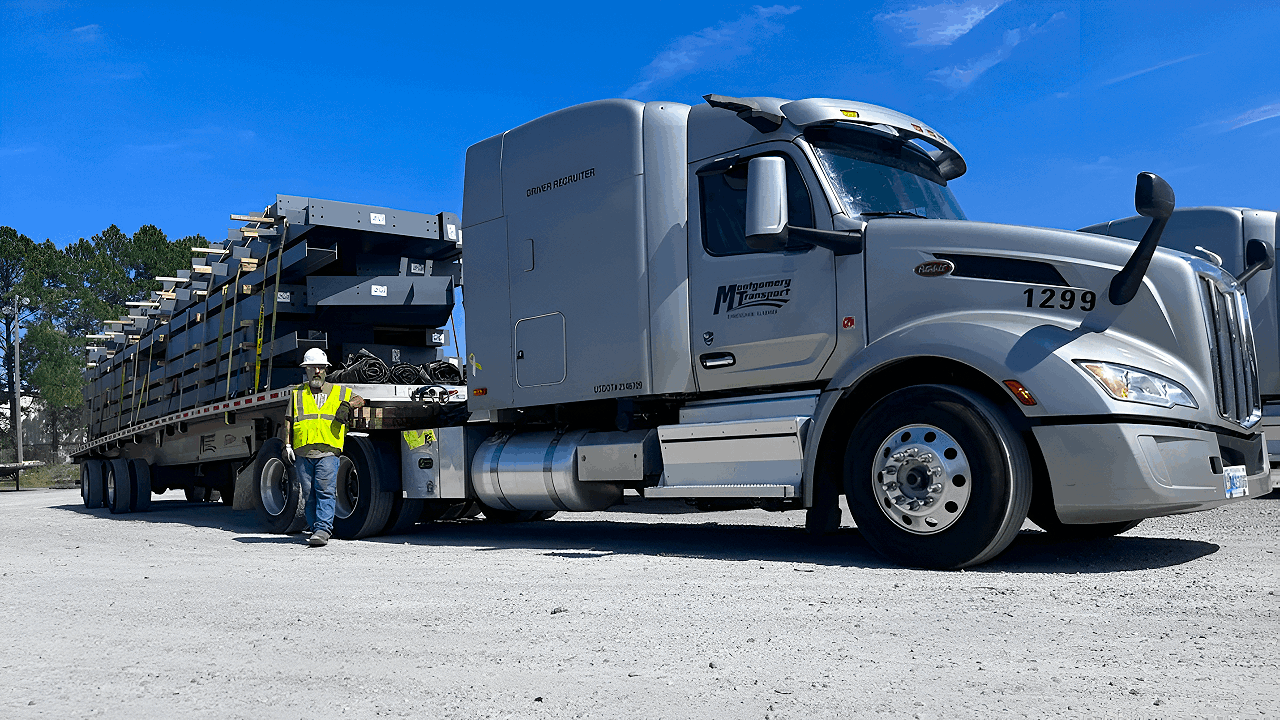

Montgomery Transport (Birmingham, AL) abruptly filed Chapter 7 in Oct 2025, leaving ~1,000 workers jobless. This sudden collapse is part of a brewing “Great Freight Recession,” as dozens of U.S. trucking firms have crumbled under mounting costs.

The shock is rippling through America’s supply chain, threatening delivery reliability and economic stability.

Mounting Costs and Credit Crunch Trigger Collapse

U.S. truckers are reeling from skyrocketing operating costs, tighter credit, and tariff-driven price surges. Many carriers expanded during the pandemic, only to face plunging demand. Dean Croke of Roper DAT bluntly warned, “None of the signals are good when it comes to truckload demand”.

The squeeze on margins and capital is proving unsustainable.

Consumers Feel the Pinch with Delays and Price Hikes

Shoppers are already seeing consequences: spot truck rates climbed to about $1.60/mile in Oct 2025, and cargo delays at ports lengthened restock times. Grocers and retailers report absorbing higher shipping fees or passing them on.

Analysts note these transport-driven costs are adding 2–3% to consumer prices, straining household budgets nationwide.

Bankruptcies and Layoffs Cascade Across Industry

Multiple carriers joined Montgomery’s fate. Jack Cooper Transport (Alabama) and Carroll Fulmer Logistics (Florida) also folded in Oct 2025. Surviving fleets are slashing staff and deferring expenses.

Werner CEO Derek Leathers warned this wave of failures is “a tipping point”, and J.B. Hunt’s Shelley Simpson admitted: “I’ve never seen a (freight) recession last three years… Everyone’s holding on”.

