An eagle-eyed In-N-Out employee noticed something peculiar last autumn. The $100 bill did not feel quite right. That split-second decision triggered a sprawling investigation across Southern California involving federal agents, surveillance footage, and a discovery that reshaped how fast food chains think about cash handling. What began as a routine Glendale transaction unraveled into a multi-county scheme, and the first date mattered.

What Started In October Changed Everything

On Oct. 21, 2025, an employee at an In-N-Out in Glendale reported receiving what appeared to be counterfeit currency. A small order of fries was purchased with a $100 bill, and change was given. But the bill’s quality raised suspicion, prompting a report. Detectives reviewed surveillance and coordinated with In-N-Out security, and an unexpected pattern soon emerged.

A Simple Trick With Big Payoff

Two suspects, 24-year-old Auriona Lewis and 26-year-old Tatiyanna Foster, both from Long Beach, used counterfeit $100 bills to buy low-cost items at In-N-Out. Each time, they received about $75-$97 in real change. The plan counted on rushed cashiers skipping checks. Yet how did a single flagged bill connect so many restaurants?

“Helped Protect Our Business And Communities”

“The identification and apprehension of the suspects helped protect our business and communities,” In-N-Out Chief Operating Officer Denny Warnick said. Leadership credited law enforcement and emphasized coordination between corporate security and public agencies. The statement, issued in November 2025, reflected a shift: counterfeit losses were no longer treated as routine shrink. That mindset set the stage for broader counts.

A Dozen In-N-Outs Got Hit

Detectives confirmed about 12 In-N-Out locations in Los Angeles and Orange counties were targeted. Reports also surfaced in Riverside, San Bernardino, and San Diego counties, suggesting a wider footprint than first documented. Multiple jurisdictions complicated the work but also elevated it into a multi-agency response. The spread raised an immediate question: where was the pattern most visible?

The Flying Dutchman Became Evidence

Surveillance images showed a suspect in distinctive pink pants buying a Flying Dutchman, the off-menu item with 2 beef patties and cheese, at a Glendale location. Another documented purchase was fries for $2.53, paid with a counterfeit $100 bill. Spending $2-$6 maximized change while limiting scrutiny. But why did the smallest orders matter most?

Police Warned Small Scams Add Up

“Counterfeit currency schemes directly impact local businesses and employees, and swift investigative action helped stop ongoing criminal activity,” the Glendale Police Department stated on Jan. 10, 2026. Officials urged businesses to report even minor incidents, arguing cumulative losses quickly become substantial. The message targeted frontline workers who might hesitate. That emphasis put attention back on the first cashier’s choice.

One Alert Worker Stopped The Bleeding

The Glendale employee who recognized the bill became the linchpin of the case. Reporting it, instead of assuming a mistake, helped link later incidents across locations. The moment highlighted why training and awareness matter in preventing financial crimes. In-N-Out later reinforced that vigilance in internal communications. Still, catching a pattern required more than instincts, and detectives leaned on video.

Detectives Turned Footage Into Leads

After Oct. 21, Glendale Police Financial Crime Detectives analyzed surveillance from the store and worked with In-N-Out corporate security to compare footage regionwide. They cross-referenced timestamps, vehicle details, and the distinctive pink clothing to build a suspect profile. The work meant cataloging each appearance and transaction. By late October, investigators had names, and evidence was about to get physical.

“Gift Cards And Transaction Receipts”

“Lewis was found to be in possession of counterfeit bills matching those used in the Glendale incident, along with numerous gift cards and transaction receipts,” Glendale Police said on Jan. 10, 2026. The items created a trail tying her to activity at multiple locations. Matching bills from the first incident provided forensic confirmation. But one technical detail made the linkage even cleaner than receipts alone.

Identical Serial Numbers Sealed It

Forensics found all the counterfeit bills carried identical serial numbers. Genuine currency never repeats serial numbers, making the fakes easy to connect across incidents once the pattern was known. The uniformity suggested a single printing source, implying the suspects likely acquired the bills rather than produced them. That possibility widened the case’s scope and raised a new question: was someone supplying them?

Who Were Lewis And Foster?

Auriona Lewis, 24, and Tatiyanna Foster, 26, lived in Long Beach. Foster had a prior burglary conviction that affected bail because of a possible probation issue. Investigators did not initially describe them as major organized counterfeiters, which fueled suspicion they were part of something larger. Federal attention increased as authorities looked for upstream links. Then the charging decisions drew scrutiny of their own.

“Based Solely On The Facts”

“Our charging decisions are based solely on the facts, evidence and circumstances of the crime and the law,” the Los Angeles County District Attorney’s Office said in Jan. 2026. Lewis faced felony counterfeiting and grand theft charges. The office defended its approach as evidence-driven as debate built over fairness and discretion. That legal tension intensified because the arrests came quickly, with a precise timeline.

