HP reported fourth-quarter fiscal 2025 revenue of $14.6 billion, up 4.2% year-over-year and surpassing Wall Street’s expectation of $14.5 billion. Non-GAAP diluted earnings per share came in at $0.93, matching consensus forecasts.

For the full fiscal year 2025, HP generated $55.3 billion in revenue, representing a 3.2% annual increase, with free cash flow reaching $2.9 billion. Forward guidance disappointed markets, triggering declines in stock prices and analyst downgrades.

PC Division Powers Ahead With Windows 11 Momentum

The Personal Systems segment, representing HP’s consumer and commercial PC business, emerged as the clear winner in the quarter. Personal Systems revenue climbed 8% year-over-year to $10.4 billion, driven by robust demand across both channels.

Unit sales increased 7% overall, with consumer PC units rising 8% and commercial units increasing 7%. AI-enabled PCs now comprise over 30% of HP’s quarterly shipments, reflecting momentum from the Windows 11 refresh cycle.

Printing Division Continues Steep Decline

In sharp contrast to PC strength, HP’s Printing segment experienced continued weakness, with revenue declining 4% year-over-year to $4.3 billion during the quarter. Printing supplies revenue decreased by 4%, while hardware unit sales plummeted by 12%, signaling a diminishing demand for traditional printing devices.

This persistent decline reflects longer-term trends in office automation and a decrease in paper consumption. The printing unit’s struggles underscore HP’s vulnerability to shifts in workplace technology.

CEO Announces AI-Focused Restructuring Initiative

CEO Enrique Lores unveiled an ambitious artificial intelligence transformation plan designed to position HP as an AI-first technology company.

The restructuring targets elimination of 4,000 to 6,000 employees globally by fiscal 2028, representing approximately 10% of HP’s 58,000-person workforce. Lores stated: “Numerous tasks currently requiring human involvement will be executed by AI more efficiently.” The initiative focuses on embedding AI across product development, customer support, operations, and manufacturing.

$1 Billion in Targeted Savings Over Three Years

HP projects that the AI restructuring will generate $1 billion in gross run-rate savings by the end of fiscal 2028, although most benefits are expected to materialize in later years. The company expects approximately $650 million in total restructuring charges, with roughly $250 million anticipated during fiscal 2026 alone.

These costs will include severance packages, facility consolidations, and investments in technology infrastructure. The timeline indicates near-term financial headwinds before realizing substantial benefits.

