At 4:06 a.m. on November 29, 2025, a drone strike rocked one of the most critical oil export terminals in the world. The Caspian Pipeline Consortium (CPC) Black Sea terminal, located near Novorossiysk, Russia, processes over 1.3 million barrels of oil per day—more than 1% of global oil supply. In an instant, shipments were halted, triggering shockwaves through the global energy market.

Market participants expressed concern over tightening supplies and looming price hikes as the world’s energy security hung in the balance. Traders frantically reassessed their positions, and refineries scrambled to find alternative sources, underscoring the critical role CPC plays in the global energy infrastructure.

Supply Chain Shock

The attack on the CPC terminal severely disrupted Kazakhstan’s oil exports, temporarily halting flows that account for 80% of the country’s total oil exports. Kazakhstan, a major oil producer, relies heavily on the CPC for its oil transit. This attack exposed the nation’s vulnerability, as no alternative route can match the CPC’s capacity.

The halt has significant implications, shaking the nation’s economy and risking job losses in Kazakhstan’s oil sector. With limited options to reroute its crude, Kazakhstan faces a critical juncture that could reshape its energy strategy and fiscal outlook for years to come.

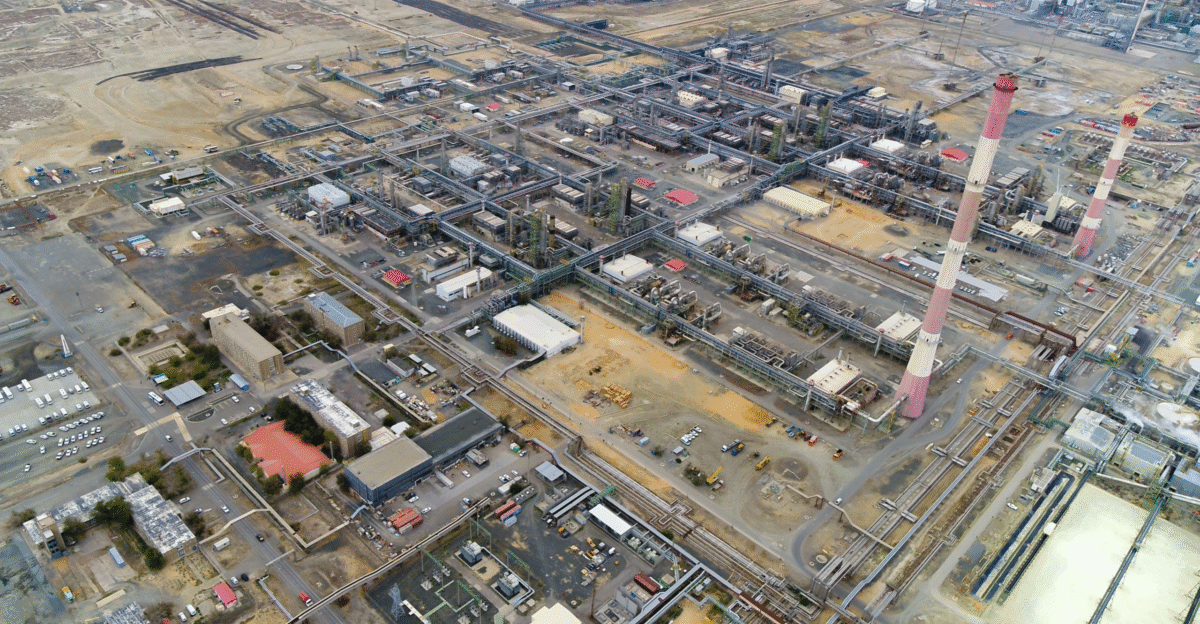

The Pipeline’s Anatomy

The CPC pipeline stretches over 1,500 kilometers from Kazakhstan’s Tengiz oil fields to the Black Sea terminal near Novorossiysk. A joint venture between Chevron, Exxon Mobil, and Russian entities, it is a crucial artery for Kazakhstan’s oil exports. This pipeline has historically been a stable energy route, but the growing geopolitical tensions in the region have put its future at risk, turning it into a high-stakes battleground.

