Hundreds of workers stream out of GM’s Factory Zero in Detroit, carrying tool bags and cardboard boxes on a cold December afternoon—each told that their jobs will disappear on January 5, 2026. Security guards stand at the entrance, while union representatives huddle with small groups of workers, trying to answer urgent questions about benefits, hours, and next steps.

The layoffs will hit 1,140 people, the largest EV job loss of 2025—but a far bigger unraveling is already underway.

Why the Bottom Fell Out Overnight

The end of the $7,500 federal EV tax credit on September 30, 2025, set off a temporary buying surge, creating a 137% jump in GM EV sales in September. When the subsidy disappeared, so did customers, exposing demand that had been artificially inflated by government incentives rather than long-term consumer preference.

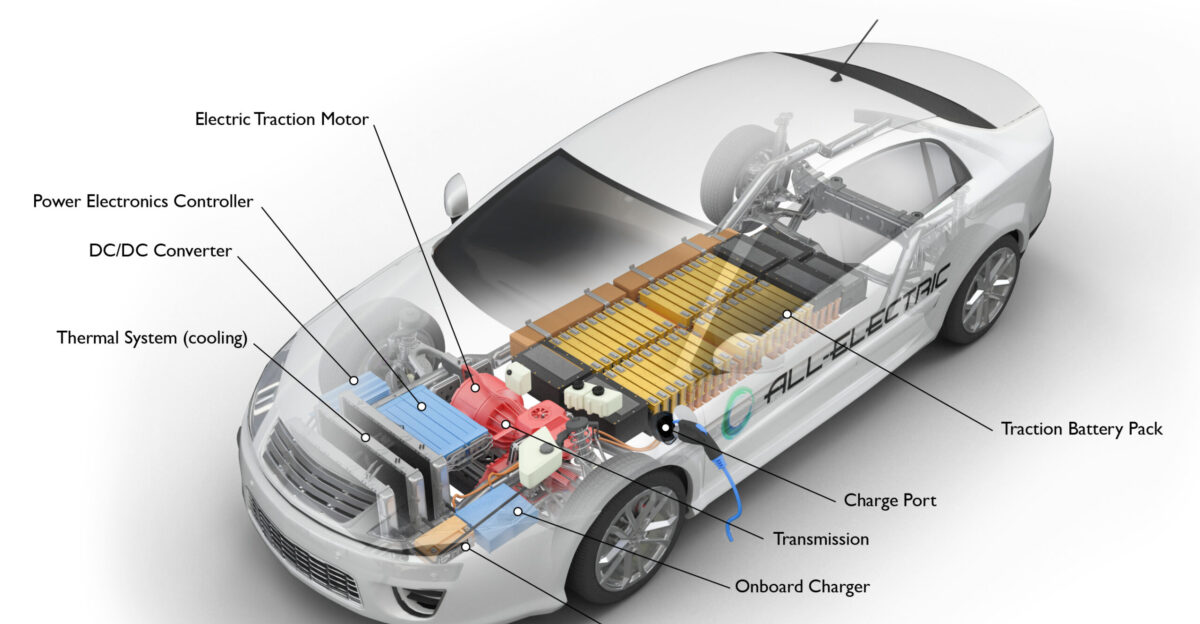

Factory Zero produces high-priced EVs—Silverado EV, Hummer EV, Escalade IQ—often selling above $100,000. GM took a $1.6 billion accounting charge in October 2025 and acknowledged that the transition to full electrification would take far longer than projected.

Human Impact Arrives Faster Than Paychecks Stop

Layoffs hit January 5—right after the holidays, during the coldest months, when heating bills peak and finances are most fragile. A worker said, “It’s Christmastime, holiday time, and people need to be working,” capturing the emotional shock of losing income during peak spending season.

UAW workers earning roughly $60 hourly in compensation face a steep fall to Michigan’s $530 weekly unemployment cap. Families have five weeks to plan, but job openings are scarce, and financial gaps are immediate.

Suppliers Experience Deeper Collapse Than Automakers

For every Factory Zero job cut, multiple supplier jobs vanish, often without severance or redeployment. One supplier saw its headcount fall from over 800 workers to around 80 in just a few months. Dana Thermal Products closed its EV battery cooling plate facility in Auburn Hills, eliminating roughly 200 jobs.

