On October 14, 2025, China started charging a special fee of RMB 400 (about $56) per net ton for US-owned, operated, built, or flagged ships entering its ports.

This action increases tensions in maritime trade between the two largest economies in the world. Analysts warn that this could lead to significant disruptions in global shipping routes and supply chains.

First Vessel Hit With Fees

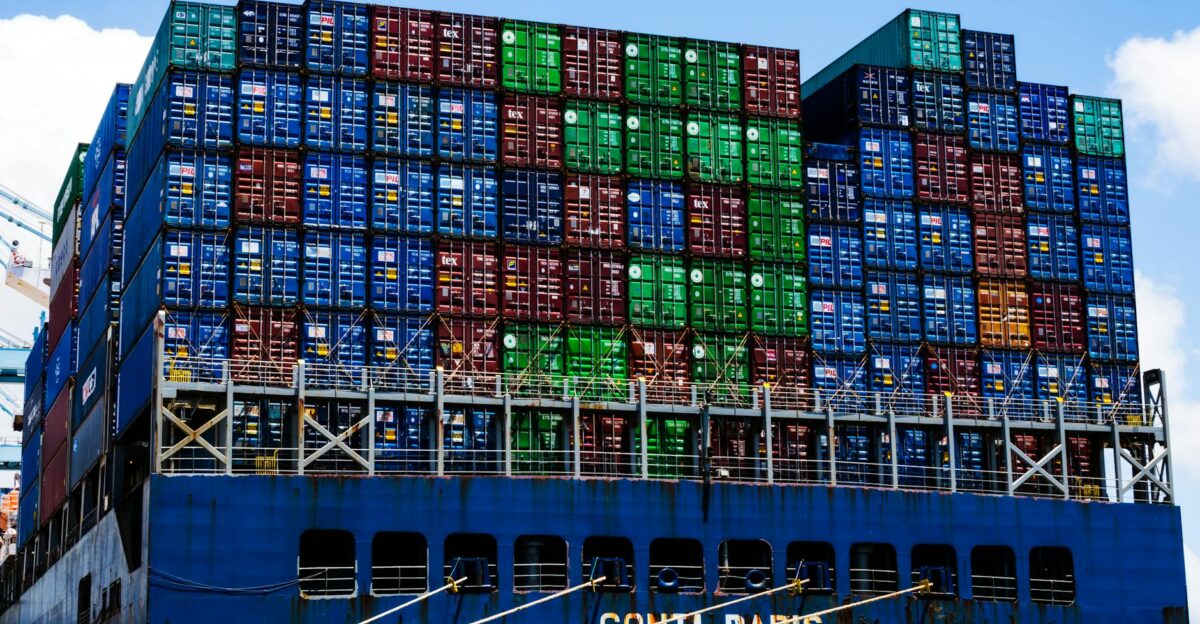

The Matson Waikiki, a U.S.-flagged container ship weighing 30,224 net tons, was the first vessel to be charged under the new rules when it docked in Shanghai on October 14.

It will face a fee of about RMB 12.09 million (around $1.7 million). Very large crude carriers (VLCCs) can face charges estimated between $9 million and $15 million each time they dock, depending on their size. This situation puts billions in annual trade at risk for affected vessel types.

Trade War Timeline

The US and China started charging port fees in 2025 as part of a trade dispute.

The US Trade Representative proposed these fees following an investigation that found China employs unfair practices to dominate the global shipping, logistics, and shipbuilding sectors. Both the US and China implemented their port fees on October 14, 2025.

Mounting Pressure

Both governments express concern about unfair practices and the excessive power of companies. The US accused China of limiting competition and weakening the supply chain.

China’s Ministry of Commerce criticized the US fees as “seriously violating relevant international trade principles” and “severely disrupting maritime trade,” while implementing its own retaliatory measures.

Fee Implementation Details

China collects the fee at the first Chinese port of entry for qualifying ships.

The Chinese Commerce Ministry stated, “If the US chooses confrontation, China will see it through to the end; if it chooses dialogue, China’s door remains open”. The fees will escalate over time, rising to RMB 1,120 ($157) per net ton by April 2028.

