A survey reported by North Carolina Health News found that three out of four people in North Carolina are concerned about receiving surprise medical bills. Nearly one-third of them must use credit cards to pay for their healthcare costs.

An analysis by KFF showed that before Medicaid expansion, 13 percent of adults in the state had medical debt. Few expected the significant change quietly developing to address this issue.

Collection Nightmare

A Duke Law School study commissioned by the NC Treasurer found that from 2017 to 2022, North Carolina hospitals sued 5,922 patients, winning $57.3 million in judgments, averaging $16,623 each.

In August 2023, the report revealed that interest added $20.3 million—35 percent of the total—with some patients facing over ten years of 8 percent annual interest.

Systemic Inequity

The Duke Law study found that five hospital systems filed 96.5 percent of medical debt lawsuits in the state. Nonprofits started over 90 percent of these lawsuits, despite their tax-exempt status.

The NC Treasurer’s report revealed markups averaging 480.5 percent above Medicare rates, while the hospitals provided less charity care than the value of their tax breaks.

Federal Foundation

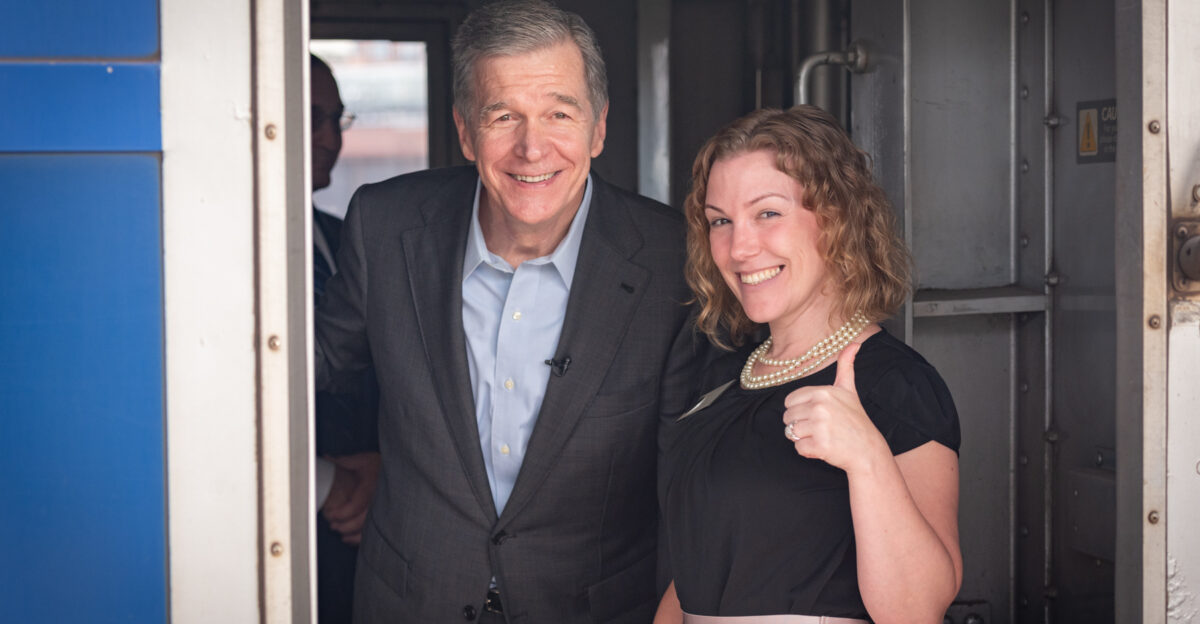

Governor Cooper announced that North Carolina expanded Medicaid on December 1, 2023, becoming the 40th state to do so.

The expansion allows adults earning up to $20,000 a year to qualify, providing financial support for significant debt relief.

Breakthrough Announced

On July 26, 2024, the Centers for Medicare and Medicaid Services approved North Carolina’s Medical Debt Relief Program, linking hospital debt forgiveness to Medicaid payments.

Governor Roy Cooper announced on August 12 that all 99 eligible hospitals agreed to erase over a decade of debt.

Regional Scale

In August 2024, Governor Cooper said over 137,000 people in Mecklenburg County qualified for relief.

NCDHHS data showed that rural areas gained 217,000 new members who received Medicaid coverage and debt forgiveness. This program reached nearly all of North Carolina.

Lives Transformed

“This is a miracle that arrived at the right time,” Nicolas M. of Winterville told ECU Health and Undue Medical Debt, noting he owed nearly $32,000.

KFF Health News profiled Tom Burke, severely injured in a 2019 car crash, who faced over $10,000 in bills that destroyed his credit and forced his family into temporary homelessness when mortgage companies denied them.

National Comparison

In July 2025, Arizona Governor Katie Hobbs announced that her state used federal rescue funds to eliminate $429 million in debt for 352,000 residents.