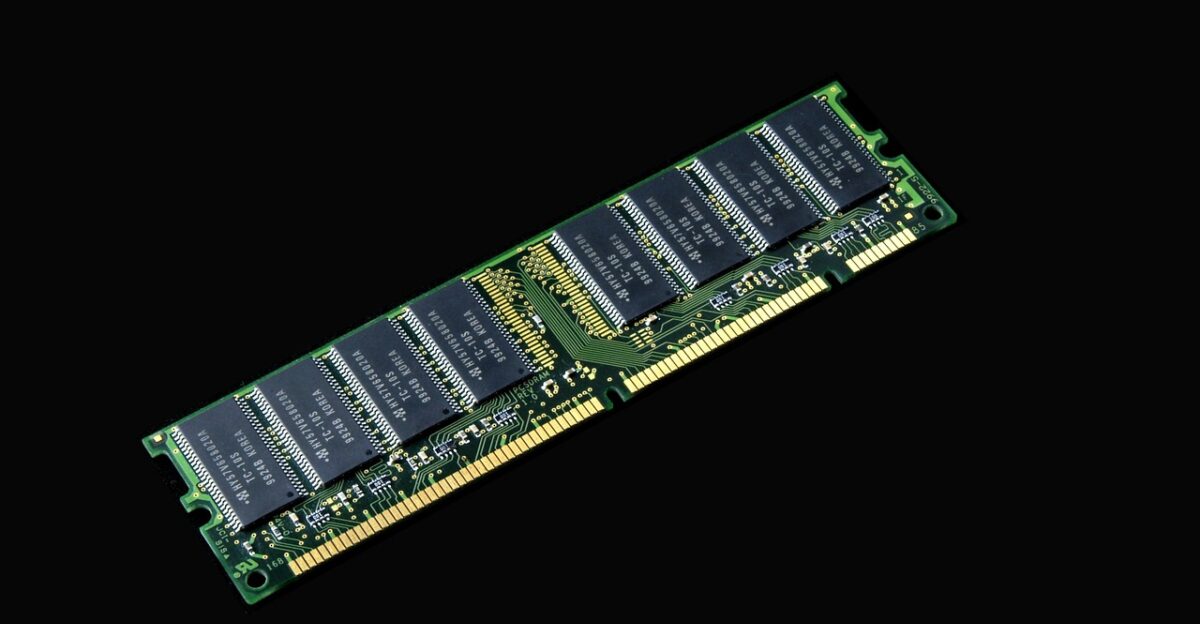

Memory Chip Costs Creating Significant Margin Pressure

Rising memory chip prices present an immediate and severe challenge, threatening HP’s profitability in fiscal 2026. Memory costs now account for 15% to 18% of a typical PC’s manufacturing cost, increasing dramatically amid surging demand for artificial intelligence data centers.

CEO Lores acknowledged that memory price increases have “accelerated” in recent weeks, with expectations for further inflation through mid-2026. Margin compression is anticipated for the second half of the fiscal year.

Weak 2026 Guidance Sparks Sharp Stock Decline

HP’s forward guidance for fiscal 2026 fell substantially short of Wall Street expectations, resulting in an immediate negative market reaction.

The company projects adjusted earnings per share of $2.90 to $3.20 for fiscal 2026, significantly below the consensus analyst forecast of $3.33. For the first quarter of fiscal 2026, HP guides earnings between $0.73 and $0.81, trailing the anticipated $0.79. Analysts attributed the weakness to rising memory costs, tariff impacts, declining printing volumes, and macroeconomic uncertainty.

Manufacturing Transformation and Tariff Mitigation Strategy

HP is actively reshoring North American manufacturing operations away from China-based production to mitigate tariff exposure and supply chain vulnerabilities. The company has recently secured a $53 million CHIPS Act grant to support semiconductor production at its Oregon facility.

This strategic initiative supports approximately 250 jobs while strengthening U.S. semiconductor supply chains and reducing geopolitical risks. However, the grant addresses long-term resilience rather than immediate memory cost pressures.

Analyst Community Delivers Coordinated Downgrades

Major investment banks swiftly downgraded HP following the release of weak guidance, with multiple price target cuts occurring within 24 hours. Goldman Sachs reduced its price target from $28 to $24, while Bank of America Securities cut from $29 to $26.

Morgan Stanley downgraded HP to “Underweight” with a $21 price target, forecasting a transition to a tougher PC cycle. JPMorgan’s Samik Chatterjee downgraded to “Neutral,” projecting memory inflation could drag EPS down $0.46.

Previous Restructuring Success Provides Strategic Template

HP’s current restructuring initiative builds on lessons from its prior transformation program announced in November 2022. That earlier “Future Ready Transformation” plan targeted 4,000 to 6,000 job eliminations and achieved $2.2 billion in total cost reductions.

The successful execution demonstrates management’s capability to execute large-scale organizational changes while maintaining operational continuity. However, needing a second major restructuring within three years suggests ongoing structural challenges.

Competitive Context: Broader Tech Industry Layoffs Accelerate

HP’s restructuring announcement comes amid a wave of workforce reductions in the technology sector throughout 2025. Amazon announced plans to eliminate 14,000 corporate positions in October, marking the company’s largest layoff in history.

Apple quietly cut dozens of sales roles in business, education, and government accounts just days before HP’s announcement. Industry trackers report over 113,000 roles eliminated across 231 technology companies in 2025.

AI Strategy Extends Far Beyond Simple Automation

Lores emphasized that HP’s AI strategy transcends basic chatbot implementations or simple automation tasks. Instead, the company is deploying sophisticated AI agents, streamlining complex business processes and AI-enhanced software development tools, and accelerating product innovation.

HP is transitioning from initial AI pilot programs to targeted enterprise-wide initiatives across product development and customer satisfaction. The breadth of transformation explains why management views substantial workforce reductions as necessary.

Supply Chain Diversification Strategy Implementation Underway

Beyond mitigating memory cost through design changes and pricing adjustments, HP is actively diversifying its supplier base to reduce its dependency on limited memory manufacturers. The company is qualifying lower-cost memory suppliers and implementing designs requiring less memory per device.

