When the U.S. imposed sweeping export limits on advanced semiconductors to China, the impact was immediate and dramatic. Tech giants like Alibaba, Baidu, and Tencent suddenly found themselves blocked from critical Nvidia chips, halting their access to the most advanced hardware in AI.

This isn’t just trade tension—it’s a reckoning. At stake is China’s entire digital future, now reshaped by geopolitics, supply crunches, and a hard push toward self-reliance. In response, China’s biggest names are fighting back—led by a bold move from Alibaba.

The Stakes Are Sky-High in the Chip War

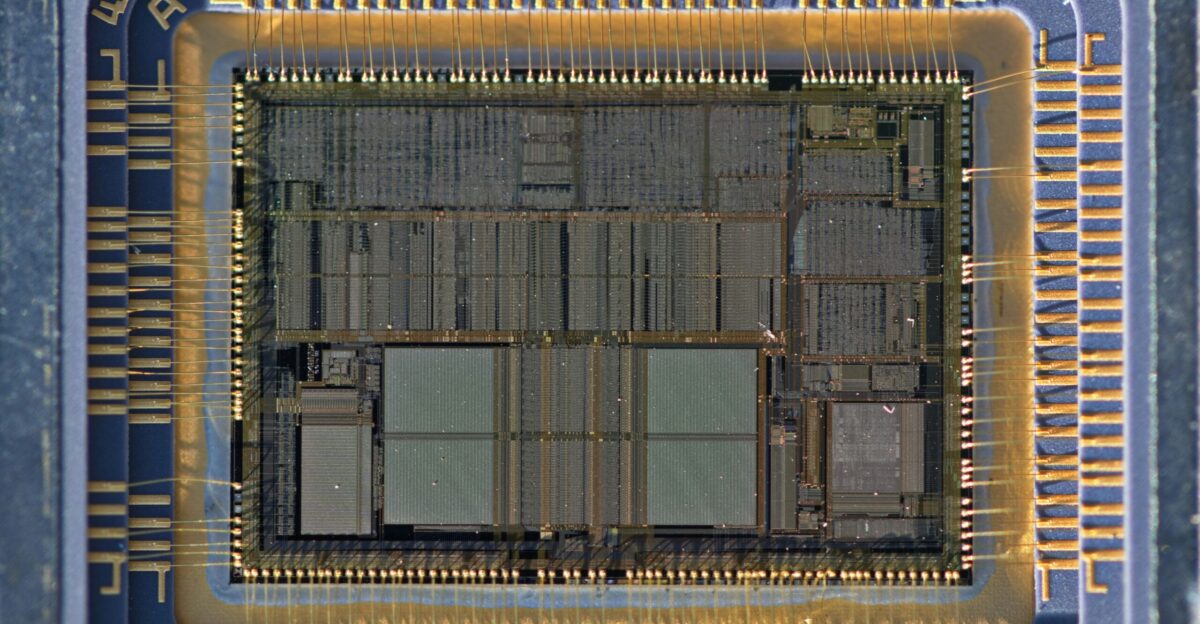

AI is booming—and chips are the power source behind it all. These semiconductors are now the foundation for industries as diverse as health care, logistics, defense, and entertainment.

As nations and corporations race to build and control this digital infrastructure, access to cutting-edge chips has become a matter of global influence and economic security.

Nvidia Cut Off—China Left in the Cold

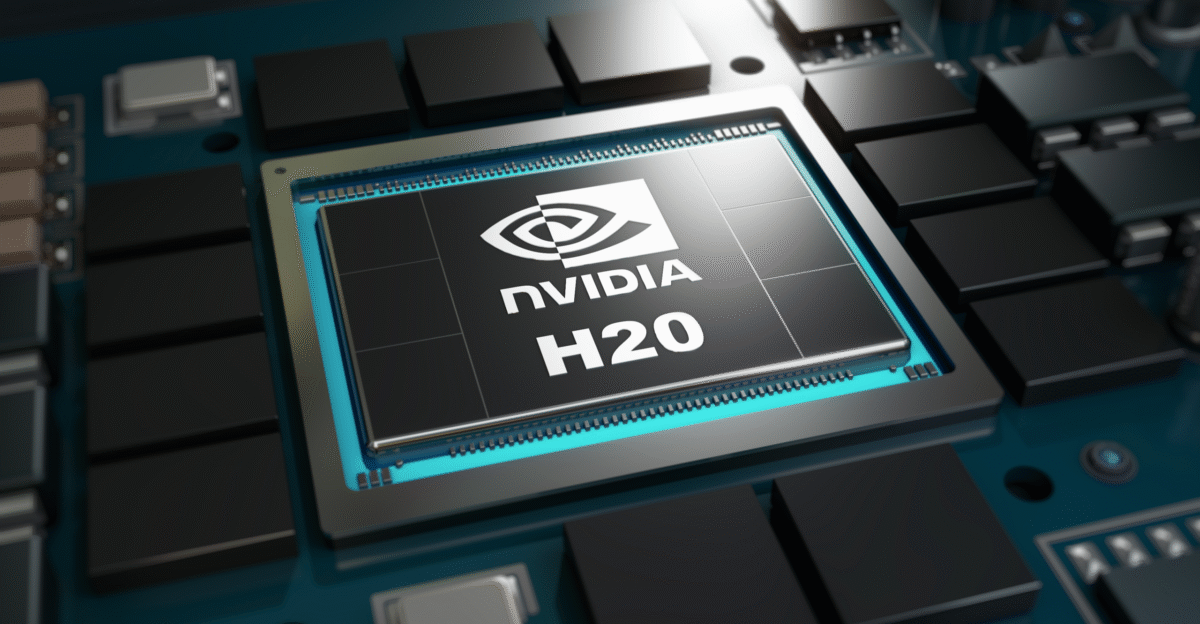

Nvidia was the global gold standard for AI chips, particularly the high-end GPUs used to train large-scale AI models. But expanding U.S. export rules have sharply curtailed what Nvidia can sell to China.

