A major change is coming to the sneaker world. One of the largest footwear retailers in the U.S. has recently announced that it is closing hundreds of stores.

This comes as traditional retailers face mounting pressure from online competition and changing consumer habits. The scale of the closures signals a pivotal moment for the industry, with ripple effects expected nationwide.

Jobs on the Line

These closures are impacting thousands of retail workers. The brand’s restructuring plan will eliminate about 5,000 retail jobs by 2026.

This is part of a broader trend, as many chains have announced layoffs and closures in response to declining in-store sales and rising operational costs. The impact on local economies and families is significant, raising concerns across affected communities.

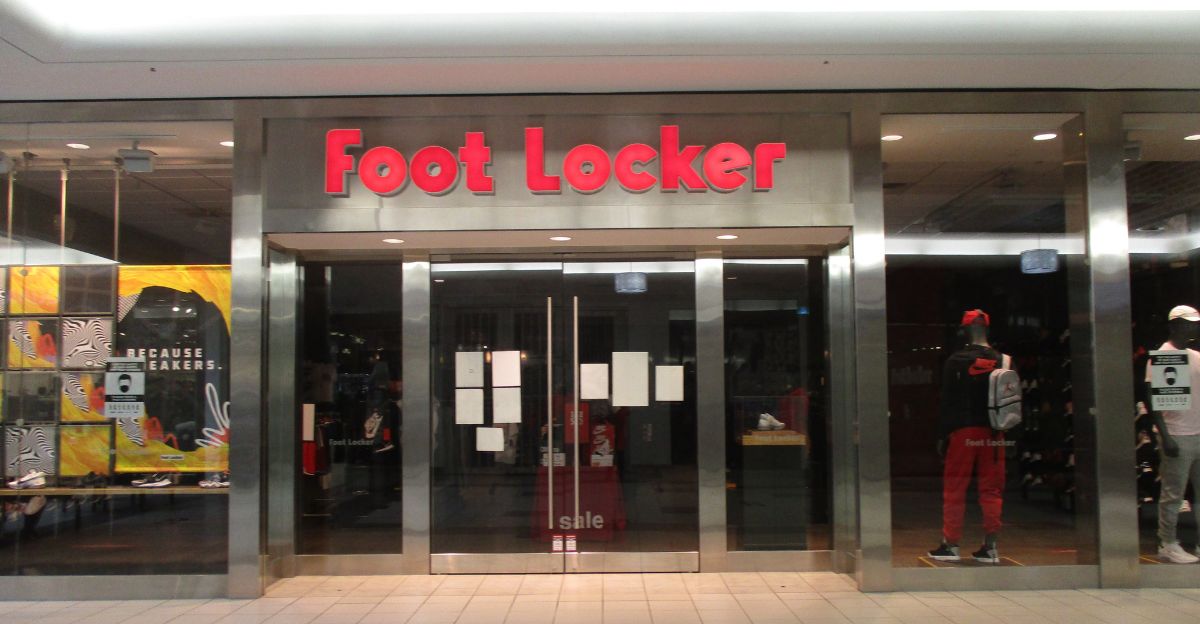

Foot Locker’s Legacy

Founded in 1974, this sneaker brand has been a staple in malls and shopping centers across America for decades. The company grew out of the historic Woolworth’s chain and became synonymous with sneaker culture, especially among youth and urban shoppers.

At its peak, it operated over 3,300 stores worldwide, dominating the athletic footwear market.

Mounting Retail Pressures

Over the years, the retail landscape has changed dramatically. More and more people are buying sneakers online, and big brands like Nike are prioritizing direct-to-consumer channels.

Mall traffic has declined significantly, and many traditional retailers are struggling to keep up. The brand’s decision reflects these mounting pressures and the urgent need for transformation.

