Kylie Leia Perez left a Florida courthouse on August 14, 2025, after posting $50,000 bond. The OnlyFans creator known as “Natalie Monroe” earned $5.4 million from 2019 to 2023, yet allegedly paid zero federal taxes, evading $1.6 million in owed taxes. Her prosecution involves the IRS Criminal Investigation and coordination with the DOJ.

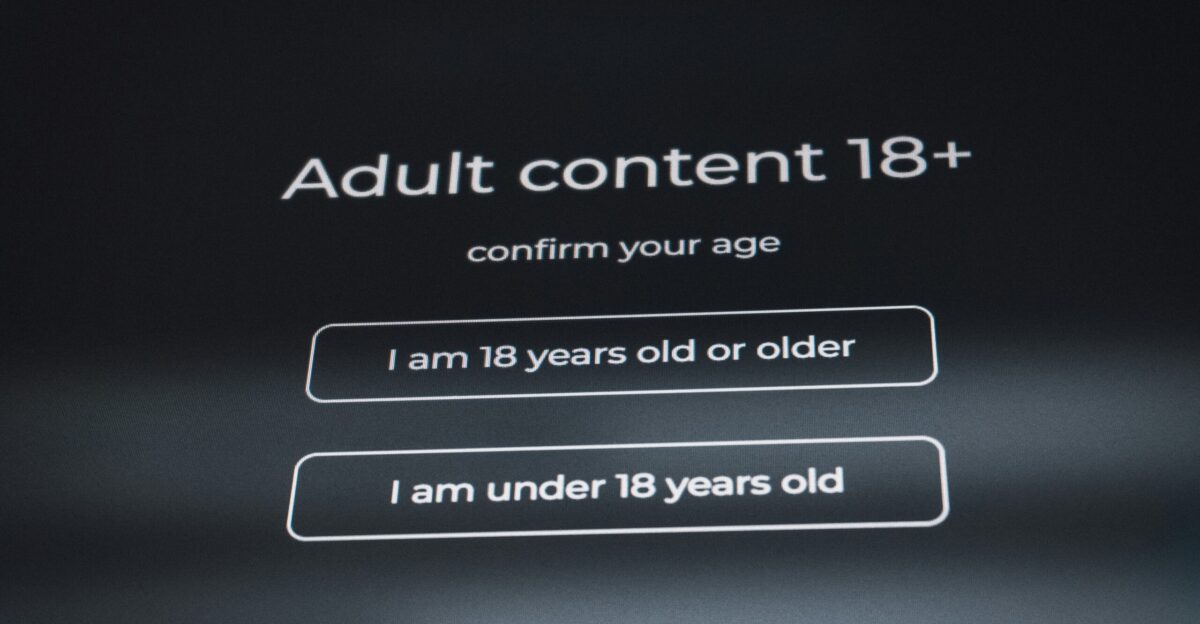

The case forces an uncomfortable reality: enforcing Trump’s “no tax on tips” law requires the IRS to determine what OnlyFans content is pornographic, potentially making agents watch explicit material during audits.

Context: A New Law Creates an Enforcement Nightmare

The One Big Beautiful Bill Act was passed on July 4, 2025, introducing Trump’s signature “no tax on tips” policy. Qualifying workers can deduct up to $25,000 in annual tip income from federal taxation through 2028. The legislation broadly covers service occupations, including digital content creators, on the Treasury’s preliminary list of eligible occupations.

However, Congress inserted a carve-out excluding tips from “pornographic or adult entertainment” activities.

The IRS Faces an Obscenity Standard Problem

Treasury and IRS released proposed guidance in September 2025, acknowledging the ambiguity but offering minimal clarity. The guidance essentially adopts the Supreme Court’s obscenity standard: “I know it when I see it.”

Tax preparer Thomas Gorczynski explained the auditor’s dilemma: “Ultimately, it would be the subjective determination of an IRS examiner or Tax Court judge. Sometimes you look at something, and it’s clearly pornography, but sometimes it’s subjective”. Accountant Katherine Studley, who works with OnlyFans creators, asks, “Where’s the line? Just because you’re on OnlyFans doesn’t mean it’s pornographic. You could have cooking or yoga channels.”

