Jennifer Lopez and Ben Affleck are hemorrhaging money on their failed Beverly Hills mansion sale, facing estimated losses exceeding $29 million after 18 months on the market.

The former power couple slashed the price from $68 million to $52 million—a devastating $16 million reduction that still leaves the estate unsold and costing them nearly $10,000 daily in carrying expenses.

Desperate Price Cuts Signal Urgency

The 38,000-square-foot Wallingford estate, purchased for $60.85 million in May 2023, now sits $8.85 million below their original purchase price.

After investing at least $10 million in renovations to create their “dream marital sanctuary,” the couple watched their investment evaporate amid a cooling luxury market and their highly publicized August 2024 divorce filing.

The Mansion Tax Trap

Los Angeles’ punitive Measure ULA—the controversial “mansion tax”—adds insult to injury. At the current $52 million asking price, Lopez and Affleck face a mandatory $2.86 million tax payment to the city, with real estate commissions adding another $2.86 million.

Celebrity agent Jason Oppenheim warned in October 2024: “They will have to pay a mansion tax of more than $3 million.”

Luxury Real Estate Expert’s Grim Prediction

Oppenheim’s forecast proved chillingly accurate. He told media outlets the couple would “lose several million dollars on the sale” and face “more than an additional $5 million after commissions, taxes, etc.”

The actual losses have exceeded even his pessimistic projections, with the $52 million price tag suggesting final sale prices in the $45-48 million range after negotiations.

Unparalleled Amenities Can’t Attract Buyers

The Crestview Manor sprawls across 5.2 acres with 12 bedrooms, 24 bathrooms, and facilities that rival commercial resorts.

The property features a standalone indoor sports complex with regulation basketball and pickleball courts, a professional boxing ring, full gym, hair salon, home theater, wine cellar, and parking for 80 vehicles—yet none of this opulence has tempted buyers.

Monthly Costs Deter Ultra-Wealthy

Realtor.com estimates monthly carrying costs at approximately $284,000, encompassing mortgage payments, property taxes exceeding $747,000 annually, insurance, security, utilities, and maintenance.

Over 18 months, these expenses total $5.1 million—money evaporating while the mansion sits empty. California’s insurance crisis compounds problems, with wildfire coverage requiring roughly $500,000 annually in premiums.