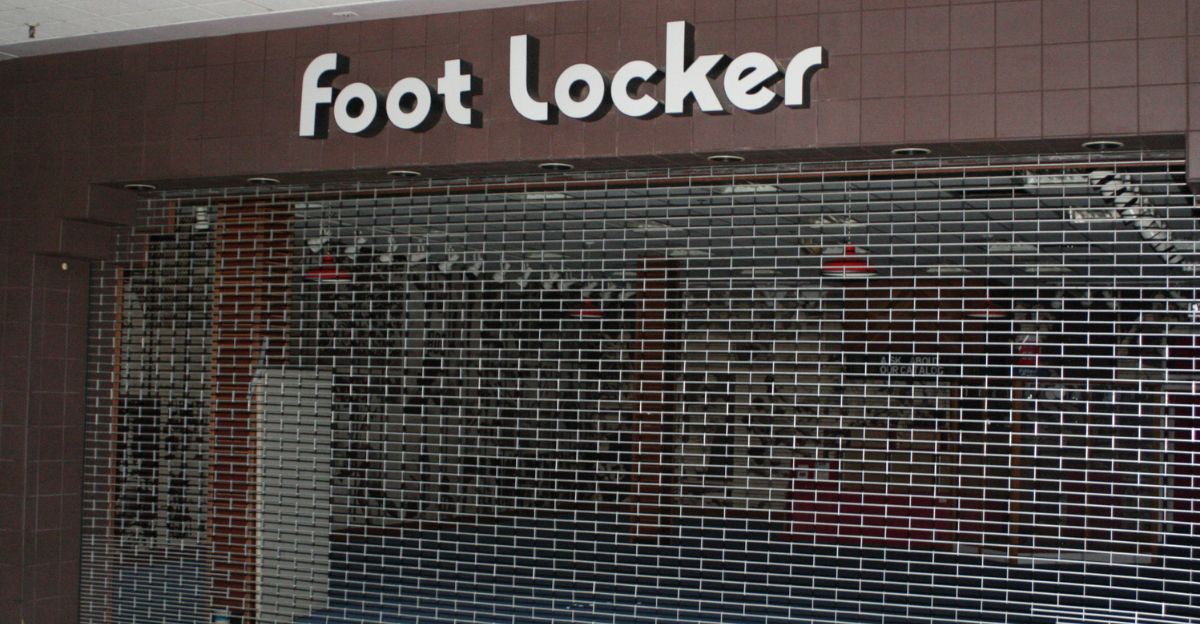

400 Stores to Close

Recently, Foot Locker announced that it would close approximately 400 underperforming stores by 2026.

The closures include 275 Foot Locker locations and 125 Champs Sports stores, both owned by the company. This move aims to streamline operations and focus on more profitable outlets and digital channels.

Regional Fallout

The closures will hit certain regions harder than others. Many affected stores are located in underperforming malls.

While specific locations have not been fully disclosed, areas with declining mall traffic are most at risk. In New England, for example, uncertainty remains about which stores will survive.

Faces Behind the Numbers

For thousands of retail workers, the announcement could lead to the loss of jobs and uncertainty. Foot Locker’s “Stripers”, which are employees known for their iconic referee shirts, face layoffs as stores prepare to close their doors for good.

The company has not detailed severance or transition support, leaving many employees to look for new opportunities in a challenging job market.

Competitors and Regulators

Foot Locker’s rivals are watching the situation closely. Brands like Nike and Adidas have already begun focusing on online sales and exclusive app releases, bypassing traditional retailers.

Meanwhile, the pending acquisition by Dick’s Sporting Goods has drawn regulatory scrutiny, with concerns about reduced competition in the athletic retail sector.

Macro Retail Trends

Store closures aren’t just hitting sneaker shops, this is happening across the U.S. retail landscape. From drugstores to electronics chains, plenty of big names are shrinking their footprint or leaving malls altogether.

Experts say the rise of online shopping, plus inflation and shifting customer habits, is pushing older retailers to either reinvent themselves or risk getting left behind.

Digital Pivot

However, one key collateral consequence is that Foot Locker is doubling down on digital. By late 2024, online sales accounted for nearly 22% of total revenue.

The company is investing in “experiential” store formats and technology, hoping to attract younger, tech-savvy shoppers and offset losses from physical closures.

Internal Strains

Inside Foot Locker, the transition has been anything but smooth. The company reported a net loss of $363 million earlier this year due to impairment charges and restructuring costs.

Employees and investors have expressed frustration over the pace and communication of changes, fueling uncertainty about the company’s direction.

Leadership and Ownership Shift

Leadership changes have added fuel to the fire. Former CEO Mary Dillon spearheaded the restructuring before stepping down after the company’s sale.

In September 2025, Dick’s Sporting Goods completed its $2.4 billion acquisition of Foot Locker, pledging to operate it as a standalone business unit.

Comeback Strategy

Meanwhile, Foot Locker’s “Lace Up Plan” is important for its comeback attempt. The strategy includes closing unprofitable stores, investing in digital channels, and launching new store concepts focused on community and experience.

The company wants to open over 280 new stores with updated formats by 2026, targeting sneaker enthusiasts and families.

Expert Skepticism

Analysts remain divided on Foot Locker’s prospects. Some see the Dick’s acquisition as a chance for synergy and growth, while others warn of risks, including brand dilution and integration challenges.

The company’s financial fragility and ongoing losses have fueled skepticism about its long-term viability.

What’s Next?

Looking ahead, the big question is whether Foot Locker can reinvent itself for a digital-first era. Will new store formats and online investments be enough to regain market share?

The outcome will shape Foot Locker’s future and the broader retail landscape for athletic footwear.

Policy and Political Ripples

The acquisition has drawn attention from policymakers. U.S. Senator Elizabeth Warren and others have raised antitrust concerns, warning that consolidation could reduce competition and harm consumers.

Regulatory reviews are ongoing, and the outcome could set precedents for future retail mergers.

International Impact

Foot Locker’s restructuring extends beyond the U.S. The company has exited unprofitable markets in Europe and Asia, selling operations in Greece and Romania.

Store closures in countries like South Korea and Denmark reflect a global retrenchment, with international sales and jobs also affected.

Legal and Environmental Angles

The store closures and layoffs have legal and environmental implications. Foot Locker faces potential litigation over severance and labor practices, while shuttered stores raise questions about mall vacancies and urban blight.

The company’s efforts to remodel and “refresh” stores may help mitigate some negative effects.

Cultural Shifts

The changes at Foot Locker mirror broader cultural shifts. Sneaker culture has moved online, with “sneakerheads” chasing exclusive drops via apps and social media. The decline of mall-based retail reflects generational changes in shopping habits, with younger consumers seeking convenience and experience over tradition.

Retail’s New Era

Foot Locker’s transformation is a bellwether for the future of retail. The company’s fate will test whether legacy brands can adapt to digital disruption and evolving consumer demands.

As the dust settles, the story offers lessons for retailers everywhere: adapt or risk disappearing in a rapidly changing world.