Rail and Air Cargo Surge to Fill Gaps

With truck capacity down, other modes are stepping up. Railroads report double-digit tonnage gains, and air cargo carriers are quickly adding capacity. The American Trucking Assoc. forecasts intermodal rail freight will grow ~2.9% annually through 2030, as shippers reroute goods onto trains.

Air freight volumes are also rising. These modal shifts are reshaping U.S. logistics flows and partly easing supply bottlenecks.

Tariffs and Port Delays Compound the Crisis

Trade wars are adding fuel to the fire. U.S. tariffs on Chinese, Mexican, and Canadian imports leapt to as high as 30–145%, driving up material costs. Imports from China plunged roughly 28.5% year-over-year in May 2025, as companies front-loaded shipments.

Meanwhile, West Coast port delays spiked: Los Angeles’s transit times nearly doubled to 4.9 days. Together, policy shocks and port snarls are forcing global supply chains to reconfigure at record speed.

Industry Demands Policy Reform

Industry groups and lawmakers are scrambling to respond. ATA President Chris Spear warned Congress that gaps in driver training and oversight “threaten safety” on U.S. highways. He urged Congress to tighten licensing standards. Senate hearings have convened on the freight crunch, and proposals range from infrastructure grants to updated labor rules.

Many experts say immediate regulatory and funding reforms are needed to stabilize the trucking sector.

Higher Costs for Everyone

Rising transport costs are feeding broad inflation. By August 2025, grocery prices rose 3.2% from a year earlier, and overall food costs are 32.1% above 2019 levels. Economists attribute much of this jump to higher fuel and freight expenses. Manufacturers and retailers across industries are passing these added costs to consumers.

The trucking crisis is amplifying price pressure on everything from raw materials to retail goods.

Global Perspective

Beyond U.S. borders, logistics are shifting. For example, U.S. container imports from China fell to 637,000 TEUs in May 2025 – a 28.5% drop year-on-year – as traders changed routes. East and Gulf Coast ports gained share while West Coast traffic declined. Global firms are “reassessing sourcing under new cost structures”, seeking alternative suppliers and routes.

American trucking woes are prompting international partners to diversify supply chains away from any single bottleneck.

Who Gains, Who Suffers

Early winners include railroads, airlines, and tech providers. With trucking’s market share eroding, rail and intermodal carriers are signing new contracts. Software firms that offer better fleet management and route optimization are in high demand. By contrast, small trucking companies and independent owner-operators – which lack deep financial reserves – have taken the hardest hit.

Although trucking still handles roughly 73% of freight tonnage, its network is buckling, leaving larger players and tech vendors in a relatively stronger position.

Local Economies Feeling the Pain

The crisis is ripping through trucking hubs. Alabama’s Montgomery Transport bankruptcy alone cost roughly 1,000 jobs. States like Texas, Ohio, and Georgia – major freight centers – report factory slowdowns and declining sales at truck stops and suppliers.

In some regions, local governments have convened task forces to retrain laid-off drivers or attract new logistics businesses. The shock has forced regional economies to scramble for relief and recovery plans.

Market Signals

Wall Street is watching nervously. By Oct 2025, the Dow Jones Transportation Average was down 15.4% year-to-date, reflecting investor concern. Credit ratings firms note rising defaults among trucking firms, and banks report weaker demand for transport loans.

Even the Fed’s recent bank survey showed lenders tightening terms on business loans. Financial markets view the trucking slump as a red flag for the broader economy.

Political Flashpoint

Trucking has become a hot political issue. With midterm elections approaching, legislators from both parties are pledging relief: proposals range from diesel tax cuts to eased regulatory burdens. Unions are lobbying for higher pay and more visas for foreign drivers, while some policymakers advocate subsidies for zero-emission trucks.

Observers note that trucking industry pressure groups are now major voices in policy debates, especially in swing states reliant on logistics jobs.

Public Outcry and Media Spotlight

The trucking crisis has captured public attention. Business outlets and social media buzz about empty shelves and expensive goods. Transportation conferences and webinars report record interest, as businesses seek answers.

Consumers are demanding transparency on why goods cost more. The sentiment is clear: trucking is no longer a behind-the-scenes industry but a front-page concern, prompting calls for immediate government and corporate action.

Road to Recovery

The events of 2025 may mark a turning point. Industry forecasts still predict modest freight growth, but only if the right reforms occur. Experts caution that “new tariffs… stricter regulations are making things even worse”, underscoring the fragility of current conditions. Restoring stability will require comprehensive action – better highways, cleaner and more efficient trucks, and a larger, well-trained driver force.

In the years ahead, resilience-building across policy and practice will be essential to preventing these ripples from becoming permanent upheaval.