In November 2025, Yanfeng Automotive Interiors, a global leader in the automotive parts industry, shocked the Michigan manufacturing heartland. The company announced the closure of its Romulus plant, signaling a massive shift in the automotive supply chain. The closure will result in 192 workers losing their jobs, causing immediate concerns in the region.

What’s driving this wave of closures in America’s automotive heartland? This decision marks a significant moment in the restructuring of the auto supply chain across the U.S.

The Supply Chain Squeeze

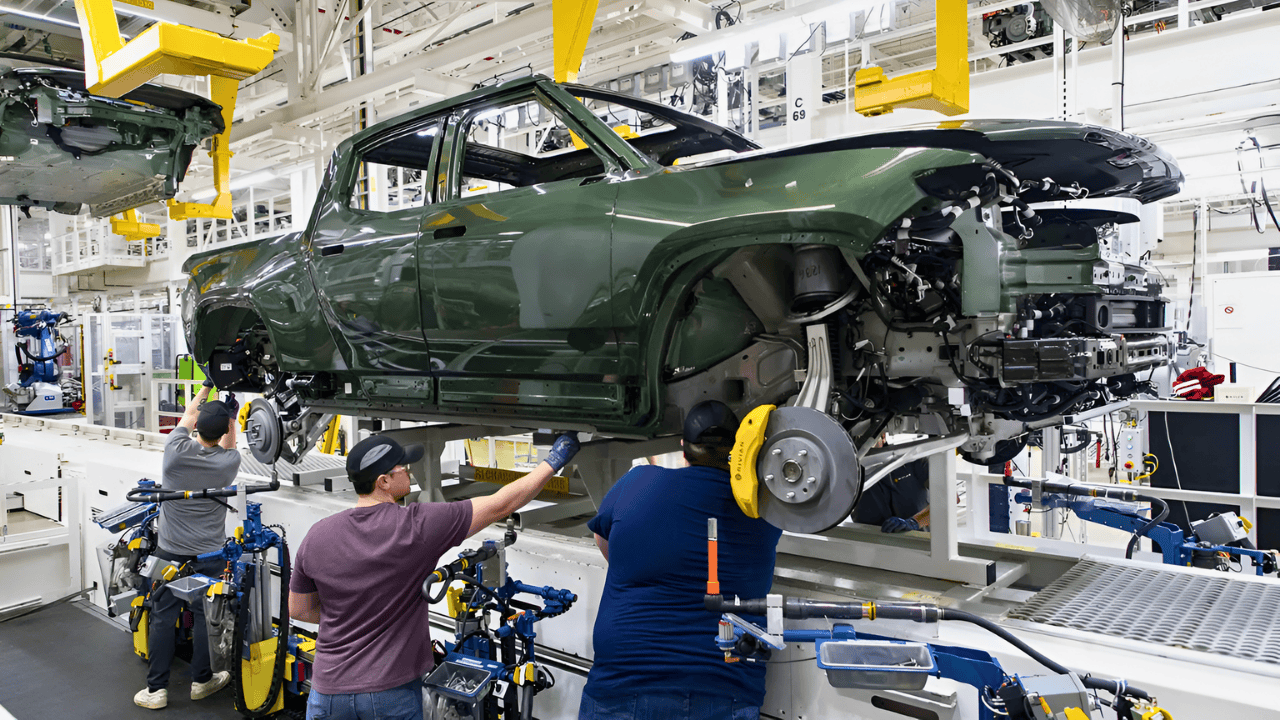

The auto industry is facing a tough reality. As demand softens and competition from lower-cost countries intensifies, suppliers are under pressure. Major manufacturers like Yanfeng are consolidating to survive, shutting down plants and cutting costs. Manufacturing employment in the U.S. has sunk by a total of 33,000 jobs throughout 2025, as the industry faces significant headwinds.

Southeast Michigan feels this pressure most acutely. With layoffs hitting just before the holiday season, thousands of workers face uncertain futures in an industry that was once a major local employer.

Yanfeng’s Global Reach

Yanfeng, based in Shanghai, China, ranks among the top 20 global automotive suppliers. With over 240 production facilities across 20 countries and approximately 57,000 employees worldwide, it generates $15 billion in annual revenue. The company’s North American headquarters is in Novi, Michigan, just 20 miles from Romulus.

Specializing in vehicle interiors, seating, safety systems, and cockpit electronics, Yanfeng has grown to a global powerhouse with more than 85 years of operational history. However, despite its vast scale, even its U.S. plants are facing the same cost pressures seen across the industry.

Legacy Plants Under Pressure

Traditional U.S. plants, designed for conventional vehicle production, are struggling with rising costs. Production costs in Michigan are 30-40% higher than in Mexico, where Yanfeng operates several facilities. As the automotive industry shifts towards electric vehicles, traditional auto parts like interior components are less in demand.

The Romulus plant, established as part of Yanfeng’s long-term North American operations, becomes a liability. Retooling it for new technologies would be far more costly than simply shutting it down, leading to the closure decision.

Yanfeng Shuts Romulus, 192 Jobs Gone

On November 7, 2025, Yanfeng filed a WARN Act notice confirming the closure of its Romulus plant by January 5, 2026. The plant’s 192 employees, including assembly operators, material handlers, and maintenance technicians, will lose their jobs.