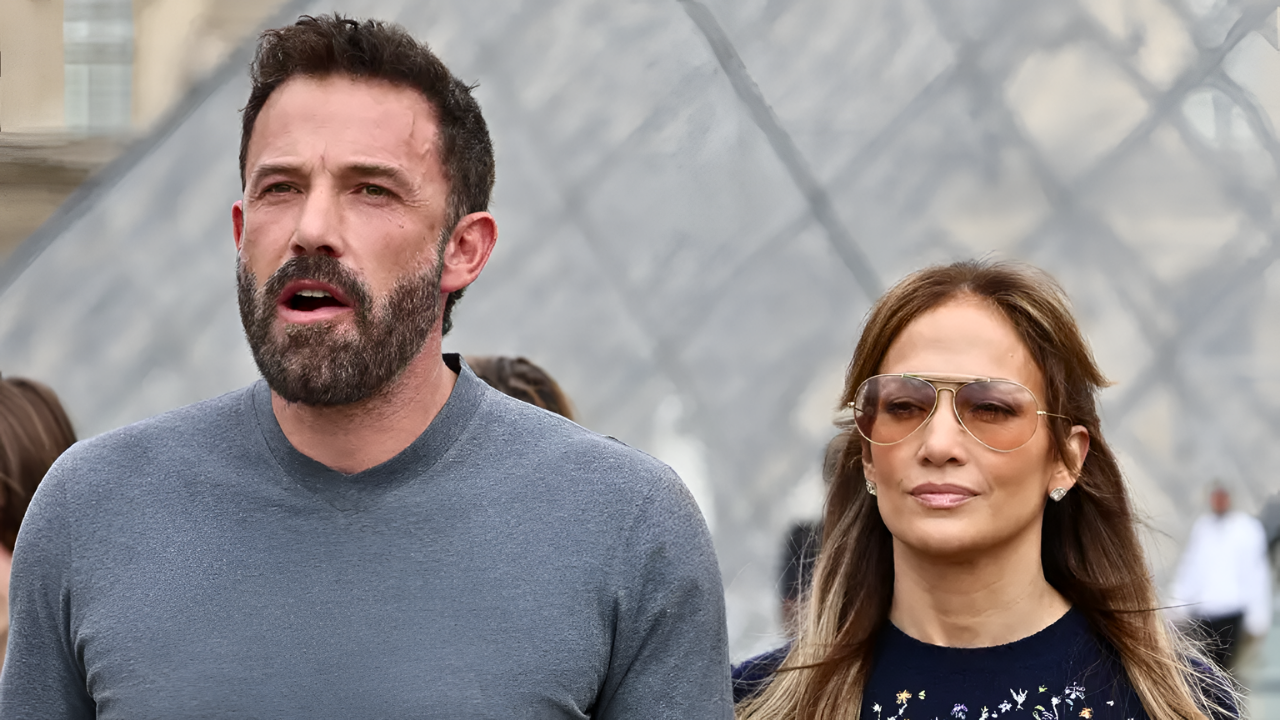

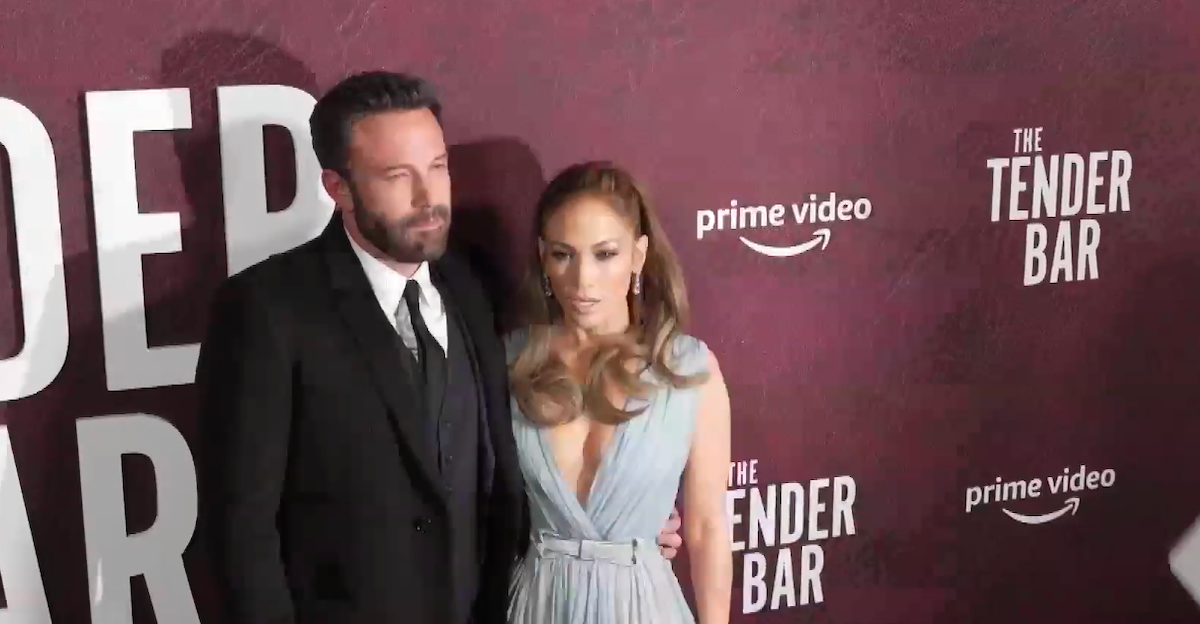

Ben Affleck Pushed for Sale, Lopez Resisted

Sources revealed stark differences in the exes’ selling strategies. Multiple insiders told media that Affleck was “very motivated to sell” and actively advocated for price reductions, viewing the mansion as “the one last thing that is a symbol of their marriage.” He desperately wanted to “cut the final cord that keeps him and Jennifer intertwined.”

