GameStop is racing to shrink its store network as gaming keeps moving online, and the speed of the downsizing is now reshaping communities, careers, and the company’s future.

At the same time, CEO Ryan Cohen’s new pay package ties his compensation entirely to dramatic performance goals, raising questions about whether aggressive cost-cutting is being rewarded more than long-term growth.

Store Closures Surge

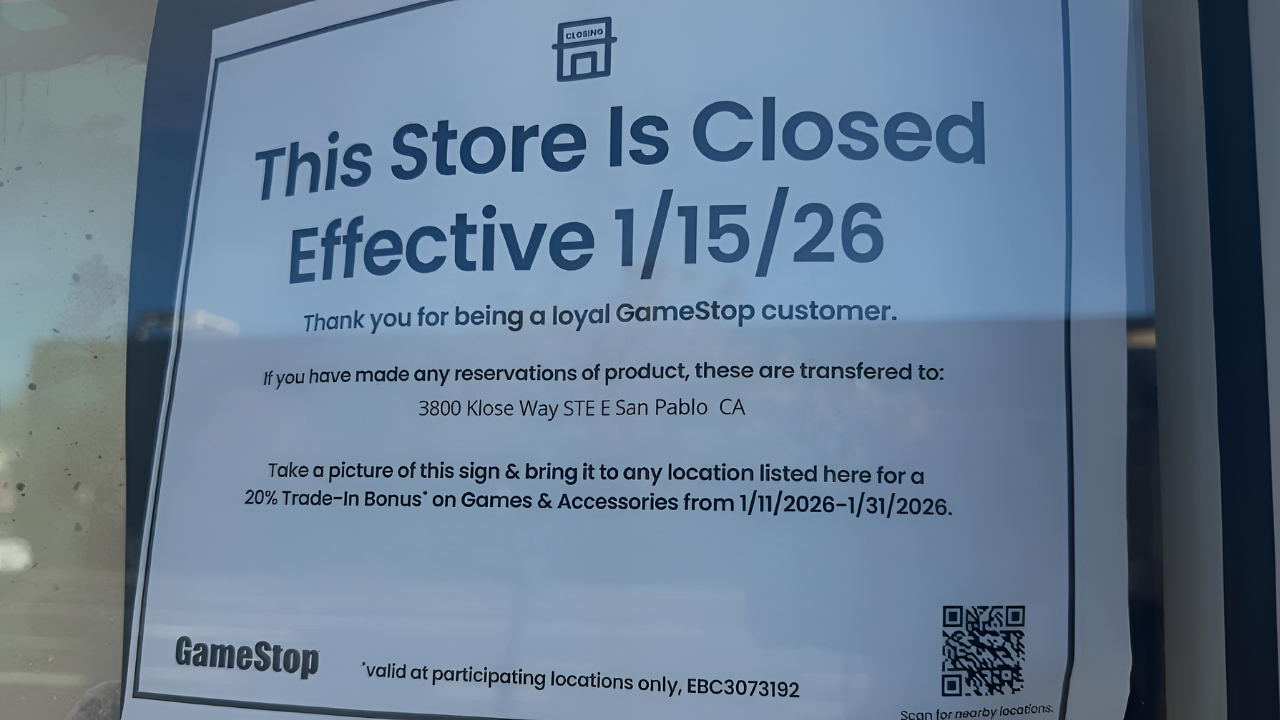

GameStop, the Texas-based video game chain once known for packed midnight launches, is now in the midst of its sharpest pullback in the U.S. to date. Recent tallies suggest roughly 400 to 410 American stores are closing or already closed heading into 2026, on top of about 590 U.S. locations shut in its last fiscal year.

That means more than 1,000 stores worldwide have disappeared in roughly two years, cutting the chain’s global footprint by about half compared with its peak earlier in the last decade. The company calls this a “store portfolio optimization review,” which is corporate shorthand for closing outlets that no longer make financial sense as more players buy games digitally instead of on discs.

Massive Layoffs Loom

Behind every darkened storefront are workers who may soon be out of a job, and GameStop’s new round of closures is expected to cost thousands of people their livelihoods across the United States. Analysts and local reports indicate that employees in more than 40 states are being affected, from suburban malls in Florida to strip centers in California and small-town outlets in the Midwest.