IRS Agents May Watch Adult Content at Work

The enforcement mechanism creates an unprecedented scenario: to determine whether taxpayers qualify for tip deductions, IRS agents or Tax Court judges may need to examine OnlyFans content directly. This isn’t hypothetical—it’s the inevitable consequence of statute language that excludes income types without defining them.

The New York Times reported that IRS officials acknowledged they wouldn’t face repercussions for viewing adult material during official duties, as content review is now part of their enforcement responsibilities.

The Criminal Precedent: Perez Prosecution Sends a Message

The Perez case demonstrates IRS enforcement intentions with unmistakable clarity. Between 2020 and 2023, she earned between $202,998 and $2,130,898 annually from OnlyFans, yet filed false returns or nothing at all.

The indictment alleges that she filed a false 2019 return and failed to file taxes for 2020-2023, despite earning substantial income from a massive platform. Federal prosecutors charged her with one count of filing a false tax return and four counts of failing to pay income tax—offenses carrying a maximum seven-year prison sentence.

Why OnlyFans?

OnlyFans hosts approximately 4.6 million creator accounts globally, with roughly 1.1 million based in the United States, representing 24-31% of the total. The platform’s creator population exploded from just 348,000 in 2019—a tenfold increase representing the fastest growth in the creator economy on any major platform.

Monthly new creator registrations reached approximately 179,000 in early 2025, indicating sustained rapid expansion.

Who Faces Real Audit Risk?

OnlyFans earnings follow an extreme Pareto distribution where wealth concentrates dramatically among elite performers. Approximately 83% of creators earn less than $100 per month, which translates to roughly $1,200 annually—an amount below the IRS audit thresholds for self-employed individuals.

However, the top 1% average $33,984 monthly ($407,808 annually), while the elite top 0.1% earn approximately $146,881 monthly, capturing 76% of all platform revenue. This concentration means actual audit risk focuses on perhaps 46,000 creators globally and 11,000 American creators earning substantial sums.

Creator Earnings Breakdown

Most OnlyFans creators earn minimal sums despite the platform mythology surrounding creator wealth. The average creator earns between $150-$180 monthly across all geographic regions.

Female creators, comprising approximately 80-84% of the platform’s creator base, average $700 monthly, with top 10% earners exceeding $10,000 monthly. Male creators average $180 monthly, with only 10% reaching $5,000 monthly thresholds. OnlyFans pays creators 80% of revenue, retaining a 20% commission.

The Systematic IRS Crackdown: Criminal Investigation’s Playbook

Since late 2022, the IRS Criminal Investigation has systematically targeted OnlyFans creators through a coordinated nationwide operation. Tax defense attorneys report that pairs of IRS Special Agents visited creators’ homes, offices, and tax preparers’ offices, serving grand jury subpoenas demanding documentation, financial records, and testimony.

This represents far more serious enforcement than routine civil audits—grand jury involvement signals Department of Justice coordination and highest-level federal investigative procedures.

What Creators Must Do Immediately

When IRS Special Agents arrive with grand jury subpoenas, creators face immediate decisions with lifelong consequences. These subpoenas compel testimony under oath or document production, and anything said can be used in criminal prosecution.

Tax defense attorneys strongly advise creators to retain separate legal counsel immediately, as the creator and accountant’s interests may diverge significantly during criminal investigations. The coordinated nature of these investigations indicates a centralized IRS strategy rather than isolated audits.

Expert Analysis

Tax advisors specializing in creator economy taxation now recommend adopting aggressive documentation practices and conservative tax reporting, pending clearer guidance from the IRS. Jessica Goedtel, a financial planner for sex workers, expressed fears that enhanced IRS scrutiny represents preliminary steps toward broader content regulation.

Conservative groups and Christian advocacy organizations lobbied the Treasury to include the pornographic activity exclusion, suggesting that government tax policy now reflects moral judgments about adult entertainment.