Meanwhile, Michigan Governor Whitmer introduced $144 million in relief. Unlike North Carolina’s Medicaid model, these states paid off debt directly. A December 2024 Budget Equity Report showed that no other state has North Carolina’s hospital payment structure.

National Context

A February 2024 KFF analysis found that Americans owe at least $220 billion in medical debt. About 14 million adults, or 6 percent of the population, have debts over $1,000.

Research from the Cornell ILR School shows that medical bills account for 66.5 percent of personal bankruptcies, with approximately 530,000 Americans filing each year due to medical expenses or illness-related work loss.

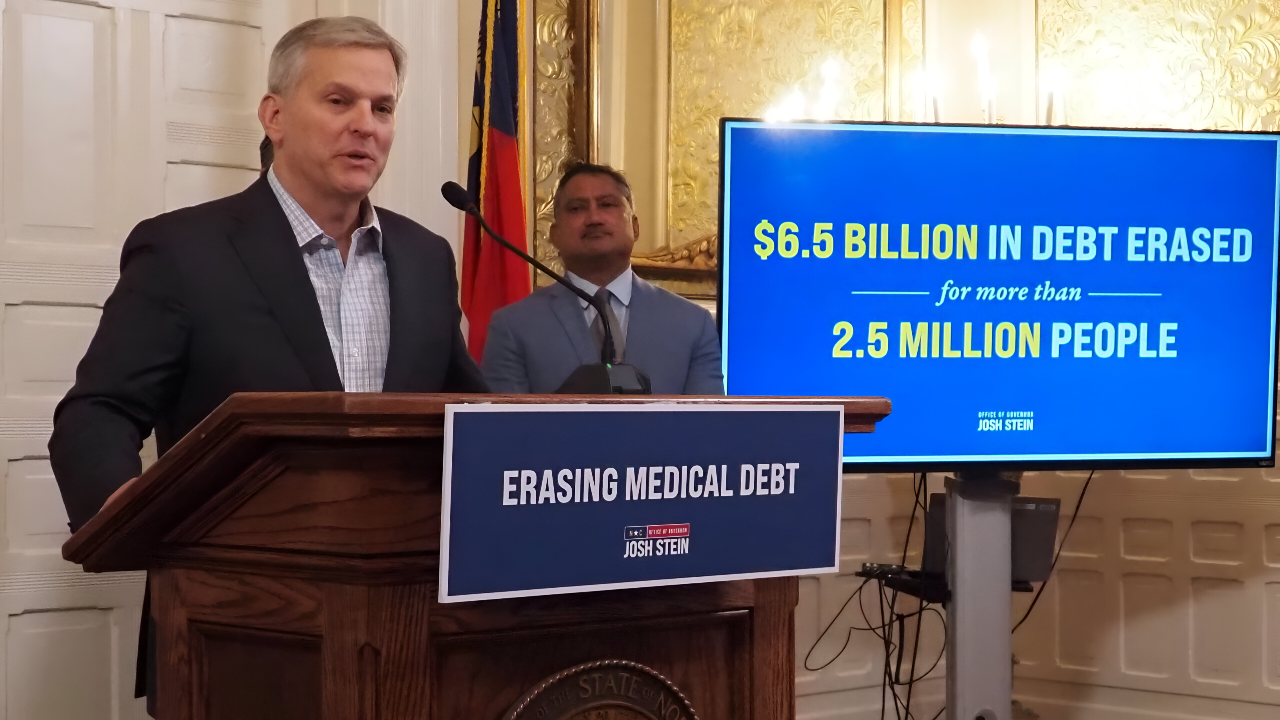

Full Scope

Governor Josh Stein announced on October 13, 2025, that a program had removed $6.5 billion in medical debt for 2.5 million residents. This exceeded the goal of $4 billion for 2 million people.

The North Carolina Department of Health and Human Services confirmed that hospitals forgave debts dating back to January 1, 2014.

Hospital Calculus

North Carolina Health News reported in August 2024 that major systems, including Atrium, Duke, and Mission Health, initially hesitated before the deadline.

The NC Treasurer’s investigation found Atrium had sued 2,482 patients from 2017 to 2022, stopping only in early 2023. Enhanced Medicaid payments, which add billions of dollars annually, ultimately outweighed concerns about forgiving uncollectible debt.

Implementation Partner

AP News confirmed that North Carolina has partnered with Undue Medical Debt, a nonprofit that has abolished over $15 billion in medical debt nationally since 2014.

The organization stated that it sent 255,000 notification letters in October 2025, informing recipients that their debt had been cancelled with no tax consequences and would be removed from their credit reports.

New Requirements

North Carolina Health News detailed that hospitals must automatically enroll eligible patients in charity care and stop reporting medical debt to credit agencies.

NCDHHS requirements mandate 100 percent discounts for patients at or below 300 percent of the federal poverty level—$93,600 for a family of four—and caps interest at 3 percent.