The partnership structure has made it a vital, yet vulnerable, piece of infrastructure amid increasing geopolitical volatility. The involvement of Western energy majors alongside Russian state interests has further complicated its operational security and political management.

Mounting Pressure

This November drone strike marks a significant escalation in a series of attacks on CPC facilities. In September 2025, Ukrainian forces hit the CPC headquarters in Novorossiysk, and earlier in February 2025, drones targeted the Kropotkinskaya pumping station. These attacks highlight the strategic importance of the CPC pipeline and raise concerns over Kazakhstan’s energy security, especially with no immediate alternatives to resume exports.

These incidents are raising alarms about the region’s stability and the growing vulnerability of key energy infrastructure. The pattern of escalating attacks suggests a deliberate targeting strategy aimed at disrupting Russian energy exports and forcing geopolitical shifts in Central Asia.

The Strike Unfolds

At 4:06 a.m. local time, unmanned naval drones targeted Mooring Point 2 at the CPC Black Sea terminal. The damage was so severe that CPC declared the mooring point inoperable, halting operations immediately. One of three key export points was rendered useless, leaving the terminal with limited capacity to process oil, triggering the suspension of oil exports to Europe.

The extent of the damage left traders and analysts scrambling to understand the full impact on global supply chains. Initial assessments suggested that recovery could take weeks, with tanker operators already diverting vessels and shifting crude sourcing strategies to adjust to the disruption.

Kazakhstan’s Immediate Crisis

Kazakhstan quickly activated emergency plans, but the options were limited. The Atasu–Alashankou pipeline to China operates well below CPC’s capacity, leaving Kazakhstan in a difficult position. Rail and Caspian Sea routes exist, but they are costly and inefficient for handling the volume that CPC typically manages.

Analysts warn that the oil backlog could persist for months, straining Kazakhstan’s finances and disrupting its oil sector. The government must now weigh immediate financial relief against long-term infrastructure investments to reduce its dangerous dependence on a single export corridor.

Hitting Close To Home

The attack didn’t just disrupt global oil markets—it also hit close to home for those living near the CPC terminal in Novorossiysk. The September attack on the CPC headquarters damaged both the administrative offices and residential areas nearby. While the November strike primarily targeted offshore infrastructure, it renewed fears of civilian casualties and the toll on local livelihoods.

The impact on the local population underscores the human stakes involved in energy infrastructure disputes. Communities dependent on CPC employment and regional economic activity now face uncertainty as geopolitical conflicts directly threaten their livelihoods and security.

Chevron and Exxon Under Pressure

Chevron and Exxon Mobil, both major stakeholders in the CPC, now face the fallout of this supply chain disaster. With operations halted, both companies are at risk of significant financial losses. The disruption threatens their oil portfolios, especially since CPC is one of the key suppliers to European markets.

Both companies remain tight-lipped on the financial impact, but market observers anticipate revenue risks as the supply chain faces restrictions. The uncertainty surrounding recovery timelines has already prompted preliminary contingency discussions among senior management at both firms regarding alternative supply and hedging strategies.

Global Market Ripples

The disruption to CPC’s Black Sea terminal is already having a ripple effect on global oil markets. Kazakhstan’s CPC Blend crude, a primary feedstock for European refineries, has seen price differentials widen. Market reports indicate risks of tightening supplies, as Europe has few alternatives to Kazakhstan’s oil.

As winter approaches, these price pressures could worsen, with European refineries struggling to secure affordable crude. The combination of seasonal heating demand and reduced pipeline capacity threatens to create a supply crunch that could elevate energy costs for consumers across the continent.

The Budget Threat

Kazakhstan’s government, reliant on oil revenues, now faces an existential threat. Oil exports make up 55% of Kazakhstan’s export earnings. The CPC disruption could cost the country up to $1.5 billion in lost revenue. If the halt continues into 2026, it could trigger fiscal stress, affecting government programs and leading to potential cuts in vital social services.

