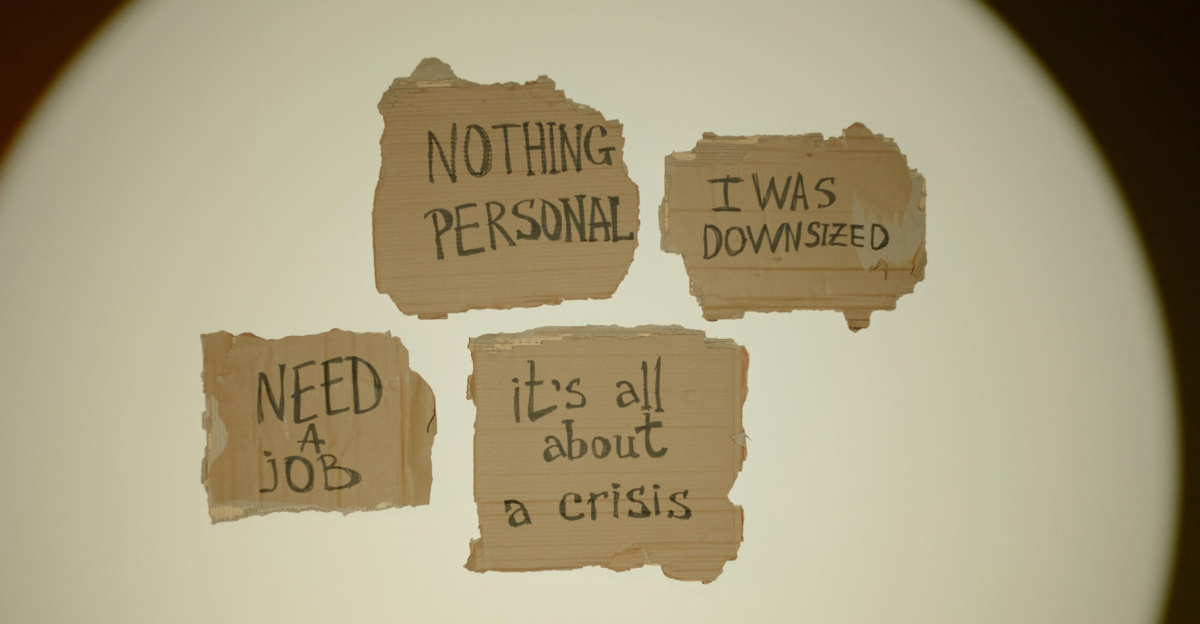

General Motors’ decision to slow down its electric vehicle (EV) ambitions is sending shockwaves through the Midwest. Nearly 3,000 factory jobs are disappearing just as the 2025 holiday season approaches. From Detroit to Ohio, thousands of union workers are now facing painful decisions, whether to move away from their homes for new assignments or deal with unemployment. Local officials warn that this setback will hurt communities already struggling from past factory closures.

The move centers on a GM plant in the Midwest worth $102 million, set to close by December 2025. That closure alone will affect about 1,700 union workers. Many will have to decide between relocating hundreds of miles or losing their jobs altogether, taking millions of dollars in wages out of the local economy.

In Detroit, GM is also laying off 1,145 workers at its “Factory Zero” electric vehicle plant, while its Ultium Cells battery facilities in Ohio are cutting around 550 positions indefinitely. Altogether, the changes will result in about 2,900 jobs lost or put on hold across GM’s EV and battery operations. Though federal rules require GM to give workers at least 60 days’ notice, that’s small comfort for families whose paychecks stop just before Christmas. Many are already cutting travel plans and holiday expenses to prepare for an uncertain future.

Electric Vehicle Slowdown Forces Strategy Change

GM’s decision reflects a slowdown in the EV market that once looked unstoppable. Electric vehicles made up more than 10% of U.S. new-vehicle sales in early 2025, but that number has since fallen. The drop came after federal tax credits, worth up to $7,500 per car, expired or changed under new government rules. Without those incentives, many buyers reconsidered the high upfront prices of EVs, leaving dealerships with unsold inventory.

In response, GM has slowed or paused its EV and battery production at plants in Ohio and Tennessee. The company also took a $1.6 billion charge related to changes in its EV plans. Despite these challenges, GM remains profitable, earning about $13 billion a year overall. Executives are now focusing on hybrid models that combine gasoline and electric power, along with tighter cost controls, while they wait for consumer demand to rebound.

CEO Mary Barra admitted that EV sales are not growing as fast as GM had hoped. The company originally aimed to sell only electric light-duty vehicles by 2035, but that goal is now uncertain. GM has cut some engineering and technical jobs as part of its restructuring. Interestingly, investors have responded positively, GM’s stock price has risen about 35% over the past year, showing confidence in the company’s shift toward profitability.

Midwest Communities Feel the Strain

The job losses are hitting hardest in places where automaking has long been the backbone of local economies. Cities like Detroit and towns such as Warren, Ohio, depend heavily on factory workers’ wages to support everything from schools to small businesses. Analysts estimate that in Michigan and Ohio alone, the recent layoffs could erase more than $100 million a year in wages. That income loss won’t just affect families, it also threatens restaurants, stores, and local contractors who rely on steady business from auto plant employees.

Small businesses near GM’s factories expect to see fewer lunchtime customers and lower sales. Local school districts are tightening their budgets since they depend partly on tax revenues linked to industrial jobs. Education officials warn that cuts to arts and sports programs could follow if new employment opportunities don’t arrive soon.

Economists note that these large-scale job losses ripple far beyond the immediate workforce. Reduced consumer spending weakens the entire community, and local governments may struggle to maintain public services if tax collections decline. For the Midwest, these effects revive difficult memories of earlier factory closures during past industrial downturns.

Union, Industry, and Future Outlook

The United Auto Workers (UAW) union is condemning GM’s decision, calling it unfair to cut so many good-paying jobs while the company continues to show strong profits. Union leaders are demanding better relocation help for workers who must move, stronger recall rights for those laid off, and renewed investment in both gasoline and electric projects in existing U.S. plants. Members are also discussing protest actions, and possibly strikes, if GM offers no additional protections.

Meanwhile, GM insists that the temporary closures and cutbacks are part of a long-term plan to balance supply with demand and prepare factories for future hybrid and EV production. Other automakers, including Ford and Stellantis, have taken similar steps, slowing or canceling some electric projects as sales growth cools. Many in the industry now believe hybrids may serve as an important bridge between traditional cars and a fully electric future.

Looking ahead, GM plans temporary shutdowns at its Ultium Cells battery plants in Ohio and Tennessee in early 2026 to upgrade equipment. Production is expected to restart by midyear, with workers receiving partial pay during the pause. Still, the region’s recovery will depend on how fast consumer demand for EVs and hybrids rebounds.

State and local leaders across Michigan and Ohio are offering tax breaks and support to attract new industries in technology and clean energy. However, outdated infrastructure and skill gaps could slow that transition. Industry analysts warn that without stronger national incentives for EVs and stable global supply chains, more job cuts may follow. For now, the Midwest’s manufacturing communities stand at a crossroads, caught between the fading promise of an all-electric future and the practical need to protect livelihoods today.

Sources:

Insurance Journal – GM EV Strategy Shifts – October 2025

The Gazette – Battery Plant Pauses – October 2025

Autobody News – Industry Supply Chain Issues – September 2025

Reuters – GM CEO Earnings Call – October 2025

UAW Official Statement – Shawn Fain on Layoffs – December 2025