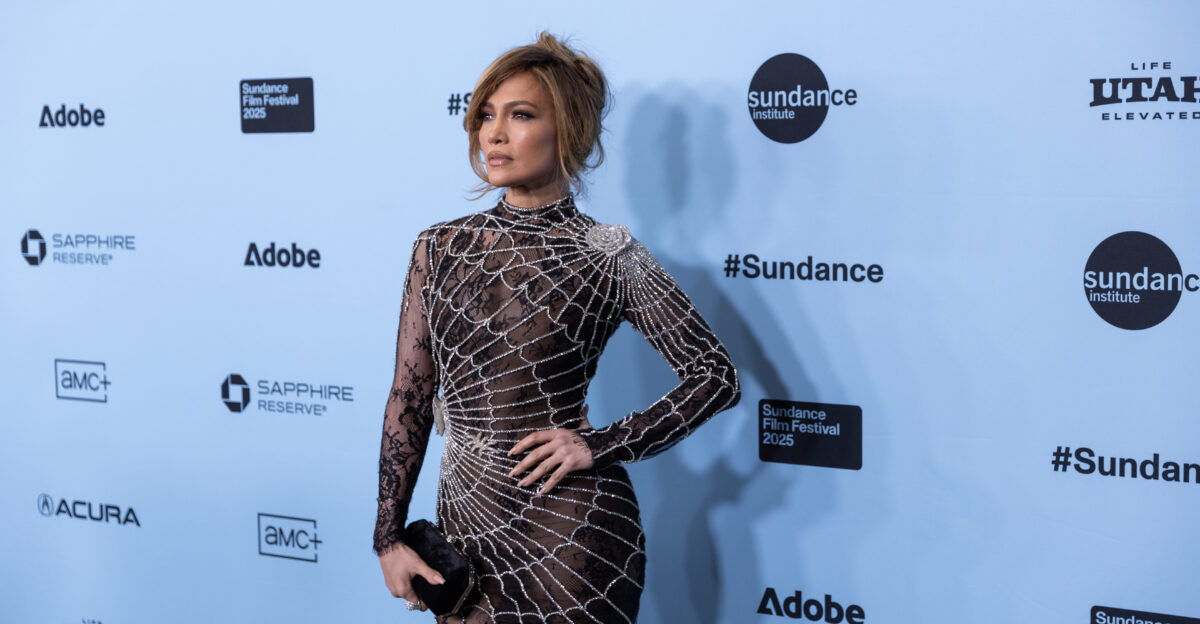

Jennifer Lopez’s Reluctance Cost Millions

Conversely, Lopez initially “dragged her feet” on price reductions, preferring to “wait it out” at higher valuations.

This fundamental misalignment likely contributed to the property being pulled from the market in July 2025 after attracting insufficient interest at $59.95 million. The September 2025 relisting at $52 million suggests Affleck’s urgency ultimately prevailed.

Beverly Hills Luxury Market Collapses

The broader Los Angeles ultra-luxury market entered a “cautious and calculated” phase throughout 2025, with Beverly Hills experiencing an 8.3% year-over-year price decline. Properties averaged 95 days on market, while ultra-luxury estates routinely sat for six to twelve months.

Oppenheim emphasized that “most homes of this magnitude are on the market for six months, and in many cases significantly longer.”

Limited Buyer Pool for $50 Million Properties

Real estate experts consistently warned that the original $68 million price tag was “way too high” for market conditions.

The pool of buyers capable of acquiring a $52 million property—before considering $284,000 monthly carrying costs—remains vanishingly small globally. Sophisticated buyers can afford to wait, demand concessions, and exploit sellers’ desperation.

Mansion Tax Backfires Spectacularly

Measure ULA, approved by Los Angeles voters in 2022, imposes a 5.5% tax on property transactions exceeding $10 million.

UCLA research reveals the policy reduced transaction rates by 38% as sellers chose to hold rather than absorb punitive taxes. Between 63% and 138% of revenue raised was offset by lower future property tax collections.

Further Price Cuts Appear Inevitable

Industry observers predict additional reductions to the $45-48 million range before a buyer emerges. At that level, the total loss for Lopez and Affleck would exceed $32-34 million once all transaction costs, taxes, and carrying expenses are aggregated—representing nearly half their total investment evaporating within three years.

Celebrity Real Estate Lesson

Every month of delay adds $284,000 to mounting losses, pressuring the divorced couple toward resolution regardless of price.

Their ordeal illustrates fundamental luxury real estate principles: overpricing based on short-term holding expectations, attempting to flip ultra-luxury properties quickly, and allowing personal conflicts to override market realism guarantees catastrophic financial outcomes. The question is no longer whether they’ll lose money, but how much they’re willing to lose to finally move on.

Sources:

“Ben Affleck and Jennifer Lopez Cut Price of Beverly Hills Marital Home with $8 Million Price Cut After 10 Months on Market.” People Magazine, May 2025.

“Jennifer Lopez and Ben Affleck Relist Marital Mansion for $52 Million After Major Price Decrease.” Realtor.com, September 2025.

“Jennifer Lopez and Ben Affleck are poised to lose money on their Los Angeles mansion thanks to the city’s tax.” Fortune Magazine, May 2025.

“Ben Affleck & Jennifer Lopez Slash Beverly Hills Mansion Price $8 Million.” TMZ, May 2025.

“The Effect of the Los Angeles Mansion Tax on Property Tax Revenue.” Cato Institute and UCLA Lewis Center, December 2025.

“Beverly Hills Housing Market: House Prices & Trends.” Redfin market data, January 2026.