This loss could send shockwaves through Kazakhstan’s financial system, impacting both public and private sectors. The government’s ability to fund infrastructure projects, education, and healthcare initiatives hangs in the balance as oil revenues—the lifeblood of the national economy—face mounting uncertainty.

Kazakhstan’s Diplomatic Dilemma

Caught in a geopolitical crossfire, Kazakhstan has issued formal statements urging protection for its energy infrastructure. The country’s energy ministry has expressed frustration, calling the attacks a threat to global energy security. As a traditionally neutral nation, Kazakhstan now faces growing pressure to shift its foreign policy, balancing its relationships with Russia, Europe, and China amid the ongoing conflict.

This diplomatic dilemma puts Kazakhstan at a crossroads in its geopolitical strategy. Astana must navigate carefully between maintaining Russian ties while potentially deepening energy partnerships with Europe and China to reduce its vulnerability to further disruptions.

Strategic Vulnerability Exposed

The CPC pipeline, controlled by a consortium of Russian and U.S. companies, is now exposed to significant geopolitical risk. Although Kazakhstan has long relied on this pipeline, its location within Russian territory has left it vulnerable to attacks. Russian regulators have previously halted CPC operations over environmental concerns, setting a troubling precedent for future disruptions.

The pipeline’s location has transformed it into a point of contention in an increasingly volatile geopolitical environment. The fact that critical infrastructure serving Kazakhstan’s economy operates entirely through Russian sovereign territory underscores the structural weakness in the nation’s energy strategy.

The Diversification Dilemma

Kazakhstan has no easy solutions to replace the CPC pipeline. Alternative routes, such as the Baku-Tbilisi-Ceyhan pipeline or increased rail transit to China, are not viable in the short term due to technical and financial constraints. Experts argue that Kazakhstan has failed to diversify its export routes, making it increasingly vulnerable to energy wars and supply chain disruptions.

Without diversification, Kazakhstan is exposed to the risks of over-reliance on a single energy corridor. Strategic planners in Astana must now accelerate long-delayed infrastructure projects and forge new partnerships to create genuine export alternatives before the next crisis emerges.

Recovery Uncertainty

CPC has not provided a clear timeline for recovery, leaving traders and refineries in limbo. With one mooring point destroyed and another under repair, it could take weeks or longer before normal operations resume. As the threat from drone strikes persists, experts warn that the uncertainty will continue to fuel market volatility, leaving oil prices elevated in the short term.

The unpredictability of the situation only adds to the tension in global energy markets. Until CPC fully resumes operations or geopolitical conditions stabilize, energy traders and policy makers will remain locked in reactive mode, unable to plan with confidence for the months ahead.

The Reckoning Ahead

As Kazakhstan navigates this crisis, the country faces a critical decision: adapt to the new geopolitical realities or risk a prolonged economic and energy crisis. With oil revenues essential to its fiscal stability, the government’s ability to address the CPC disruption will define its future economic and geopolitical strategy.

Kazakhstan must decide whether to accelerate export diversification, deepen ties with China or Europe, or risk remaining trapped in a single-pipeline dependency that leaves it vulnerable to forces beyond its control. The outcome of these decisions will reverberate across global energy markets and reshape Central Asia’s geopolitical landscape for decades to come.

Sources:

The Kyiv Independent – “Drone attack forces oil terminal in Russia’s Novorossiysk to halt all loading operations” (November 29, 2025)

Kursiv Media – “Kazakhstan eyes $1.5 billion export slump after CPC attack” (December 1, 2025)

Astana Times – “CPC Continues Restoration of Kropotkinskaya Pumping Station After Drone Attack” (March 25, 2025)

ICIJ – “Putin’s pipeline: How the Kremlin outmaneuvered Western oil giants” (April 21, 2025)

Ukrinform – “Drones strike Caspian Pipeline Consortium office in Novorossiysk” (September 23, 2025)