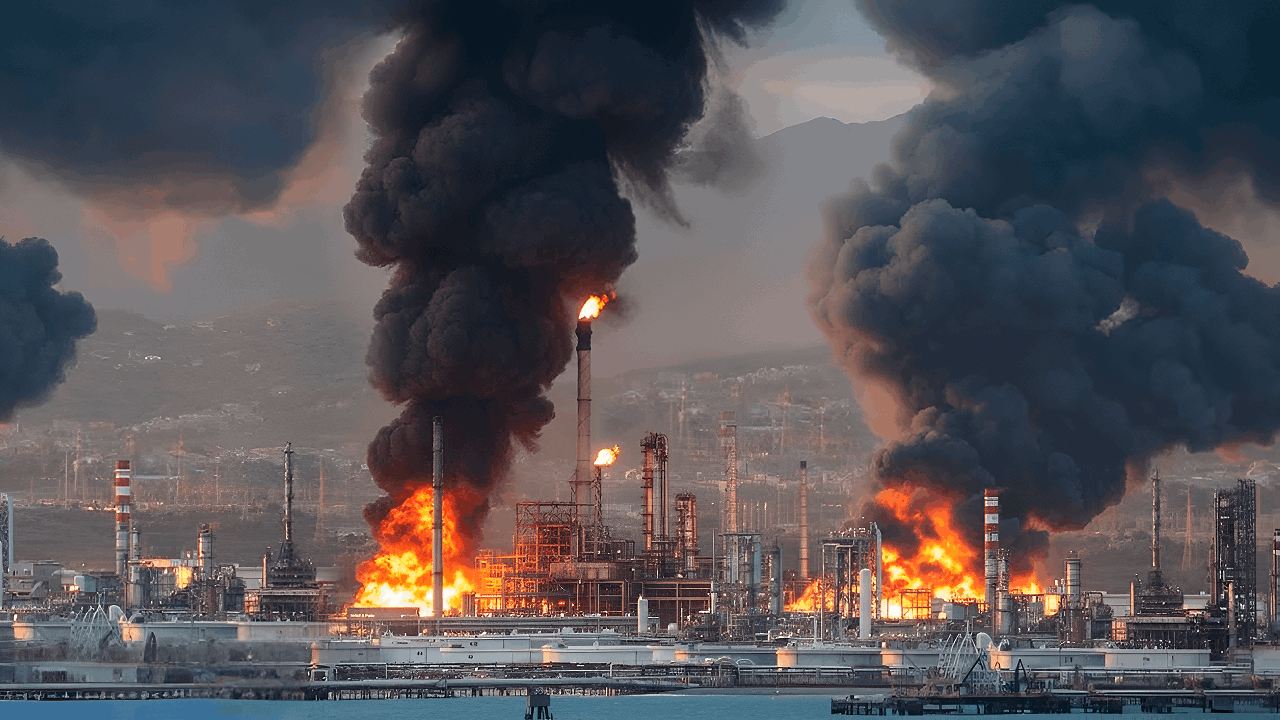

On October 19, 2025, a Ukrainian drone strike ignited a massive fire at Russia’s Orenburg gas processing plant, the world’s largest facility of its kind, according to Reuters.

The attack forced an immediate halt to the intake of Kazakh gas, disrupting a critical energy artery and raising alarms across the region. Officials reported no casualties, but the economic and geopolitical fallout was immediate and far-reaching.

Energy Shockwaves

The Orenburg plant’s shutdown sent shockwaves through global energy markets. With a processing capacity of up to 45 billion cubic meters of gas annually, according to The Guardian, any disruption at this facility threatens not just Russian supply, but also cross-border flows to Kazakhstan and potentially Europe.

The incident shows the vulnerability of energy infrastructure in times of conflict, with ripple effects still unfolding.

A Strategic Hub

Built nearly 50 years ago, the Orenburg gas processing plant has long been a linchpin in Eurasian energy logistics. Its proximity to Kazakhstan and integration with the Karachaganak field make it essential for both Russian and Kazakh exports.

The plant’s vast scale and strategic location have made it a high-value target as regional tensions escalate.

