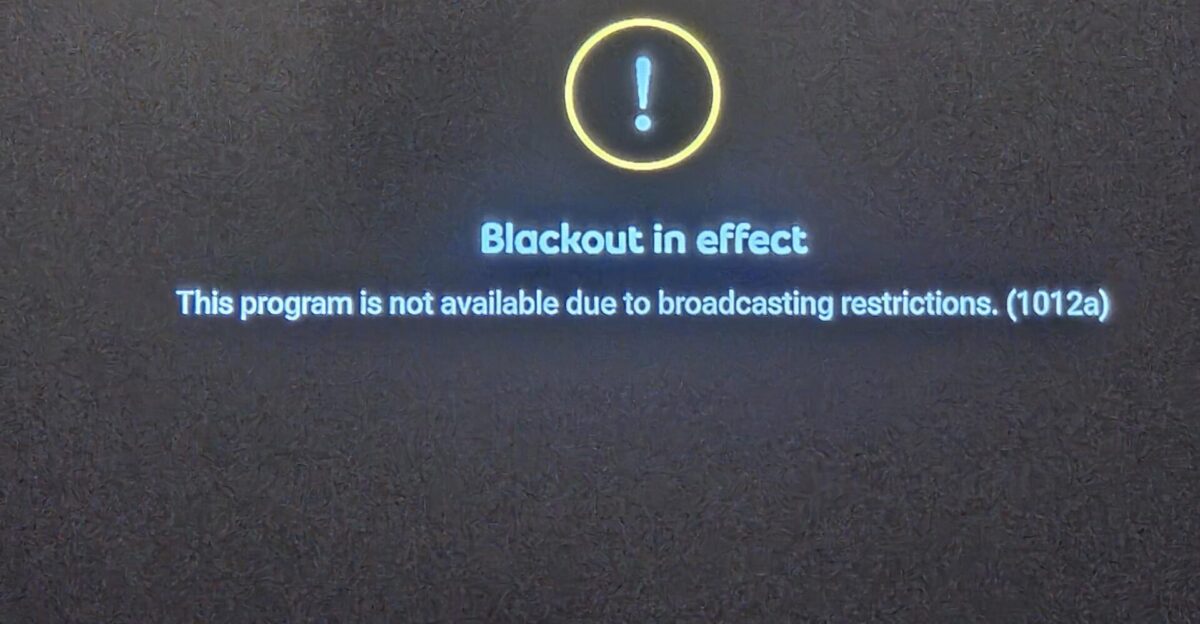

At midnight on October 30, 2025, millions of YouTube TV subscribers awoke to find a gaping hole in their channel lineup: Disney’s suite of networks—including ESPN and ABC—had abruptly disappeared. The blackout, triggered by a high-stakes contract dispute between Disney and Google, left viewers scrambling for answers and alternatives as the standoff dragged on, costing Disney an estimated $4.3 million in daily revenue. The impasse quickly became a flashpoint in the ongoing evolution of the streaming landscape, exposing vulnerabilities for both companies and their customers.

Behind the Blackout

The sudden disappearance of Disney channels from YouTube TV stemmed from a bitter carriage dispute. Disney accused Google, YouTube TV’s parent company, of refusing to pay what it called fair market rates for its content. Google countered that Disney’s proposed price increases would force YouTube TV to raise its monthly subscription fee, making the service less affordable for consumers. With neither side willing to compromise, negotiations stalled, and the blackout began. The timing was especially disruptive, coinciding with major sporting events and the start of the holiday television season.

Subscribers Left in Limbo

For YouTube TV’s 10 million subscribers, the blackout was more than an inconvenience—it was a disruption of daily routines and anticipated events. Sports fans missed out on Monday Night Football and key college football matchups, while others lost access to ABC’s news and entertainment programming. The service’s $72.99 monthly fee suddenly seemed steep for a package missing some of its most popular channels. In response to mounting frustration, YouTube TV offered a $20 credit to affected users starting November 13. While the gesture acknowledged the disruption, many subscribers felt it fell short of compensating for lost content, especially as the blackout stretched on.

The Fallout: Churn and Competition

The blackout’s ripple effects extended beyond subscriber frustration. Industry analysts warned that as many as 24% of YouTube TV users could cancel their subscriptions if the dispute persisted. Even a modest increase in cancellations would translate into significant revenue losses for Google. Meanwhile, rival streaming services such as Hulu + Live TV, Sling TV, and FuboTV seized the opportunity to lure disaffected viewers with promotional deals and more reliable access to Disney-owned channels. Traditional cable providers also reported a bump in new sign-ups as some consumers reconsidered cord-cutting in favor of stability.

Advertisers and Content Creators Caught in the Crossfire

The blackout’s impact was felt not just by viewers, but also by advertisers and content creators. Major NFL games, college football, and primetime ABC slots lost access to an audience of 10 million YouTube TV subscribers, forcing advertisers to rethink their holiday season strategies. The disruption also created uncertainty for independent networks, local stations, and regional providers that rely on YouTube TV’s reach for distribution and ad revenue. As viewership numbers dipped, so did advertising opportunities, raising concerns about the long-term viability of certain content creators on the platform.

A Shifting Streaming Landscape

While YouTube TV struggled, Disney’s direct-to-consumer platforms—including Disney+, Hulu, and the newly launched ESPN Unlimited—saw a surge in interest. ESPN Unlimited, which debuted in August 2025, quickly attracted sports fans seeking uninterrupted access to live events. Projections indicated the service could reach 3 million subscribers by September 2026, generating up to $720 million annually. The blackout underscored Disney’s growing leverage as both a content creator and distributor, and hinted at a future where media giants increasingly bypass third-party platforms in favor of their own streaming services.

The standoff also drew scrutiny from Wall Street and regulators. Disney’s November earnings call was dominated by questions about the dispute’s financial toll and the company’s long-term strategy. Lawmakers began discussing potential regulations to protect consumers from similar blackouts in the future, signaling that the era of unregulated streaming may be coming to an end.

Looking Ahead

The Disney-YouTube TV blackout has become a defining moment in the streaming wars, highlighting the fragility of partnerships between content owners and distributors. As both companies weigh the costs of lost revenue, subscriber churn, and reputational damage, the outcome of their negotiations could set a precedent for future carriage disputes across the industry. For consumers, the episode serves as a reminder that the promise of seamless, affordable streaming remains subject to the same corporate battles that once plagued traditional cable. As the dust settles, the streaming landscape is likely to emerge more fragmented—and more fiercely competitive—than ever before.