Cost Debate

Joseph Harris of the John Locke Foundation told Carolina Journal he questioned whether the program shifts costs rather than eliminates them, describing it as a circular funding approach where federal taxpayers absorb unpaid bills.

Healthcare policy experts countered to NCDHHS that the debt was already uncollectible, with hospitals expecting to recover only pennies on the dollar.

Future Expansion

NCDHHS announced in February 2025 that the Healthcare Access and Stabilization Program generates nearly $6.5 billion in gross revenue from July 2025 through June 2026, creating ongoing funding that could support continued debt relief.

Other states are studying North Carolina’s approach, with NCDHHS publishing a toolkit for replication.

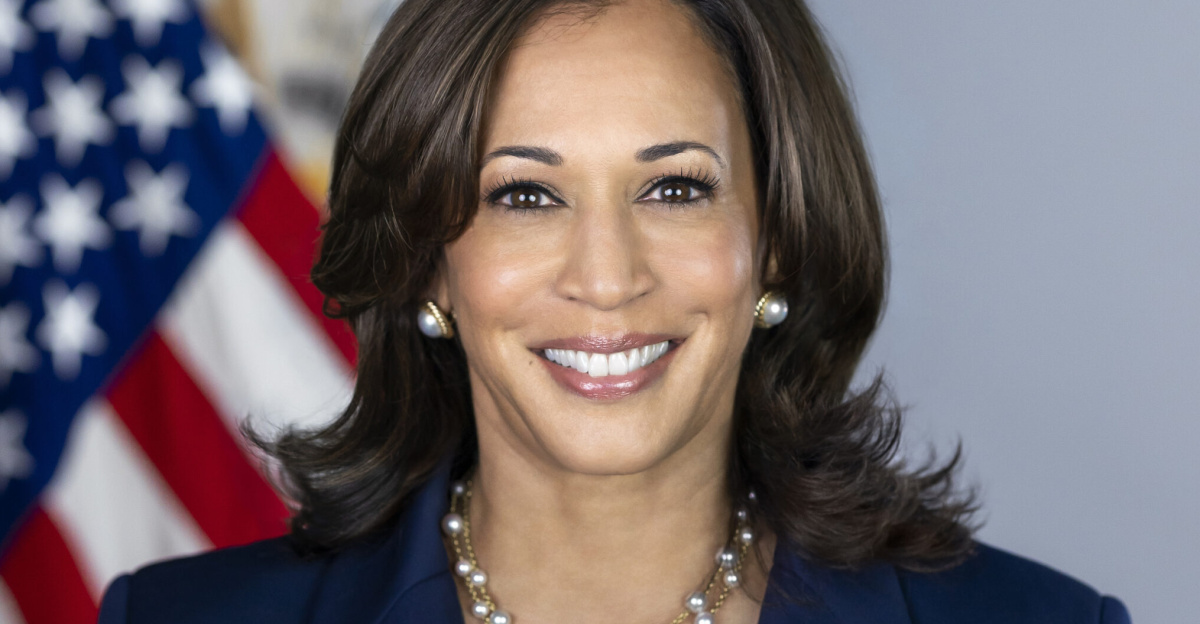

Political Context

A January 2025 White House fact sheet outlined Vice President Kamala Harris championing medical debt relief as a 2024 campaign priority, proposing to remove all medical debt from credit reports.

However, Undue Medical Debt reported that in July 2025, a federal district court vacated the CFPB’s credit reporting rule, leaving 15 million Americans with $49 billion in medical debt that still affects their credit scores.

Medicaid Mechanics

KFF’s September 2025 Medicaid financing analysis explained that state-directed payments allow states to direct Medicaid managed care organizations to make specific payments to providers, subject to CMS approval.

The federal government matches the expansion of populations at a rate of 90 percent. The American Academy of Actuaries noted North Carolina leveraged this to draw down federal dollars without state appropriations.

Federal Requirements

A 2024 American Medical Association report highlighted that the Affordable Care Act requires tax-exempt hospitals to maintain written financial assistance policies and limit charges before sending bills to collections.

North Carolina Health News reported that the state’s program exceeded these requirements by mandating automatic enrollment in charity care and prohibiting the sale of debt to collectors entirely.

Collection Reversal

North Carolina Health News reported in October 2024 that by September, Atrium Health began canceling old judgments and lifting liens against thousands of patients whose homes had been encumbered for years.

Four other major systems followed, marking what Governor Stein described as a dramatic reversal from aggressive collection practices that had defined North Carolina hospital finance for decades.

Lasting Impact

Governor Stein’s October 2025 announcement indicated that recipients averaging $2,600 in debt relief will see improvements beyond their credit scores—reduced financial stress, restored access to preventive care, and liberation from the fear that had kept many from seeking treatment.

KFF analysis and AP News reporting suggest that whether this signals a fundamental reimagining of how America addresses medical debt depends on whether others follow North Carolina’s lead.