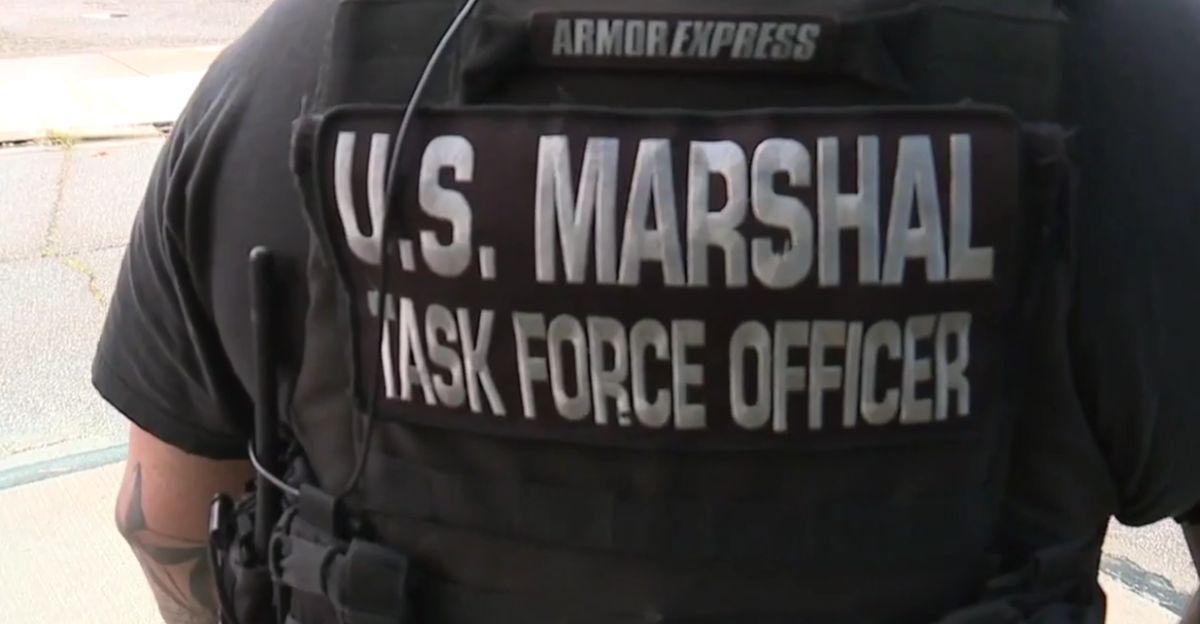

A Fast Arrest In Palmdale

On Oct. 30, 2025, 9 days after the first report, Glendale Police Financial Crime Detectives, assisted by U.S. Marshals Task Force operatives and K9 units, arrested Auriona Lewis in Palmdale, about 40 miles from the initial location. She allegedly had matching counterfeit bills, In-N-Out gift cards, and receipts. The multi-agency presence signaled higher stakes, and court consequences soon followed.

Charges That Carry Heavy Exposure

In November 2025, the Los Angeles County District Attorney’s Office charged Lewis with felony counterfeiting and grand theft. Potential exposure included up to 20 years in federal prison under 18 U.S.C. § 472, plus fines up to $250,000. Lewis pleaded not guilty and was set for a Pasadena court appearance on Jan. 20, 2026. With Foster still pending, public debate shifted to how prosecutors chose severity.

“Why Are Black People Disproportionally Charged”

“The real story is about why Black people are disproportionally charged with felonies in Los Angeles County,” said Elizabeth Lashley-Haynes, Lewis’s public defender. She argued prosecutors could have filed misdemeanors instead, raising concerns about disparities in charging discretion. Prosecutors rejected that framing and pointed back to the evidence. The clash echoed broader California debates about equity and punishment, and it landed during a hard moment for In-N-Out.

In-N-Out Faced Other California Strains

The counterfeit case landed amid other challenges for In-N-Out in California. In March 2024, the company closed its Oakland location, its first closure in 75 years, citing rampant crime, vehicle break-ins, and armed robberies. CEO Lynsi Snyder also announced plans to relocate her family to Tennessee. The chain’s operational worries extended beyond fake cash, and the broader context made the scam feel less isolated.

A National Counterfeit Problem Persists

The scheme reflected wider counterfeiting trends. Federal Reserve research estimates about $15-$30 million in counterfeit U.S. currency circulates, roughly 1 in 40,000 to 80,000 genuine notes. In 2025, law enforcement reported 60 counterfeiting cases nationally, a decline but still persistent. Digital printing has increased sophistication, challenging detection systems. Those statistics put fresh pressure on what happened with the second suspect, Foster.

Foster Surrendered, But Questions Stayed

Tatiyanna Foster surrendered to Glendale Police on Dec. 15, 2025, after more than 6 weeks. She was held without bail due to a possible probation violation tied to a prior burglary conviction. Her court appearance was scheduled for later this month, with formal charges expected. Investigators still weighed whether a larger counterfeiting network supplied the bills and how many more locations were hit, leaving the story open-ended.

Sources

In-N-Out Burger outlets in Southern California hit by counterfeit bill scam. Los Angeles Times, Jan. 10, 2026

Glendale Police Arrest Two In Counterfeit Currency Scheme. Glendale Police Department, Jan. 10, 2026

Fake cash scheme busted at In-N-Out. FOX 11 Los Angeles, Jan. 10, 2026

Estimating the Volume of Counterfeit U.S. Currency in Circulation. Federal Reserve, Feb. 2025

Counterfeiting, fiscal year 2024 data summary. U.S. Sentencing Commission, 2024