America’s semiconductor industry has reached a breaking point. Once dominated by Intel, U.S. chipmakers now lag Asian rivals.

Taiwan’s TSMC alone holds roughly 64% of global foundry capacity.

Intel’s revenues and profits have cratered amid fierce competition, and its stock has plunged (losing about 60% of its value in 2024).

This slump comes as chips become central to everything from F-35 jets to smartphones.

The United States faces an unprecedented national-security risk: ceding cutting-edge chipmaking is akin to surrendering a strategic asset, and the clock is ticking.

Hemorrhaging Losses

Intel’s financial woes deepened in 2025. In Q2 2025, the company reported a $2.9 billion loss, following another loss in Q1.

Investors have fled: the stock crashed from roughly $50 to under $20 per share (about a 60% drop).

Billions in shareholder value have evaporated. Industry analysts note that with costs still high and revenue stagnant, Intel can’t afford more missteps.

One veteran investor warns that only a focused, decisive strategy can stop the bleeding – anything less risks a death spiral for the U.S. chip champion.

Silicon Sovereignty

U.S. chipmaking dominance has all but vanished. In 1990 America made ~37% of global chips; today that’s down to around 10%.

By contrast, Taiwan (via TSMC) produces the vast majority of cutting-edge chips. This lopsided shift leaves America strategically vulnerable.

A 2022 CSIS report bluntly warns that if an adversary overtakes U.S. semiconductor capabilities or cuts off access to advanced chips, it “could gain the upper hand in every domain of warfare”.

Dependence on foreign fabs isn’t just an economic issue — it could tilt future conflicts.

Manufacturing Exodus

Amid this crisis, Intel has been scaling back its own fab ambitions. The company now openly warns that if it fails to secure external customers for its next-generation 14A node, it may abandon leading-edge manufacturing entirely.

Which means scrapping plans for America’s last hope of homegrown advanced chips. Intel has already slowed or halted projects abroad (ditching German and Polish fabs) and is in no hurry on its Ohio plant.

Each day Intel delays, U.S. high-tech firms grow more dependent on Asian foundries — a gap that will widen if 14A disappears.