Mounting Pressures

Ukraine’s campaign against Russian energy infrastructure has intensified in recent months, with drone and missile strikes targeting oil refineries and gas plants deep inside Russian territory.

These attacks aim to disrupt Moscow’s revenue streams and weaken its war effort, while also exposing the fragility of interconnected energy networks across the region.

The Strike Unveiled

Orenburg regional governor Yevgeny Solntsev revealed that the October 119 attack partially damaged the plant and that the drone strike had caused a fire to break out at a workshop at the plant. Kommersant, a Russian media outlet, reported that the fire was later put out. “All emergency services were dispatched to fight the fire,” Solntsev noted.

The facility, operated by Russia’s state-owned Gazprom, sits in the Orenburg region near the border with Kazakhstan. It forms part of a massive production and processing complex. The plant processes gas condensate from Kazakhstan’s Karachaganak field, along with output from Orenburg’s own oil and gas reserves.

Regional Fallout

According to The Guardian, a separate drone attack struck Russia’s Novokuibyshevsk oil refinery in the Samara region, near Orenburg, igniting a fire and damaging key refining units. The refinery, operated by Rosneft, has an annual capacity of 4.9 million tonnes and produces over 20 different petroleum products.

At the same time, Russian forces targeted a coal mine in Ukraine’s Dnipropetrovsk region and an energy facility in the Chernihiv region, officials said. Energy company DTEK confirmed that all 192 miners were safely evacuated without injury, while Chernihivoblenergo, the regional power provider, reported heavy damage that left 55,000 customers without electricity.

Human Toll

While no casualties were reported at the Orenburg gas processing plant, the attack upended the lives of hundreds of plant workers and local residents.

Kazakhstan’s Energy Ministry said that Gazprom had notified Kazakhstan of the emergency but had yet to provide details on the extent of the damage or a timeline for resuming full operations.

Supply Chain Strain

The Orenburg shutdown forced Kazakhstan’s Karachaganak Petroleum Operating consortium to enact a “controlled” reduction in output.

The incident accelerated discussions in Kazakhstan about building a new domestic gas processing plant to reduce reliance on Russian infrastructure, a move fraught with technical and political challenges.

Market Jitters

The attack on Orenburg rattled energy markets, which were already on edge from previous strikes. According to Pravda, Russian oil product exports had dropped by over 17% in September, and fuel shortages were reported across the country.

The latest disruption raised fears of further price spikes and supply instability as winter approached.

Collateral Impact

The Orenburg strike was part of a broader Ukrainian campaign targeting Russian energy assets.

Nearly one-third of Russian refineries have been affected by attacks since August, compounding the strain on Moscow’s energy sector and its ability to fund military operations.

Internal Friction

Inside Russia, the attacks have fueled frustration and debate over the security of critical infrastructure.

The Federal Antimonopoly Service was asked to impose maximum prices at gas stations as fuel shortages worsened. The government faces mounting pressure to reassure the public and stabilize supplies amid ongoing threats.

Ownership Under Scrutiny

Gazprom, Russia’s state energy giant, operates the Orenburg facility and has come under scrutiny for its crisis response.

The company has yet to provide a clear timeline for when operations might resume fully, leaving partners and customers in limbo. The incident has reignited debates over the risks of centralized energy infrastructure.

Recovery Efforts

By October 22, the Orenburg plant had resumed reception of raw gas from Kazakhstan, allowing Karachaganak to ramp production back to normal levels.

However, the episode has accelerated Kazakhstan’s plans to build its own gas processing plant, aiming to reduce future vulnerability to cross-border disruptions.

Expert Doubts

Industry insiders warn that building new infrastructure outside Russian control will be controversial and technically complex.

The Orenburg incident has exposed deep vulnerabilities in regional energy security, with experts questioning whether current measures are sufficient to prevent future disruptions amid ongoing conflict.

What’s Next?

The Orenburg attack has forced a reckoning for Russia, Kazakhstan, and Europe.

As Ukraine’s campaign against energy infrastructure continues, will the region adapt with new investments and alliances, or remain exposed to further shocks? The answer may shape the future of Eurasian energy and the balance of power for years to come.