Yanfeng closes its Romulus facility on January 5, eliminating 192 jobs. International Automotive Components shuts two Michigan plastics plants, cutting 250 jobs. The collapse ripples far beyond GM’s payroll.

Battery Plants Shut Down for Half a Year

Ultium Cells—GM’s joint venture with LG Energy Solution—will suspend operations at battery plants in Warren, Ohio and Spring Hill, Tennessee, starting January 5, lasting until mid-year. Warren faces 850 temporary layoffs and 550 permanent job losses; Spring Hill sees 700 temporary layoffs.

Six-month shutdowns push workers into income gaps that unemployment often can’t bridge. Michigan’s 26-week maximum benefit runs out just as plants could restart, leaving workers exposed if reopening timelines shift.

Industry-Wide Pullback Reveals Structural Weakness

GM is not alone. Ford, Stellantis, Rivian, and Volkswagen are also scaling back EV production as post-incentive demand collapses across the sector. Ford reported significant EV sales declines in November 2025; Stellantis temporarily laid off 900 workers earlier in the year.

VW halted ID.4 production, while Rivian cut 600 workers. Far from a GM-specific misstep, the downturn suggests an industry-wide miscalculation tied to policy-driven demand rather than stable consumer adoption.

GM’s Michigan Megaproject Unravels

Factory Zero represented a core pillar of GM’s $7 billion Michigan investment. GM spent $2.2 billion converting the Detroit-Hamtramck plant in 2020 as part of its “zero crashes, zero emissions, zero congestion” vision. In 2022, GM announced its largest-ever Michigan investment—aiming to create 5,000 new manufacturing jobs.

But by late 2025, GM canceled its Orion EV conversion and will retool for gas-powered models by 2027. Workers who built EV lines now watch them being dismantled, calling it wasteful and demoralizing.

Detroit’s Local Economy Faces Multiplier Damage

Factory Zero workers earn roughly $140 million annually in wages and benefits, supporting restaurants, housing markets, retail spending, and small service businesses. Manufacturing job losses carry high economic multipliers—generating indirect losses 2.5x to 3x initial wage reductions.

Losing 1,140 high-wage workers sends shockwaves through local supply chains. Reduced spending cuts revenue for small businesses that are heavily dependent on predictable, high-discretion income.

Food Banks Prepare for Surging Demand

Detroit’s food-assistance system, already strained by SNAP disruptions and inflation, faces new pressure from newly unemployed auto workers. Mayor Mike Duggan allocated $1.75 million in emergency funding to food pantries in November 2025, opening more than 100 distribution sites.

Organizations report supply shortages and rapid depletion. Volunteers describe a “perfect storm of hungry people,” as job losses collide with high living costs, insufficient benefits, and shrinking household budgets.

Michigan’s Unemployment System Faces New Test

Thousands of claims arrive just as Michigan raises its maximum benefit to $530 weekly on January 1, 2026, with dependent allowances increasing to $19.33. Benefits last up to 26 weeks, but surges can overwhelm processing systems.

Michigan’s unemployment agency has previously struggled with backlogs during economic disruptions. Auto workers may qualify for supplementary support, but navigating systems while confronting rent deadlines is emotionally and financially taxing.

Housing Markets Face Delayed Shock

Detroit entered 2025 with optimism: 3-6% projected home price growth and 93.8% apartment occupancy. The loss of thousands of paychecks presents a new risk. Mortgage default rates lag unemployment, meaning housing stress builds quietly before surfacing visibly.

Workforce housing—once a stable source of occupancy growth—now becomes vulnerable. Landlords face vacancies, lenders confront delinquencies, and rising interest rates limit refinancing options for struggling homeowners.

Restaurants and Retailers Lose High-Spending Customers

Factory Zero employees earned wages that supported Detroit’s consumer economy. High-margin spending—restaurants, travel, retail, subscriptions—stops immediately when paychecks vanish. Small businesses already operating on slim margins face 10–15% foot traffic declines.

Consumer behavior shifts from discretionary purchases to survival priorities. Retail layoffs follow auto layoffs, amplifying the shock. Business owners reduce staff, cancel deliveries, and reinvent inventory strategies under defensive conditions.