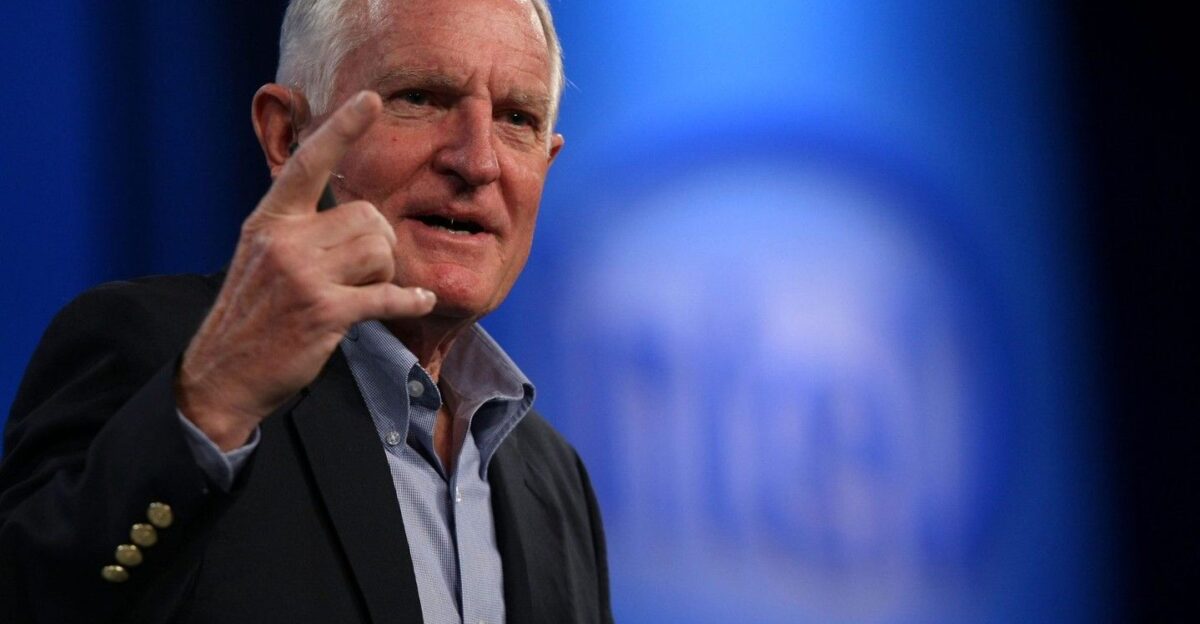

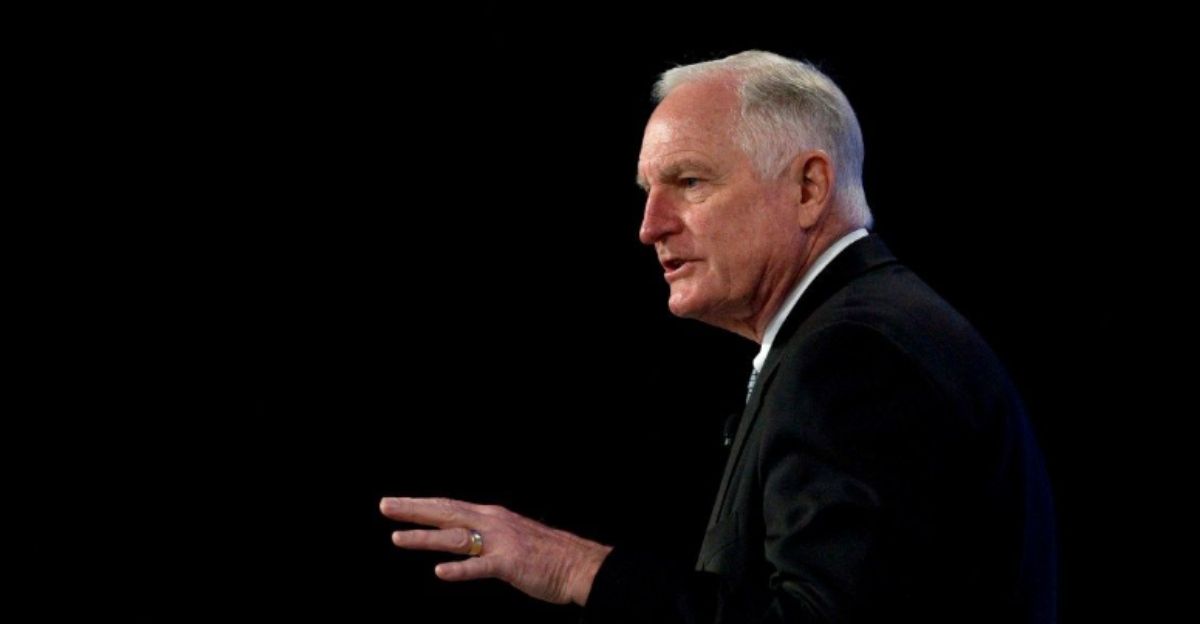

Barrett’s Battle Cry

Into this breach stepped former Intel CEO Craig Barrett. In a fiery August 2025 Fortune op-ed, Barrett – who led Intel during its Pentium-era glory – warned that U.S. tech sovereignty is at stake.

He bluntly declared that without a massive cash infusion, Intel would lose the chip war. “The only place the cash can come from is the customers,” he wrote, proposing that Intel’s eight largest clients (like Apple, Google, Nvidia) each put up $5 billion in exchange for guaranteed U.S. supply.

Barrett minced no words: he called the current management’s cautious strategy “a joke,” arguing that dramatic action is long overdue.

(As Barrett notes, Nvidia and Apple literally build their products on Intel’s chips — they have a vested interest in its survival.)

Regional Collapse

Intel’s retreat is already rocking America’s heartland. The company plans to end 2025 with about 75,000 core employees – down from roughly 99,500 at the end of 2024.

In other words, about 24,000 jobs are vanishing, on top of earlier cuts. Major projects are on ice: Intel has scrapped a German fab and delayed an Ohio plant, reallocating some operations overseas.

Cities in Arizona, New Mexico, and Oregon that bet on new Intel factories now face harsh uncertainty.