Policy Origins: How Adult Content Got Excluded

The pornographic activity exclusion didn’t emerge from legislative accident—it resulted from targeted advocacy by conservative groups and Christian organizations. These groups sent formal letters to Treasury Secretary Scott Bessent, arguing that the government shouldn’t subsidize industries that exploit young adults.

The Heritage Foundation’s Project 2025 includes provisions calling for pornography to be outlawed entirely, though that remains theoretical. This context suggests the pornographic exclusion represents the opening wedge of broader regulatory efforts.

Enforcement Challenges

The fundamental challenge underlying the “no tax on tips” enforcement mechanism is that pornography determinations are inherently subjective. Legal standards trace back to Supreme Court cases from the 1960s, establishing that obscenity is difficult to define. This led Justice Potter Stewart to famously write, “I know it when I see it.”

Tax law now depends on similar case-by-case subjective judgment—what one examiner considers pornographic, another might classify as artistic expression.

The Millions Under Scrutiny

Approximately 1.1 million American OnlyFans creators now operate under heightened tax scrutiny resulting from this policy convergence. While most earn minimal amounts below meaningful audit thresholds, the top 5% of earners, who collectively represent roughly 75% of total platform revenue, represent legitimate IRS targets.

Form 1099-K reporting thresholds were reversed back to $20,000 and 200 transactions, reducing automatic IRS reporting for smaller creators.

Documentation Requirements: The Compliance Nightmare

OnlyFans creators claiming “no tax on tips” deductions must maintain meticulous documentation distinguishing tip income from fully taxable amounts, a task complicated by OnlyFans’ payment architecture.

The platform typically does not segregate tips from subscription revenues—subscribers often bundle tips within their total payment amounts. Proposed Treasury regulations require contemporaneous written documentation of all tip receipts, showing the date, amount, payor identification (when available), and payment method.

How Other Nations Approach Creator Taxation

The United States isn’t alone in targeting creator economy taxation, as tax authorities worldwide struggle with compliance challenges. Ireland’s Revenue Commissioners conducted systematic investigations into OnlyFans creators, discovering massive underreporting of individual and corporate income, value-added tax, and employment obligations.

One prominent Irish creator operator owed combined personal and corporate liabilities exceeding €266,000 after penalties and interest.

Psychological Impact on Creators

The Perez prosecution and IRS enforcement announcements have created widespread apprehension across creator communities. Creators face uncertainty about the correct compliance approaches given the statutory ambiguity regarding tip deduction eligibility.

High-earning creators recognize they represent audit targets but lack certainty about what tax positions the IRS will challenge. The prospect of IRS agents reviewing adult content creates additional anxiety.

Policy Questions Going Forward

The fundamental ambiguity in the “no tax on tips” law suggests Congress may revisit statutory language, either clarifying what constitutes pornographic activity or modifying the adult entertainment carve-out entirely.

Several policy options exist: Congress could establish explicit content classification standards, eliminate the exclusion for pornographic activity, phase out the deduction for high earners, or simplify the entire provision.

What Lies Ahead

The convergence of aggressive IRS enforcement and ambiguous statutory language has created a perfect storm for OnlyFans creators navigating 2025 tax obligations. Tax professionals anticipate that the first wave of “no tax on tips” deduction claims will trigger extensive IRS scrutiny, particularly for creators in adult entertainment categories.

Early audit outcomes will establish precedent, shaping creator behavior for years.

Bottom Line

Approximately 1.1 million American OnlyFans creators now operate under intensified IRS scrutiny resulting from systematic criminal investigations, aggressive prosecution, and new statutory provisions creating ambiguous tax treatment.

High-earning creators above $150,000 annual income face the greatest risk, losing access to “no tax on tips” deductions while remaining attractive prosecution targets.

Sources:

U.S. Department of Justice Press Release; Middle District of Florida Indictment (August 2025)

The Independent; IRS OnlyFans Content Review Investigation (December 2025)

MissTechy; OnlyFans Creator Statistics and Platform Data (2025)

Business Observer Florida; Tampa OnlyFans Tax Fraud Case Coverage (August 2025)

U.S. Treasury Department; Proposed Regulations on “No Tax on Tips” Implementation (September 2025)