GameStop’s latest retrenchment underscores how quickly the video game business is leaving physical retail behind. The company is starting 2026 by closing an estimated 300 to 500 U.S. locations in January alone according to early reports and crowdsourced tracking, eliminating roughly 1,800 to 3,000 jobs, often with only days of warning for store staff. The cuts are part of a larger plan to shrink its global footprint from about 6,000 outlets to 3,200, one of the most aggressive one‑month closure waves in GameStop’s 42-year history. The move will reshape shopping centers and main streets across the country and further weaken a long‑familiar presence in gaming culture.

Digital Dominance and GameStop’s Business Squeeze

The forces driving these closures have been building for years. Digital distribution now generates about 95% of global gaming revenue, through downloads, subscriptions, and streaming access rather than discs and cartridges. As players increasingly buy games directly from console and PC platforms, in-store purchases have steadily eroded.

Industry headwinds compound GameStop’s problems. Hardware sales are down more than 30% year over year and software revenue has fallen over 25%, pressuring a retailer still heavily dependent on selling consoles, games, and accessories. The company has built a large financial cushion, holding about $8.8 billion in cash and marketable securities and more than $500 million in bitcoin, yet its sales continue to slide. A 4.6% revenue decline in the third quarter of 2025 underlined that a strong balance sheet has not reversed the shift toward digital consumption.

On Wall Street, sentiment has turned sharply. GameStop’s share price has dropped 36% over the past year and is down about 95% from its meme‑era intraday peak of $483. Analysts increasingly recommend avoiding the stock, saying its emphasis on physical locations and crypto assets is unlikely to counter structural changes in how players get games.

Communities, Workers, and a Changing Retail Map

For many customers, GameStop has been more than a place to buy games. Stores doubled as informal gathering spaces where fans traded used titles, discussed new releases, and browsed retro consoles and collectibles. As locations disappear, that social dimension of the hobby becomes harder to find in person, especially for younger players who may never experience a dedicated game shop in their own neighborhood.