The company has announced that the work will be moved to other Yanfeng facilities, though details about the new locations remain unclear. This is not a temporary shutdown—it’s a permanent closure that will have lasting effects on the local workforce.

Romulus Faces a Hard Hit

Romulus, a city of about 24,500 residents, relies heavily on industrial jobs. The closure of Yanfeng’s plant will have a significant impact on the local economy. Workers who typically earn wages in the automotive manufacturing sector will now face uncertainty.

While unemployment benefits will offer some relief, the broader impact on Romulus’s economy is significant. Job placement and retraining options are uncertain, leaving many workers in a precarious situation.

The Clock Ticks: Six Weeks Until Layoff

The WARN Act requires companies to provide a 60-day notice before mass layoffs, giving the Romulus workers roughly six weeks to prepare. However, the timing couldn’t be worse. The layoffs are set to take effect right after the holiday season, leaving workers with little time to find new opportunities.

As the transition unfolds, any relocation offers will be conditional, but such opportunities are rare in automotive supply plant closures. The pressure on workers is mounting.

Consolidation in Motion

Though Yanfeng hasn’t specified where the work will go, many analysts suspect it will be shifted to Mexico, where labor costs are significantly lower. This is part of a broader industry trend: major suppliers like Magna have already invested heavily in Mexican operations.

This trend of consolidating operations isn’t isolated to Yanfeng. It reflects the ongoing restructuring of the U.S. automotive supply chain, as companies prioritize cost savings over local employment.

U.S. Auto Supplier Decline

The U.S. auto supplier sector has been steadily shrinking. Multiple supplier plants have closed in recent years, and Southeast Michigan has borne much of the brunt. While electrification is reshaping the industry, many traditional auto parts suppliers are struggling to remain viable.

The shift towards electric vehicles is pushing production into new regions, leaving legacy suppliers behind. As margins continue to shrink, companies like Yanfeng are left with little choice but to close plants.

The Limitations of the WARN Act

While the WARN Act mandates companies to give workers 60 days’ notice before mass layoffs, it offers limited protection. It doesn’t require companies to provide severance pay, retraining, or relocation assistance. For the workers at Romulus, the notice is a small consolation.

Michigan’s unemployment benefits extend for 26 weeks, after which workers will find themselves in a tough position. The absence of additional support means that many will face an uphill battle in securing new employment.

The Strategic Paradox: Novi vs. Romulus

Yanfeng’s North American headquarters is in Novi, Michigan, just a short distance from the Romulus plant. Yet despite having a significant regional presence, the company is choosing to shut down the Romulus plant and move jobs elsewhere. This raises questions about Yanfeng’s long-term commitment to Michigan.

While Novi remains a hub for corporate functions, the company is shedding blue-collar jobs in Romulus. This strategic shift highlights the broader trend of cost-cutting taking precedence over local loyalty.

Global Cost Optimization Takes Precedence

Yanfeng’s parent company prioritizes global cost optimization. As a state-backed Chinese company, its leadership focuses on cutting costs and increasing efficiency. In this context, Romulus becomes a liability due to its high labor costs and aging infrastructure.

While the closure may benefit shareholders, it comes at a significant cost to Michigan workers. The company’s decision reflects the growing importance of cost optimization over local job retention.

Retraining: A Slim Hope for Workers

Michigan’s retraining programs, including the Workforce Innovation and Opportunity Act (WIOA) and Trade Adjustment Assistance (TAA), exist and offer limited financial support and career services to help workers transition to new employment. These programs are available but cannot guarantee success for all workers in transition.

Many workers will find it difficult to transition into industries like healthcare or technology. The job market in Romulus is tight, and many of the new opportunities pay far less than their previous roles in manufacturing.

Lack of Union Representation Limits Worker Power

The Romulus plant is not unionized, leaving workers with minimal bargaining power. While unions like the UAW have fought plant closures for years, they’ve struggled to prevent these layoffs in non-unionized plants. Yanfeng made the decision to close Romulus unilaterally, without negotiating with workers.

With no union representation, Romulus employees have few options for recourse. The company’s offer of relocation opportunities is vague and unlikely to provide real solutions.

What’s Next for Michigan?

Will Yanfeng eventually leave Michigan entirely, or will it shift its focus to the electric vehicle market? The uncertainty surrounding the company’s future is compounded by Michigan’s lack of industrial policies to protect workers. As Michigan struggles to keep manufacturing jobs, the closure of Romulus represents a larger challenge facing the Midwest.

The region must adapt to these changes or risk further job losses and economic decline in its manufacturing base.

Sources:

Michigan Department of Labor and Economic Opportunity – WARN Notice Filing (November 7, 2025)

CBS News Detroit – Global auto supplier to lay off 192 workers at Southeast Michigan plant (November 24, 2025)

Detroit Free Press – Romulus auto supplier announces layoffs. When jobs cuts take effect (November 24, 2025)

CBS News National – The U.S. is losing thousands of manufacturing jobs (September 9, 2025)

Wikipedia – List of the largest automotive suppliers (May 2023, updated regularly)

U.S. Department of Labor – WARN Act FAQ (Ongoing resource)