Warren Buffett recently spoke to CNBC about his outlook on America’s railroads. The remarks set off reactions in financial markets, while also raising curiosity about what he might… or might not… be planning next.

He clearly dismissed one strategy and leaned into another. This raises questions: what’s his real intention? If you’ve heard hints already, don’t jump ahead.

The full picture is still unfolding. Keep going to uncover what exactly he revealed, and what’s still being held close, for now.

Quiet Denial

Buffett told CNBC that Berkshire Hathaway is firmly not looking to buy another railroad. That statement came amid renewed speculation that BNSF, owned by Berkshire, might pursue CSX.

Instead, he made clear that no acquisition is in play. This surprised some investors and put an early end to merger rumors.

Market Response

CSX’s shares fell sharply after Buffett’s CNBC comments. Reuters reported a decline of around 4.5 %, while other sources noted a 5 % drop. This shows how sensitive markets are to even subtle shifts in merger expectations.

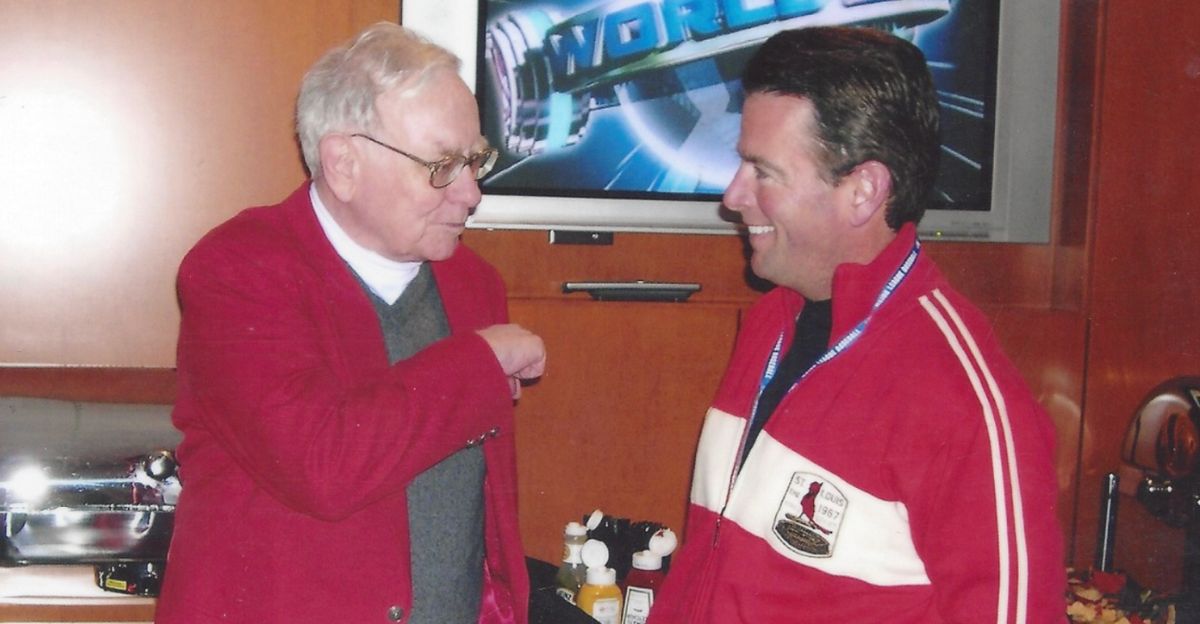

Private Meeting

Earlier in August, Buffett and Greg Abel met privately with CSX CEO Joseph Hinrichs in Omaha. The discussion made one thing clear: there would be no bid for CSX. Instead, the focus was on other ways to align their businesses.

Preference for Cooperation

That cooperation took a concrete turn last week: CSX and BNSF launched new intermodal services offering seamless coast-to-coast freight movement. This lets them deliver goods across long distances more efficiently, without transferring between lines.

Coast-to-Coast Service

That cooperation took a concrete turn last week: CSX and BNSF launched new intermodal services offering seamless coast-to-coast freight movement. This lets them deliver goods across long distances more efficiently, without transferring between lines.

Broader Industry Context

The rail industry is abuzz with consolidation talk. In July, Union Pacific and Norfolk Southern proposed an $85 billion merger to create a true coast-to-coast network. That has raised pressure on other players to respond.

Shrinking Pool of Partners

But consolidation options are shrinking. Canadian Pacific Kansas City and BNSF both publicly rejected merger opportunities with CSX. That leaves fewer paths for consolidation in response to the Union Pacific-Norfolk merger.

Regulatory Concern

Regulators are watching closely. The Surface Transportation Board is expected to overweight competitive balance, especially if only one major merger is in play. Without a counter-merger, a Union-Pacific/Norfolk deal may face greater scrutiny.