Many store staff first learned their locations were closing from signs on the door, a jarring discovery that left some scrambling to find answers for customers even as they processed the news themselves. GameStop has not publicly released a full list of affected sites, leaving workers to rely on internal messages and community‑run closure trackers.

Gaming Retail Struggles

GameStop’s crisis is part of a broader shake‑up in video game retail, as physical stores lose ground to downloads and subscription services. The chain once operated thousands of locations around the world and dominated the market for new and used games, but that model has been eroded by digital storefronts built into consoles, PC platforms like Steam, and cloud gaming services.

Over 1,000 U.S. closures across 2024 to early 2026 mark the steepest two‑year contraction in the company’s history, a shift that would have been unthinkable during the early 2010s when midnight releases wrapped lines around the block.

Digital Tide Rises

The economic logic driving GameStop’s cuts is straightforward: consumers are rapidly choosing digital purchases over physical discs, and the numbers are shifting faster than many retailers can adjust. Digital downloads offer instant access, no shipping delays, and no risk of items selling out, while cloud saves and online libraries make players less concerned about owning a boxed copy on their shelves.

As publishers lean into digital releases and recurring revenue from in‑game purchases, physical retailers are left with fewer must‑have launches to draw customers through the doors. GameStop has tried to adapt by focusing on preorders and concentrating inventory in higher‑traffic locations, but that leaves smaller or lower‑volume stores looking empty and uninviting, making them prime candidates for closure.

CEO Award Unveiled

Even as stores disappear, the company’s board has set an extremely ambitious incentive plan for CEO Ryan Cohen, linking his pay entirely to performance. In a January 7, 2026 filing, GameStop disclosed that Cohen’s compensation would consist solely of stock options that vest only if the retailer hits a series of steep market‑value and profit milestones, ranging from a $20 billion market capitalization up to a staggering $100 billion.

The award also ties payouts to cumulative performance EBITDA targets between roughly $2 billion and $10 billion, raising the stakes for how efficiently the company is run over time. Reporting by outlets that reviewed the plan notes that it echoes high‑risk, high‑reward packages seen at tech firms, with no base salary or guaranteed bonuses.

Nationwide Closures Hit

The closures are not isolated to one region: they are sweeping across the country, reshaping shopping centers from coast to coast. Community‑run tracking sites and local reports list around 400 or more GameStop stores slated to close in 2026, covering at least 42 states and including high‑profile locations in major malls and neighborhood plazas. States such as California, Texas, Florida, New York, and Pennsylvania appear repeatedly on unofficial lists, reflecting both their large retail footprints and the heavy concentration of gaming customers there.

Remaining inventory from shuttered shops is often shifted to nearby locations or sold off quickly, while landlords quietly start searching for replacement tenants to fill the empty spaces.

Workers’ Harsh Reality

For workers, the financial strategy behind these decisions translates into unpaid bills, disrupted routines, and sudden job hunts. Many employees are part‑time staffers or early‑career workers who depend on steady hours, and the loss of a store can mean losing both income and a place in the tight‑knit communities that often form around gaming shops.

Some have been offered transfers to remaining locations, but those moves can require longer commutes or schedule changes that are not feasible for staff with families or second jobs.

Rivals Gain Ground

As GameStop retreats, rivals with stronger digital infrastructure and broader product mixes are moving to fill the gap. Online powerhouses like Amazon already dominate digital and physical game sales, while big‑box chains such as Walmart and Best Buy offer games alongside groceries, electronics, and household goods, making them more convenient one‑stop destinations.

These competitors can spread costs across huge networks and use data from online storefronts to fine‑tune inventory, giving them an advantage that a specialty retailer like GameStop struggles to match. With each GameStop closure, a prime retail spot opens for rivals or for other categories entirely, from cell phone carriers to discount chains.

Valuation Gap Exposed

The scale of Cohen’s incentive package stands in stark contrast to GameStop’s current financial profile, and that gap is fueling debate on Wall Street. Recent market data places the company’s value at around $9 to $10 billion, a figure far below the $100 billion market cap threshold embedded in the CEO’s stock‑option plan.

GameStop’s latest earnings reports show pressure on revenue from declining physical game sales and a notable miss versus analysts’ expectations, even as cost cuts have helped stabilize profitability. In the most recent quarter, the company generated about $821 million in revenue, short of forecasts, amid weaker demand for core physical products.