Political Pressure Builds on State Leaders

Michigan lawmakers confront rising demands for relief programs. Governor Gretchen Whitmer criticized federal policy changes, arguing they destabilized manufacturing. The state lost 6,300 manufacturing jobs since February 2025, a decline triple the national average.

Budget negotiations reflected deep fiscal strain. Federal spending cuts removed $1.1 billion from state budgets. Leaders now weigh emergency subsidies, extended unemployment, and retraining assistance—but fund shortages limit ambitious responses.

Michigan’s EV Manufacturing Promise Stalls

Michigan positioned itself as the hub of U.S. EV manufacturing, offering large state incentives to secure investments and retrain workers. The governor’s MI Healthy Climate Plan outlined aggressive targets for infrastructure by 2030. But by late 2025, adoption rates lag targets and infrastructure gaps persist.

Charging stations cannot fix demand problems tied to $100,000 price tags and waning incentives. Workers retrained for “green jobs” now face unemployment rather than long-term careers.

EV Skepticism Morphs into Consumer Resistance

Consumer concerns long hidden beneath tax incentives resurface sharply. Surveys show 60% of potential buyers cite cost as the primary barrier; 44% worry that charging access is insufficient. The September sales spike confirmed demand was subsidy-driven, not organic.

Tesla captures roughly half of the U.S. EV market, but its dominance creates a winner-take-most environment. Lower-volume automakers struggle to compete without deep discounts or policy support.

Hybrids and Gas Engines Become Unexpected Winners

As EV momentum falters, automakers and consumers shift toward hybrids and internal combustion vehicles. Ford’s gas lineup remains strong while its EV results lag. Toyota and Honda’s hybrid-centric strategies appear prescient, prioritizing affordability and range certainty.

GM is pivoting, canceling EV conversions at Lake Orion and planning to retool for gas-powered Escalade, Silverado LD, and Sierra LD by 2027. Market signals suggest pragmatism over ideology.

Wall Street Rewrites the EV Investment Script

GM’s $1.6 billion write-down forced investors to reconsider EV growth assumptions. The company attributed slower adoption to changing federal policy and reduced consumer incentives. Tesla’s stock performance lagged the S&P 500 in 2025, while Ford’s missed targets further spooked markets.

Rivian and Lucid, once high-valuation startups, remain small in scale and unprofitable. Analysts now question whether EV adoption can ever scale without sustained subsidies.

Guidance for Workers Facing Immediate Disruption

Workers should file unemployment claims immediately to secure benefits and avoid delays. Michigan offers up to $530 weekly, plus dependent allowances, for up to 26 weeks. Mortgage lenders and landlords should be contacted proactively before payments are missed.

Job searches should extend beyond automotive, targeting healthcare, logistics, skilled trades, and advanced manufacturing. Local food assistance programs—Forgotten Harvest, Gleaners, Metro Food Rescue—provide immediate support during transition periods.

What This Means for America’s EV Transition

Factory Zero was America’s most symbolic EV facility. The fact it shed 28% of its workforce raises profound questions about the viability of the push toward electrification. Was the industry driven by sustainable demand or temporary policymaking?

Tesla’s market share suggests success is possible, but dominance creates competitive asymmetries. For legacy automakers, the transition is expensive, risky, and politically fragile. Workers face economic, geographic, and career decisions with limited safety nets.

Final Reflection: What Happens in Detroit Won’t Stay There

1,140 permanent Factory Zero layoffs are just the visible layer. Reduced hours, battery plant shutdowns, supplier collapses, and spending declines place 10,000–15,000 Detroit-area households under economic stress. Food banks strain, housing markets wobble, and consumer economies erode.

GM’s $7 billion investment is overshadowed by layoffs and a $1.6 billion write-down. “Zero emissions” becomes “zero job security” for thousands retrained for a promised future that evaporated in five years.

Sources:

Reuters; GM to take $1.6 billion charge as tax credit blow muddies EV plans (October 14, 2025)

CBS Detroit / WARN Act filings; GM permanent layoffs of 1,140 workers at Factory Zero Detroit-Hamtramck; Ultium Cells furloughs

Detroit Free Press / Michigan.gov LEO WARN notices; Dana Thermal Products Auburn Hills closure; Yanfeng Romulus layoffs; International Automotive Components Michigan plant closures

State of Michigan UIA unemployment law changes; unemployment benefits and dependent allowances