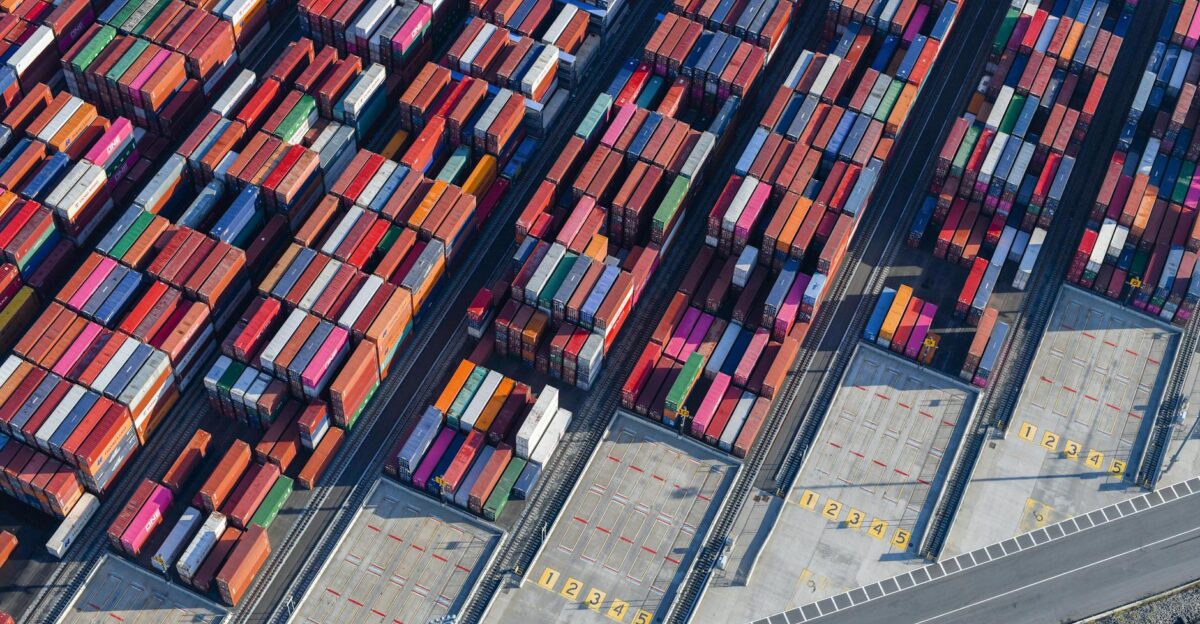

Regional Impact

The fee applies to all ports in China, including major ports such as Shanghai, Shenzhen, and Ningbo. Clarksons Research initially estimated that these port fees could impact oil tankers that make up about 15% of global capacity, before exemptions were clarified.

Ship-tracking company Vortexa found that 45 LPG-carrying VLGCs, which represent 11% of the total fleet, might be subject to these fees.

Industry Scramble

Shipping companies are scrambling to adapt to the new regime. Independent dry bulk analyst Ed Finley-Richardson noted, “We are in the hectic stage of the disruption where everyone is quietly trying to improvise workarounds, with varying degrees of success”.

Some shipowners are attempting to sell cargoes to other countries while vessels are en route to avoid fees.

Competitor Adjustments

Major shipping companies, such as Maersk, Hapag-Lloyd, and CMA CGM, are reducing their exposure by relocating China-linked ships out of US routes.

Analysts say COSCO will be the most affected by new US fees, likely covering almost half of the expected $3.2 billion cost for the container shipping industry in 2026.

Shipping as Statecraft

Athens-based maritime broker Xclusiv Shipbrokers stated, “This tit-for-tat symmetry locks both economies into a spiral of maritime taxation that risks distorting global freight flows”.

The firm observed, “The weaponization of both trade and environmental policy signals that shipping has moved from being a neutral conduit of global commerce to a direct instrument of statecraft.”

Key Exemptions

China does not charge a fee for ships built in China and empty vessels that enter Chinese shipyards for repair. The fee is collected only at the first port where a vessel arrives during its voyage.

Each vessel pays this port fee for no more than five voyages in a year. Because Chinese-built ships are exempt, fewer vessels are affected by this fee.

Ownership Complexity

Industry stakeholders are worried about unclear definitions in the fee systems of both countries. The ambiguity surrounding ownership thresholds—such as the 25% equity, voting rights, or board seats—makes compliance difficult.

Maritime lawyer Ren Yanbing from Dentons’ Guangzhou office emphasized that determining ownership through multiple offshore layers will be challenging.

Corporate Responses

COSCO SHIP HOLD approved a plan to buy back up to RMB 1.5 billion (approximately $210 million) worth of shares within three months to maintain corporate value amid the turmoil.

Hanwha Ocean, a South Korean shipbuilder, saw shares drop nearly 6% after China imposed sanctions on five of its US-linked subsidiaries.

Alternative Strategies

Shipping lines are exploring various strategies to minimize costs. The US announced a temporary carve-out for long-term charterers of China-operated vessels carrying ethane and LPG, deferring port fees through December 10, 2025.

Importers and exporters are reassessing logistics strategies to reduce direct exposure to the fees.

Consumer Impact Concerns

A Shanghai-based trade consultant, speaking anonymously to Reuters, said, “What are we going to do? Stop shipping? Trade is already pretty disrupted with the US, but companies are finding a way.”

Industry experts believe the measures could ultimately be passed to consumers through higher retail prices.

Political Context

The port fee escalation coincides with broader trade disputes. President Trump threatened on October 11 to impose additional 100% tariffs on goods from China, with implementation potentially by November 1, 2025, depending on Beijing’s actions.

China has expanded rare earth export restrictions in response to US trade measures.

Global Fleet Exposure

Financial analysts estimate that approximately 13% of crude tankers and 11% of container ships in the global fleet could be affected by the combined US and Chinese port fees, representing significant disruption to international maritime logistics.

However, exemptions for Chinese-built vessels reduce the actual impact.

Market Disruption

The port fees triggered immediate market reactions. VLCC freight rates surged back above $100,000 per day as the port fee dispute sparked uncertainty in global tanker markets.

Container shipping rates and vessel chartering patterns are being reshaped as operators minimize exposure to the new fees.

Limited US Direct Exposure

Despite high per-vessel costs, US shipping faces relatively limited direct exposure to China’s fees. Less than 1% of the global fleet—approximately 430 ships—is US-flagged or US-built.

Only 18 US-flagged or US-built vessels visited China in 2025. However, US-controlled vessels operating under foreign flags and ships with 25% or more US ownership remain vulnerable.

Outlook and Negotiation Potential

With both nations implementing port fees simultaneously, the maritime industry faces a new era of trade policy uncertainty. Beijing has indicated the fees could be “dynamically adjusted as needed,” leaving room for negotiation.

If the US cancels or reduces its port fees, China has signaled it would follow suit accordingly. The long-term impact on global shipping routes, vessel ownership structures, and consumer prices remains uncertain as companies adapt to this unprecedented use of port fees as economic leverage.