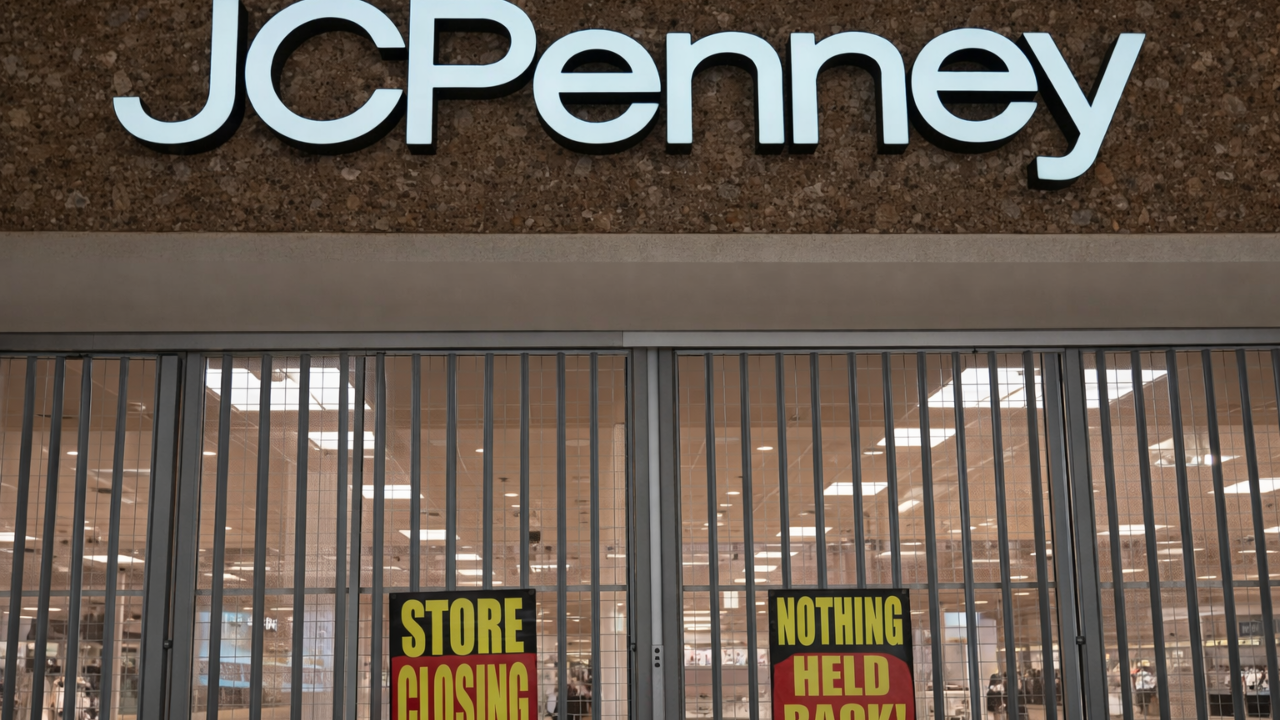

J.C. Penney’s ambitious $947 million agreement to sell 119 stores to Onyx Partners has collapsed, thrusting these locations across 35 states into limbo just after the December 22, 2025, closing date, with a final termination deadline of December 26.

The breakdown stems from Onyx’s inability to secure essential tenant documentation, despite repeated delays from an initial September 2025 target. This snag not only questions the properties’ $8 million per store valuation but also underscores broader market hesitations in handling large-scale retail transactions amid economic pressures.

Stores Stay Operational Amid Uncertainty

All 119 stores, spanning states including Texas and California, continue daily operations under Catalyst Brands, J.C. Penney’s parent company. Customers face no disruptions, particularly vital during peak holiday periods, as the properties remain functional despite the ownership void. A Catalyst Brands spokesperson confirmed that the collapsed deal “does not impact JCPenney store locations or operations”, though the company previously announced warehouse consolidation affecting nearly 300 employees at its Texas facility earlier in 2025. The portfolio includes 21 stores in Texas and 19 in California across 35 states, representing significant geographic concentration in major retail markets facing broader industry headwinds.

Restructuring Challenges Surface for Retail Giant

This setback exposes J.C. Penney’s ongoing post-bankruptcy struggles following its 2020 filing and subsequent merger with SPARC Group into Catalyst Brands. The Copper Property Trust, which oversees 160 stores and six distribution centers, highlights the company’s efforts to offload assets. Yet the failed deal signals persistent hurdles in stabilizing a legacy brand founded in 1902, now navigating inflation-driven costs and shifting consumer habits away from malls.

Sector-Wide Pressures Mount

The retail landscape mirrors J.C. Penney’s woes, with peers like Macy’s and Kohl’s accelerating 2025 closures. Industry forecasts point to 8,200 store shutterings this year, up 12% from 2024, intensifying uncertainty in mall-dependent communities already scarred by prior losses. Anchor store instability ripples outward, reducing foot traffic at affected sites and impacting nearby hospitality and logistics sectors, even as apparel supply chains maintain steady deliveries to open locations.

Global Interest Offers Paths Forward

Over 700 inquiries from private equity firms and institutional investors signal robust demand for these distressed U.S. assets, potentially leading to piecemeal sales if the December 26 deadline passes unresolved. Real estate investment trusts watch closely, anticipating fragmented deals that could reshape North American retail real estate. Meanwhile, J.C. Penney accelerates its e-commerce pivot, integrating brands like Brooks Brothers and Aéropostale, while online leaders such as Amazon and Walmart gain ground in the digital shift.

The transaction’s collapse highlights ongoing complexities in retail bankruptcy restructuring, as the Copper Property Trust operates under court-mandated liquidation deadlines established during JCPenney’s 2020 Chapter 11 proceedings. As traditional department stores grapple with e-commerce dominance and evolving lifestyles, J.C. Penney’s next moves—whether individual sales or strategic adaptation—will test the sector’s resilience, determining if brick-and-mortar icons can endure or fade into obsolescence.

Sources:

“J.C. Penney’s $947 Million Deal Collapses Amid Delays and Documentation Issues.” Retail Dive, 2025.

“Onyx Partners Purchases J.C. Penney Properties in Multi-Million Dollar Deal.” Commercial Observer, 2025.

“J.C. Penney Faces Uncertainty as 119 Stores Remain in Limbo After Failed Deal.” Bloomberg, 2025.

“The Rise of Retail Distress: The Future of U.S. Malls in the Wake of Major Store Closures.” CNBC, 2025.