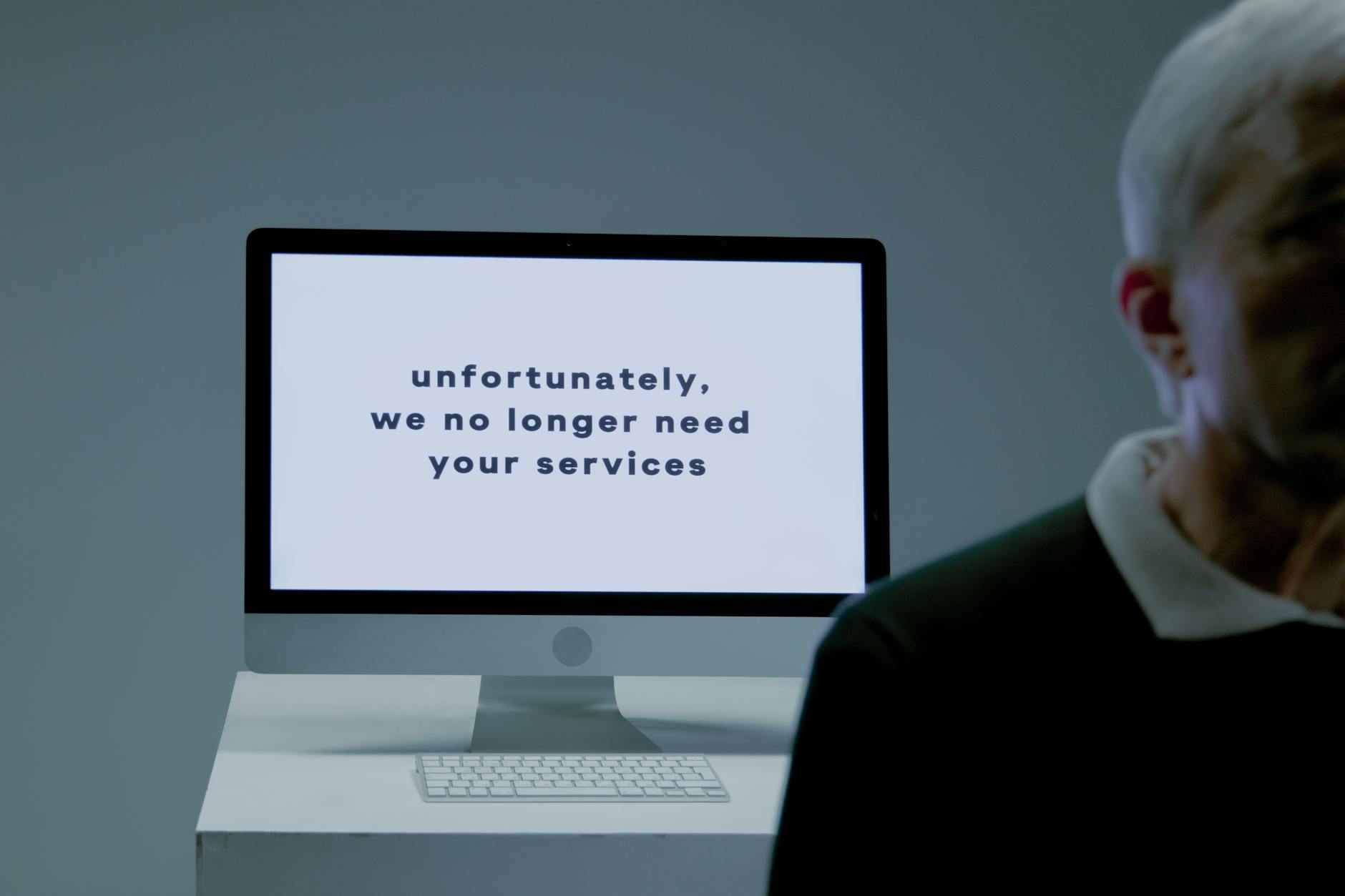

The closures carry a clear human cost. Thousands of employees are directly affected, with some receiving only brief notice before their store shuts down. The impact is especially pronounced in small towns and rural areas, where retail jobs are limited and a GameStop can serve as both employer and community touchpoint. Retraining programs are available in some regions, but access is uneven, and many workers must weigh relocating, changing industries, or piecing together part‑time work.

Local governments are also feeling the strain. In places like Grapevine, Texas, where GameStop is headquartered, officials are watching for the combined effect of reduced commercial tax revenue and the loss of retail anchors in malls and shopping centers. Some states are exploring workforce development grants and retraining subsidies to help displaced employees transition, while landlords search for new tenants to backfill prominent storefronts.

Winners in the Digital and Local Transitions

As a large chain pulls back, the broader retail and technology landscape is adjusting. Big-box stores such as Best Buy now face fewer national competitors focused on gaming hardware, even as they reconsider how much floor space to devote to physical games. At the same time, independent shops and specialty retailers are stepping into the gap. Some, like regional collectibles stores and game boutiques, are recruiting former GameStop staff for their expertise and customer relationships.

Beyond traditional retail, smaller businesses in other sectors are benefiting from the real estate churn. Vacant GameStop spaces are being re‑leased for gaming cafés, fitness studios, and local hobby shops, reshaping the tenant mix in many malls and plazas. In this environment, niche stores that emphasize retro titles, trading cards, and memorabilia are drawing enthusiasts who still want a tactile, in‑person experience alongside their digital libraries.

In the digital realm, subscription and cloud services are clear beneficiaries. Platforms such as Xbox Game Pass, PlayStation Plus, Nintendo Switch Online, and PC-focused services like Steam, Epic Games, and GOG are expanding catalogues and experimenting with cloud technology, pulling more players into ecosystems where purchases and play sessions rarely involve a physical store. As these offerings grow, they reinforce the trend away from discs and cartridges and make it harder for brick‑and‑mortar retailers to compete on selection or convenience.

A Global Retreat and Debates About the Future

GameStop’s retrenchment is not limited to the United States. The company closed 69 stores in Germany in early 2025, cutting about 500 jobs, and has already exited several European markets, including the sale of its operations in Italy. In countries where digital infrastructure is less developed, the departure of an international chain leaves room for local competitors and regional retailers to expand. Still, adoption of mobile and cloud gaming is accelerating worldwide, suggesting that even these markets are likely to follow the digital trajectory over time.

The broader shift raises lifestyle and environmental questions. As more game purchases occur online, fewer people visit stores, contributing to reduced foot traffic and greater reliance on home-based leisure. Gaming cafés and esports venues may emerge as new hubs for in‑person interaction, but the traditional model of a dedicated game shop is fading. On the environmental front, some observers see fewer stores and less shipping of boxed games as a climate positive. Others point out that large data centers and the hardware needed for cloud and digital libraries consume significant energy and generate electronic waste, complicating any simple assessment of digital gaming as greener.

GameStop’s rapid contraction offers a visible marker of where the industry is heading. Over the next few years, the landscape is likely to consolidate around major technology platforms, online marketplaces, and specialized boutiques that cater to collectors and enthusiasts. For GameStop, continued closures and an emphasis on digital initiatives represent an effort to adapt before its legacy model becomes unsustainable. For communities, workers, and players, the outcome will help define what buying and experiencing games looks like in an increasingly download‑driven era.

Sources:

“GameStop closing stores 2026: list of doomed locations grows.” Fast Company, 6 Jan 2026.

“GameStop Discloses Third Quarter 2025 Results.” GameStop Corp. Investor Relations, 8 Dec 2025.

“GameStop buys bitcoin worth $513 million in crypto push.” Reuters, 28 May 2025.

“Digital to make 95% of video game revenues in 2023, or $174.5 billion.” TweakTown, 22 Dec 2023.