Even the H20 series, designed to navigate earlier bans, was blocked by new license revocations in 2025. Virtually overnight, China’s access to state-of-the-art AI chips was severed.

Alibaba’s Answer: Go Domestic

In response, Alibaba accelerated efforts to develop a homegrown AI inference chip, a pivot aimed squarely at filling the void left by Nvidia’s exit. It’s not just business, it’s strategic survival.

The company’s in-house chip initiative reflects Beijing’s broader push for technological autonomy, especially in sectors critical to AI and national resilience.

Built for Inference—Alibaba Finds Its Niche

Inference is the phase where trained AI models actually do their work—detecting objects, translating languages, recommending content. That’s the slice Alibaba is targeting.

Focusing on inference allows Alibaba to maintain AI service performance even without new imports, offering Chinese consumers and enterprises a viable alternative.

Made in China—And Proud of It

Earlier Alibaba chips were manufactured overseas, often in Taiwan. This one? Built in China. It’s a signal that the country’s domestic manufacturing muscle is finally maturing in one of tech’s most complex arenas.

The goal is clear: greater self-sufficiency, especially in tech systems vulnerable to political pressure and supply shocks.

Nvidia’s Exit Fueled the Rush

When the U.S. pulled approval for Nvidia’s H20 chips—despite efforts to keep them export-compliant—Chinese companies were blindsided. Inventories dried up, deployment plans stalled.

Alibaba moved quickly to plug the hole and stop the bleeding, fast-tracking its own chip to stabilize missions-critical AI pipelines.

Beijing’s Bigger Play for Autonomy

The chip isn’t just about Alibaba—it’s part of China’s national agenda. Through its “dual circulation” framework, Beijing is mandating local sourcing in sensitive sectors, especially semiconductors.

With domestic cloud providers now expected to buy local, this policy is beginning to reshape the supply chain from the inside out.

It’s a Race—And Everyone’s Running

Alibaba isn’t alone. ByteDance, Tencent, Baidu, and Huawei have each launched their own chip initiatives, funneling massive investments into semiconductor R&D.

Competitors are betting that the next generation of innovation will come from within—and that whoever cracks the code first will dominate China’s AI future.

Powering the Cloud, Holding the Line

Alibaba’s chip is already being integrated into its massive cloud business, directly supporting infrastructure that delivers search, content, and speech recognition to hundreds of millions of users.

With the chip in place, Alibaba aims to shield its backbone services from external shocks and keep domestic AI rolling, regardless of global tensions.

Suppliers Stand to Cash In

This homegrown effort has big knock-on effects. Companies like Inventec and other local integrators are seeing a wave of new demand for system design, assembly, and custom solutions.

It’s not just a tech project—it’s fueling whole subsectors of the Chinese hardware economy.

Markets React—Winners and Losers Emerge

Investors moved fast. Alibaba stock rebounded on news of the chip breakthrough and growing confidence in domestic resilience.

Meanwhile, Nvidia’s share price fell after losing the China market, leading to a trimmed sales forecast for 2025. Wall Street has taken notice of the shifting tides.

Early Tests, Promising Signals

Alibaba’s new chip is now in testing—and early performance metrics look encouraging. While not equivalent to Nvidia’s top-tier GPUs, it’s showing potential for common inference tasks.

These results suggest China finally has a credible, if modest, substitute for at least part of its foreign chip dependence.

Analysts Call It a Turning Point

Experts say what Alibaba has done is less about perfect parity, and more about control. By building a working alternative, China insulates itself from future disruptions and builds leverage over sourcing.

The chip won’t win on raw benchmarks—yet—but it’s a milestone in China’s digital sovereignty.

More Than Commerce—This Is Infrastructure

AI chips aren’t just for apps. They run defense systems, smart cities, energy grids, and industrial tools. Losing access to them puts more than profits at risk—it could put entire strategic sectors in jeopardy.

So governments are treating chips not just as assets, but as vital infrastructure requiring national oversight and investment.

Backing China’s AI Push—From Policy to Practice

China’s Five-Year Plan lays it out clearly: chips are at the heart of the country’s AI ambitions, and domestic supply is nonnegotiable.

From logistics networks to healthcare, every forecast for economic growth now ties back to how strong China’s semiconductor sector becomes.

Bridging the Gap Will Take Years

Despite progress, Chinese chips still lag global leaders in architecture, software, and design depth. Tackling those gaps will require steep investments in talent, tools, and R&D.

But every advance, every functioning chip and stable deployment, is one step closer in a long race toward parity.

Supply Chains Start to Shift

Alibaba’s pivot to local chips is a wake-up call across the global supply chain. Exporters are seeing lower Chinese demand; logistics routes are being re-evaluated.

Even trans-shipments through Southeast Asia are facing scrutiny as compliance teams try to navigate the new tech reality.

Trade Tensions Ripple Worldwide

With each new restriction from Washington—and counter-investment from Beijing—the risk of broader market disruption grows. Some fear a full-blown tech decoupling.

From Southeast Asia to Europe, governments and industries are watching closely, bracing themselves for a realignment of trade flows and alliances.

A New Chapter in Tech Sovereignty

Alibaba’s launch of a domestically made AI chip isn’t just a tech achievement—it’s a political and strategic marker.

It shows that China is unwilling to cede ground on core technologies, and that digital independence will be a cornerstone of global power in the years ahead. The chip war is no longer coming—it’s here.