Family budgets and local economies are fraying, even as national leaders argue over who should fund the turnaround.

Worker Exodus

Within Intel, morale is low. CEO Lip-Bu Tan’s memo to staff put it starkly: “There are no more blank checks. Every investment must make economic sense,” he wrote.

Gone are the days when Intel would pour money into risky projects without question.

A longtime engineer in Oregon described “mounting anxiety” on the factory floor as rumors of layoffs spread.

Even managers admit they’re running on “survival mode,” cutting costs at every turn. For many workers, the sense of betrayal is palpable: one veteran recalled that Intel once boasted it would bankroll every next-gen chip, but now even promised fabs are uncertain.

TSMC’s Dominance

Meanwhile, TSMC looms larger than ever. In late 2024, it held about 64% of the world’s contract foundry market, far more than any single company.

It manufactures Apple’s A-series chips, Nvidia’s GPUs, AMD’s CPUs – practically all the high-end gear for today’s tech giants. Its new U.S. fabs (like the one in Arizona) will help, but won’t reach full volume for years.

Industry forecasters note that TSMC’s Arizona plant is essentially booked solid through 2027.

In the meantime, American firms continue to rely on chips flown in from Asia, especially during this frantic AI boom when every high-performance chip is hotly contested.

Supply Chain Vulnerability

The shortage isn’t just inconvenient; it’s dangerous. The U.S. military depends on advanced chips built in Taiwan for hypersonic missiles, drones, satellites, and the F-35 fighter jet.

In a worst-case scenario — say, a Chinese invasion of Taiwan — the U.S. could lose access to the most sophisticated semiconductors overnight.

Defense analysts caution that this could cripple American systems.

As one CSIS study notes, an adversary that cuts off U.S. access to cutting-edge chips “could gain the upper hand in every domain of warfare”. Our army of drones and missile interceptors is only as strong as the chips that power them.

The $8 Billion Question

Intel already booked a landmark win last year: about $7.86 billion from the federal CHIPS Act for its U.S. fabs.

That’s roughly enough to build one leading-edge factory – a huge subsidy. But is it enough? Barrett and others argue it’s only a down payment.

They point out that Nvidia alone invests multiples of that in a single AI R&D project. The big question: will Silicon Valley’s cash-rich giants really come to Intel’s rescue next?

Or will more government support be needed? As an industry observer put it, $8B may help slow the bleeding, but it won’t win the battle unless private capital steps in too.

Chinese Complications

Amid the funding debate, CEO Tan’s China ties have ignited controversy. Earlier in 2025, Reuters reported that Tan personally invested at least $200 million in Chinese semiconductor startups.

Shockingly, that portfolio included stakes in roughly eight companies linked to China’s military procurement.

Washington took notice: Senator Tom Cotton wrote to Intel’s board demanding answers, and President Trump – stoking the furor – publicly called Tan “highly conflicted” and urged his resignation. (In response, Intel insists Tan has operated legally and disclosed everything.)

The point is, the CEO’s global ties have become a political flashpoint just as Intel needs unity, adding instability to an already turbulent scene.

Leadership Crisis

Intel has had trouble even settling on a leader through this crisis. Pat Gelsinger was abruptly pushed out in late 2024, and veteran chip executive Lip-Bu Tan took over in March 2025.

Tan wasted no time reorganizing – telling investors he would “remove organizational complexity” to speed decision-making – but his tenure has been anything but smooth. Internal morale is shaky, and ongoing investigations (Congressional and media) are a constant distraction.

Every week brings new headlines: Trump-Biden ping-pong calls, Senate letters, whistleblowers.

As one board member admitted privately, Intel desperately needs a steady hand to carry out any rescue plan, yet its officers keep changing amid turmoil.

Barrett’s Blueprint

Barrett’s rescue plan is straightforward: customers invest. He’s calling on eight leading tech firms — Nvidia, Apple, Google, Amazon, and the rest — to each commit $5 billion in exchange for guaranteed chip supply and price premiums.

These companies would take equity stakes in Intel, funding new fabs while locking in American-made chips. Barrett argues this aligns incentives: the customers need Intel to survive as much as Intel needs their money.