Investor Pressure

CSX faces pressure from activist investor Ancora Holdings, which is urging the company to pursue a merger, either with BNSF or CPKC, or consider leadership changes to drive better performance.

CSX’s Response

CSX management has responded that they’re focused on exploring opportunities that drive shareholder value and customer service improvements.

They’ve not closed any doors, but remain committed to solutions that don’t necessarily involve full consolidation.

Impact on Stock

CSX’s stock continued to slip, down another 1.2 % after the initial drop. This reflects lingering doubts about whether it can compete effectively without a merger partner.

Analyst Views

Analysts note that without a BNSF bid, the industry may see only one transcontinental railroad, Union Pacific/Norfolk. That would reduce competition, a concern both for regulators and shippers.

Pros and Cons

Some believe deeper cooperation between CSX and BNSF may yield benefits without the risks of merger.

Others say structural consolidation is needed to keep pace with industry changes. Both approaches carry trade-offs.

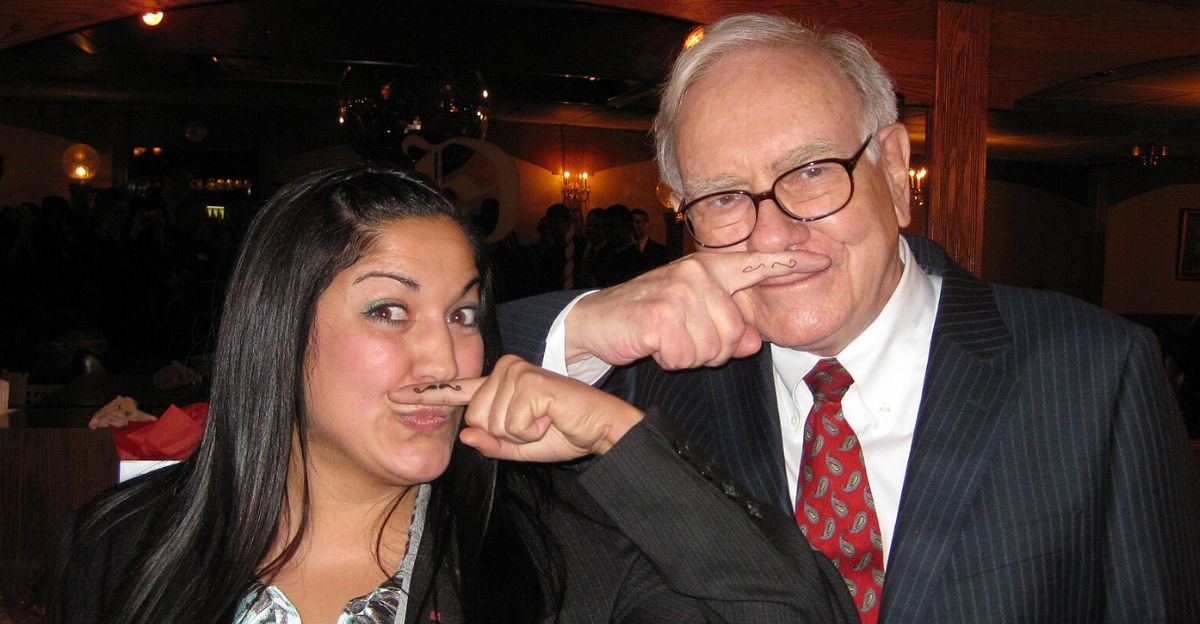

Buffett’s Style

Buffett is known for all-cash offers, few intermediaries, and quiet approaches to deals. That style informed expectations he might bid for CSX, but his statements show he’s steering clear of that route, at least for now.

Cash Position

Berkshire Hathaway sits on a massive cash pile: around $344 billion in T-bills plus $44 billion in other cash reserves. That fuel would easily cover a big acquisition. Still, Buffett appears to prefer less aggressive moves.

Clearing the Air

In short: Buffett isn’t buying CSX. He supports aligning operations with BNSF. This keeps strategic flexibility without committing to deal-making disruptions.

What to Watch Next

Key developments to follow include whether CSX and BNSF deepen their operational ties, how regulators view upcoming mergers, and whether activist investors press forward or accept cooperation as sufficient for now.

Implications for Shippers

Companies that rely on freight services should note that improved intermodal paths may enhance logistics. But if consolidation doesn’t happen, pricing and capacity dynamics may evolve differently. Stay alert to service changes.

Final Note

Warren Buffett’s comments revealed no megadeals, only a push for smarter partnerships. He’s chosen collaboration over conquest, at least in public for now. Future updates could still reshape the rail landscape. But today, cooperation is the headline.