Record Contraction Pace

Whatever the long‑term plan, the present reality is that GameStop is shrinking faster than at any point in its history. The closure of roughly 590 U.S. stores in the prior fiscal year, followed by early‑2026 estimates of more than 400 additional shutdowns, puts the company on track to erase nearly half its domestic footprint in a very short window.

Retail experts note that such rapid downsizing is more common in bankruptcy restructurings than in companies that remain profitable on paper, underscoring how aggressively GameStop is repositioning itself. Supporters argue that cutting weak locations now could leave a leaner, more efficient chain better suited to survive in a digital‑first world.

Employee Backlash Builds

As the job losses mount, frustration is turning into organized pushback from workers and some customers. Petitions, social media campaigns, and small protests outside closing stores have called attention to abrupt shutdowns and the contrast between front‑line layoffs and the generous upside promised to top leadership.

Some long‑time employees and fans say they feel betrayed by a company they supported through the meme‑stock surge of 2021, when retail investors rallied around GameStop as a symbol of defiance against Wall Street.

Cohen’s Leadership Shift

Ryan Cohen’s rise from activist investor to chairman and then CEO has defined GameStop’s strategy since 2021, and his latest pay package cements his central role in the company’s fate. Cohen, who made his fortune founding pet‑supply e‑commerce firm Chewy, owns a significant personal stake in GameStop and presents himself as a champion of shareholders pushing for a leaner, more tech‑driven business.

Supporters say his decision to accept no base salary and to rely entirely on performance‑based stock options shows confidence in his turnaround vision and aligns his incentives tightly with investors. Critics counter that linking such a large potential payout to market cap and EBITDA could encourage aggressive cost cutting, from store closures to staffing reductions, rather than investments in innovation.

Cost‑Cut Strategy Emerges

Taken together, the store closures, restructuring moves, and CEO award reveal a strategy that leans heavily on tightening costs and boosting profitability metrics. GameStop’s filings and earnings discussions emphasize improving cash flow, trimming underperforming assets, and focusing resources on a smaller base of higher‑volume stores and digital initiatives.

By shuttering weaker locations and reducing store‑level expenses, the company can lift its earnings before interest, taxes, depreciation, and amortization, a key measure tied directly to Cohen’s potential payout. At the same time, management has highlighted GameStop’s strong cash position and relatively low debt as cushions that allow it to be more aggressive in reshaping the business.

Skeptics Question Odds

Despite the bold narrative of a transformation, many analysts doubt that GameStop can realistically hit the sky‑high targets embedded in its CEO’s award, given the structural changes in how people buy and play games. Digital platforms run by console makers and tech giants increasingly control the relationship with players, leaving third‑party retailers with less leverage and fewer exclusive offerings.

Even with store closures and cost savings, the company still faces declining physical sales and strong competition across both hardware and software categories. Research notes describe the $100 billion market‑cap goal as “extremely ambitious,” a phrase that in Wall Street language borders on skeptical.

Future Uncertain

GameStop now stands at a crossroads, with fewer stores, a high‑stakes CEO pay plan, and an industry that keeps moving further into the cloud. Shareholders are watching to see whether Ryan Cohen can leverage his e‑commerce experience to build new revenue streams and turn a leaner GameStop into a sustainable business, rather than a shrinking relic of the disc‑era.

For workers and communities losing stores, the questions are more immediate: what jobs will replace those that vanish, and what happens to local hubs where gamers once gathered in person? Analysts say the company’s next few years will test whether any specialty retailer can reinvent itself in a world where the most popular games are bought, updated, and often streamed entirely online.

Sources:

Fast Company, GameStop closing stores 2026: list of doomed locations grows, January 6 2026

The Verge, GameStop is kicking off 2026 by shutting down over 400 stores in 42 states, January 11 2026

Military.com (republishing GameRant), GameStop is Closing Hundreds of Stores In January 2026, January 8 2026

Retail Dive, GameStop floats CEO pay entirely tied to performance, January 6 2026

Investing.com, GameStop announces performance-based stock option award for CEO Ryan Cohen, January 8 2026

Polygon, GameStop shutters hundreds of stores as CEO gambles on $35B payday, January 8 2026