But even Barrett acknowledges it’s a long shot. Skeptics note that convincing eight tech titans to plow tens of billions into Intel (which hasn’t delivered a cutting-edge chip in years) will require a very compelling pitch — one many analysts doubt exists.

Industry Skepticism

Reality-check time. Many investors have heard bold rescue plans before. Intel’s recent track record feeds doubt.

Reuters exposed serious issues with its latest 18A chip process – yields are so low that only a tiny fraction of chips were saleable – and one insider likened the launch to a “Hail Mary” pass.

Big customers have memory: Intel has a history of missing its own roadmaps. That makes them wary.

As one chip analyst put it, “We’ve seen this story of delays and layoffs too many times” (paraphrased).

Pundits ask: why bet the farm on a foundry that still can’t reliably produce its own designs?

National Crossroads

America has arrived at a national crossroads. On one side lies comfortable dependence on foreign chips, accepting that Intel will never reclaim the lead.

On the other is a painful rebuilding of a strategic industry at enormous cost.

Barrett warns this may be “the final opportunity” to choose tech independence.

Voters, industry, and government must decide: do we let Asian fabs hold the keys to our economy and defense, or do we commit the resources — public and private — to restore a U.S. champion? The answer will shape the fortunes and security of generations to come.

Tariff Precedent

Barrett points out a historical lesson: when faced with losing vital industries, U.S. policymakers have used tariffs. In 2018–21, Trump imposed 25% tariffs on steel and aluminum to protect domestic producers (and later increased them).

This year, his administration even announced high reciprocal tariffs on a wide range of imports, including semiconductors and related equipment.

If heavy duties can shield steel mills and canneries, Barrett asks, why not defend chip fabs the same way?

Proposals to impose targeted tariffs on foreign-made chips or equipment are gaining traction — though critics warn such trade barriers could spark retaliation and higher prices for U.S. tech companies.

Global Implications

Behind the scenes, China is racing to dominate the next era. Its leaders have declared semiconductor independence a national priority, pouring massive resources into AI, quantum, hypersonic weaponry and microelectronics.

If Intel’s foundry is lost, Barrett argues China gains a generational advantage in those fields.

Some experts warn that Beijing’s entry into any future conflict would be empowered by an assured chip supply, while the U.S. scrambles for GPUs and accelerators back home.

The global stakes are clear: a weakened U.S. chip sector cedes leadership in emerging technologies to an increasingly assertive rival.

CHIPS Act Inadequacy

Even $52.7 billion in the CHIPS and Science Act isn’t a panacea. That funding includes ~$39 billion in fab subsidies, but as of 2025, it has only spurred projects far from the technological edge.

The U.S. still cannot produce the most advanced chips (7nm and below) domestically; its brightest minds must outsource to Taiwan or Korea.

Barrett’s plan tacitly acknowledges this gap: government grants alone can’t rebuild confidence.

Instead, it shifts responsibility (and risk) to the private sector’s customers — those whose own future products hinge on secure chip supplies.

Silicon Shield Erosion

Finally, consider Taiwan’s “silicon shield.” For years, it was argued that China would think twice before invading the island that makes the world’s most critical chips. But that protection is eroding.

Experts note that TSMC’s new fabs abroad (like Arizona) don’t break the link to Taiwan’s main sites.

As one analysis put it, even if TSMC’s U.S. fabs keep running, they still depend on Taiwanese R&D and supply chains.

The bottom line: diversifying production has made chips more global, not secure. Barrett’s vision is to rebuild a U.S. “fortress” of fabs so America isn’t at the mercy of any single island or foreign power.

Moment of Truth

Barrett’s $40 billion ultimatum forces a stark choice: comfortable dependence, or costly independence.

In the coming weeks, corporate leaders and legislators will weigh whether to double down on Intel or quietly concede the chip crown.

Their decision will echo for decades: future engineers and soldiers will inherit either a chip-independent America or one forever reliant on Asia’s factories.

In an AI-powered world, technological sovereignty is as crucial as any missile silo or cyber shield. This is America’s moment of truth – and the outcome will define our strength in the 21st century.