These supply chain initiatives aim to cushion against memory cost volatility through mid-2026. However, immediate pricing increases carry a risk of dampening PC demand during critical periods.

First-Half 2026 Protection Through Strategic Inventory Positioning

While HP faces significant margin pressure in the second half of fiscal 2026, the company maintains adequate inventory to mitigate the impact on results during the first six months. Current inventory levels of $8.5 billion provide sufficient buffering against memory price spikes expected during late 2025 and early 2026.

CEO Lores stated management is “well protected” for H1 but taking a “prudent approach” for H2. This inventory advantage is temporary and will diminish as the stock is depleted.

Windows 11 Upgrade Cycle Runway Remains Substantial

Despite concerns about PC market saturation, HP executives emphasized that the Windows 11 replacement opportunity remains substantially underpenetrated.

Approximately 60% of HP’s installed PC base has transitioned to Windows 11, leaving significant runway for replacement purchases. This ongoing upgrade cycle provides a structural tailwind supporting PC volume growth through 2026. However, analyst forecasts suggest that PC shipment growth will be 6.6% in 2025, followed by a 2.2% decline in 2026.

Restructuring Implementation Timeline Extends Through Fiscal 2028

HP is implementing the 4,000 to 6,000 job eliminations gradually through fiscal 2028, rather than concentrating cuts in a single year.

This extended timeline allows careful transition of critical functions to AI systems while maintaining service quality. However, near-term cost savings will be limited, with most of the $1 billion in targeted savings materializing only in fiscal 2027 and 2028. This timing mismatch explains analyst concerns about fiscal 2026.

Shareholder Returns Continue Despite Near-Term Challenges

Despite profitability headwinds and restructuring investments, HP maintained significant capital returns to shareholders during fiscal 2025. The company returned $1.9 billion to shareholders through dividends and share repurchases, with $0.8 billion during the fourth quarter.

This continued commitment signals management confidence in the long-term recovery trajectory and ability to navigate challenges. However, weak guidance suggests limited financial flexibility if conditions deteriorate sharply.

CEO Expresses Confidence in Long-Term AI Transformation

Despite acknowledging substantial near-term challenges, CEO Lores maintained optimism regarding HP’s long-term competitive positioning following AI-driven transformation. Lores stated: “It’s crucial to be at the forefront, embrace new technologies, and change our work processes.”

He emphasized this restructuring represents an industry-wide trend HP must embrace to remain competitive. This executive confidence contrasts sharply with analyst skepticism about near-term earnings recovery.

Critical Path Forward Amid Industry Transformation Wave

The juxtaposition of strong quarterly results with major job cuts and weak guidance encapsulates the tension facing many technology companies in 2025. HP must balance current profitability with the imperative to invest heavily in AI transformation, even as the transformation displaces thousands of workers.

The company’s success depends on executing phased restructuring while protecting profitability during the critical, memory-price-challenged second half of fiscal 2026. Investors will monitor AI investments.

Market Reaction and Investor Sentiment Shift

HP shares plummeted more than 5% in extended trading following the restructuring announcement, reflecting investor concerns about forward guidance and the scale of the restructuring. The stock closed at $24.38 on November 25, having declined 17-25% year-to-date, underperforming the broader market.

Wall Street’s rapid downgrades and price target cuts within 24 hours signal deep concern among analysts. The market’s harsh reaction underscores the challenge HP faces in executing long-term transformation while delivering near-term earnings.

Sources:

HP Inc. Fiscal 2025 Fourth Quarter Earnings Press Release, November 25, 2025

HP Inc. Investor Relations Q4 2025 Earnings Presentation

Reuters: HP Announces 6,000 Job Cuts and AI Restructuring Plan, November 25, 2025

Bloomberg: HP Stock Falls as Profit Outlook Misses Estimates, November 25, 2025

CNBC: HP Inc. Shares Fall on Weak Guidance and 6,000 Employee Cutbacks, November 25, 2025

Goldman Sachs Equity Research: HP Inc. Price Target Adjustment, November 26, 2025

Morgan Stanley Equity Research: HP Inc. Sector Analysis, November 2025